- Bitcoin MVRV momentum shows a potential return to bullish territory.

- BTC has risen 4.95% in the past week.

Bitcoin last week [BTC]has had strong upward momentum. The price recovery has seen BTC regain higher resistance levels, reviving market optimism.

At the time of writing, BTC was trading as high as $63,062. This represented an increase of 4.95% compared to the previous week.

These gains on the weekly charts have pushed BTC to post positive gains on the monthly charts, recovering from a monthly low of $52,546 with an increase of 3.95%.

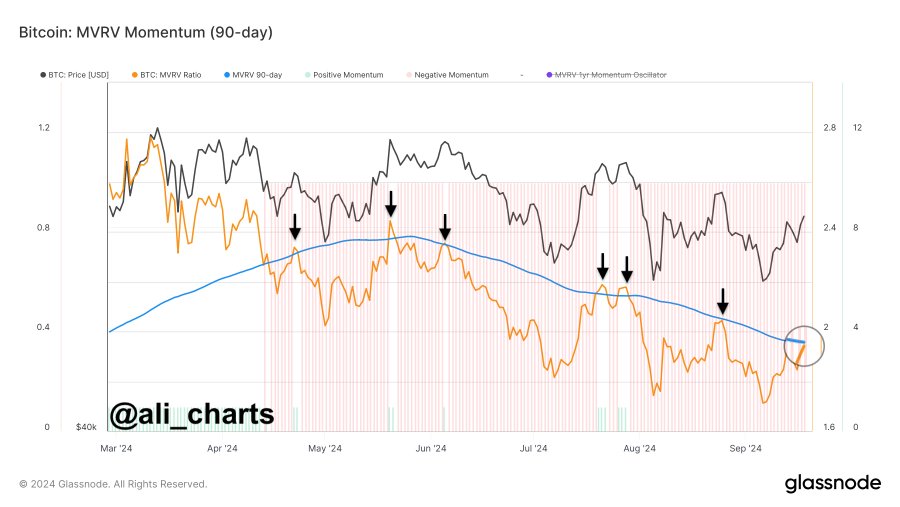

These recent price movements have undoubtedly sparked widespread debate among analysts. One of them is popular crypto analyst Ali Martinez, who has predicted an upcoming bullish run citing the MVRV momentum.

What market sentiment says

In his analysis states Martinez quoted the MVRV’s latest shift from negative to bullish territory.

Source:

According to his analysis, the MVRV shifted to negative momentum in late April. During this period, BTC fell from a high of $67,241 to a local low of $49,577, before a brief recovery and another decline.

Based on this observation, after a long period of negative momentum, MVRV is now showing a return to bullish if it manages to close above its 90-day moving average.

What this means is that the downtrend is reversing and the market could turn bullish again, with the potential for further gains.

For example, the last time rates fell below the 90-day MA was in mid-2023. After a recovery, prices stabilized, followed by a sustained increase.

Therefore, now that the market has taken advantage of the buying opportunity, BTC is well positioned for price growth.

What BTC Charts Suggest

As noted by Martinez, the BTC market is showing a potential return to bullish territory after a sustained period of decline. Current market sentiment could therefore spur Bitcoin to further price growth.

