- BTC has risen 9.92% over the past seven days, but fell again at the time of writing.

- Despite the surge, BTC remains in a bearish market, especially with declining transaction volume.

Bitcoin last week [BTC] has staged a recovery and temporarily returned to the $60k level.

Since hitting a local low a week ago, Bitcoin tried to maintain upward momentum but failed as it fell back below $60,000. On the plus side, prevailing market conditions have got analysts talking.

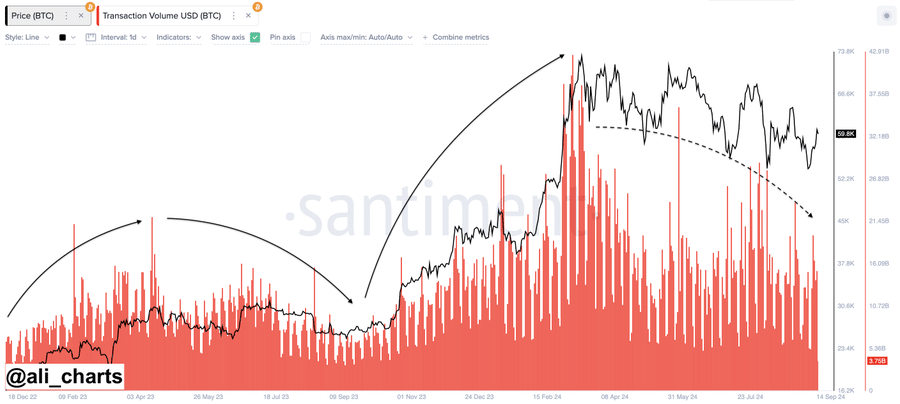

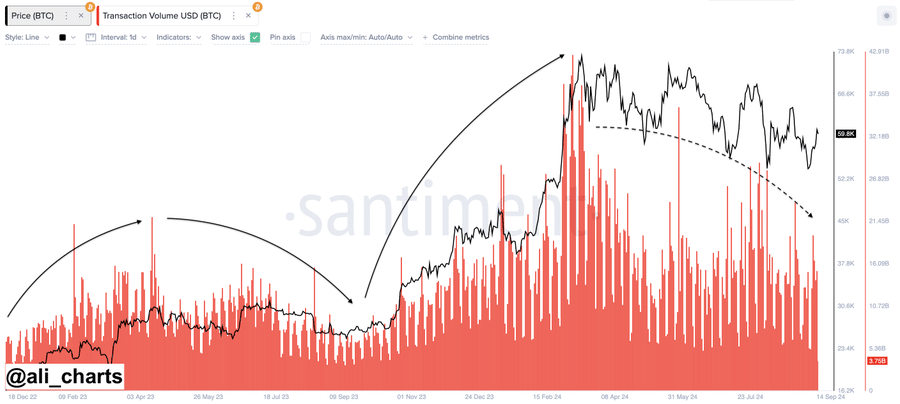

Popular crypto analyst Ali Martinez suggested that a trend reversal was not complete, citing Bitcoin’s transaction volume.

The prevailing market sentiment

In his analysis states Martinez cited declining trading volume, indicating no trend reversal has occurred.

Source:

According to this analysis, BTC transaction volume tends to increase during uptrends and decrease during a downtrend. Since the current situation has a decreasing trading volume, the market is still in a downward trend.

In this context, during a price uptrend, transaction volume increases as more investors actively buy and sell, resulting in higher market activity.

So an increase in volume usually confirms the strength of an uptrend, because more investors are actively involved in the market.

Then, when the markets are in a downtrend, volume decreases. Lower volume indicates fewer market participants. This indicates that bearish market sentiment is still at play.

As Martinez notes, Bitcoin trading volume is down 58.66% over the past day. Therefore, based on this analysis, BTC is still in a bearish market.

What BTC Charts Suggest

As noted by Martinez, bears still dominate the market even though BTC has tried to break out. Therefore, current market conditions could cause Bitcoin to decline.

