- BTC approached resistance near its 200-day simple moving average.

- Selling pressure on the coin has increased over the past 24 hours.

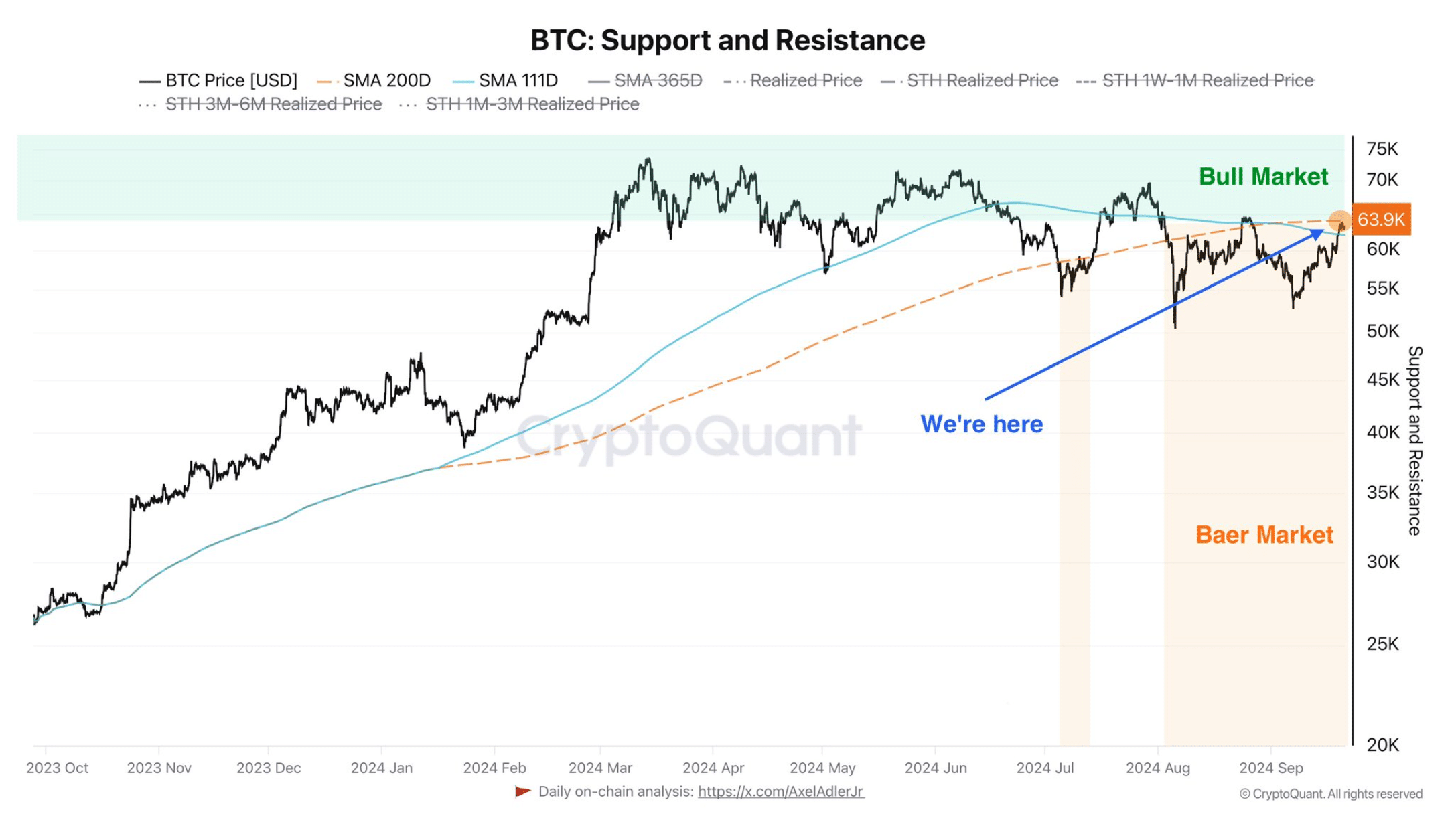

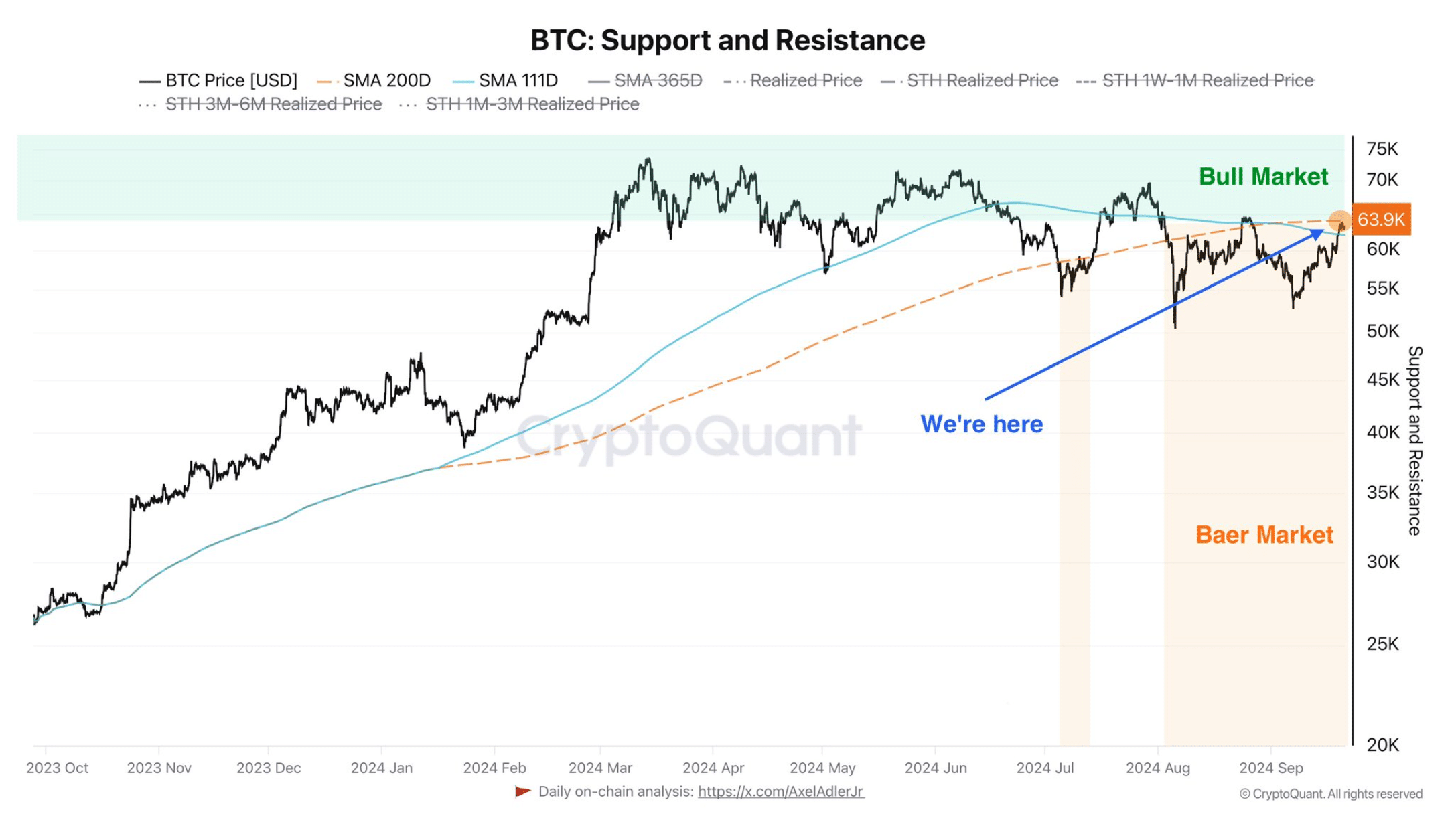

Bitcoin [BTC] has been on an upward trend and the king coin was approaching a crucial resistance. The latest analysis shows that it is imperative for the coin to rise above that level in order to enter an actual bull market.

Bitcoin is approaching a crucial resistance

After a week of gains, BTC faced a slight correction. To be precise, the BTC price has risen by more than 5% in the past seven days. But over the past 24 hours, the price of the king coin has fallen marginally.

At the time of writing, BTC was trade at $63,037.03 with a market cap of over $1.25 trillion.

In the meantime, Axel, a popular crypto analyst, posted one tweet shows an interesting development. According to the tweet, it was crucial for Bitcoin to convert its 200-day Simple Moving Average (SMA) resistance into its new support.

If that happens, only we can enter a true bull market, the tweet said. At the time of writing, Bitcoin was testing resistance.

