- Analysts believe the crypto market will “bounce” once Bitcoin sees a major breakout

- Altcoins are expected to benefit significantly when this breakout occurs

The global cryptocurrency market capitalization has been in flux in recent weeks, experiencing both rises and falls. After rising as much as $2.7 billion in March, the market has struggled to maintain its momentum since then, with periodic rate hikes failing to recover from the broader downtrend.

At the time of writing, the global cryptocurrency market capitalization had fallen 1.4% to $2.122 trillion. This, after a brief rise to $2.140 trillion earlier in the day. This volatility is largely driven by Bitcoin, the dominant player in the cryptocurrency market.

Bitcoin itself has shown a mix of bullish and bearish trends. After briefly crossing $58,000 yesterday, Bitcoin fell below this threshold again. At one point, it was even trading as low as $57,292, after falling 0.5%.

However, despite this uncertainty, analysts continue to share insights into the future of the crypto market, with many predicting major moves.

Popular crypto analyst CrediBull has offered a particularly compelling perspective. According to him, The Bitcoin Breakout out of the current consolidation phase will trigger a broader market rally.

Analyst Outlook on the Coming Crypto Bull Run

CrediBulls insights on He believes that Bitcoin’s impending breakout from its five-month consolidation phase will likely see the entire crypto market boom.

However, CrediBull warned that not all altcoins will benefit equally. Some, especially those who form distribution tops over several months, may see temporary ‘dead cat bounces’ before experiencing a further downward phase known as a ‘markdown’ of the crypto market.

The analyst advised investors to be cautious, suggesting that these temporary upticks could be the last chance to exit certain altcoins before deeper declines occur.

Looking at Dogecoin (DOGE) as an example of altcoin performance, the memecoin reflects the volatility of the Bitcoin market. DOGE briefly traded above $0.104 on Monday, but the gains were short-lived, with assets correcting to $0.098 mid-week.

However, DOGE has since registered some recovery and was trading at $0.1031 at the time of writing, having risen 0.4% in 24 hours. Despite these fluctuations, the memecoin’s resilience is a sign that some altcoins may still have room for growth amid uncertainty.

