- BTC bounced back to $58,000 after slower inflation data in August

- Alameda/FTX has returned more than $23 million in SOL as reimbursement for victims approaches

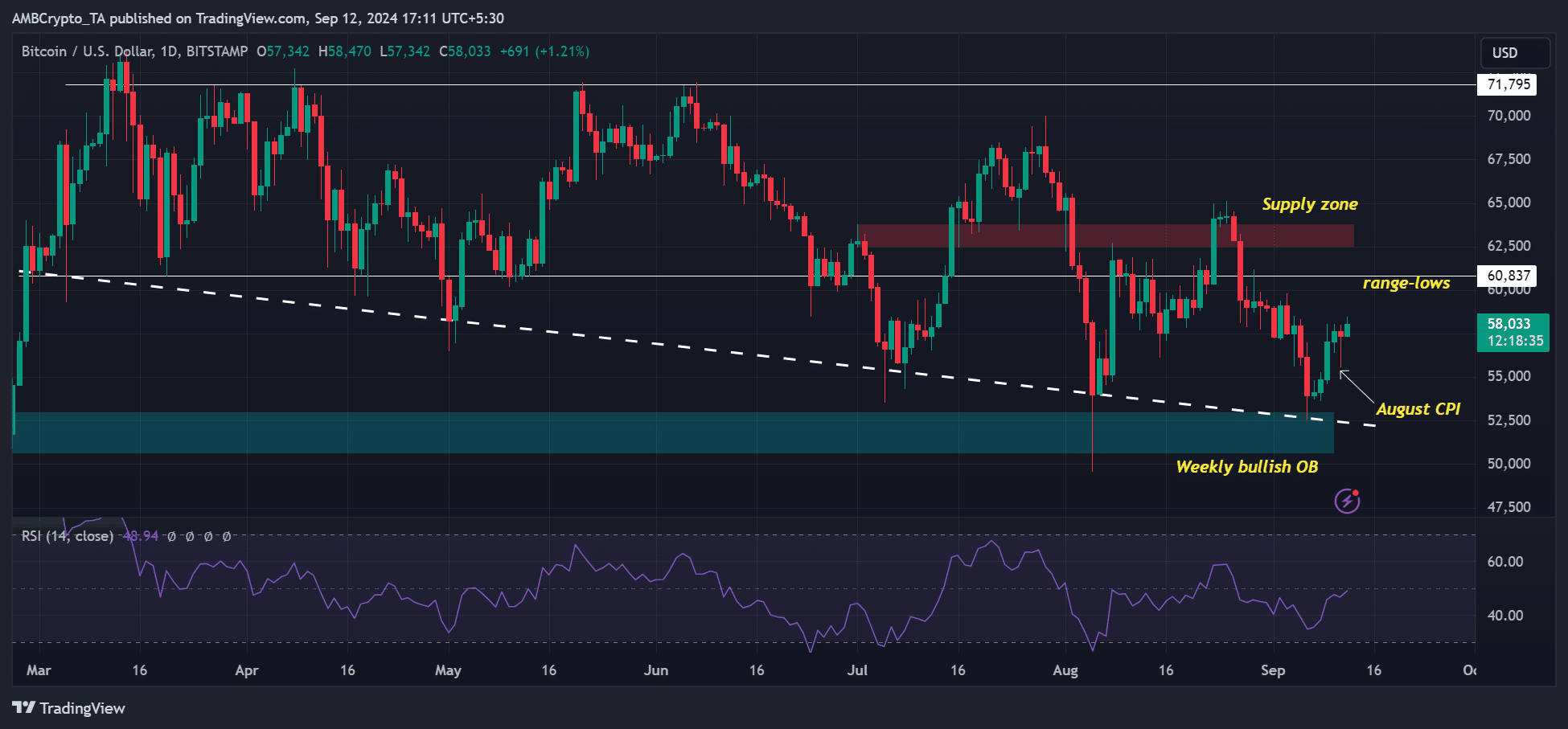

Bitcoin [BTC] recovered on Thursday after slower inflation data for August. The US CPI (Consumer Price Index) rose 0.2% last month, meeting analysts’ expectations. However, the core CPI was slightly higher at 0.3%, above the forecast 0.2%. The data caused the price of BTC to drop to $55.5k on the charts.

