- Sui’s TVL exceeded $1.03 billion, indicating growing liquidity and greater confidence in the network.

- With rising active addresses and market activity, SUI is positioned to break the $1.38 resistance.

Sui [SUI] has reached a major milestone, with its total value (TVL) exceeding $1.03 billion on September 19. This achievement reflects the growing confidence and capital inflow into the blockchain decentralized finance (DeFi) ecosystem.

With Sui trading at $1.34, reflecting a 14.84% increase in the last 24 hours at the time of writing, the question now is: could this spark a bullish rally and push the price of SUI above the current $1, can push 38?

TVL Growth: A Catalyst for Momentum

Sui’s meteoric rise from $802 million to $1.03 billion in TVL in a short period of time signals greater confidence in its ecosystem. The accompanying chart shows that Sui’s TVL has seen consistent growth, especially in 2024, peaking at $1 billion.

TVL is an important metric in DeFi as it reflects the total capital tied up in smart contracts, boosting liquidity and attracting developers to the platform.

Reaching $1 billion isn’t just a psychological barrier; it solidifies Sui’s position among the best DeFi protocols. The additional liquidity can attract more users and investors, further boosting the network’s adoption and long-term prospects.

Source: DeFiLlama

Rising active addresses: growing user participation

Sui has also seen an increase in the number of daily active addresses, from 1.47 million to 1.66 million, representing a 12.93% increase in just one day. This increase indicates a growing commitment to the platform’s decentralized applications and services.

A growing user base often translates into more assets being locked into smart contracts, which could support the upward trajectory of Sui’s TVL and contribute to future price movements.

Source: SuiVision

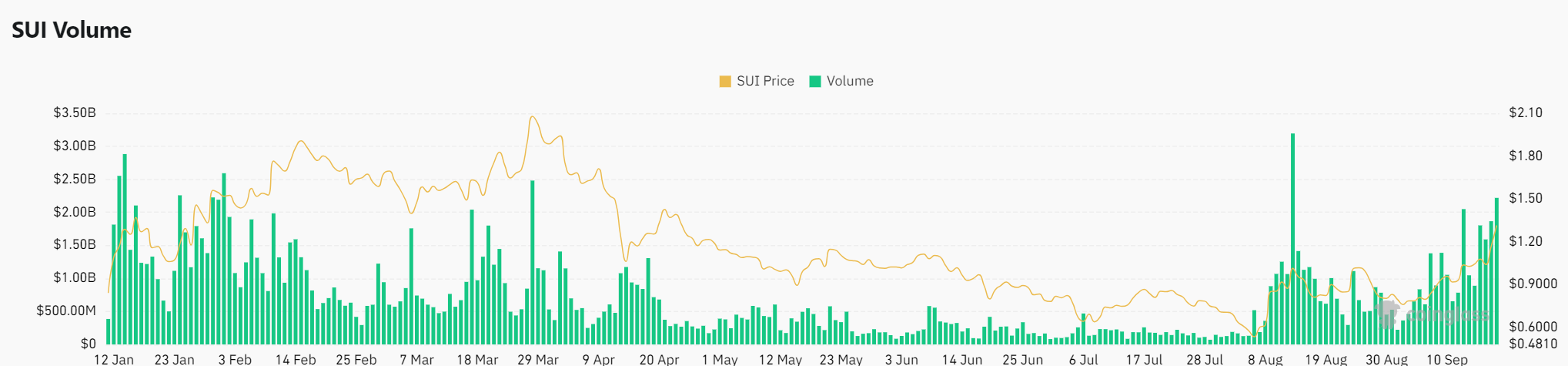

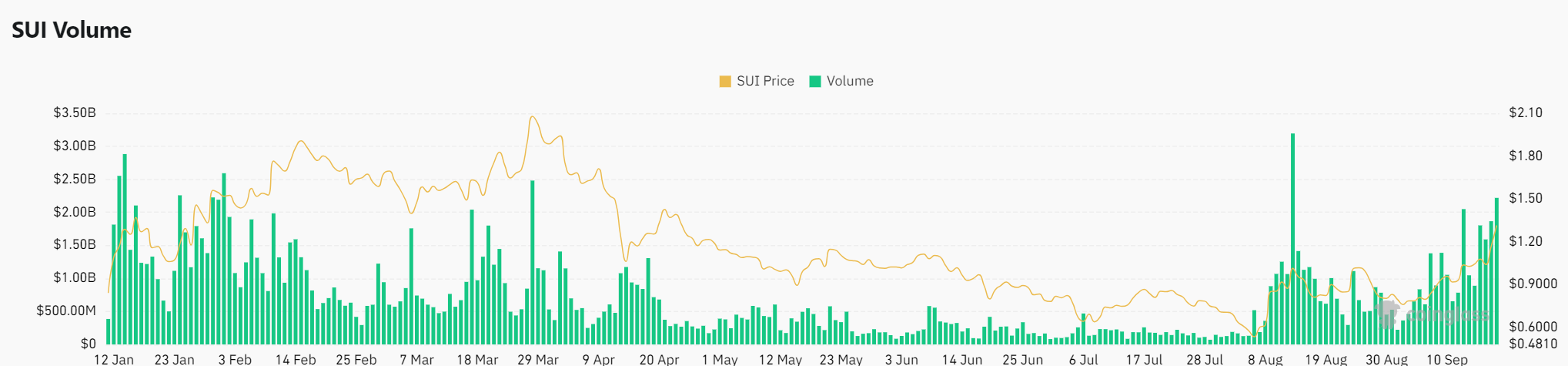

Volume and Liquidity: Signs of a Bullish Outlook

Sui’s derivatives volume of $2.49 billion, up 35.57% in 24 hours at the time of writing, indicates increased market activity.