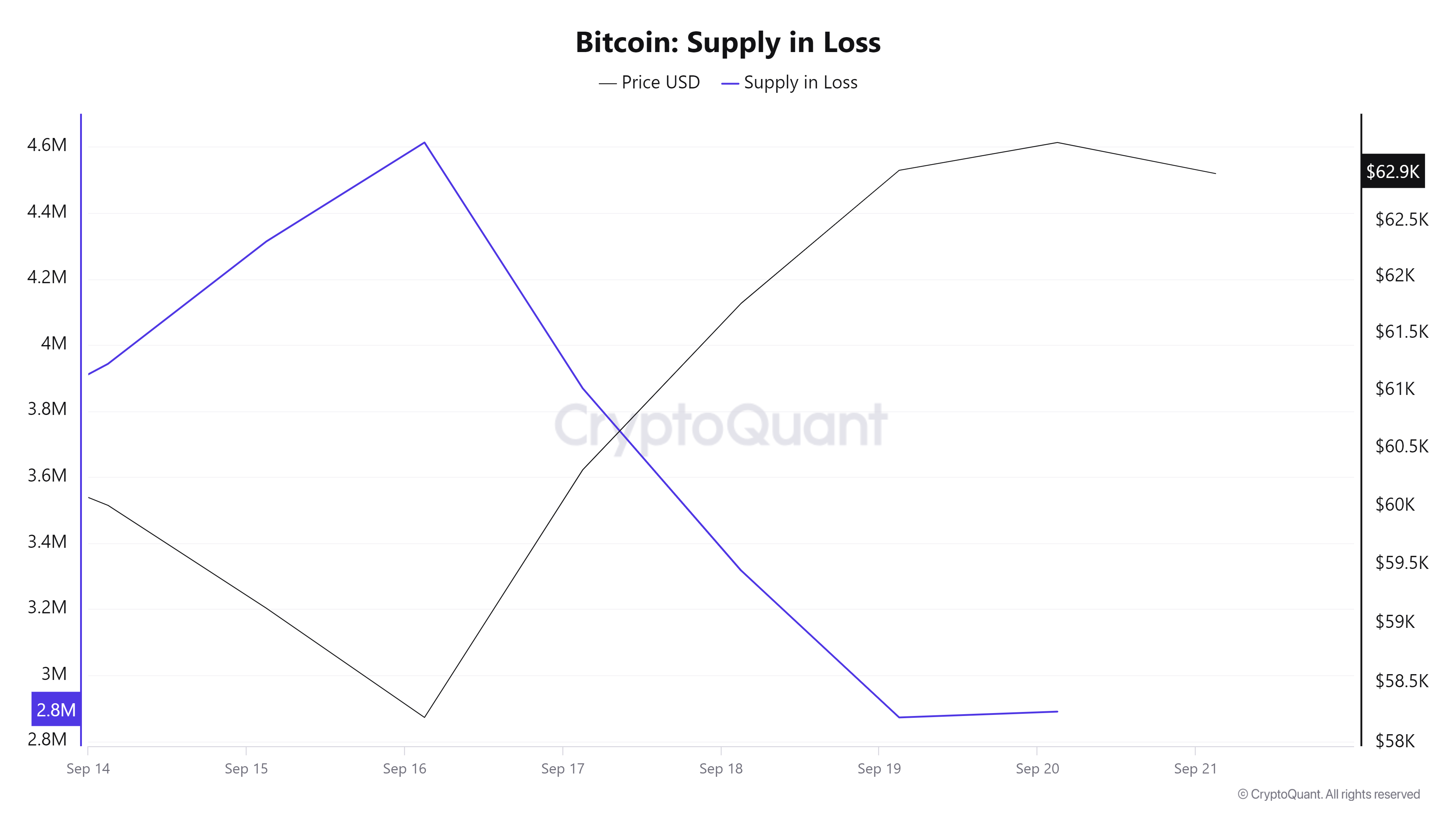

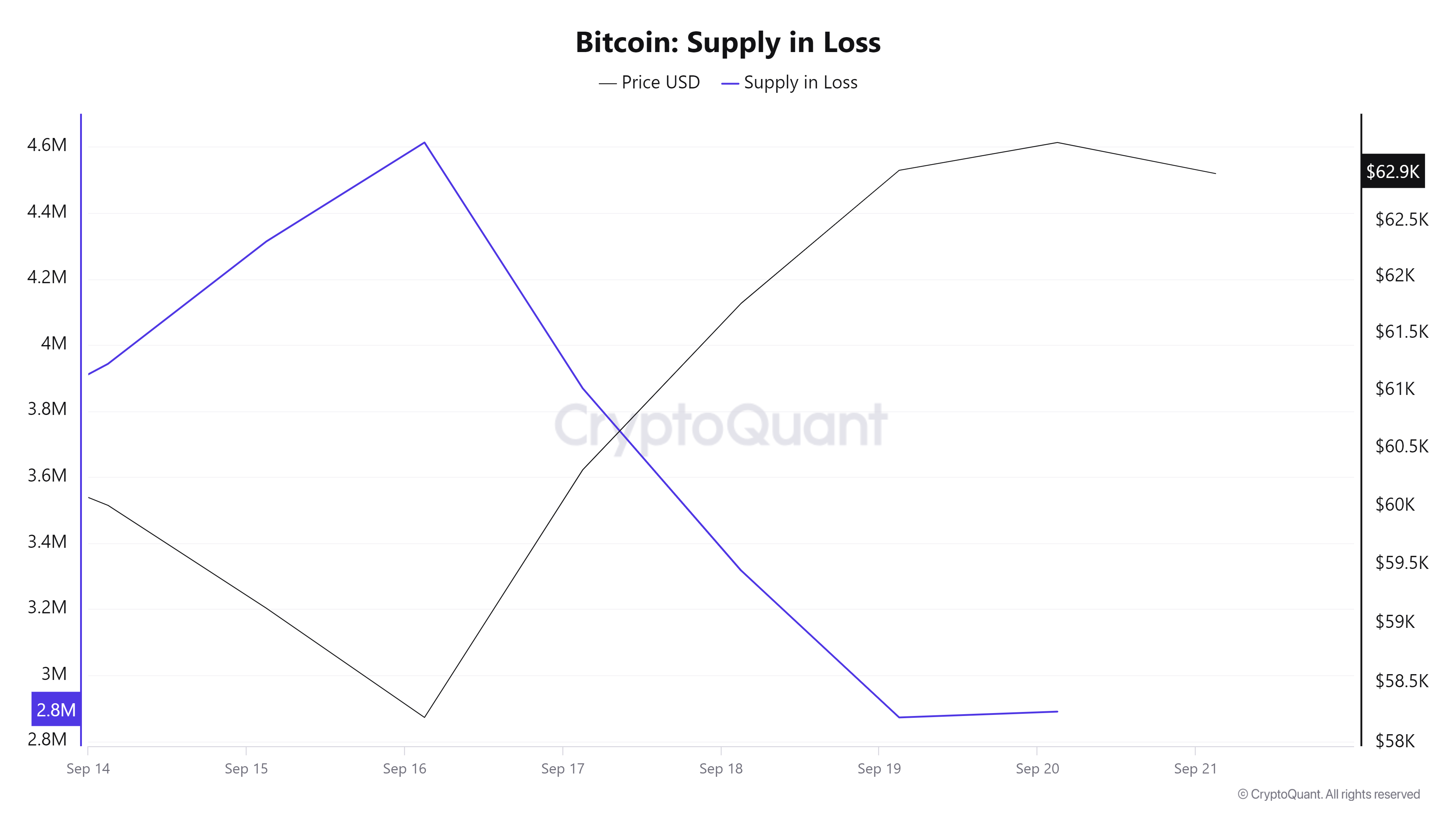

Source: CryptoQuant

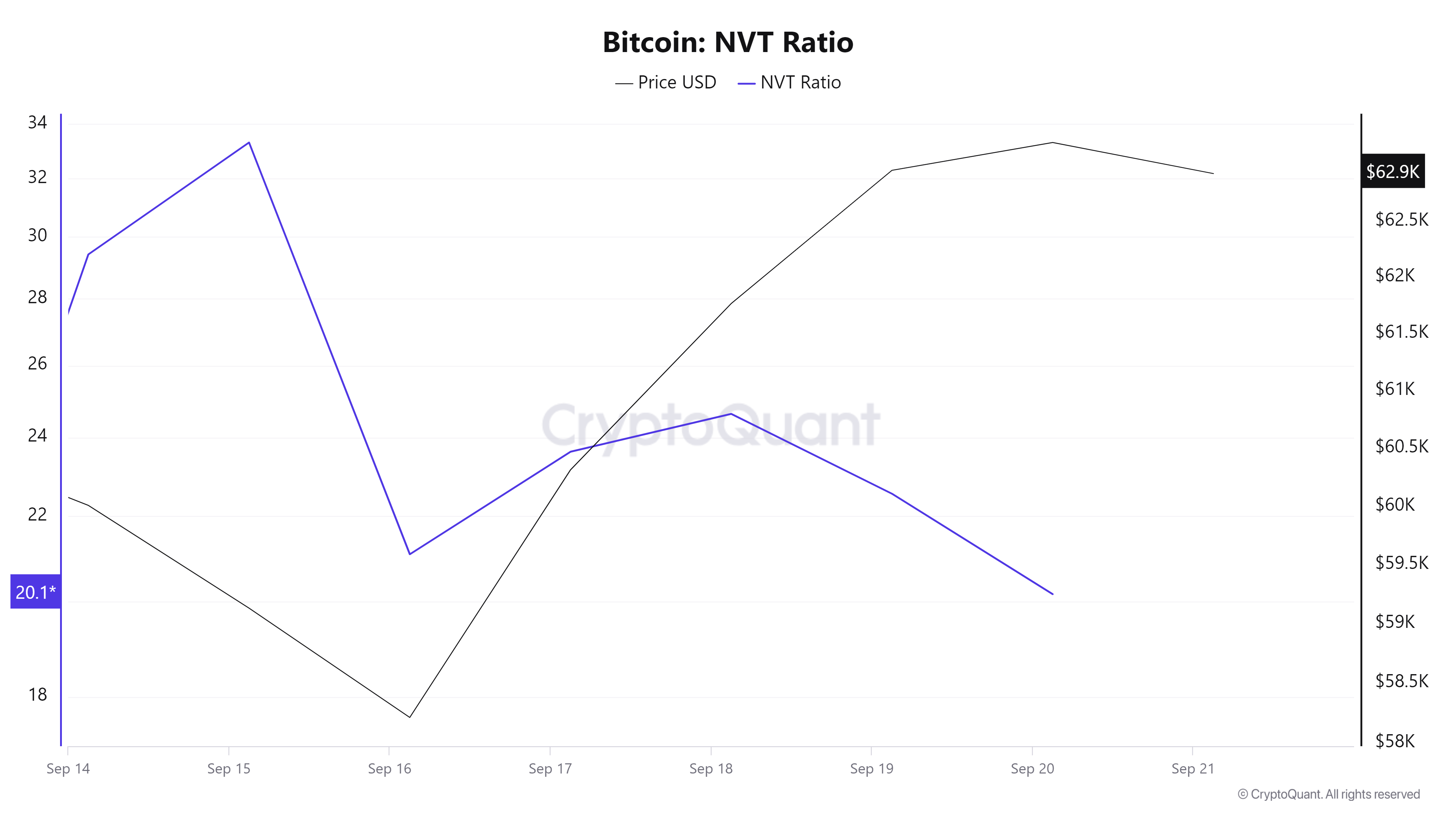

For example, Bitcoin’s NVT ratio has fallen from 33.3 to 20.1 over the past week, indicating that on-chain transaction volume is growing faster than the MC.

This acts as a bullish indicator as it implies that the network is being actively used and the price is devalued compared to the utility. Such a decline signals investor confidence in the long-term viability of the network.