The decline preceded investors’ risk-off mode as BTC saw $750 million outflow from exchanges on September 10 – A day before the CPI data was even released.

Source: BTCUSD, TradingView

However, the world’s largest digital asset has undergone a reverse development and was valued at $58,000 at the time of writing. Commenting on the post-CPI move, Joshua Kang, Head of Trading at Mozaik Capital, noted that the market will focus on next week’s FOMC (Federal Open Market Committee) meeting. He said,

“I think we can use the dips to slowly scale up. There may be some volatility before or after the FOMC, but volume should provide continued upside in October.”

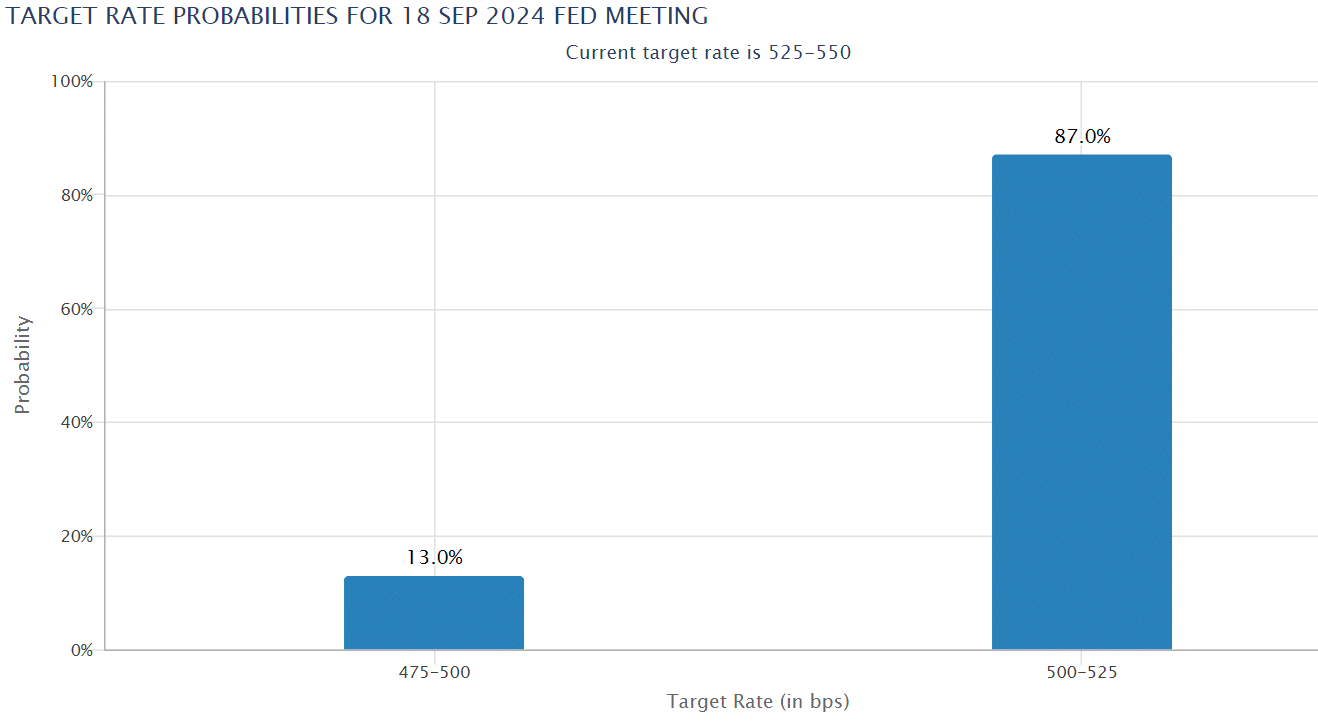

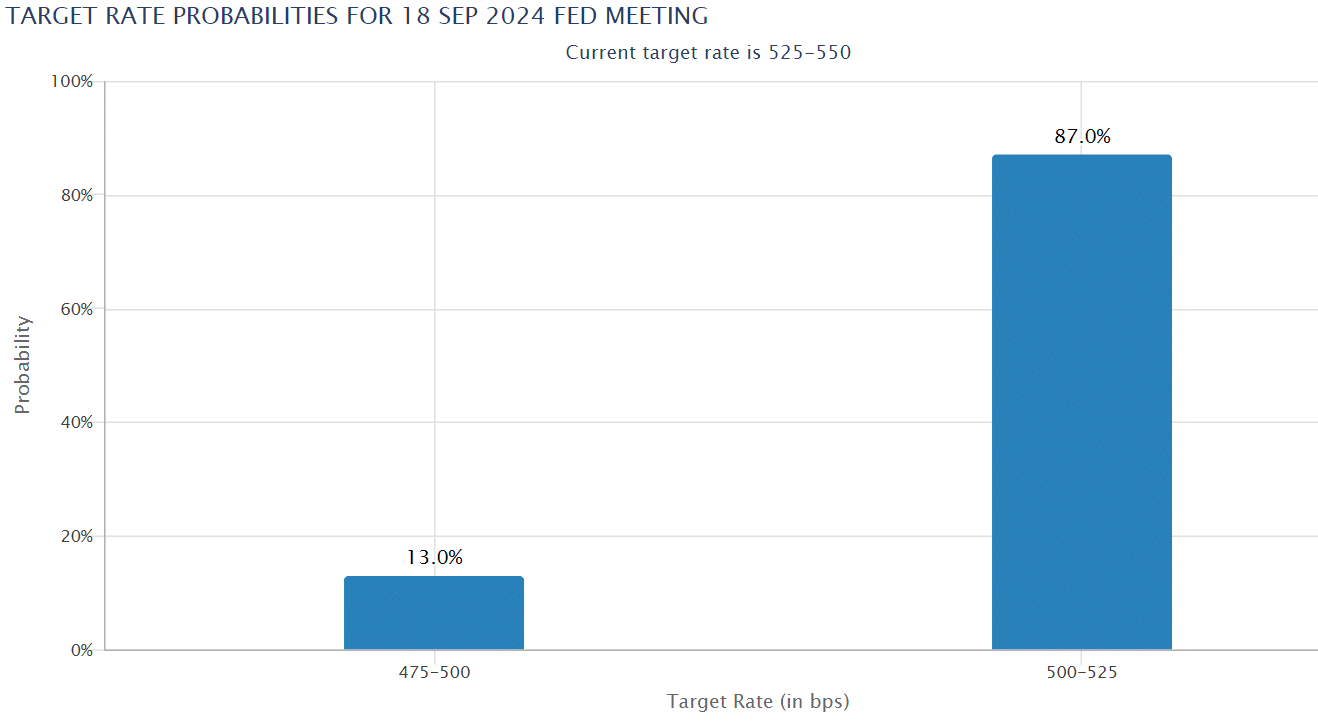

After the lower CPI, the market seemed to estimate an 85% chance of a 25 basis point Fed rate cut at the next FOMC meeting.

Source: CME FedWatch

According to crypto trading firm QCP Capital, demand for Bitcoin rose and painted a bullish outlook for the fourth quarter post-CPI data. The company said,

“Options activity reflects this, with demand growing for Calls with expiration dates from October to December.”

