- The Bitcoin Golden Cross could represent an opportunity for a breakout to $65K.

- However, for this cross to be realized in the long term, several conditions must align.

Bitcoin [BTC] Bulls have left bearish pressure behind after a week of solid attempts to break above $64,000, reaching a daily high of $64,825.

This level has been tested several times since BTC reached its ATH of $73K in March. In August, the bears reaffirmed their dominance, thwarting a potential breakout to $68,000.

With BTC trading at $63,687 after another failed attempt to hold support, what will it take to break the cycle?

Bitcoin Golden Cross needs long-term security

Source: TradingView

OOn the daily price chart, Bitcoin’s 50-DMA has crossed the 200-DMA, indicating a Golden Cross.

Historically, this pattern has been a reliable signal for following Bitcoin’s directional trends. When the short-term moving average crosses above the long-term average, it often indicates strong upward movement.

Interestingly, the short MA almost approached the long MA during the last week of the August cycle, indicating a possible bull rally.

However, a revival The number of short positions prevented the crossover from materializing, leading to a sharp rejection and a return to the $55,000 support.

If a similar scenario unfolds, the trend could turn into a Death Cross, which foreshadows a bearish market. What needs to change?

Rejecting BTC short control is critical

Typically, traders interpret a Golden Cross as a signal to take long positions in anticipation of future price gains.

With this in mind, AMBCrypto analyzed the speculative market to assess whether traders were positioning themselves to profit from the cross.

