- RENDER saw a huge interest in whales, which was a sign of a recovery in the market.

- Whales had a huge influence on the market, owning almost 92% of RENDER’s supply.

Render network [RENDER] has seen remarkable growth on the price charts and increased interest in whales amid the resurgence of AI and DeFi.

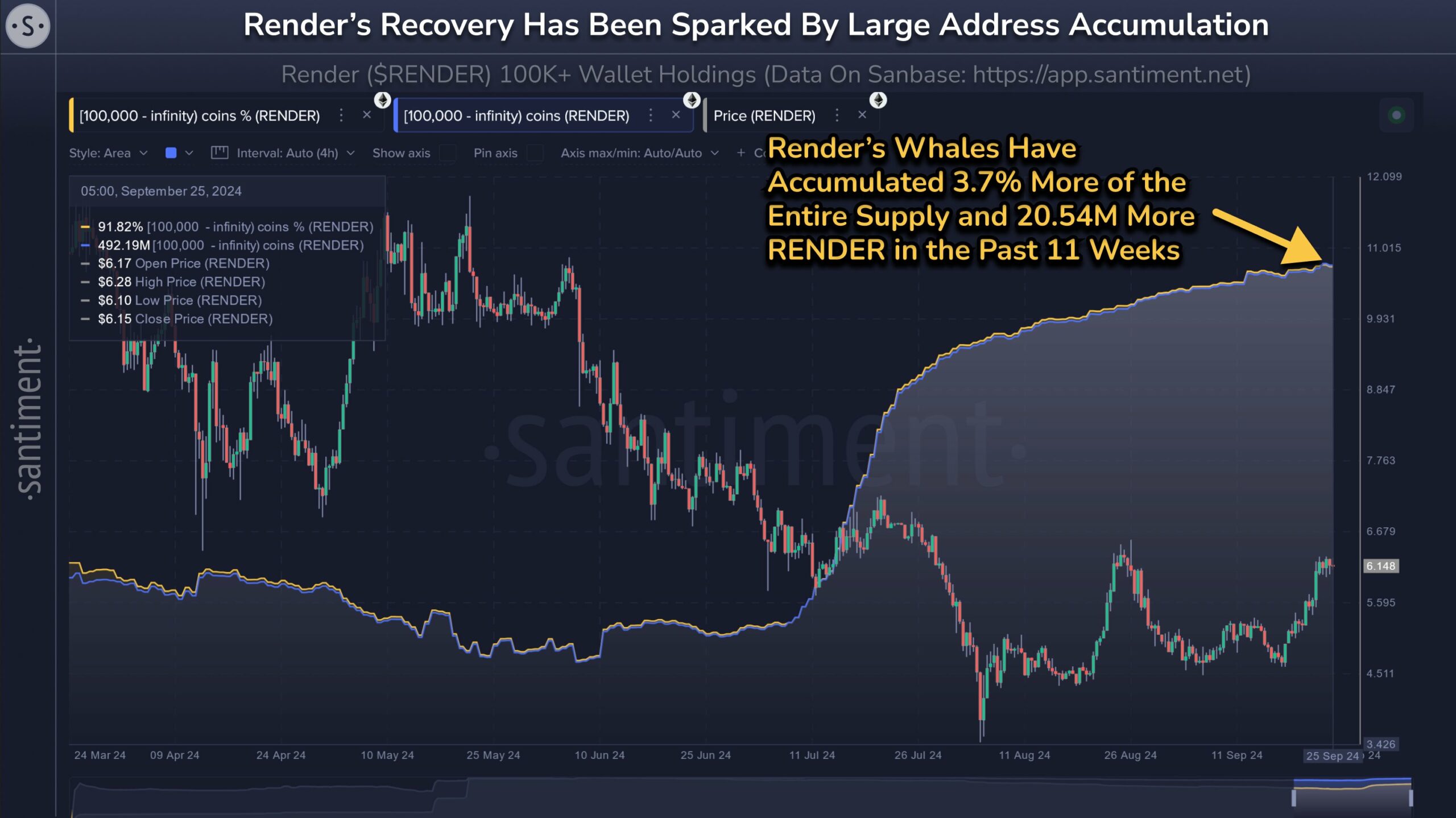

According to Santiment factswhales have increased their holdings on RENDER during the recent recovery.

They have grabbed 3.7% more in the last three months (20.54 million tokens), bringing their dominance to 92% of the total supply.

“Wallets with at least 100,000 RENDER, classified as sharks and whales, have collected an additional 20.54 million coins (worth $126.3 million) in 11 weeks and hold 91.82% of the supply.”