Alameda/FTX acquires $23.75 million SOL

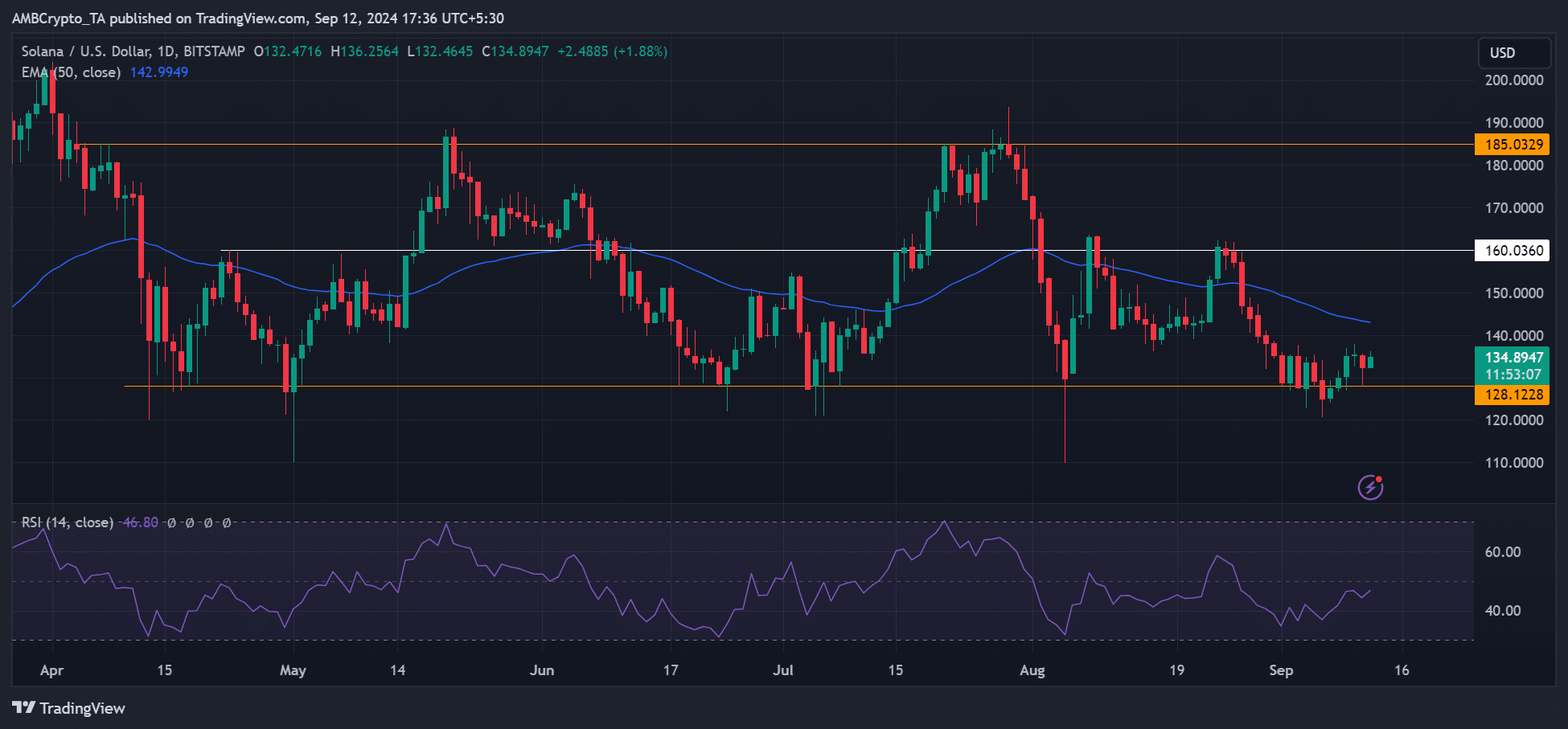

A wallet associated with Alameda/FTX bought out 177,693 SOL from Solana PoS staking and still had $951 million SOL staked. The move came as FTX’s refund to victims was getting closer.

Although FTX reportedly sold most of its SOL through OTC (over-the-counter) markets, says EmberCN, a market analyst suggested that the undeployed SOL could soon reach the central exchanges.

