- BTC bulls managed to take advantage of the earlier dip to test the $61,000 ceiling.

- The critical task now is to preserve $64,000; Missing this level could lead to a likely retracement.

Bitcoin [BTC] approaching its late August high of $64K. Until this resistance is broken, breakout potential remains uncertain as underlying factors can disrupt momentum and delay a breakout if conditions waver.

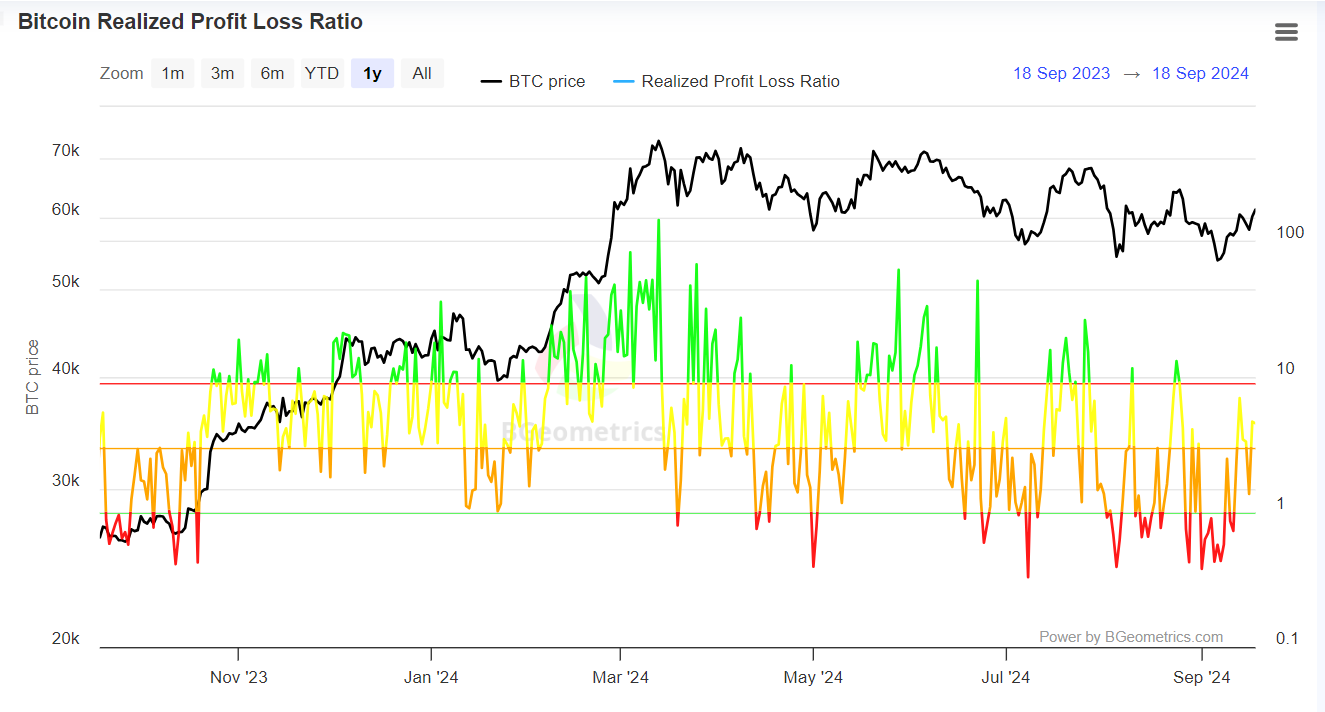

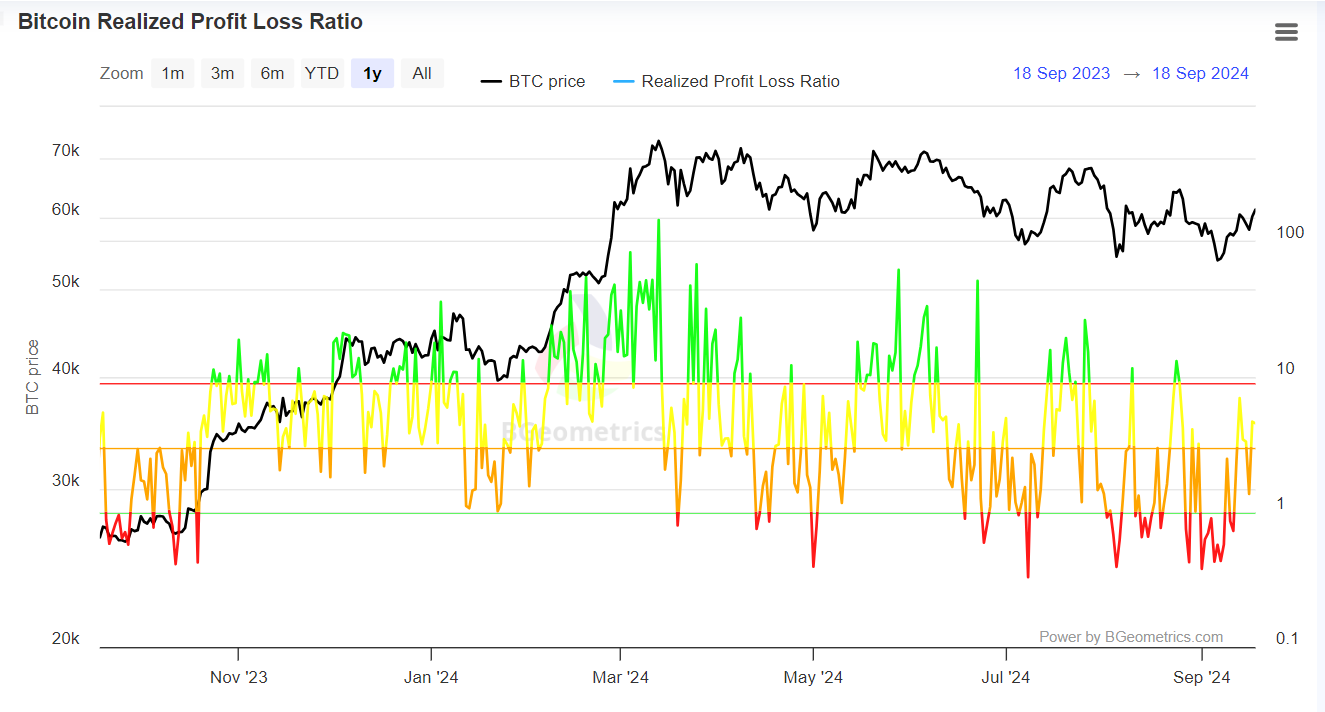

Bitcoin market realizes profits

A year ago, Bitcoin participants suffered losses, as evidenced by a net RPL ratio approaching zero. Simply put, the amount of BTC sold at a loss was high.

This typically happens during times of high volatility, when stakeholders lose confidence in the trend reversal.

Source: BGeometrics

A year later, the BTC market is now seeing significant gains, encouraging stakeholders to hold on for future gains. The Fed’s rate cut has certainly fueled this trend.

However, the market is still in a neutral phase. A significant boost could turn the net RPL ratio into the green, which could potentially signal a market top, according to AMBCrypto.

In summary, the market has not yet reached its peak, indicating a bullish outlook and potential for future growth. The key question is whether bulls will benefit from this trend or retreat for smaller gains.