Source: Santiment

Should you copy whales?

Such massive bids by large portfolios always indicate high conviction of a potential price increase in the future, especially with bullish expectations in the fourth quarter.

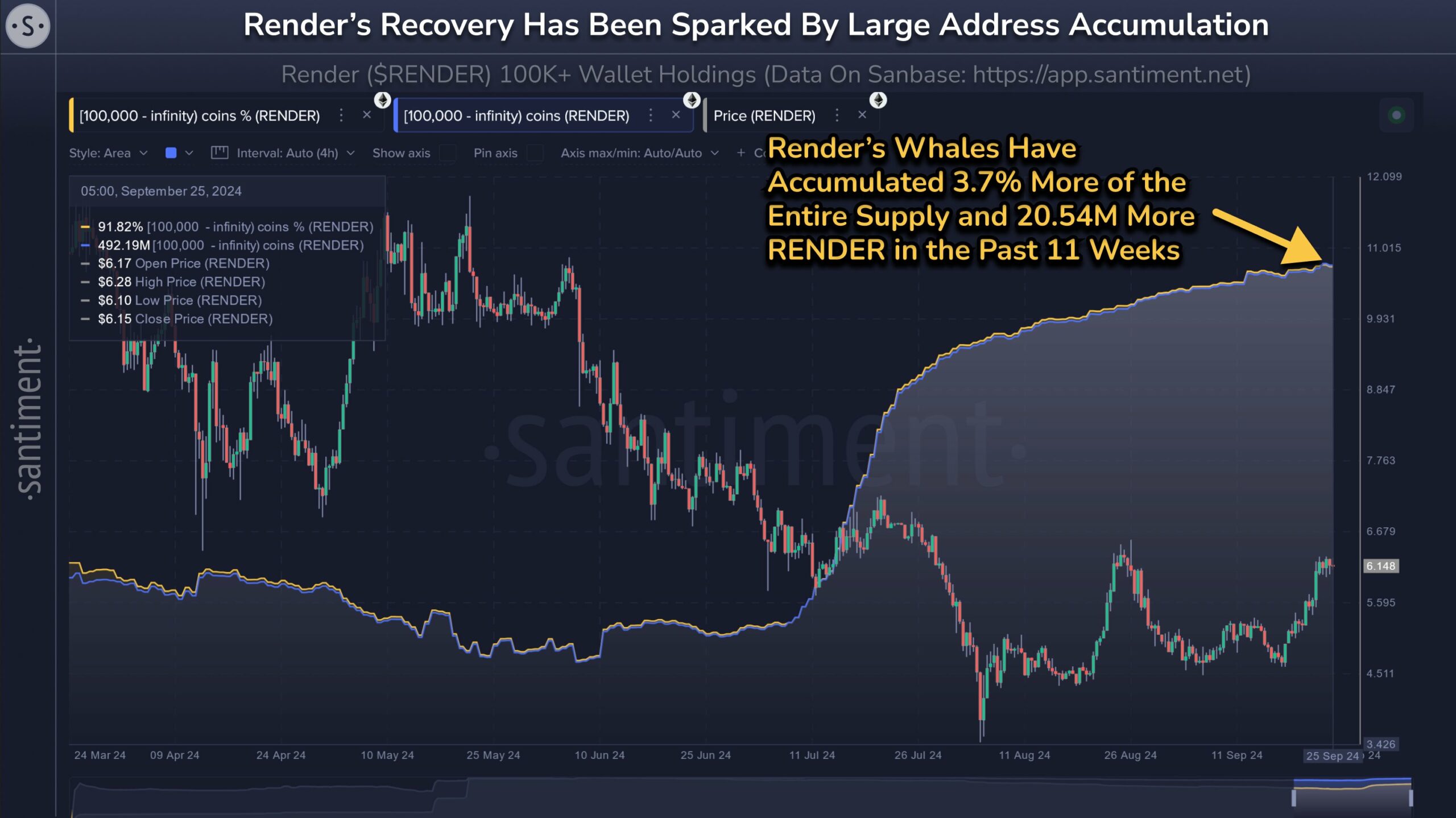

The token rose 26% overall in September launch in the AI sector.

Source: RENDER/USDT, TradingView

Since the extended decline in August, RENDER has remained below $6.3 (a third-quarter low). On the daily charts, the altcoin has formed a bullish double-bottom pattern, with $6.2 as the neckline.

A breakout to the upside could send the RENDER up nearly 30% and above $8 or the 200-day MA (Moving Average).