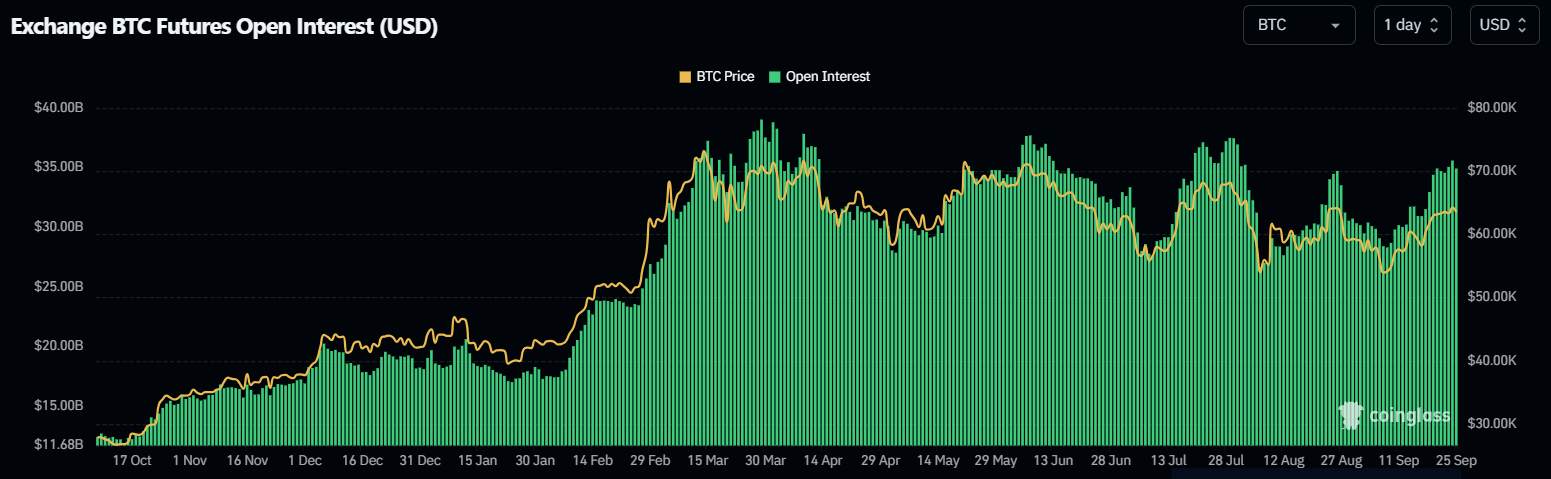

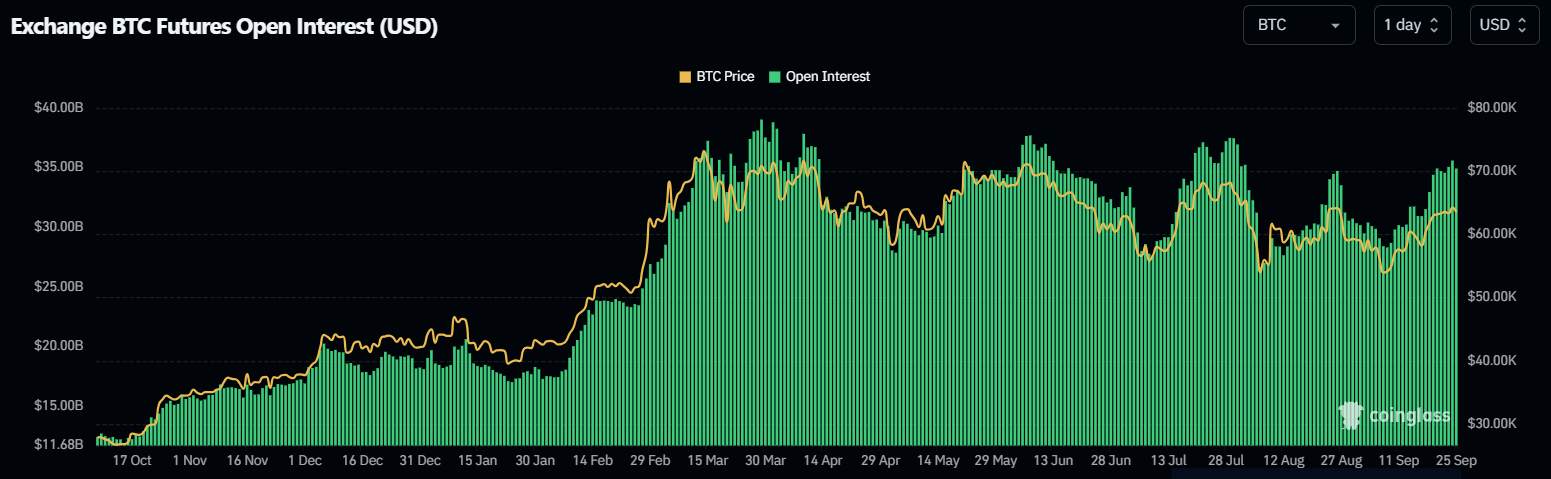

Source: Coinglass

Normally, when Open Interest (OI) rises, it typically coincides with Bitcoin testing critical resistance levels.

Simply put, each spike has been marked by a notable increase in the number of futures traders going long, but this increase typically ends with them closing their positions, resulting in a sharp decline for BTC.

While OI mirrors these market tops, it is surprising that BTC’s price has not followed suit, possibly signaling a resurgence in short control.

As Bitcoin bulls enter their fifth day of trying to push BTC above $65,000, there has been a significant influx of long positions. arose.

However, if the short control continues, a long liquidation could trigger another downturn, potentially sending BTC back below $60,000 before a breakout attempt could occur.

