- BTC continues to fall as speculation about federal rate cuts continues.

- Analysts see a recovery to $62,000 after the FED decision.

Bitcoin [BTC] has experienced extreme volatility over the past month. Although it has tried to break the September curse over the past week, the crypto has not had enough momentum for the uptrend.

This past week has seen BTC move from a local low of $52546 to a local high of $60,670. However, it has suffered fluctuations in the past 24 hours, losing most of its gains. At the time of writing, BTC was trading at 58,552. This represented a decline of 2.38% in the past week.

Before this, Bitcoin was on the rise, rising 5.98% on the weekly charts. Although the crypto has fallen over the past 24 hours, trading volume has soared. In fact, trading volume increased 100% over the past day to $26.9 billion.

Current market conditions have sparked widespread debate. This has led many analysts to see the possibility of future Fed interest rates as the cause.

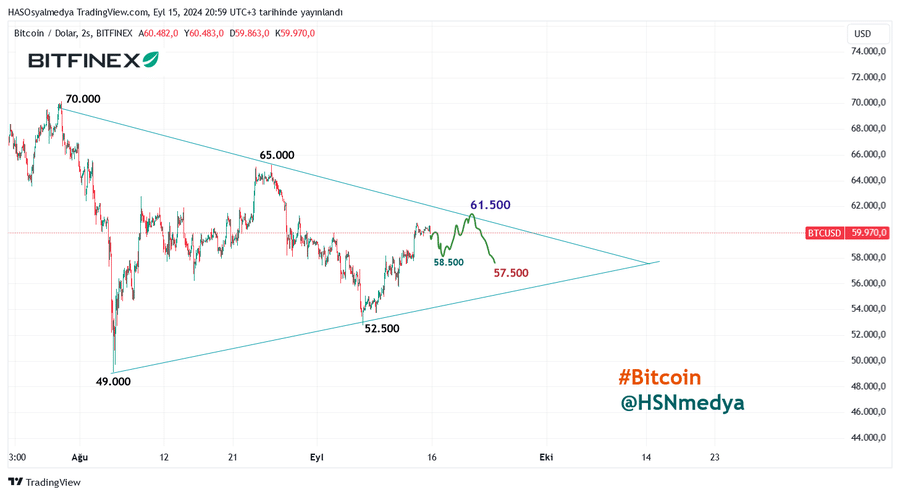

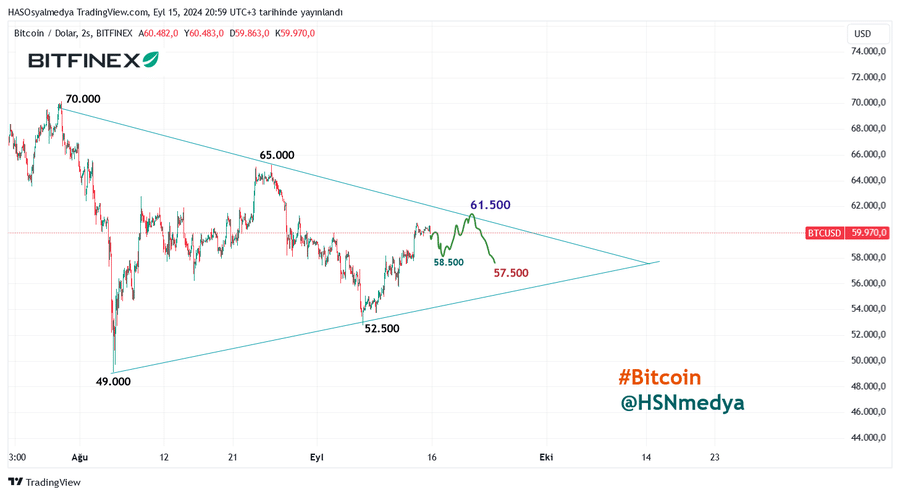

Popular crypto analyst Hasan has suggested that federal budget cuts are one of the factors driving market sentiment.

What’s next for Bitcoin?

In his analysis states Hassan this week cited upcoming federal budget cuts as the main factor fueling market uncertainty.