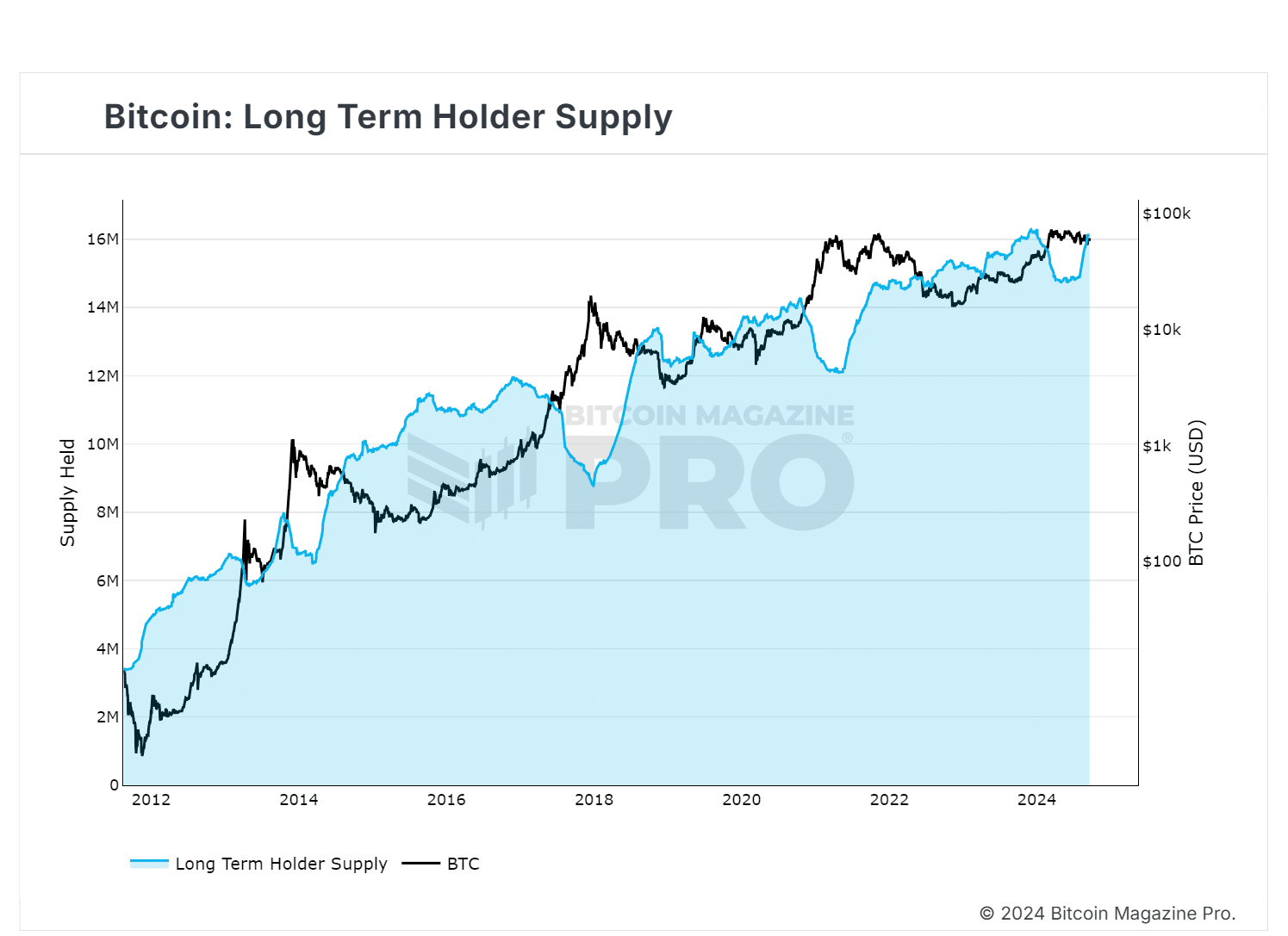

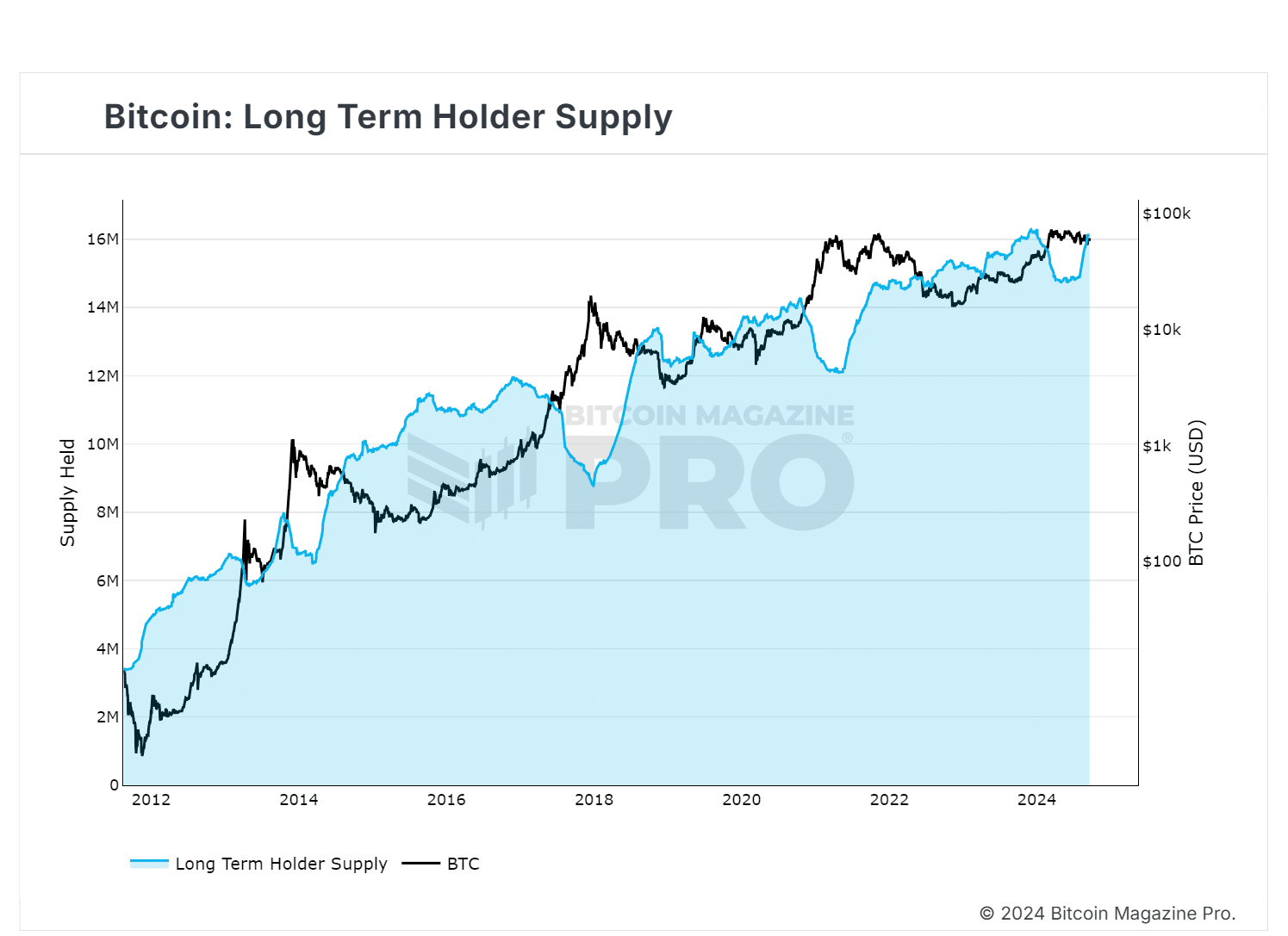

LTHs benefit from the BTC price bottom

Historically, sharp declines in BTC supply for more than 155 days often indicate market tops as holders sell at a profit, leading to price declines.

The latest instance occurred at $71K, where BTC’s pullback below $55K saw a surge in supply volume, indicating that long-term holders bought the dip.

Source: Bitcoin Magazine Pro

This added to the optimismthat large holders view $64K as a price floor, accumulating for future gains and targeting the next resistance around $70K.

Overall, the rate cut has complemented this strategy, increasing the likelihood of a recovery and strengthening confidence in asset retention. However,