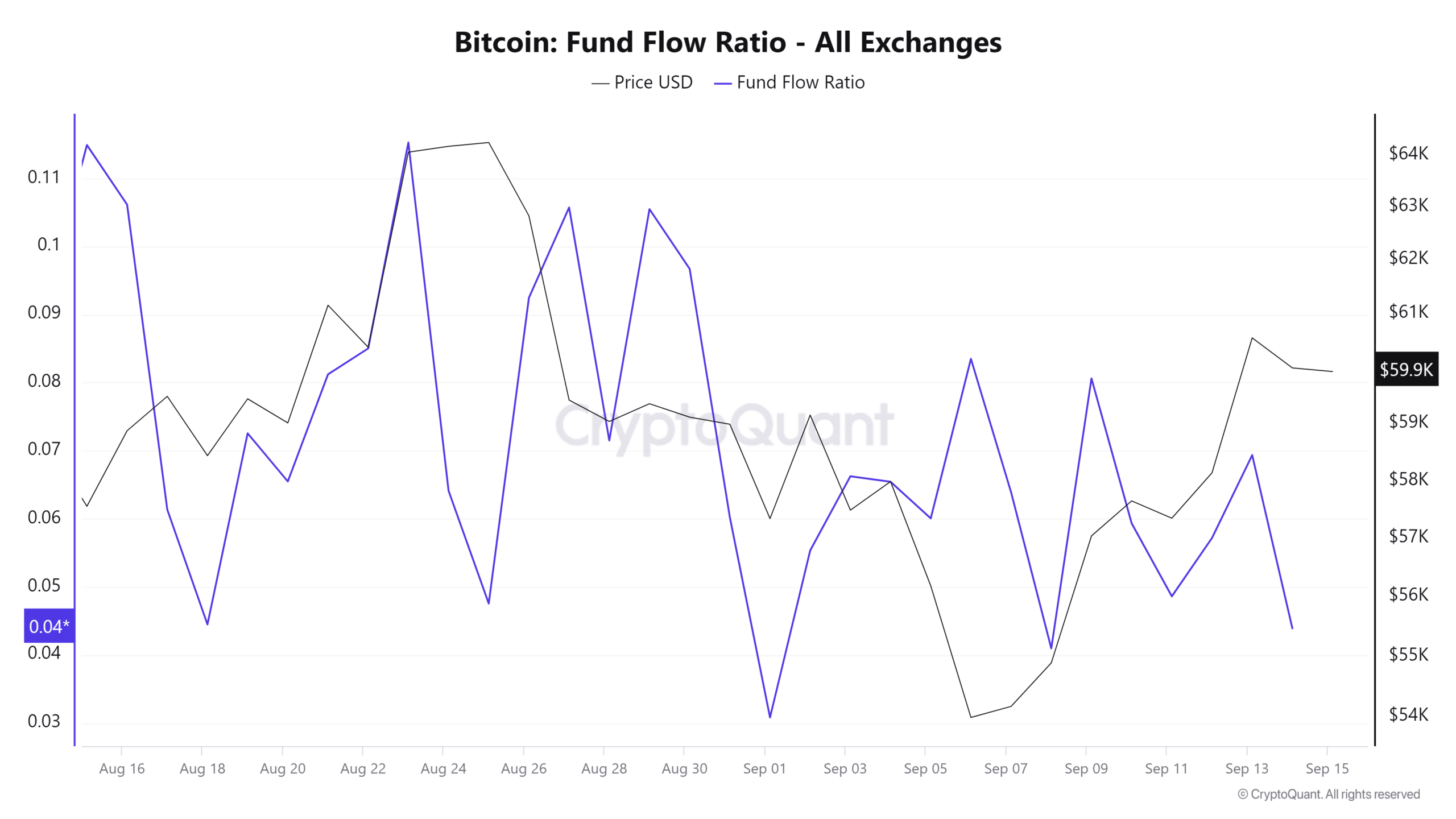

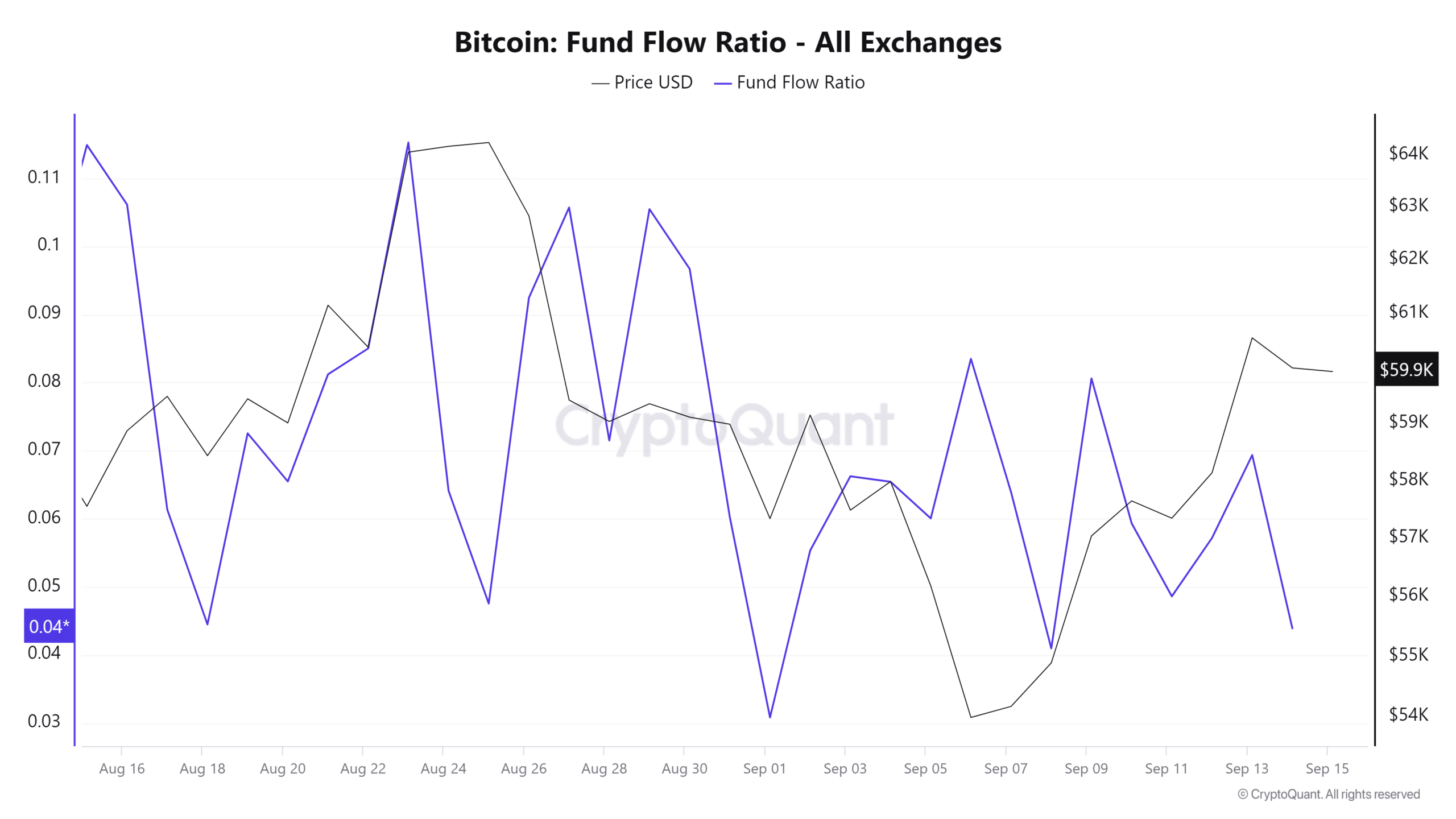

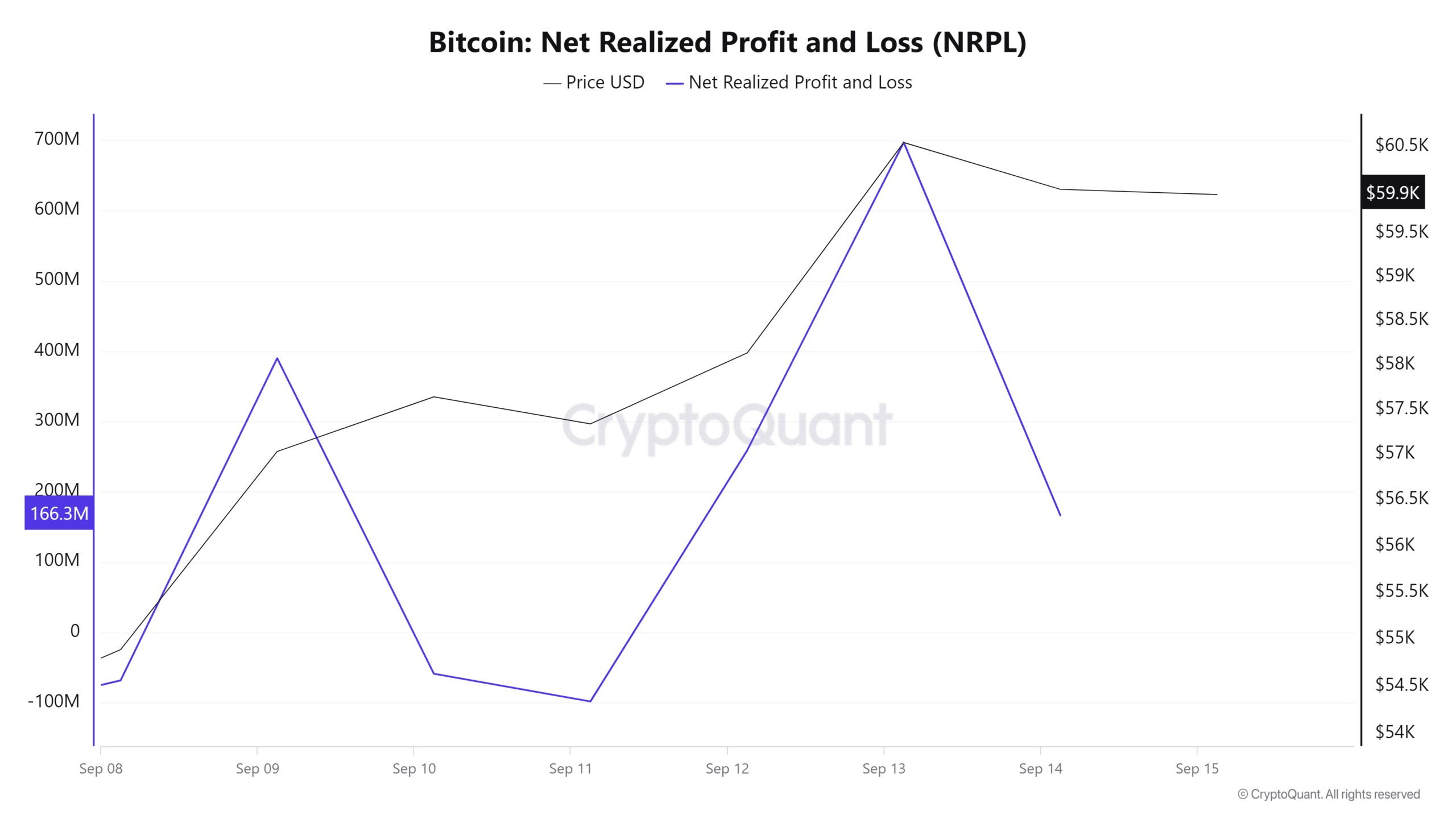

Source: Cryptoquant

For example, Bitcoin’s fund flow ratio has fallen over the past week. This implies that there is less buying activity compared to selling, meaning few investors are injecting their money into the market.

This is bearish market sentiment as investors close out their positions, adding to downward price pressure.

