- BNB’s bearish wedge pattern and MACD crossover indicated a potential 40% price breakout

- On-chain activity, including active addresses and transactions, supported this hypothesis

Binance coin [BNB] rose 6.58% in the last 24 hours to reach $544.48 on the charts at the time of writing. As expected, this has given rise to speculation about a possible outbreak.

In fact, a post on X (formerly Twitter) from The Moon Carl suggested that BNB could see a price increase of at least 40%. This, if it breaks a six-month falling wedge pattern. Hence the question: is this a buying opportunity?

BNB’s chart showed a falling wedge pattern, a classic bullish indicator. This is what analysts have arrived at to predict a potential gradient of 40%.

Source:

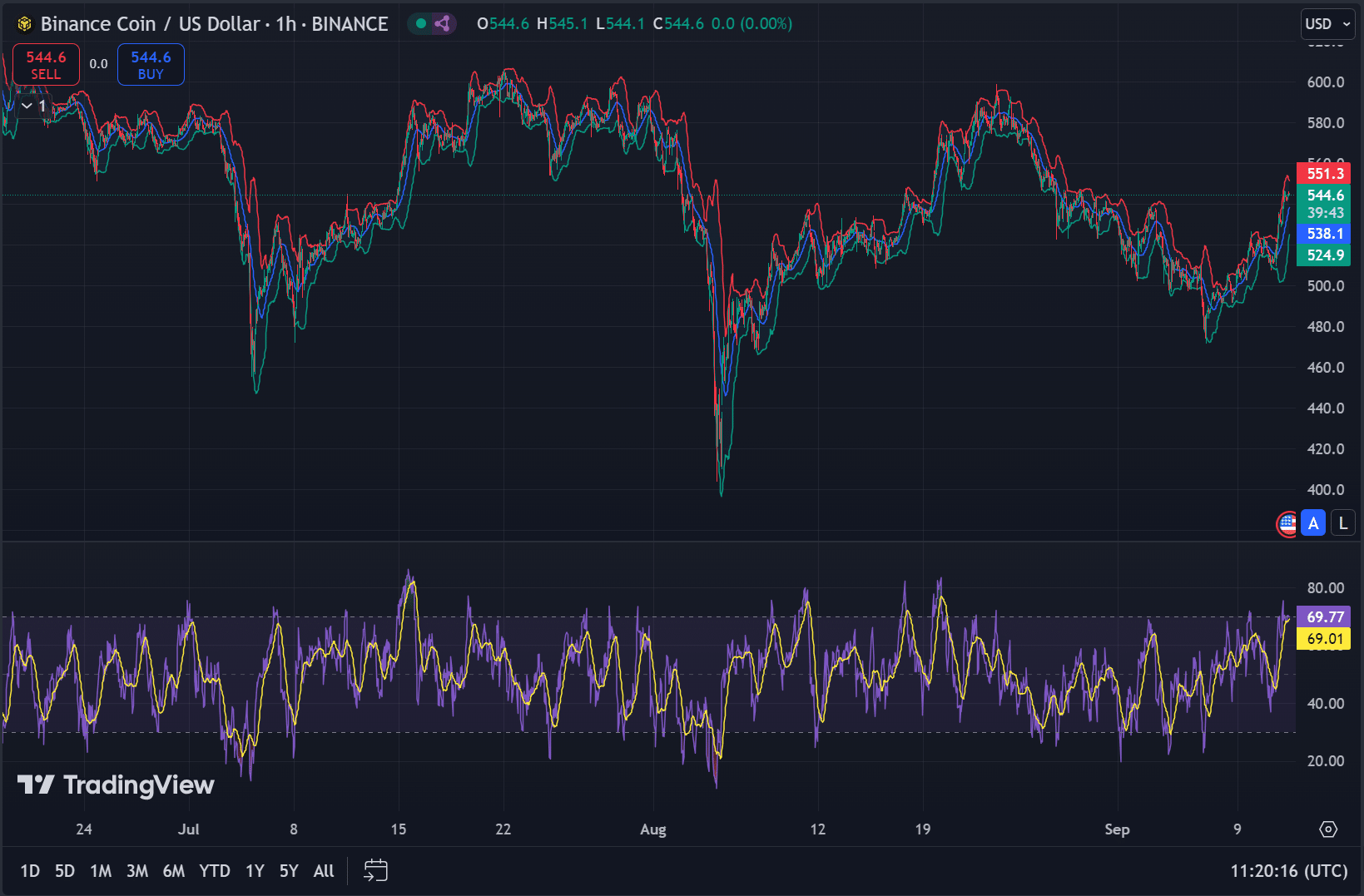

On the chart, the Moving Average Convergence Divergence (MACD) showed a bullish crossover. The MACD line at 6.4 crossed above the signal line at 6.3 – a sign of upside momentum.

Source: TradingView

Moreover, BNB’s trading volume increased by 25.29%, reaching $1.8 billion in the past 24 hours. This is further confirmation of the growing interest from the market. Therefore, traders could keep an eye on resistance around $580 as the critical point for a breakout.

What do on-chain metrics suggest?

Data from the chain provided additional insights into the power of BNB. The number of active addresses increased by 4.03% and reached 925.07K. Furthermore, transactions increased by 15.8%, reaching a total of 4.20 million in just 24 hours.

Source: Nansen

These numbers highlight the growing user activity and interest in Binance Smart Chain. Whale accumulation may also be a factor in the current rally, with large holders potentially positioning themselves ahead of a major price move.

Can BNB face a setback?

However, despite these positive signs, traders should remain cautious. The Relative Strength Index (RSI) appeared to be approaching overbought territory at 69.01 – a sign that BNB could soon face resistance.

Failure to break above $580 could trigger a pullback, with support levels around $500 and $460 acting as potential downside targets.

Source: TradingView

Furthermore, a decline in the number of active addresses or transaction volumes could indicate declining interest. This would undermine the bullish outlook.

Should traders buy BNB now?

Although the technical patterns and on-chain metrics indicated that BNB is about to make a major move, caution is still warranted. Overbought conditions and the potential resistance at $580 mean the market could experience short-term volatility.

However, BNB is still at a critical juncture. This makes it an important token to keep an eye on in the coming days.