However, to extend the recovery, bulls need to cross the $6.2 mark. The bearish order block (OB), highlighted in red, is at $7.

If the token jumps above $7, the next bullish target would be $10.

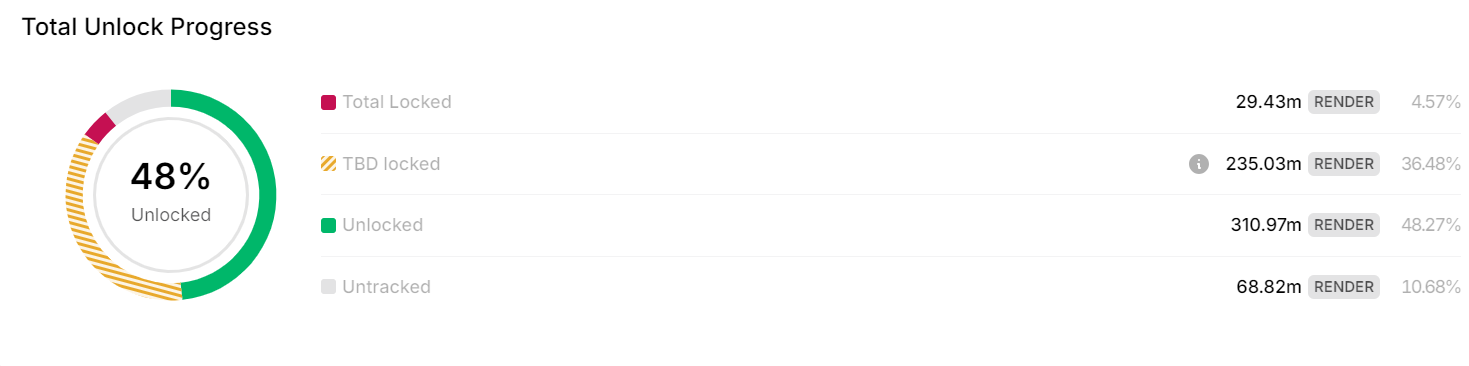

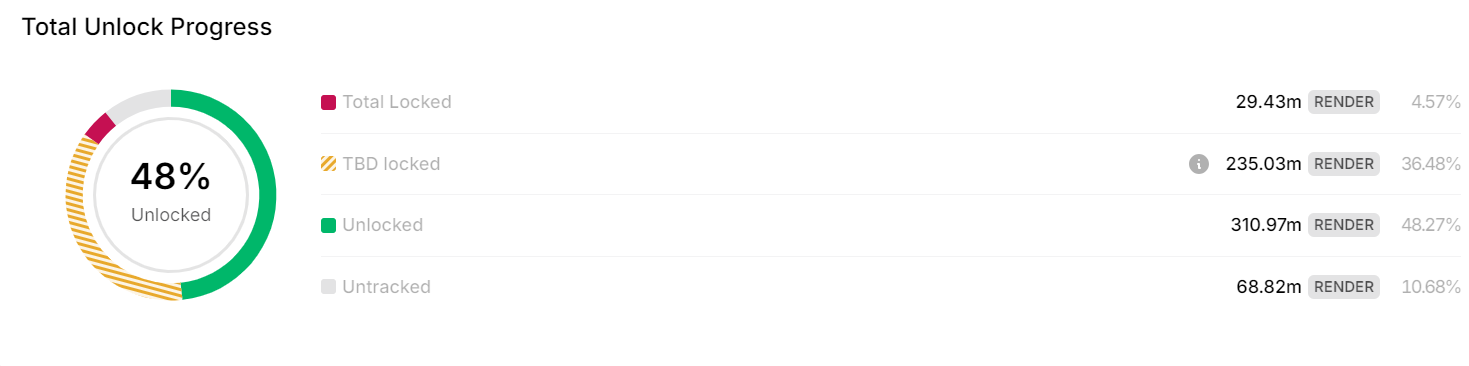

Source: Token Unlocks

Despite RENDER’s attractive risk-reward (RR) ratio, there was still significant excess supply from token unlocks.

According to Token Unlocks factsonly 60% of the total supply of 644 million tokens has been unlocked.

About 235 million tokens (To Be Determined Locked), intended for things like treasury operations, had yet to be released and there was no official timeline for their unlocking.

The huge supply surplus can affect prices if it is unexpectedly introduced to the market.

Ergo, the dominance of whales in RENDER meant that they would dictate prices. As such, speculators must rely on the actions of whales to gauge market entry and profit points.