THIS adjustment can make a difference

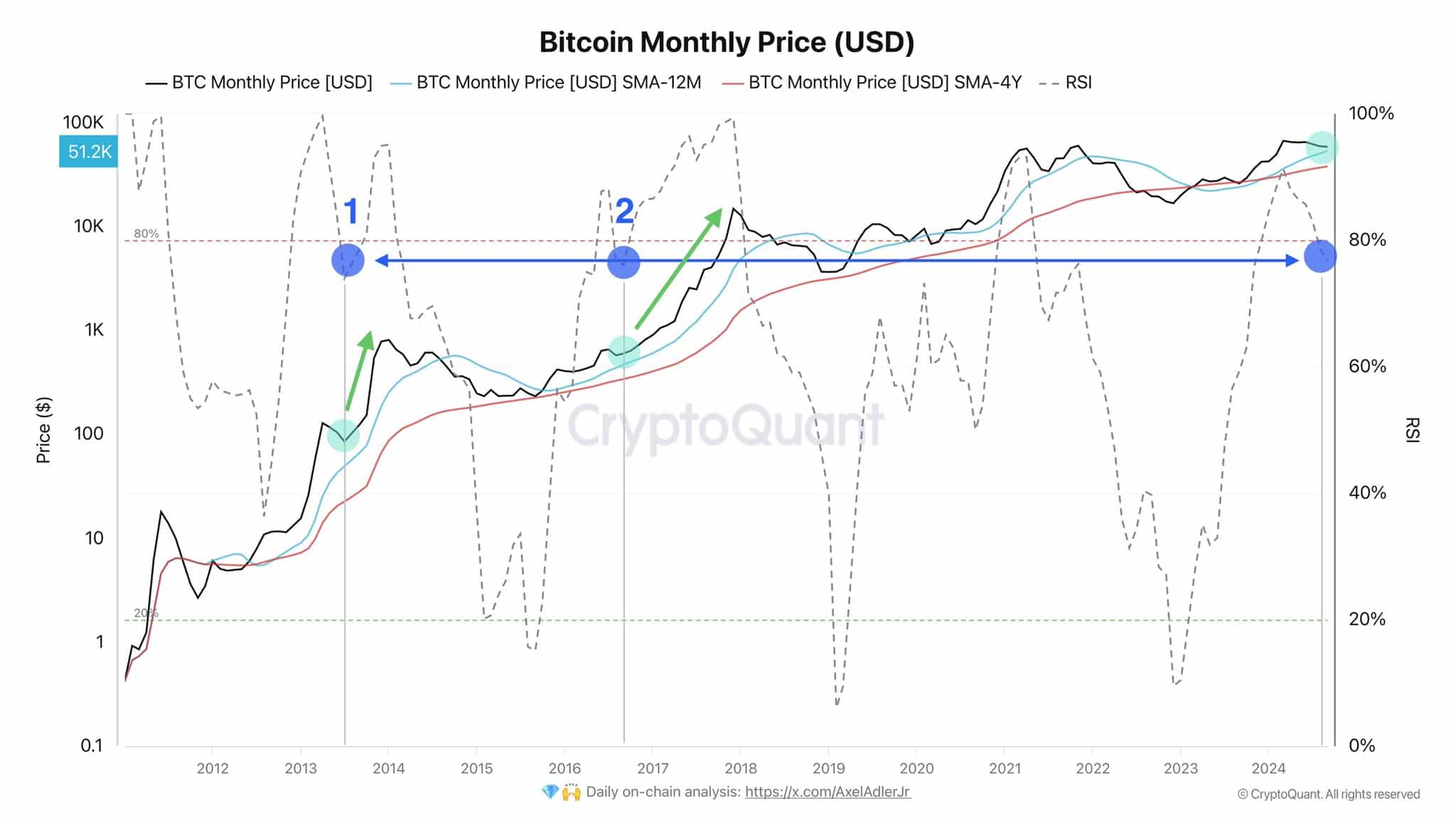

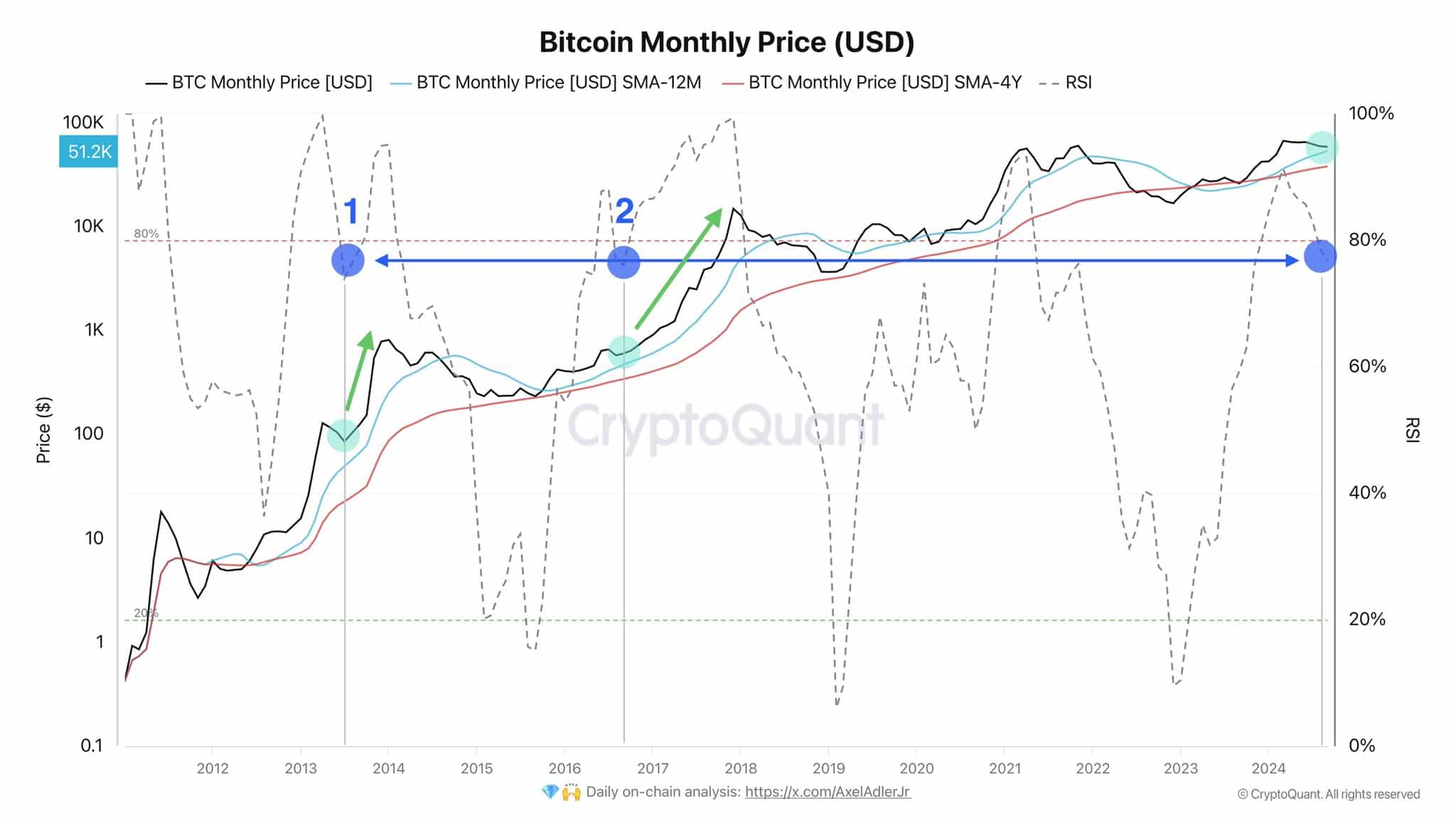

On a monthly basis, the RSI has fallen below 80%. AMBCrypto’s analysis suggested that Bitcoin may be gearing up for a near-term price correction as oversold conditions often lead to renewed buying interest.

Source: CryptoQuant

Historically, such RSI declines have heralded upward price corrections during bullish cycles, prompting investors to grab perceived bargains.

Read Bitcoin’s [BTC] Price forecast 2024-25

While this could increase the likelihood of the Golden Cross becoming a reality soon, the market needs to reduce OI by at least 10% for long-term stability. This reduction would make Bitcoin less susceptible to short control.

Without this adjustment, BTC is unlikely to remain above $64,000 in the near term, but it is unlikely to reach $65,000 in the near term.

Stay cool, stay onchain with .pengu

Stay cool, stay onchain with .pengu