- Bitcoin’s dominance rises above 57.68%, with indicators pointing to potential bullish volatility.

- Activity in the chain is increasing, while the MVRV ratio indicates potential buying opportunities for investors.

Bitcoin [BTC] has made a major breakthrough by closing its dominance level at 57.68% for the first time since April 2019. Historically, when Bitcoin’s dominance reached such levels, it initiated a long-term uptrend, pushing its dominance to 71%.

With this recent breakout and Bitcoin currently trading at $59,179, up 0.73% in the past 24 hours at the time of writing, many are speculating whether it is on the verge of another massive rally.

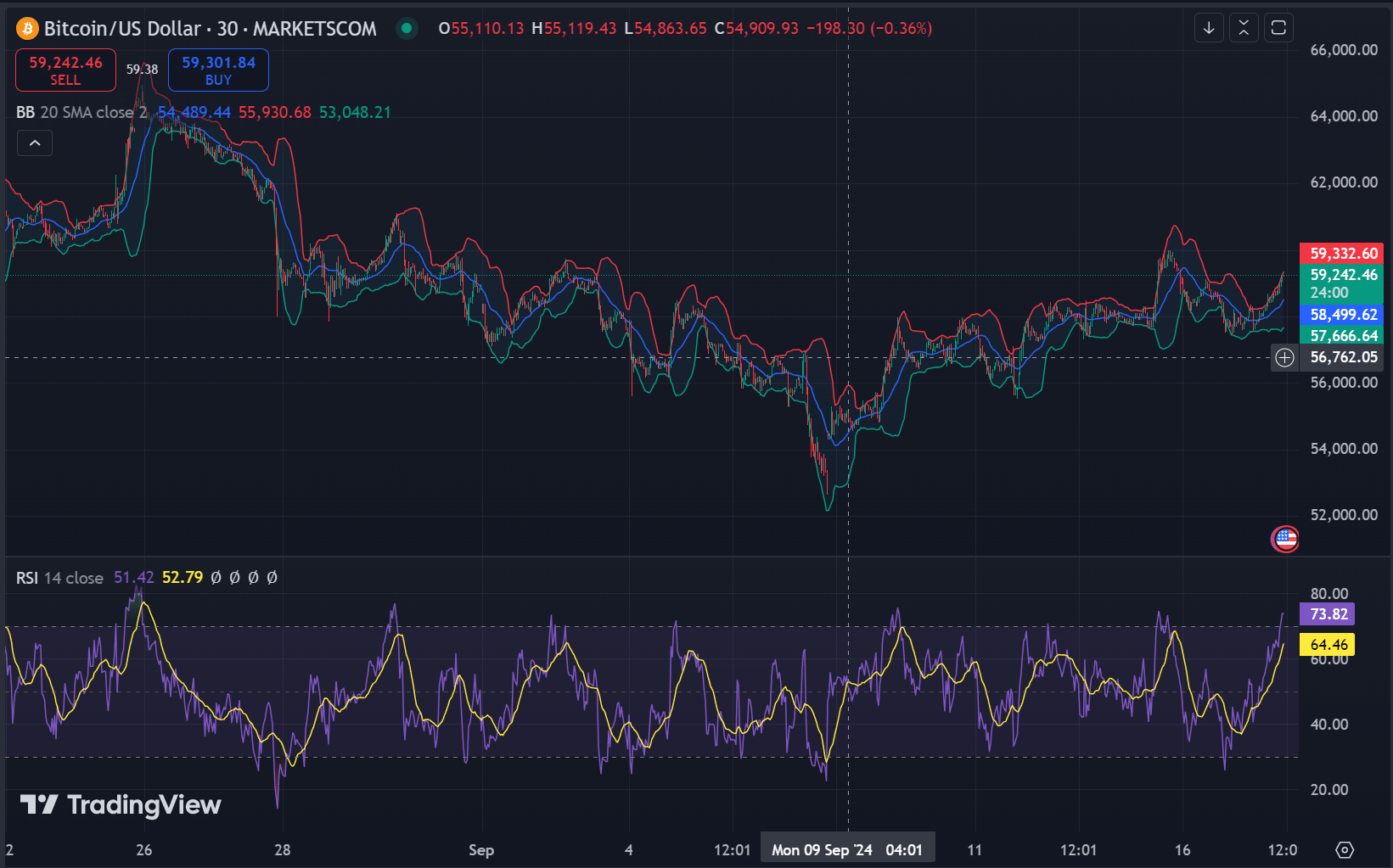

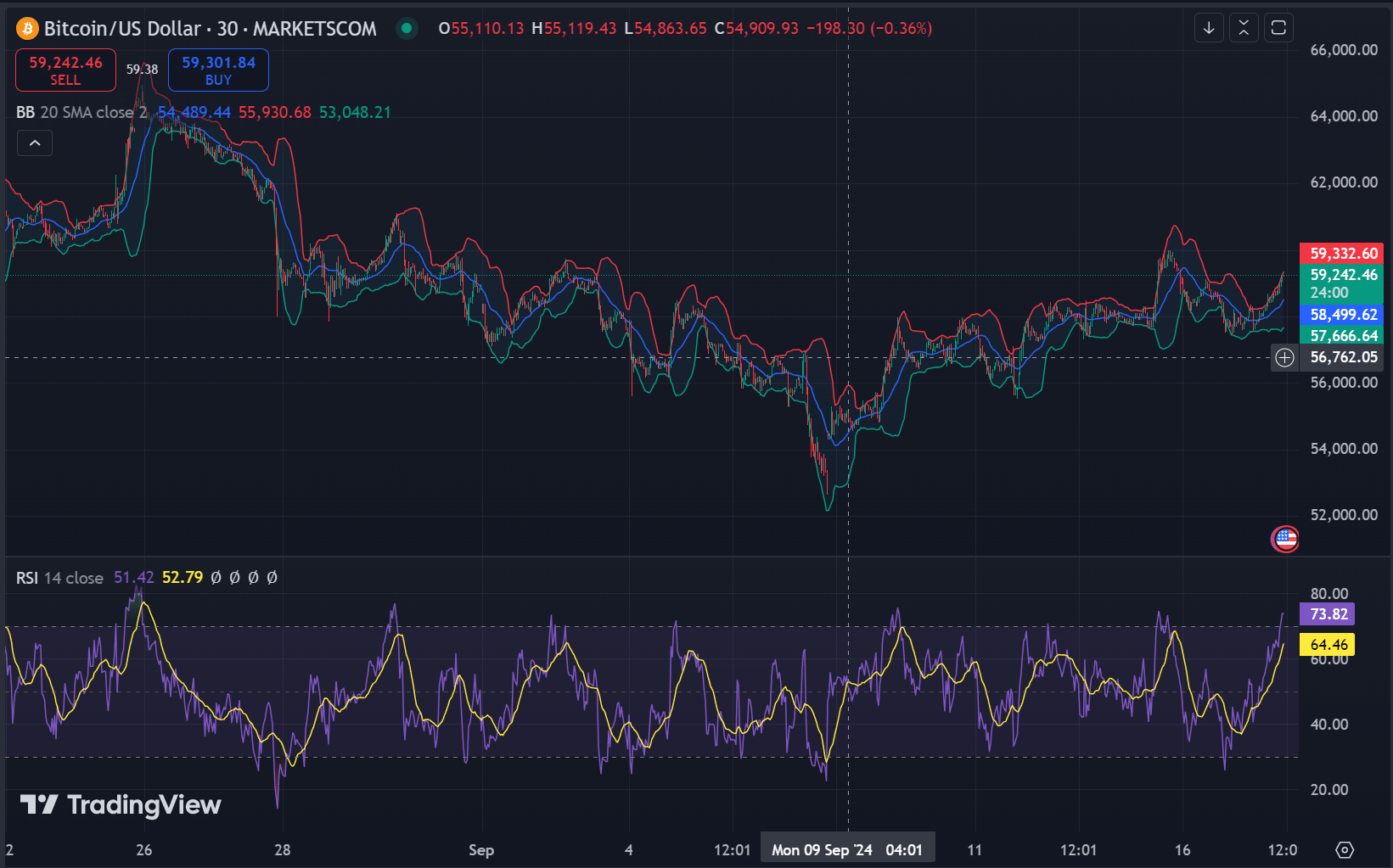