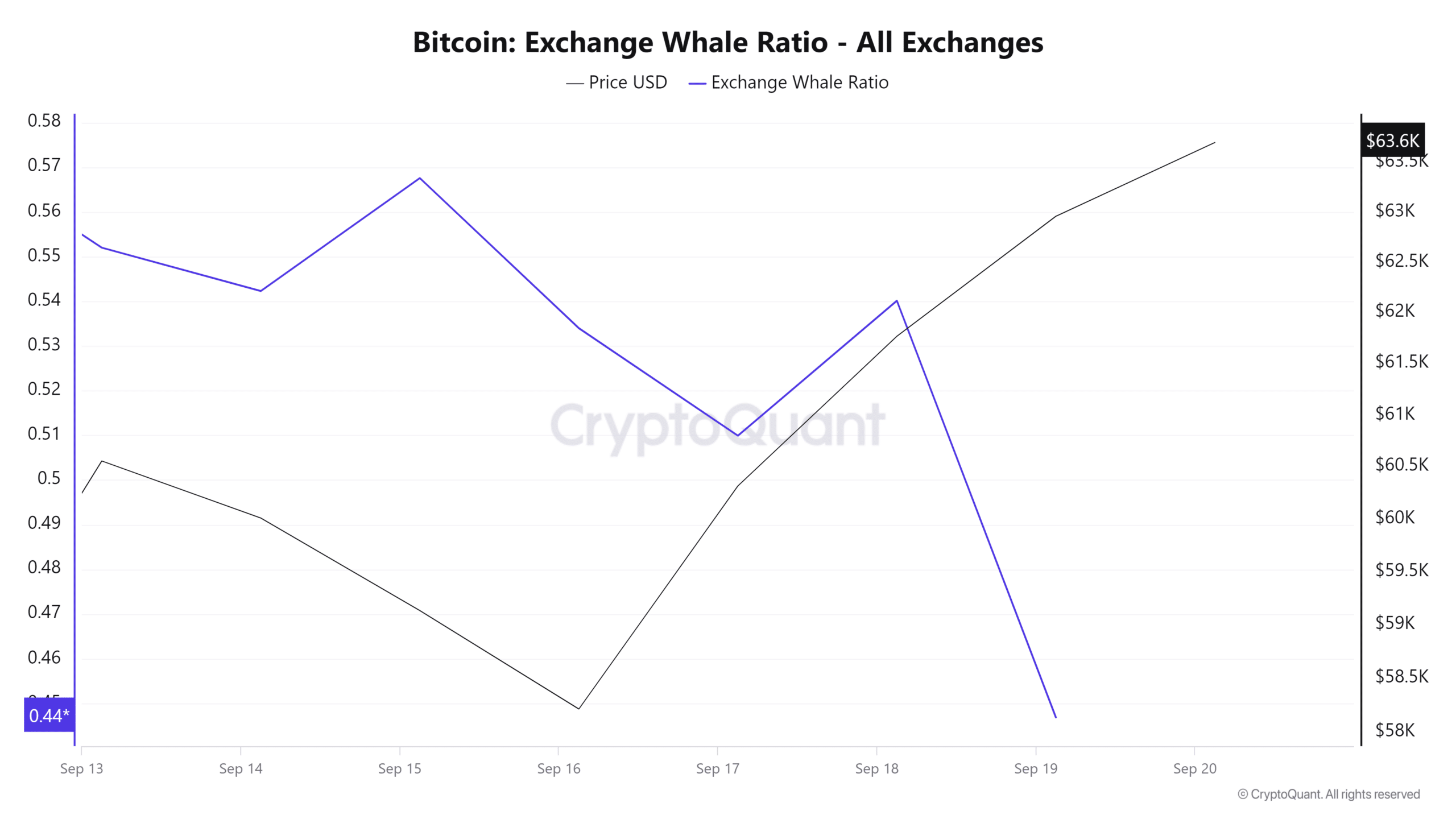

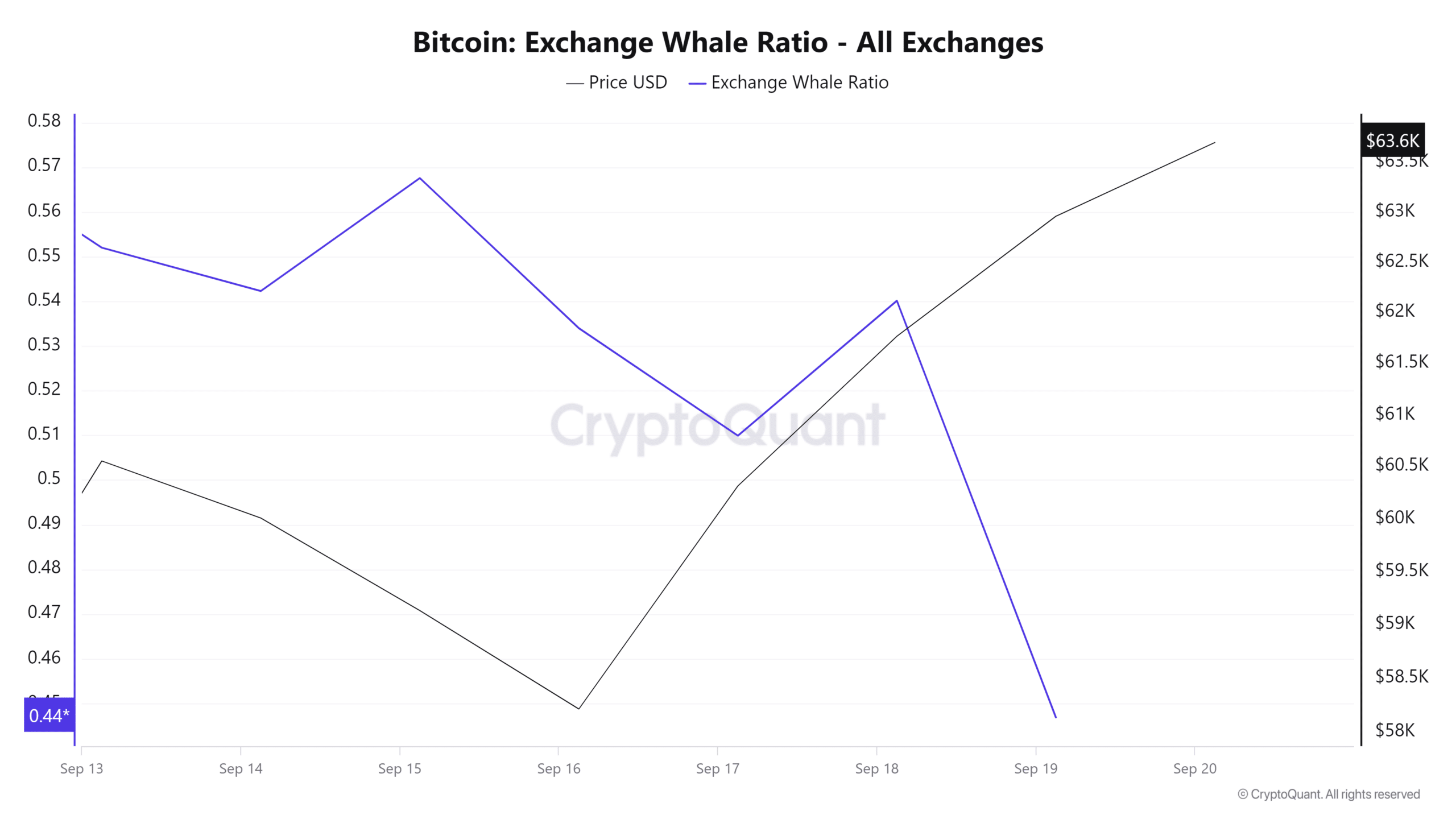

Source: Cryptoquant

Furthermore, Bitcoin’s losing supply has fallen from 4.2 million to 2.8 million over the past week. This decline suggests that the BTC price is rising, making previously underwater assets profitable. This is another bullish signal indicating upward momentum.

Source: Cryptoquant

Finally, Bitcoin’s supply ratio on the exchange has fallen from a high of 0.13128 to 0.1308 over the past week. This indicates that holders are moving their BTC from exchanges to cold wallets.

Read Bitcoin’s [BTC] Price forecast 2024-25

This suggests that the behavior is being held for the long term rather than being sold. Such activity reduces selling pressure, which is usually a bullish sign.

Therefore, as noted, BTC is increasingly preferred by investors. If current market sentiment holds, BTC will challenge the next resistance level at $64262.