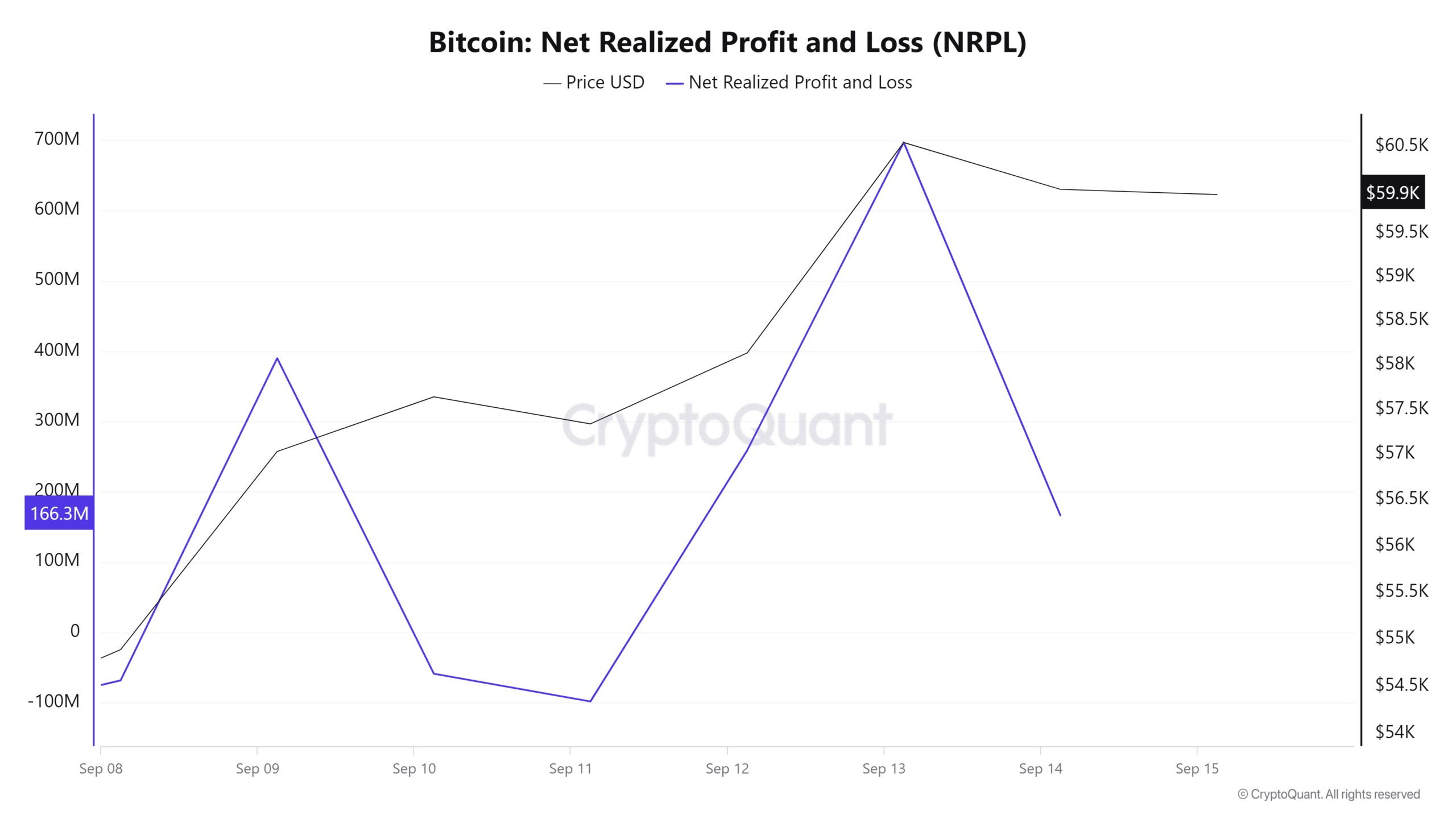

Source: Cryptoquant

Additionally, Bitcoin’s net realized gain/loss has declined over the past two days, after peaking the previous days. A decline in the NRPL implies that investors are selling at a loss.

Source: Santiment

This suggests that there is reduced demand for BTC as fewer buyers are willing to buy at higher prices or there is less trading activity.

Finally, Bitcoin’s price-DAA divergence has remained over the past week. A negative DAA divergence means that Bitcoin prices increase while daily active addresses decrease.

Read Bitcoin’s [BTC] Price forecast 2024–2025

This suggests that even though prices are rising, the fundamental use of the network is not catching up. This is bearish as the price increase is just a speculative rally.

Simply put, as Martinez points out, Bitcoin is still in a bearish trend. So if this negative market sentiment continues, BTC risks a decline to $57342.