Therefore, AMBCrypto planned to take a closer look at the state of the coin to see how likely BTC is to convert this resistance into its new support.

Source:

What’s next for BTC?

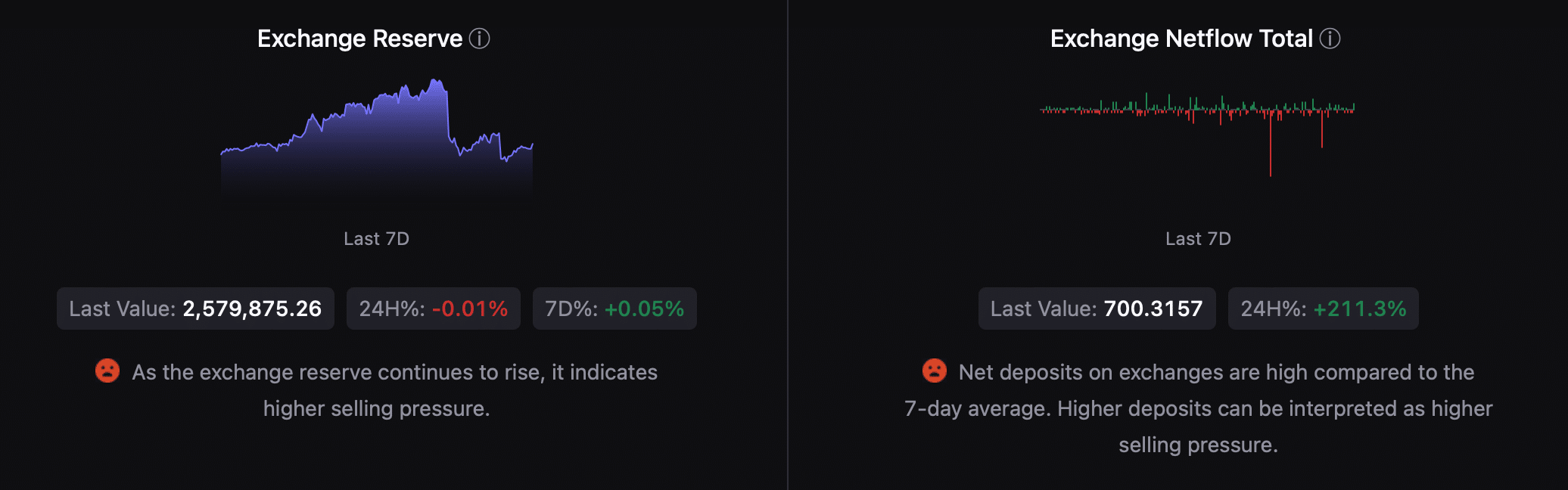

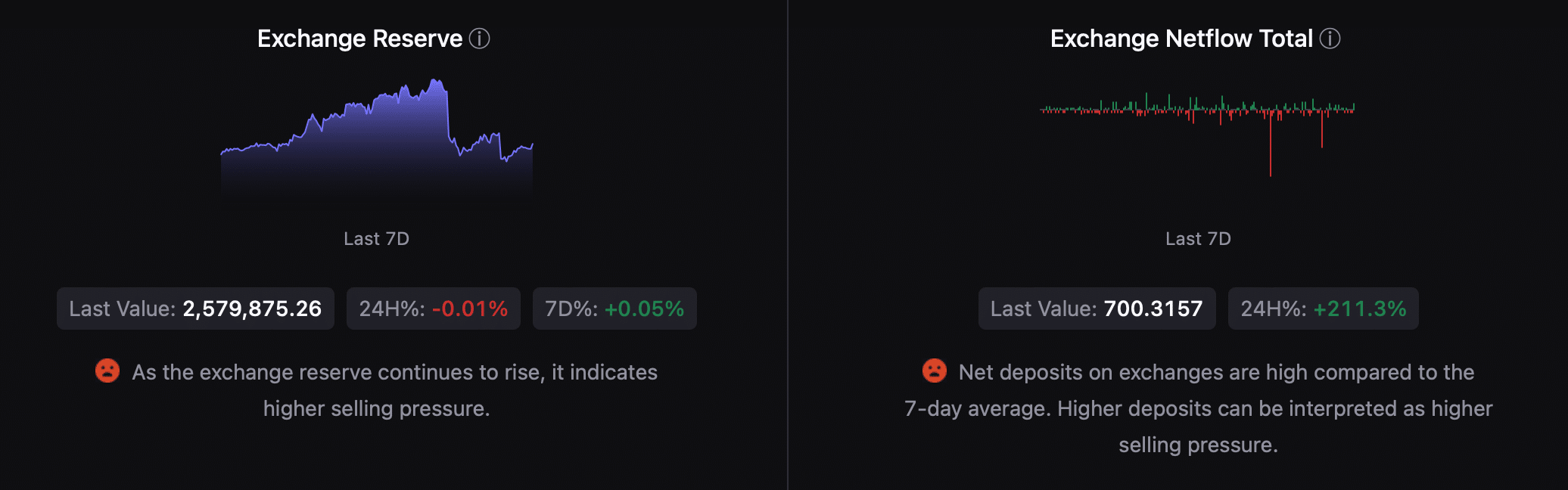

According to our analysis of CryptoQuant data, selling pressure on BTC increased. For example, BTC’s foreign exchange reserve increased. The coin’s net deposits on exchanges were also high compared to the average of the past seven days.

These two metrics indicated that selling pressure on Bitcoin was high. Moreover, the coin’s aSORP was also red. This suggested that more investors were selling at a profit. In the middle of a bull market, this could indicate a market top.