RSI and Bollinger bands suggest potential upside

Bitcoin’s RSI currently stands at 51, reflecting a neutral market with no signs of extreme buying or selling pressure. Meanwhile, the Bollinger Bands show BTC near the upper band, often indicating potential upside price volatility.

If BTC can break above the $59,000 threshold on strong volume, it could signal further price growth that could maintain or expand its market dominance.

Source: TradingView

Foreign exchange reserves indicate long-term holders

Bitcoin’s foreign exchange reserves stand at 2.585 million BTC, with only a small increase of 0.04% in the last 24 hours. While this indicates short-term selling pressure, the overall trend over the week shows a decline in reserves.

This indicates that investors may be moving Bitcoin off the exchanges and into cold storage, a strong signal of long-term confidence.

Source: CryptoQuant

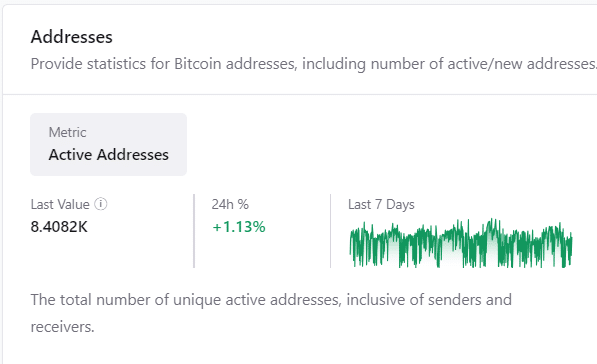

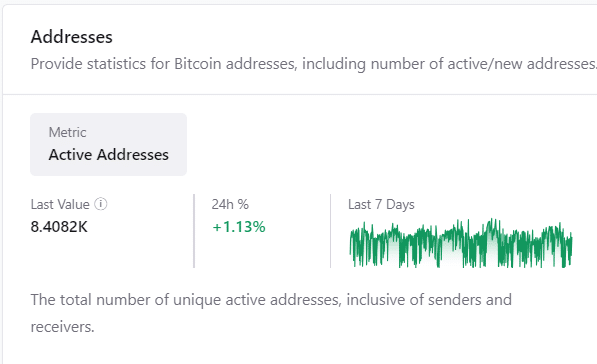

Active addresses and transactions show strong network activity

Bitcoin’s network continues to show robust activity, with over 8.4 million active addresses, reflecting a 1.13% increase over the past day. The number of transactions also rose to 515,260 in the past 24 hours, an increase of 0.83%, according to CryptoQuant data.

Source: CryptoQuant

This steady growth in on-chain activity supports Bitcoin’s dominance, highlighting its strong network fundamentals.