Caution is advised

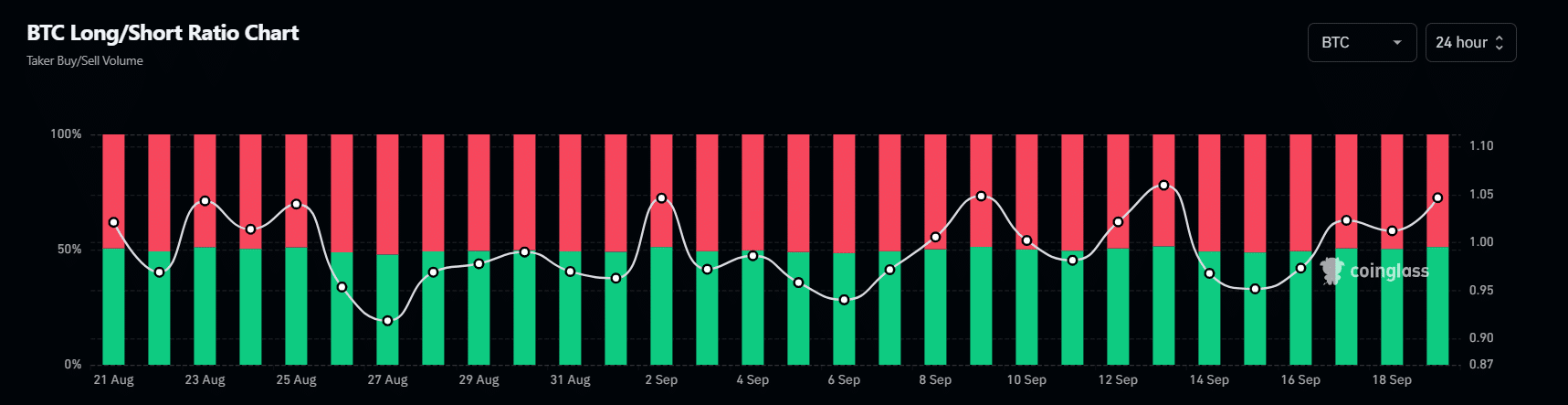

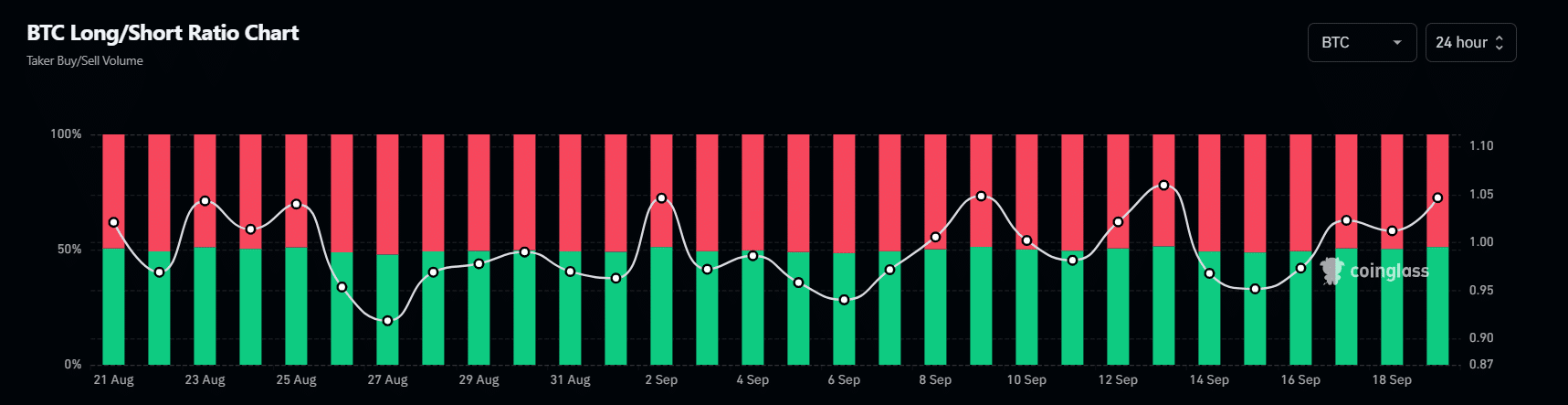

It is no surprise that BTC is vulnerable to fluctuations in the perpetual market. Currently, longs dominate speculative trading, with institutions refraining from shorting Bitcoin.

Source: Coinglass

A similar pattern occurred early in the last week of August, with longs outpacing shorts for three days, creating conditions ripe for a short squeeze.

Read Bitcoin’s [BTC] Price forecast 2024-25

Still, BTC plummeted from $64,000 to less than $55,000 the next day as shorts regained dominance. Overall, holding $64,000 is critical to prevent this scenario from happening again.

Although the current charts favor the bulls, caution is advised. Otherwise, one A retracement to $55,000 remains a possibility if the bears regain control.