Source: CryptoQuant

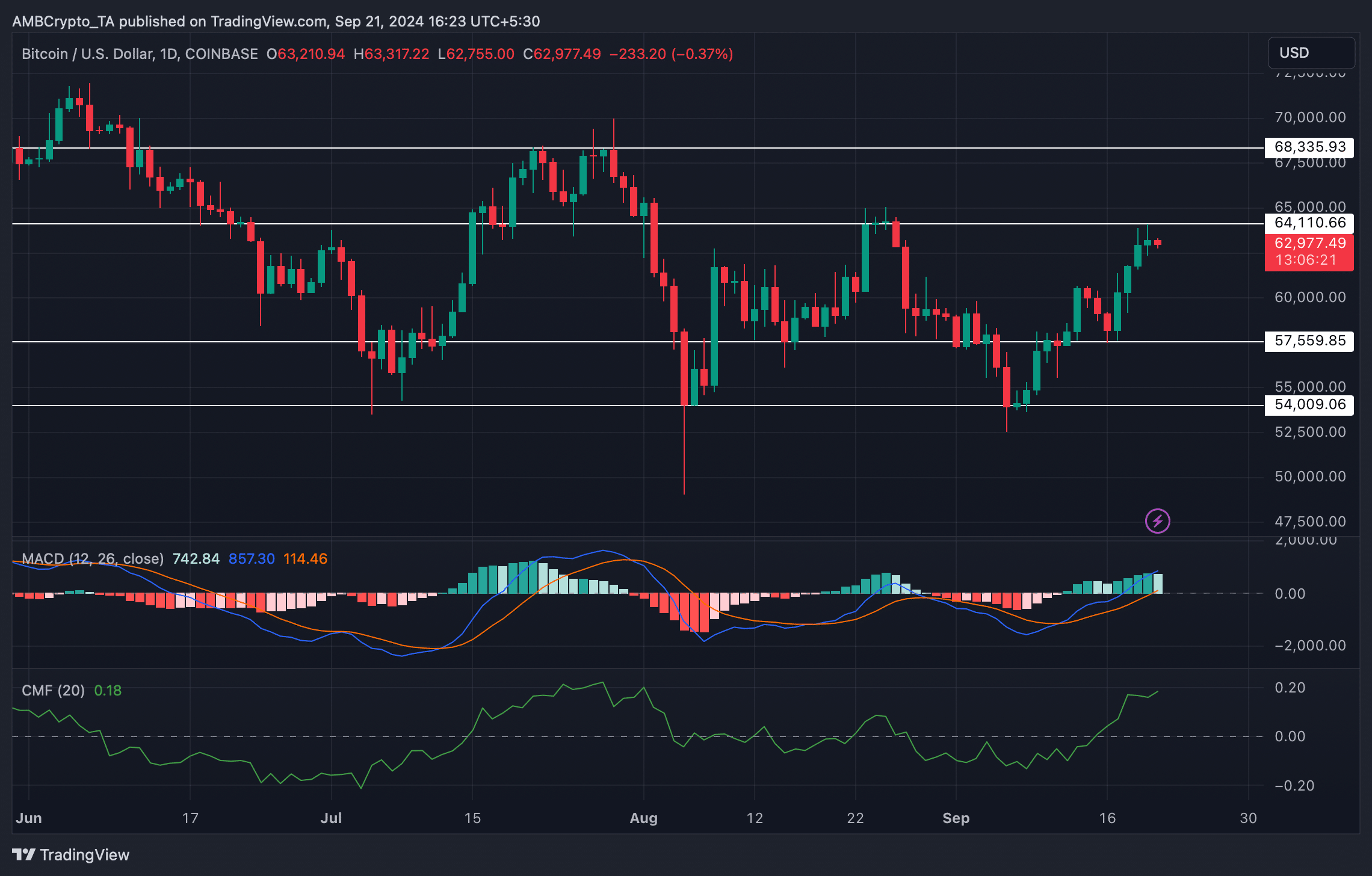

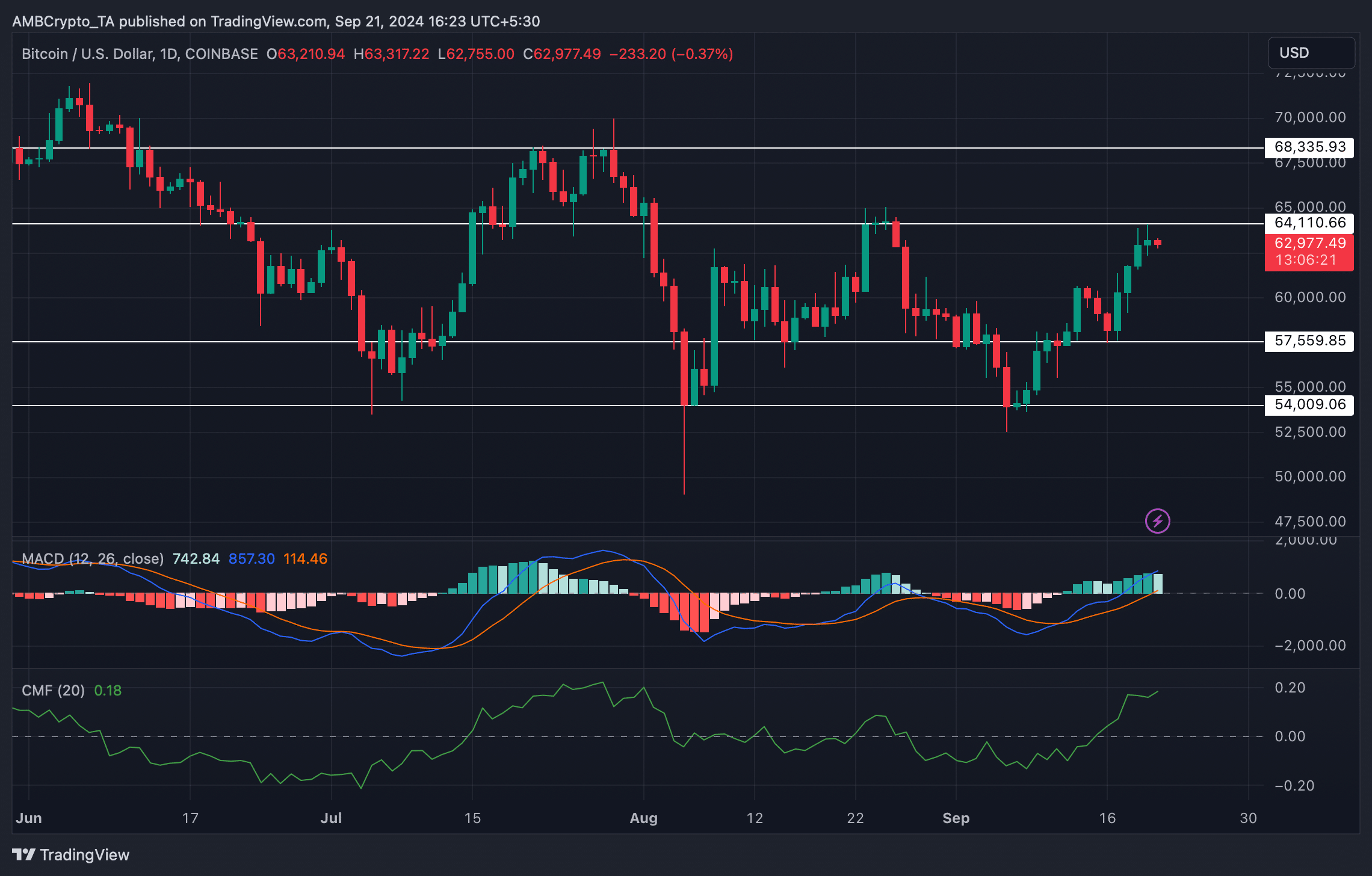

We then looked at the daily chart of BTC to see if it is ready for a price correction. We also found that BTC was approaching resistance near $64,000. The good news was that the MACD showed a bullish advantage in the market.