Source:

According to his analysis, BTC markets will see a sell-off of around $58,500, making this the critical support level until the federal austerity decision is announced.

However, the analyst states that even though markets may experience some sell-off at this level, he expects a recovery from this level to $61,500.

Therefore, if the FED announces 25 basis point rate cuts, BTC will rebound and price selling will rise to the $61,500 and $62,000 range.

However, if the market experiences a correction after the FED decision, BTC prices will fall to $57,500.

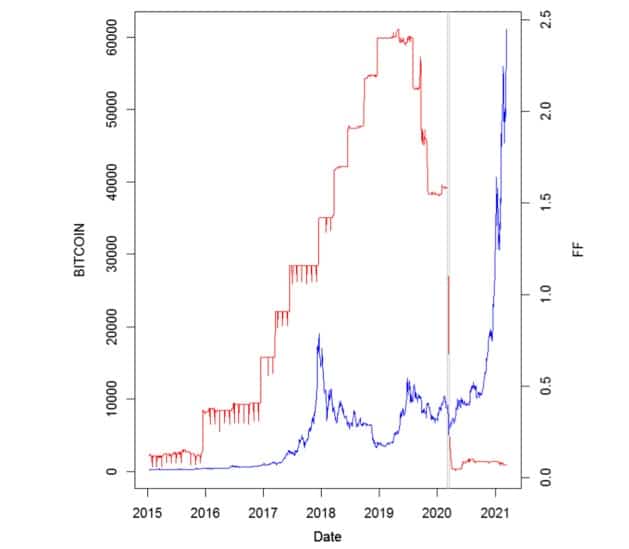

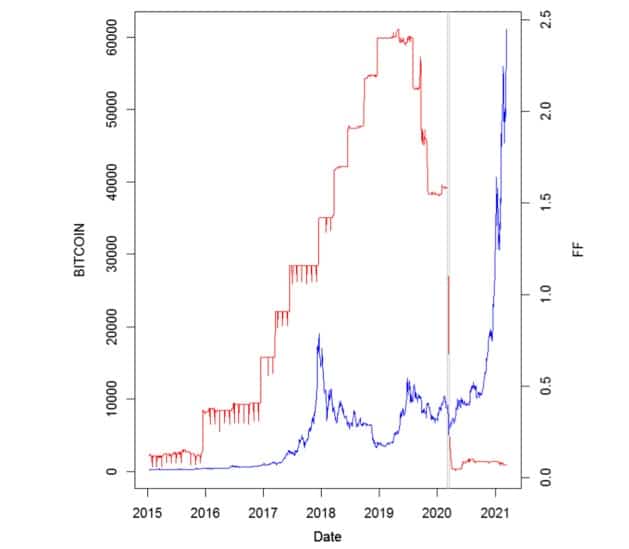

Source: Springer.com

Historically, federal interest rate cuts have had a positive impact on BTC prices. For example, in March 2020, BTC prices rose above their previous highs following the cuts caused by the COVID-19 economic shock.

Therefore, the expected interest rate cuts after four years will likely increase cash flow among retail and institutional traders, increasing the BTC fund flow ratio. However, if the crypto breaks away from the historical trend, it will undergo further correction.

What BTC Charts Suggest

As Hasan noted, market uncertainty has increased due to expected Fed rate cuts. Until then, current market conditions show a further decline.

