- India led global cryptocurrency adoption despite regulatory challenges and high trade taxes

- Bitcoin ETF stimulated institutional transfers, fueling growth in high-income regions like North America

Amid rising interest in cryptocurrencies, the Chainalysis Global Crypto Adoption Index unveiled its fifth annual report. It provided important insights into grassroots adoption around the world.

This year’s report, which covers data from Q3 2021 to Q2 2024, introduced a refined methodology that emphasizes DeFi activity while excluding trading volumes from P2P cryptocurrency exchanges.

Furthermore, by integrating both on-chain and off-chain data, Chainalysis has identified which countries are leading the way in cryptocurrency adoption and why these regions are increasingly embracing digital assets.

Chainalysis crypto adoption report – explained

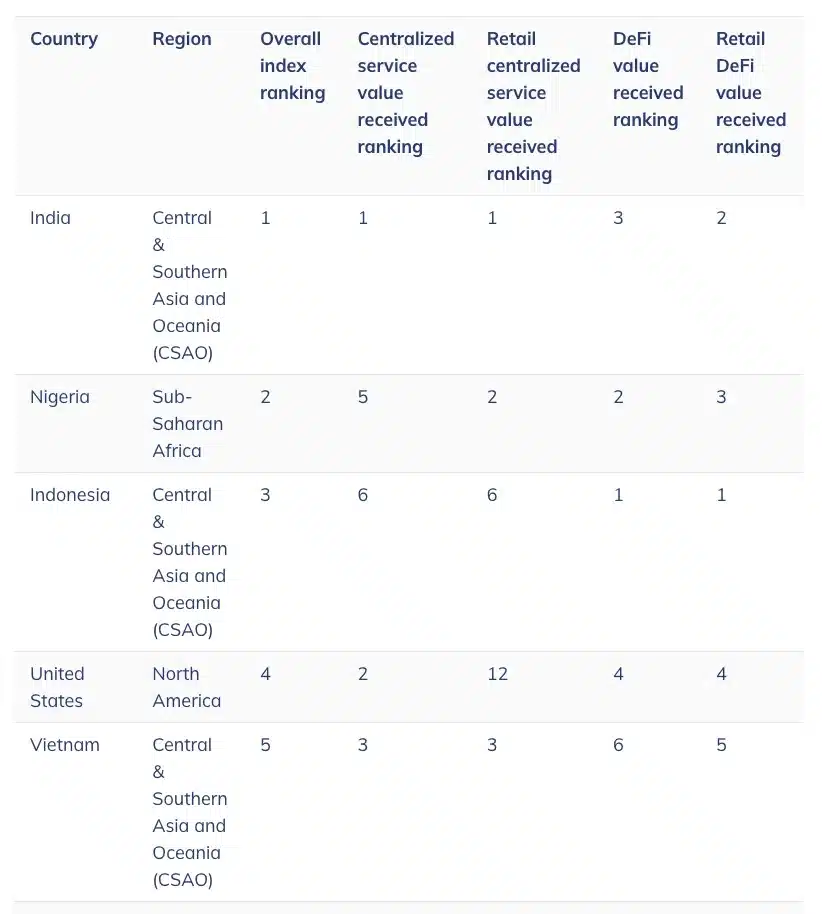

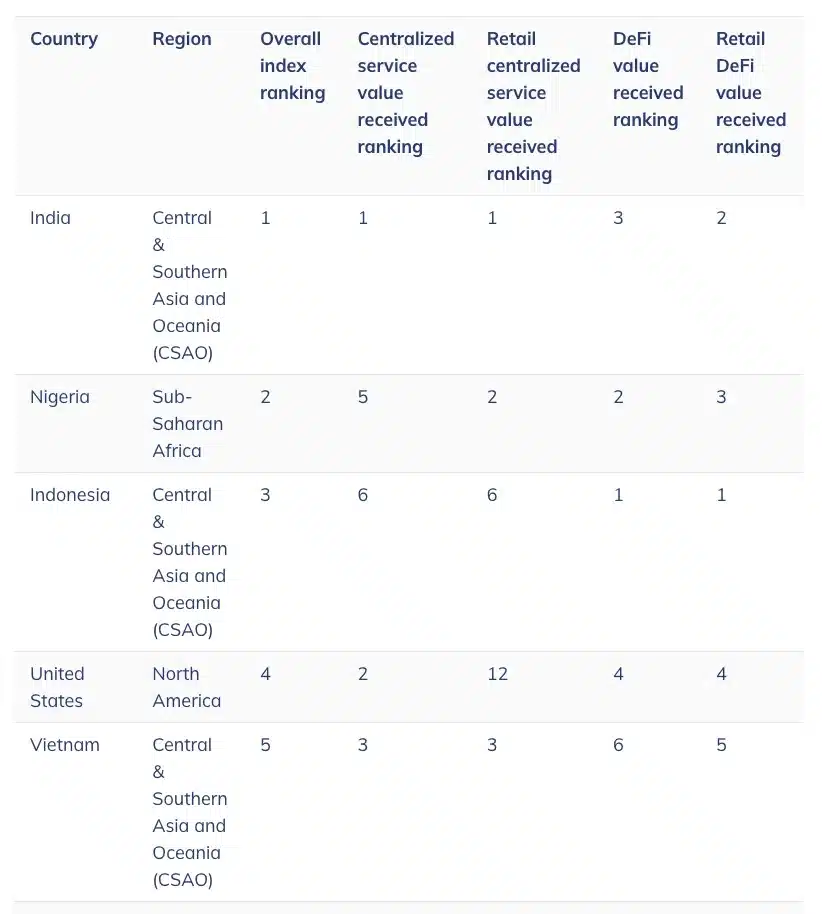

According to the latest findings, India and Nigeria continue to lead the global cryptocurrency adoption, while Indonesia has emerged as the fastest growing market.

Source: Chain analysis

India has maintained its lead in global cryptocurrency adoption for the second year in a row, despite a difficult legal environment and high trade taxes.

For those unfamiliar, the country’s strict regulations have been in place since 2018. This includes recent actions by the Financial Intelligence Unit (FIU) in December 2023. At the time, the FIU issued show-cause notices to nine offshore cryptocurrency exchanges for failure to comply with local regulations.

However, this all-encompassing regulatory environment has not deterred Indian investors. The above figures demonstrate India’s resilience and leadership in the global cryptocurrency market.

Eric Jardine, research leader at Chainalysis commented:

“India also has a fairly broad-based level of adoption across various cryptocurrency assets despite restrictions, implying that new entrants would have joined crypto through services that were not banned.”

US losing ground?

On the contrary, despite significant media attention surrounding cryptocurrencies in the United States – spurred by presidential candidate Donald Trump and ETF developments – the country ranked only fourth in global cryptocurrency adoption.

The country was ranked below India, Nigeria and Indonesia. This suggested that big discussions and high-profile events don’t always translate into industry-leading adoption rankings.

Nevertheless, the report highlighted that the launch of the Spot Bitcoin [BTC] ETFs in the United States have significantly boosted BTC activity globally. In fact, there has been large year-on-year growth in institutional transfers and notable increases in high-income regions such as North America and Western Europe.

Diving deeper into adoption rates, Chainalysis’ report revealed:

“Between the fourth quarter of 2023 and the first quarter of 2024, the total value of global crypto activity increased substantially, reaching higher levels than those of 2021 during the crypto bull market.”