Moreover, the Chaikin Money Flow (CMF) also supported the bulls as they moved higher, indicating a breakout above the resistance.

Source: TradingView

Read Bitcoins [BTC] Price prediction 2024–2025

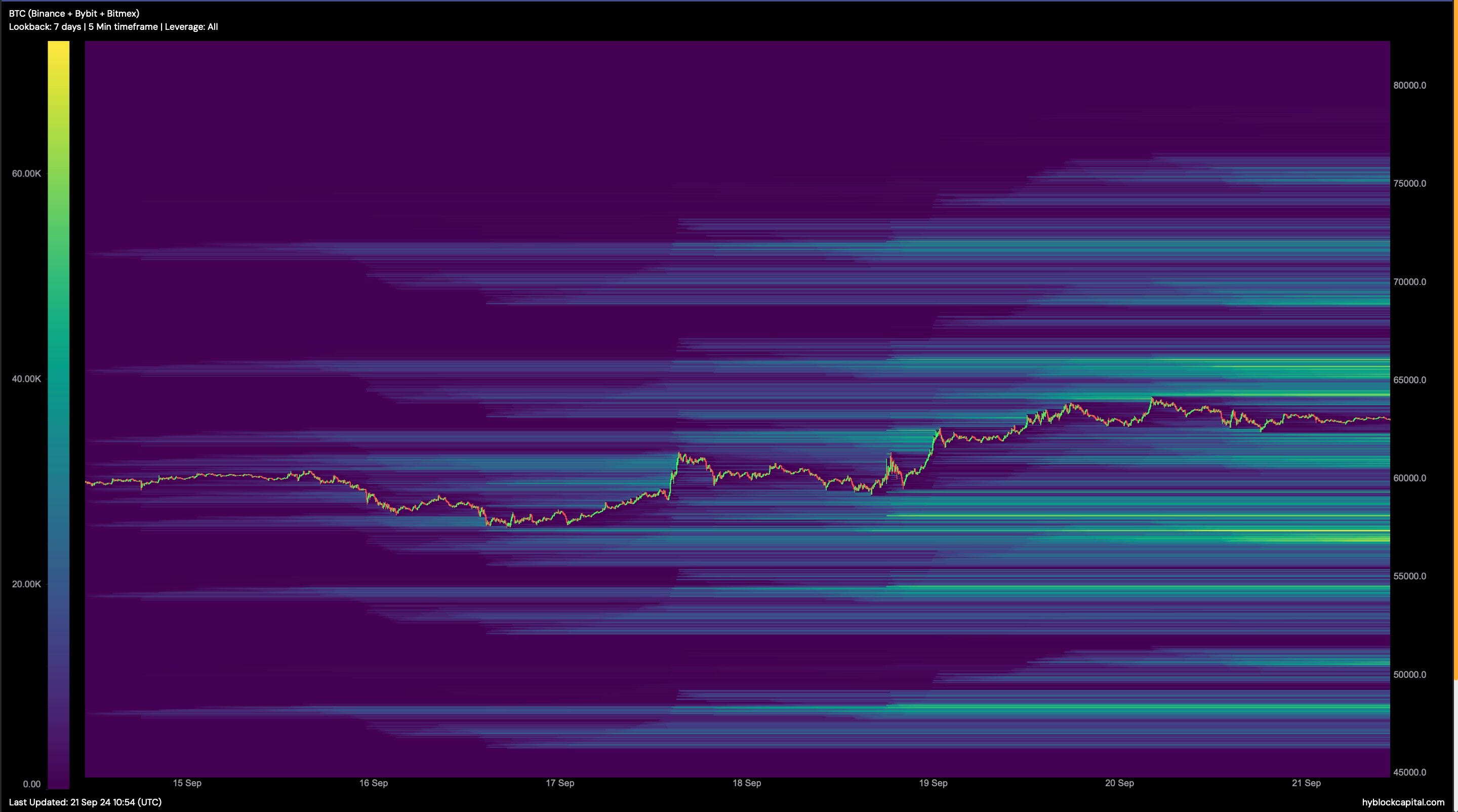

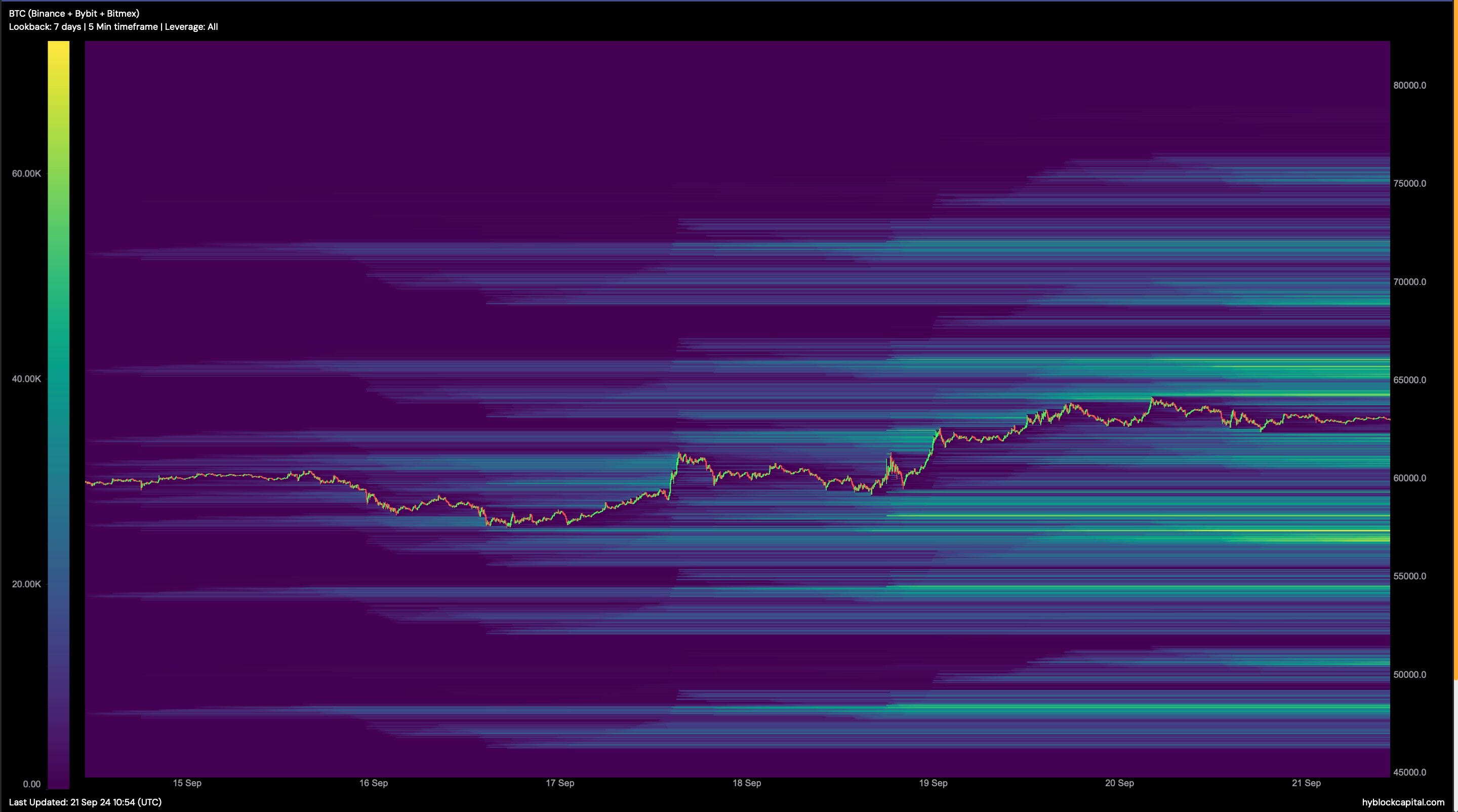

Apart from this, Hyblock Capital’s data also revealed that BTC’s path to $64,000 was clear as liquidation at that level would only increase. Generally, an increase in liquidation results in short-term price corrections.

But in the event of a bearish takeover, it won’t be surprising to see BTC drop again to $57,000.

Source: Hyblock Capital