With a price increase of 17% in the last seven days, Avalanche (AVAX) has been active lately a winning run. Currently, the cryptocurrency is trading at $28.12, up 7% in the last 24 hours alone. This abrupt increase is part of a larger recovery in the crypto market, driven by a significant shift in the US financial scene: the Federal Reserve’s decision to cut interest rates.

The Fed cut rates by 50 basis points on September 18 and therefore defined the new range at 4.75%-5%. The Fed’s decision to cut rates, aimed at helping lower inflation and promoting economic development, is the first in four years.

While the cut was expected, it nevertheless caused volatility in both the conventional and cryptocurrency markets; AVAX emerged as one of the best performers. Meanwhile, AVAX’s price projection is still quite positive. With the cryptocurrency selling 227% below expected price forecasts for next month, this is a big increase The increase could be just around the corner.

DeFi powerhouse in the making

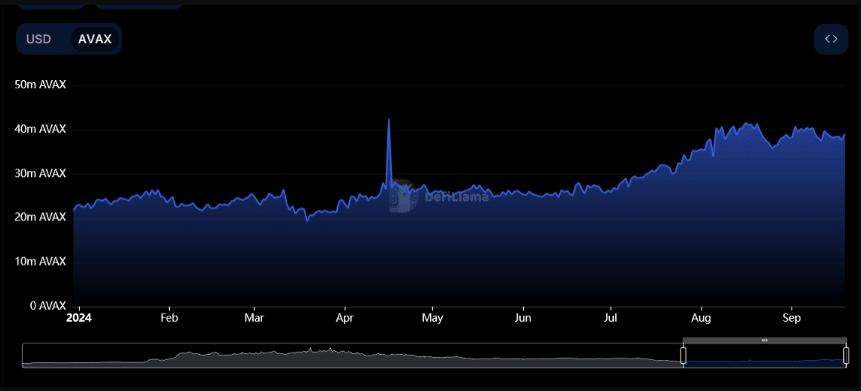

The current price increase goes beyond purely macroeconomic considerations. As Avalanche continues to increase its total value (TVL), Avalanche is also making big strides in the decentralized finance (DeFi) department.

From 28.1 million AVAX in the first quarter to 30.8 million AVAX in the second quarter, Avalanche’s TVL has risen 11% in recent months, according to data from DeFiLlama. The TVL for all protocols on the network was 38.63 million AVAX on September 18.

Evaluating adoption and liquidity within DeFi networks critically depends on TVL. A higher TVL usually indicates that more people are locking assets in DeFi systems, which would translate into greater price stability and long-term expansion for AVAX.

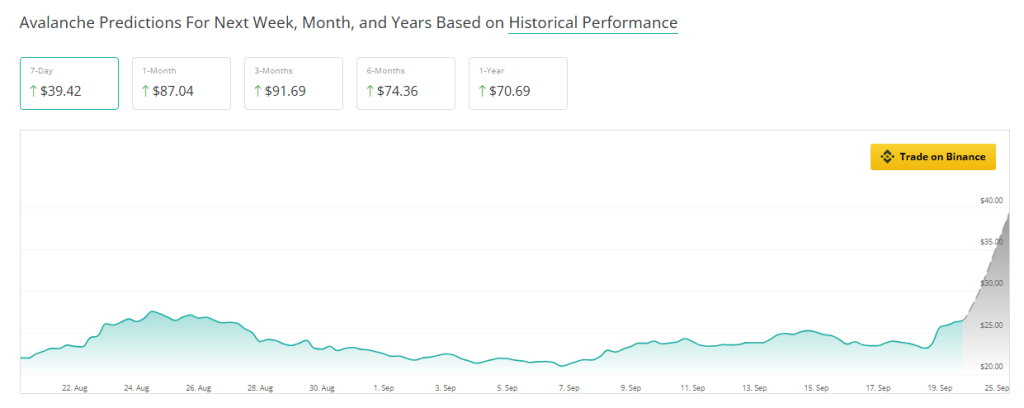

AVAX projections: short term/long term

AVAX technical indicators point to a bright future. Backed by significant accumulation and improving market sentiment, analysts estimate that the token could rise 245% in the next three months. In six months, a gain of 180.19% is expected; an increase of 166.37% will follow in the coming year.

As Avalanche gains traction in both its DeFi space and the larger crypto market, these predictions confirm that productive months lie ahead.

The influence of the Fed

While the Federal Reserve’s rate cut has given the market some major momentum, some experts believe its impact could be transitory. While the longevity of this increase is still unknown, risky assets such as cryptocurrencies generally respond significantly to changes in interest rates. But with about half of AVAX holdings currently profitable, investor attitudes are generally positive.

All eyes are on the token’s ability to break major resistance levels as Avalanche gains traction in the DeFi market. Should the state of the market remain positive, AVAX could be on a path to growth in both the long and short term.

Featured image from Pexels, chart from TradingView