Source: Coinglass

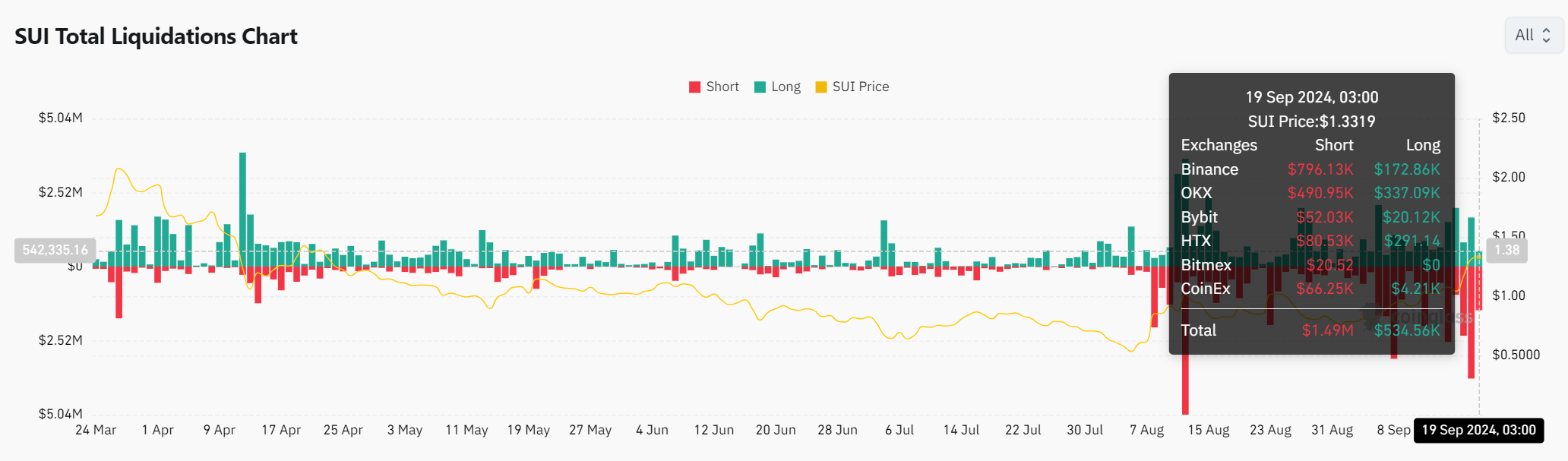

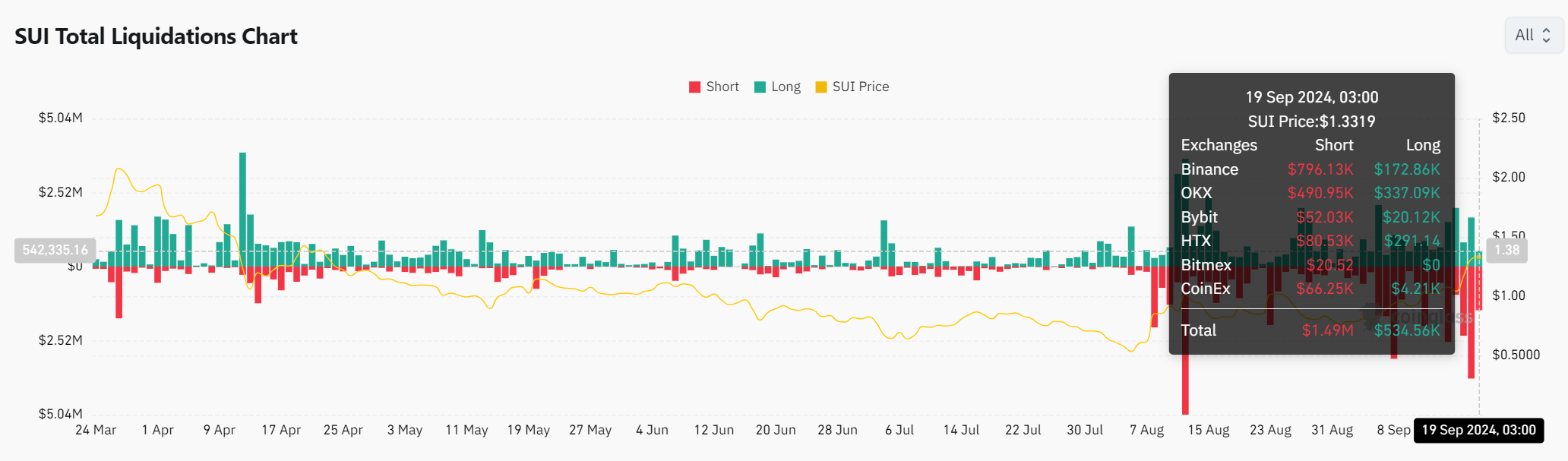

Additionally, the liquidation chart shows $1.49 million in short liquidations versus $534,560 in long liquidations, indicating a shift in sentiment as shorts are squeezed out of the market.

Source: Coinglass

This signals potentially bullish momentum, especially as trading volumes rise alongside TVL growth.

Can SUI break $1.38?

Given rising TVL, increased user activity and strong trading volumes, Sui is positioned for a potential breakout.

Read Sui [SUI] Price forecast 2024-2025

The $1.38 price level is a critical resistance, and if Sui can surpass it, it could signal the start of a sustained bullish rally.

Investors will be watching closely to see if this momentum can push prices higher.