The DOGE fundamentals point to potential market stability

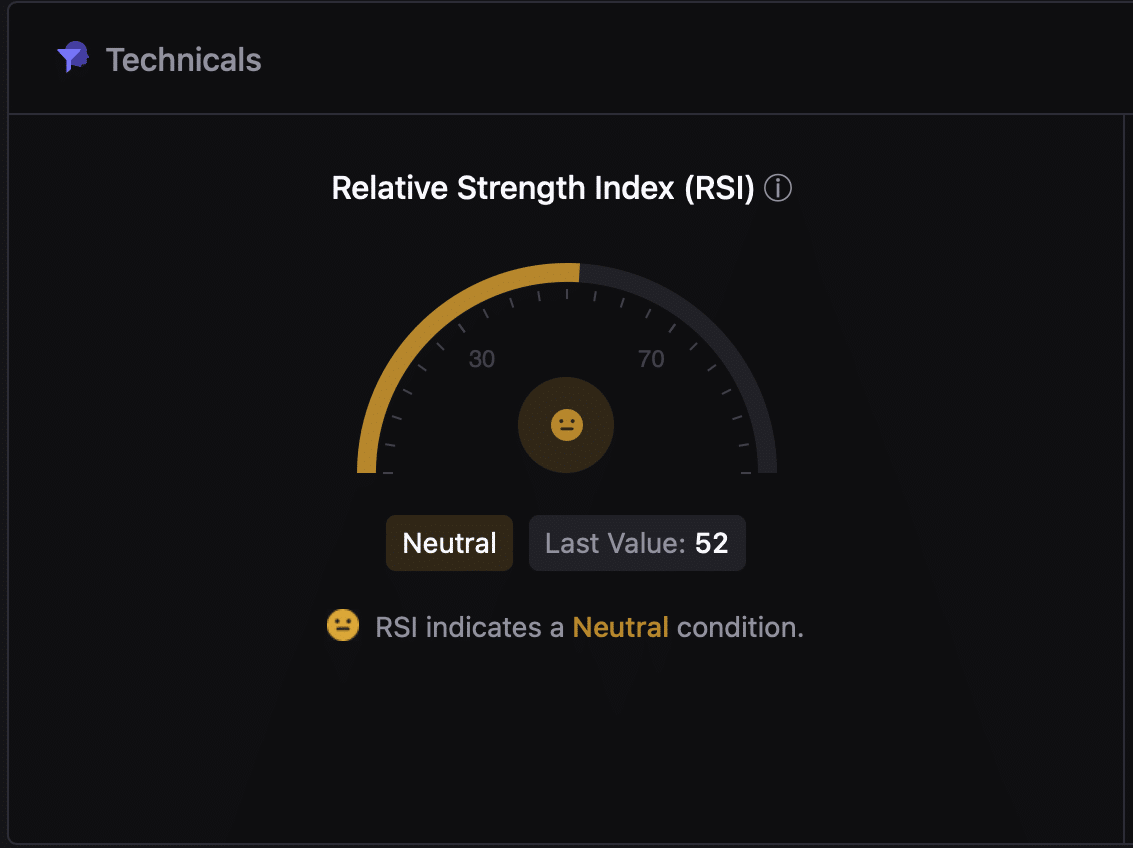

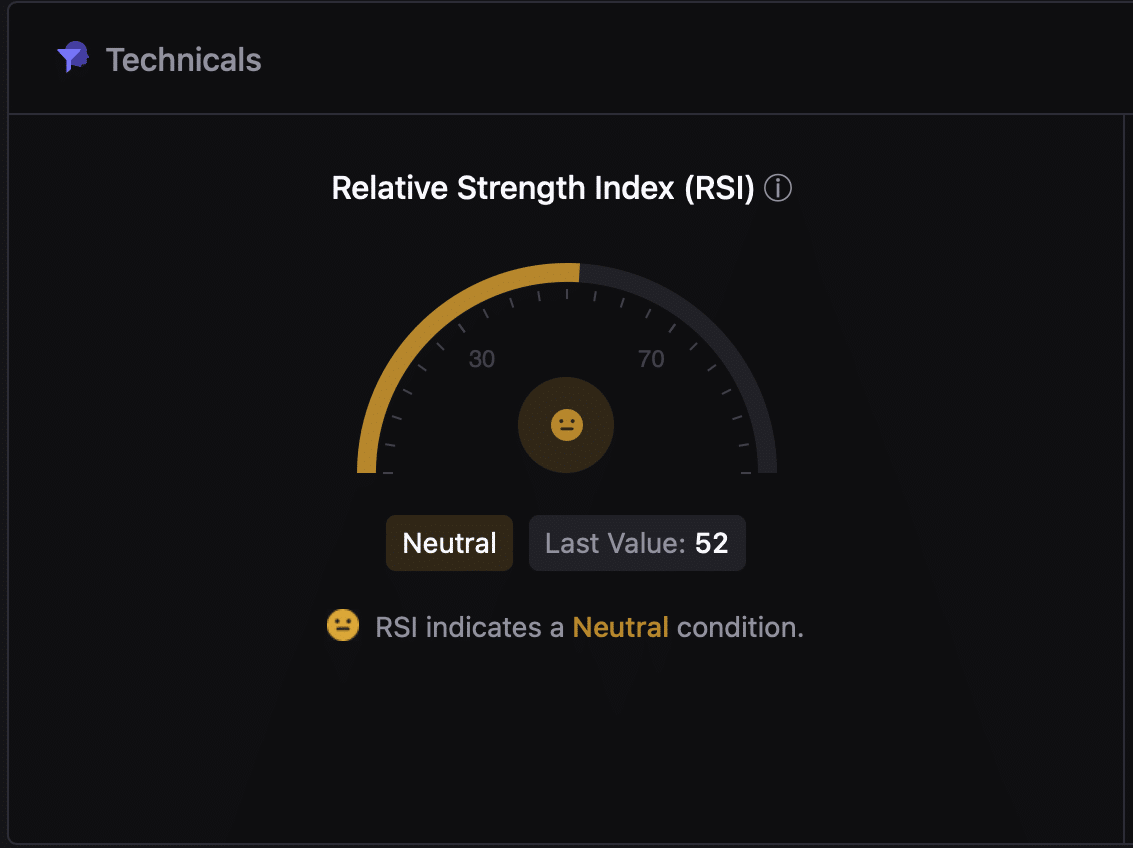

In addition to the price action, assessing DOGE’s fundamentals gives us additional insights into the market potential. For example – According to facts of CryptoQuant, DOGE’s Relative Strength Index (RSI) had a value of 52, indicating neutral market conditions.

Source: CryptoQuant

An RSI reading between 30 and 70 means the asset is not overbought or oversold – a sign of potential short-term price stability.