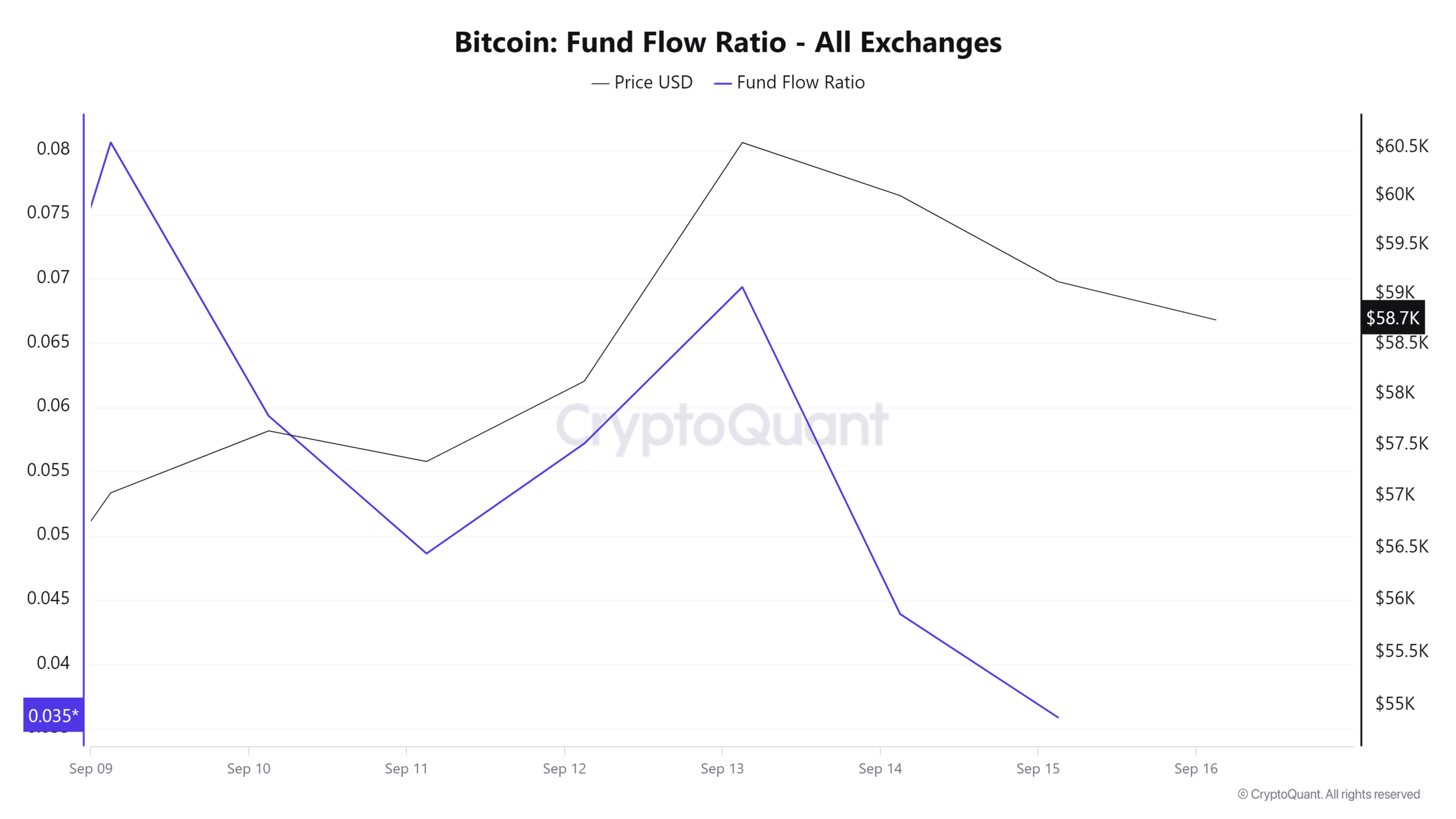

Source: Cryptoquant

For example, this past week, Bitcoin’s fund flow ratio fell from a high of 0.08 to 0.03. The decline indicates that more funds are leaving the market than entering. This flow is supported by a 100% increase in trading volume.

These trading activities therefore create selling pressure, causing prices to fall further.

