- Bitcoin moved closer to a supply crunch and a major rally as foreign exchange reserves fell lower.

- A CryptoQuant analyst highlighted why BTC reserves and increasing stablecoin supply pointed to an upcoming major rally.

Bitcoin [BTC] holders have been expecting a major bullish breakout in 2024. But as the year nears its end, many are wondering if the bull run has been canceled.

Before the heights of expectation descend into the valleys of despair, there are still signs that Bitcoin bulls may still emerge.

According to CryptoQuant analyst TarekBitcoin’s next big bullish move is fast approaching.

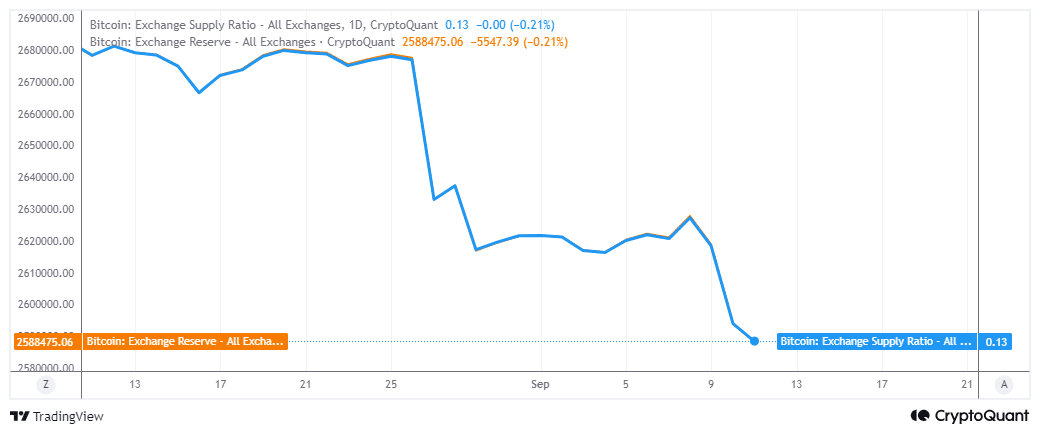

The analyst highlighted dwindling Bitcoin exchange reserves as the first major sign. This decline has accelerated over the past three days, after previously registering an increase between September 4 and 8.

Source: CryptoQuant

Currency reserves fell by 39,356 BTC (worth approximately $2.28 billion) during the three-day period. This could also explain why Bitcoin bulls have recently shown strength in recovering from recent local lows.

It also coincided with a revival in demand for ETFs.

Stablecoin reserves recently reached new highs

The dwindling reserves underline the tightening Bitcoin supply. The lower prices recently observed offered buyers, especially whales, a significant amount of time to accumulate lower prices.

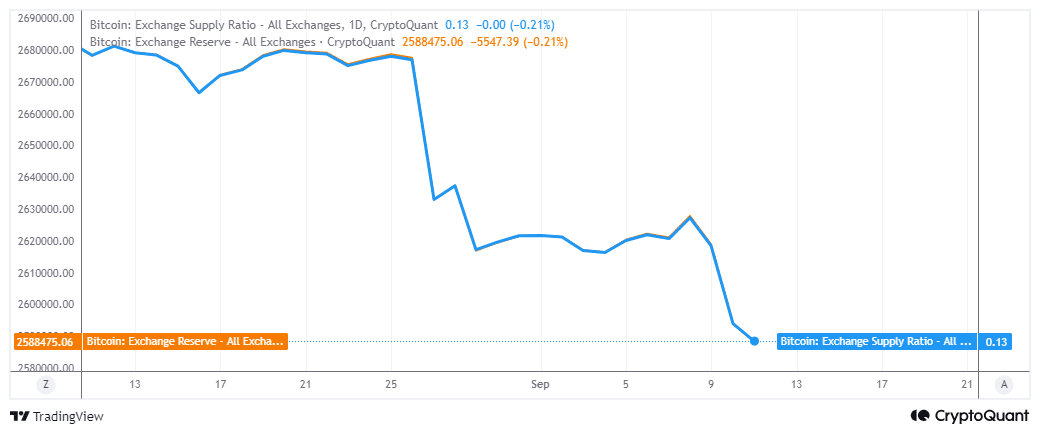

The analyst also pointed to rising stablecoin reserves as another sign pointing to the possibility of a rally.

Source: CryptoQuant

According to CryptoQuant, the total ERC20 market cap for stablecoins on exchanges recently reached a new ATH of over $25.5 billion.

The analyst noted that the rapidly growing market capitalization of stablecoins is a sign that market demand for stablecoins is high. This usually happens when investors prepare to move liquidity into crypto.

The combination of declining Bitcoin reserves and growing stablecoin reserves indicates that a big rally is likely on the horizon.

Bitcoin has also shown strength above $50,000. An indication that any dip below that level would be seen as a large discount.

The above observations also align with the Bitcoin halving timeline. Historically, this event was followed by a large rally months after the halving.

The fact that institutional demand is now more present than ever could give Bitcoin another strong bullish move.

Read Bitcoin’s [BTC] Price forecast 2024–2025

What does this all mean for price action? Bitcoin could soon enter new price discovery regions. Some authorities in the investment landscape, such as Cathie Wood, expect prices to exceed $200,000.

Therefore, a more modest expectation would be above $90,000, possibly before the end of the year, and even higher in 2025.