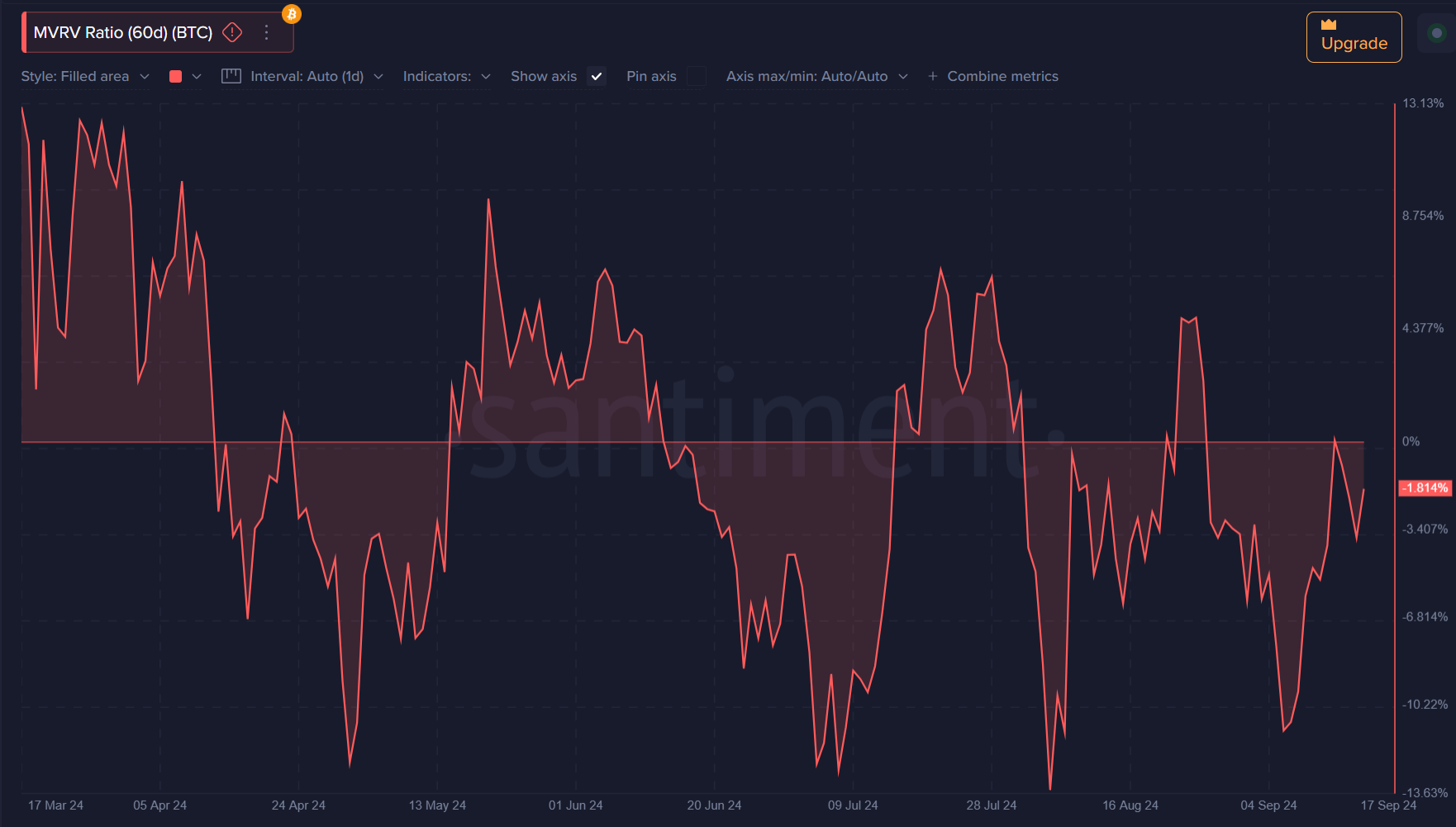

The MVRV ratio indicates a buying opportunity

The 60-day MVRV ratio currently stands at -1.81%, indicating that investors are holding Bitcoin at a small loss on average.

Historically, negative MVRV values have signaled undervaluation, indicating that Bitcoin could be poised for an upward correction, making this a potential buying opportunity.

Source: Santiment

Read Bitcoin’s [BTC] Price forecast 2024-25

Can Bitcoin Lead the Market to a New Bull Run?

With a dominance of over 57.68%, strong on-chain fundamentals and technical indicators aligning, Bitcoin may be gearing up for another big rally.

However, key levels like $59,000 and continued network activity will be crucial in confirming whether Bitcoin can extend its dominance and reignite a broader bull market.