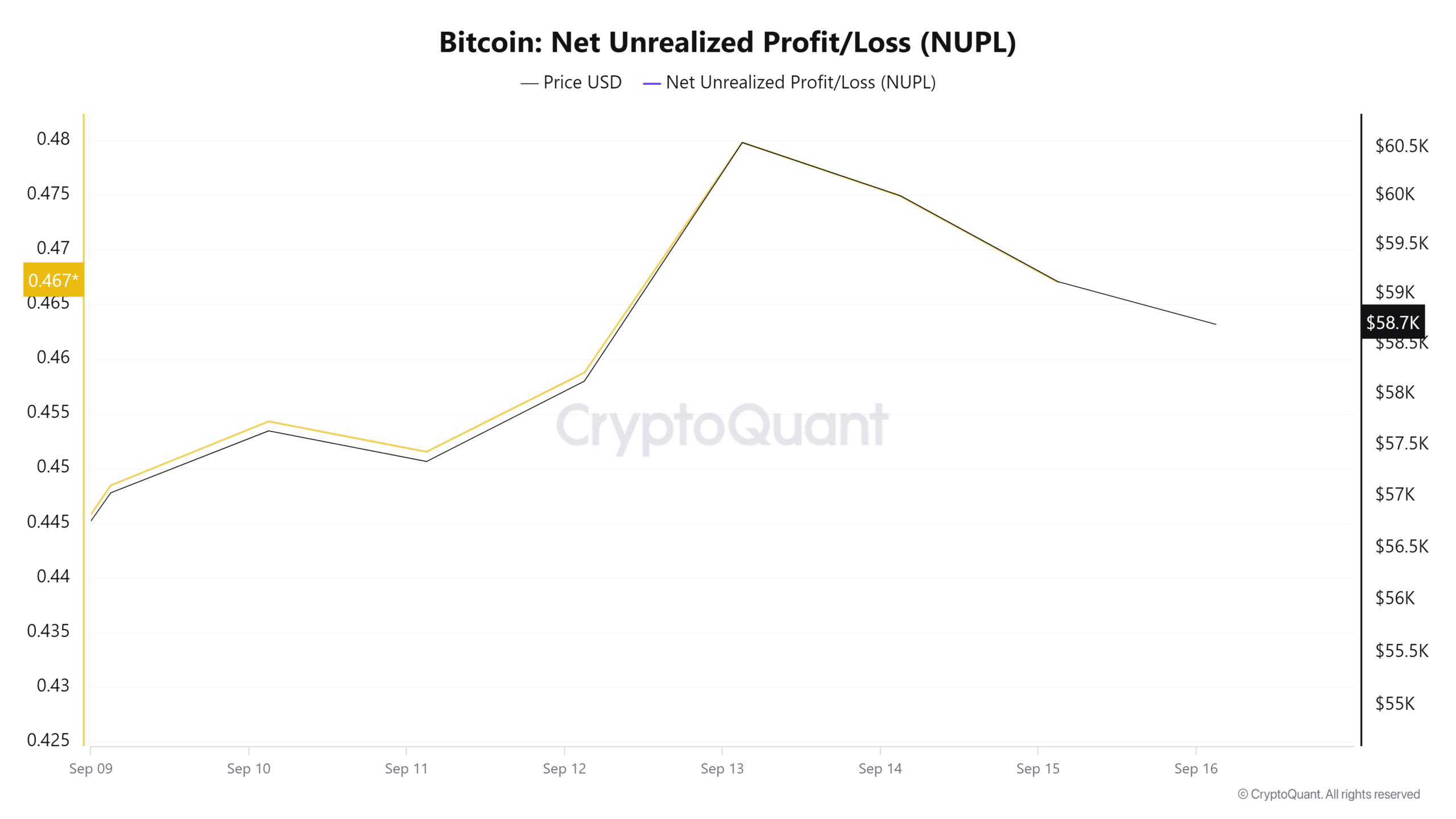

Source: Cryptoquant

Furthermore, BTC’s net unrealized gain/loss has declined over the past three days. This indicates that the number of holders with profits is decreasing, while the number of holders with losses is increasing.

Such a market condition leads to bearish sentiment as investors panic and sell to avoid further losses. This further leads to higher selling pressure.