Source: Chain analysis

Bitcoin – The most used token

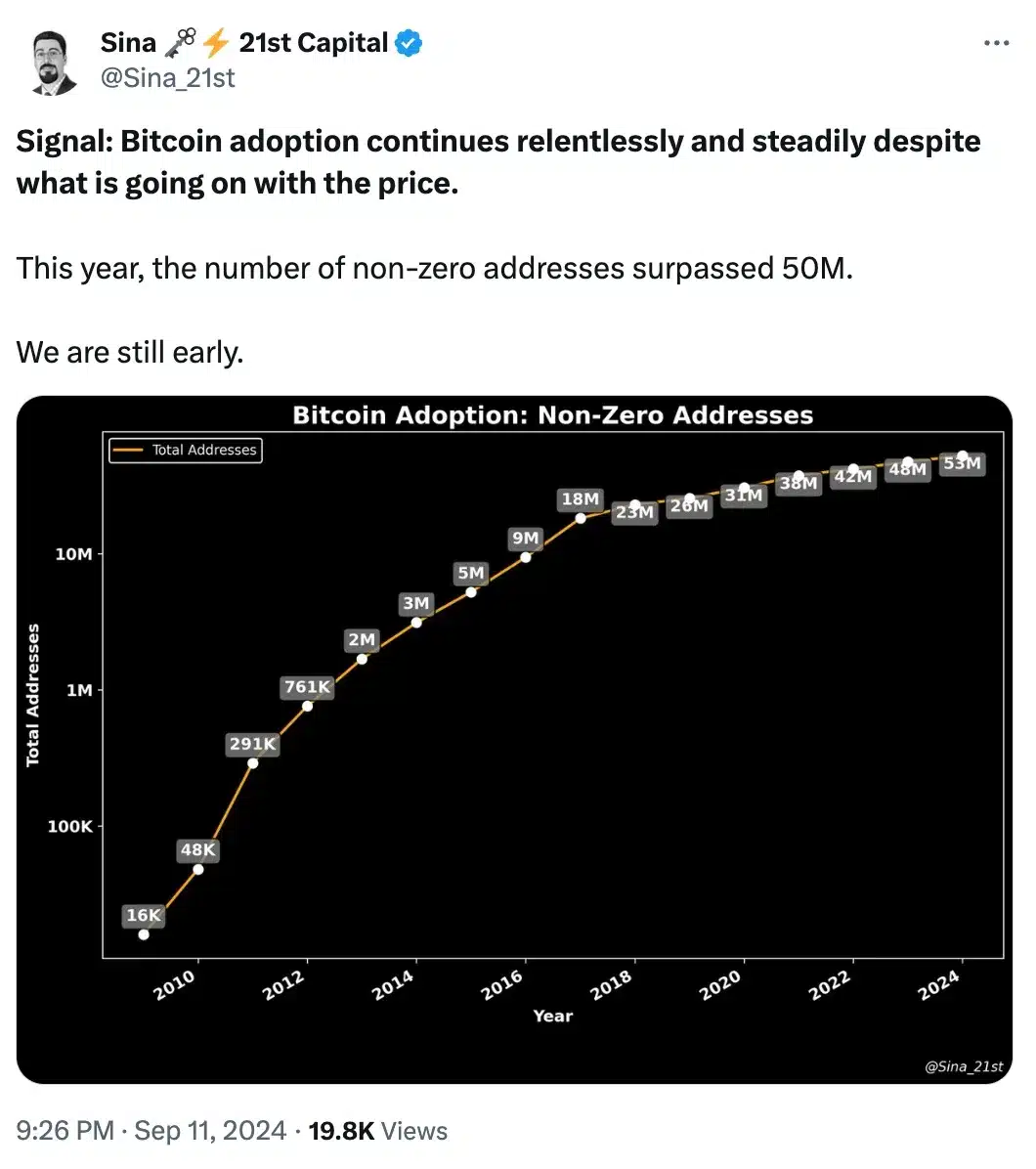

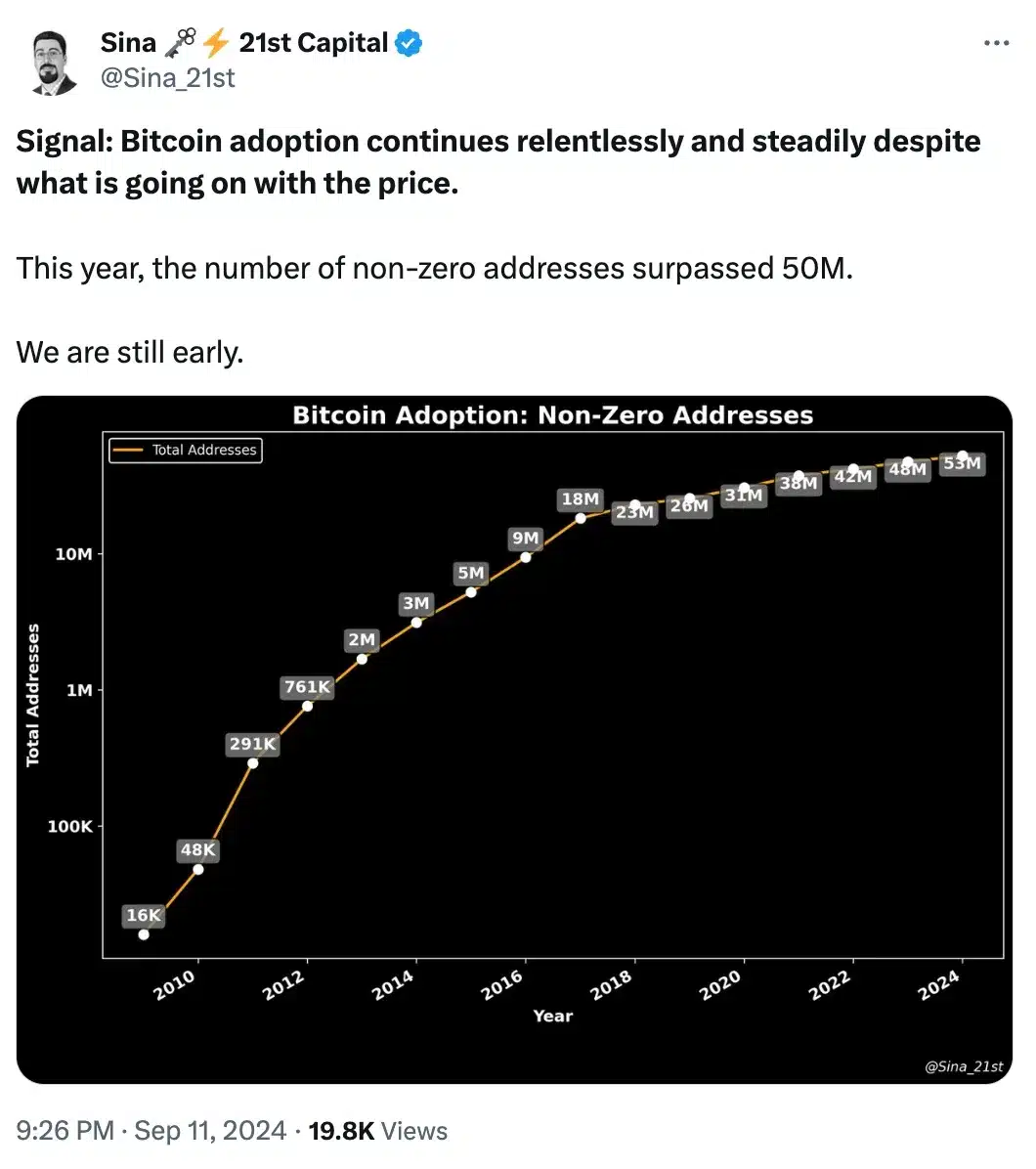

As expected, Bitcoin has emerged as the most talked-about cryptocurrency and a driving factor behind cryptocurrency adoption.

Whether it’s the increasing interest in Bitcoin ETFs or its growing relevance in political discussions, from elections to institutional strategies, BTC continues to attract attention.

This was further confirmed by a recent update from a user on

Source: Sina/X