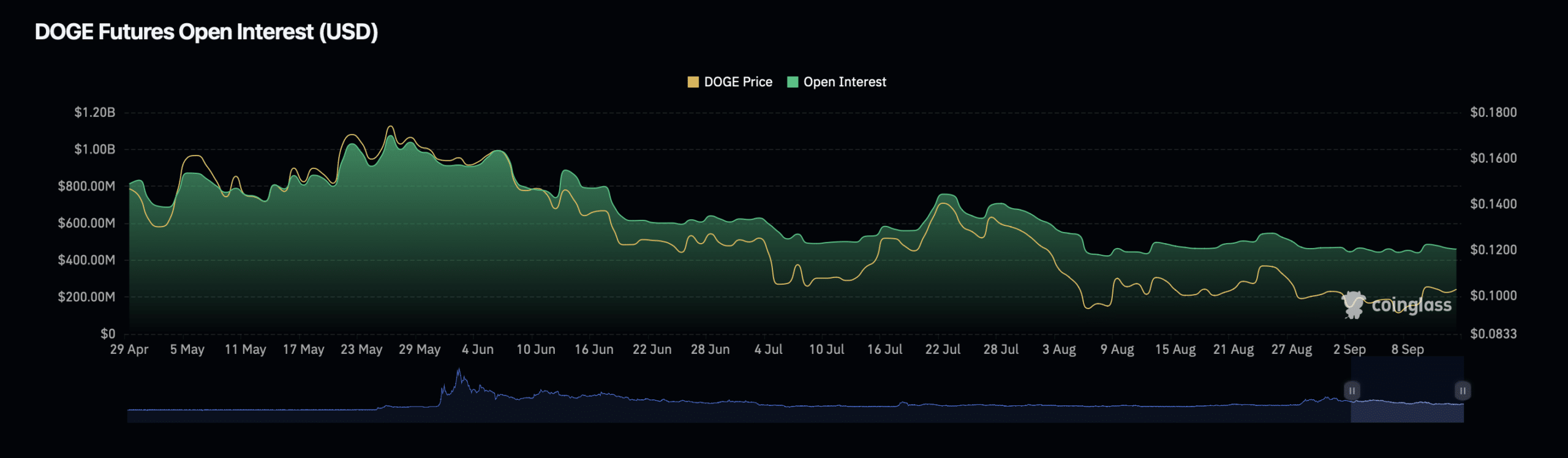

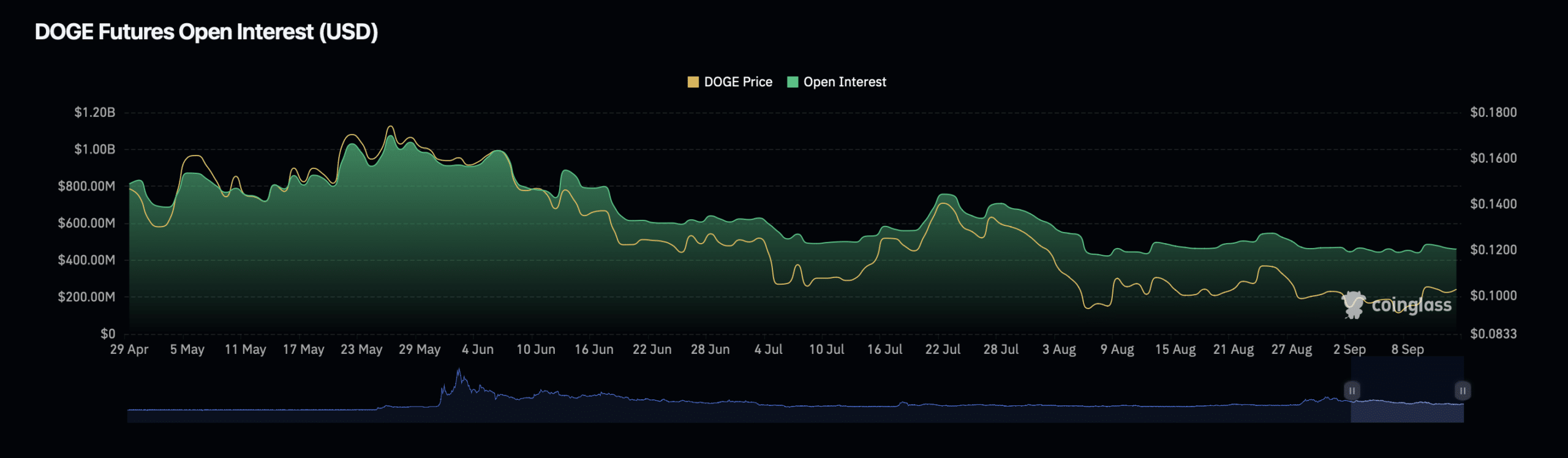

Additional, facts from Coinglass suggested that DOGE’s Open Interest rose 1.46% to reach a valuation of $476.12 million. On the contrary, the asset’s Open Interest volume also fell by 13.46%, to $670.33 million.

Source: Coinglass

The revival of Open Interest, despite the decline in volume, could imply that investors are cautiously positioning themselves in the market. They may be doing this while anticipating future price movements in the DOGE charts.