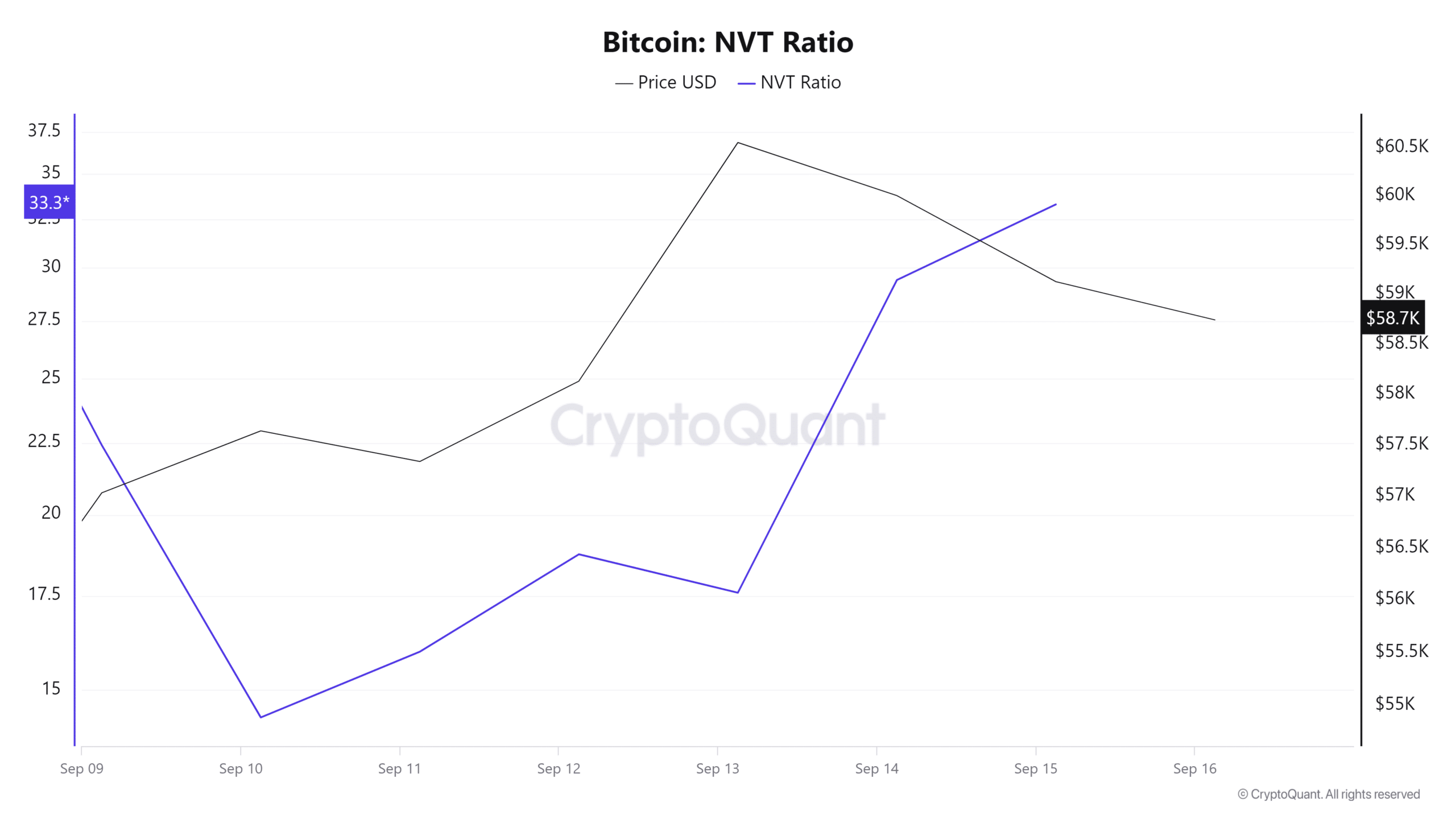

Source: Cryptoquant

Finally, Bitcoin’s NVT ratio has risen from a low of 14.3 to 33.3 over the past week. An increase in the NVT ratio suggests that the recent price increase was due to speculative purchasing.

Read Bitcoin’s [BTC] Price forecast 2024-25

Recent price growth is therefore unsustainable without adequate fundamentals to support it. This results in a market compatibility correction, which is what BTC is experiencing after the recent spike.

Therefore, until the FED rate is cut, BTC will continue to fall. If the market reacts positively to upcoming rate cuts, it will challenge $62,852. However, if the market experiences a correction, it will fall to $57,342.