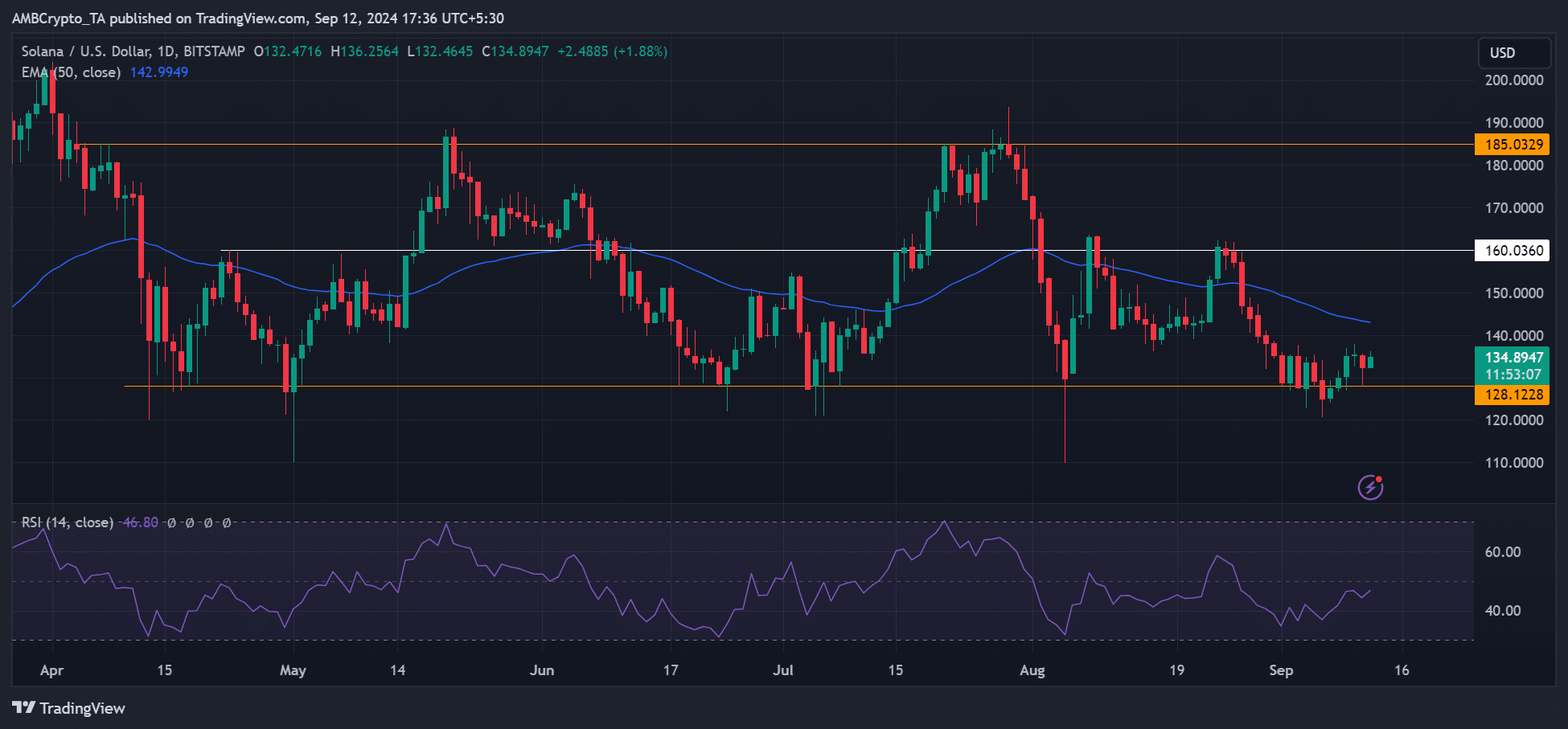

If so, this could put downward pressure on SOL. At the time of writing, the altcoin was trading at $134, slightly above the yearly support of $128.

Source: SOL/USD, TradingView

Swift unveils support for digital asset transfers

Finally, Swift will support regulated digital and real-world tokenized asset transfers as part of its ‘global interoperability strategy’. Part of the company’s statement read,

“Our vision is that our members can use their Swift connection to alternately transact using both existing and emerging asset and currency types.”

The update follows a series of blockchain payments experiments last year involving Chainlink, Ethereum and many banks including BNY Mellon. This move will allow buyers to settle and exchange tokenized assets in real time over the Swift network.