- XRP could break the seven-year resistance with a potential upside of 500%. Analysts suggest a bullish breakout.

- The growing interest in XRP derivatives and bullish chart patterns indicate great potential for price movement.

XRPs The current price movement has caught the attention of market analysts as the crypto is showing signs of a possible bullish breakout.

Crypto analyst Javon Marks has done just that noted that the setup on the XRP chart reveals multiple hidden bullish divergences, indicating a possible 500% price increase.

With XRP currently consolidating within a major symmetrical triangle, analysts are speculating whether the token could break its 7-year resistance and reach a near-term high of $3,313.

Historical bullish trends indicate strong potential

XRP’s chart history reveals two major bullish breakouts from symmetrical triangles. The first occurred in 2017, which led to a 1,220% rally, and the second in 2020, when the price rose 2,436%.

Meanwhile, these previous breakouts suggest that XRP has a history of substantial price movement when similar chart patterns emerge. XRP was trading within another symmetrical triangle at the time of writing, and many believe it could replicate past performance.

Source:

Crypto experts point out that hidden bullish divergences often lead to strong upward moves, and the multiple confirmations on the XRP chart indicate the potential for another major rally.

This could lead to XRP breaking the long-standing resistance level, which has been in place for almost seven years.

Technical indicators are showing mixed signals

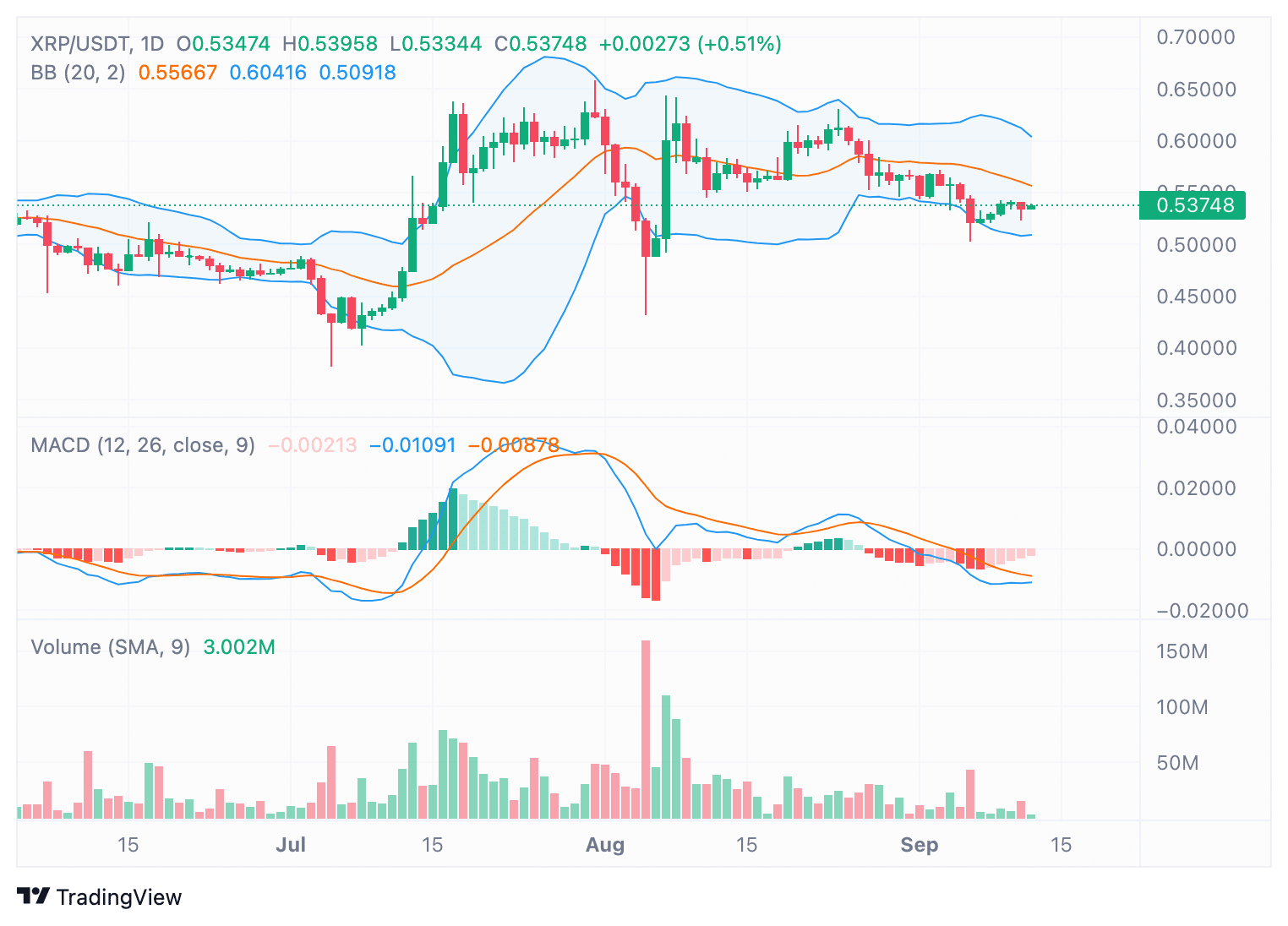

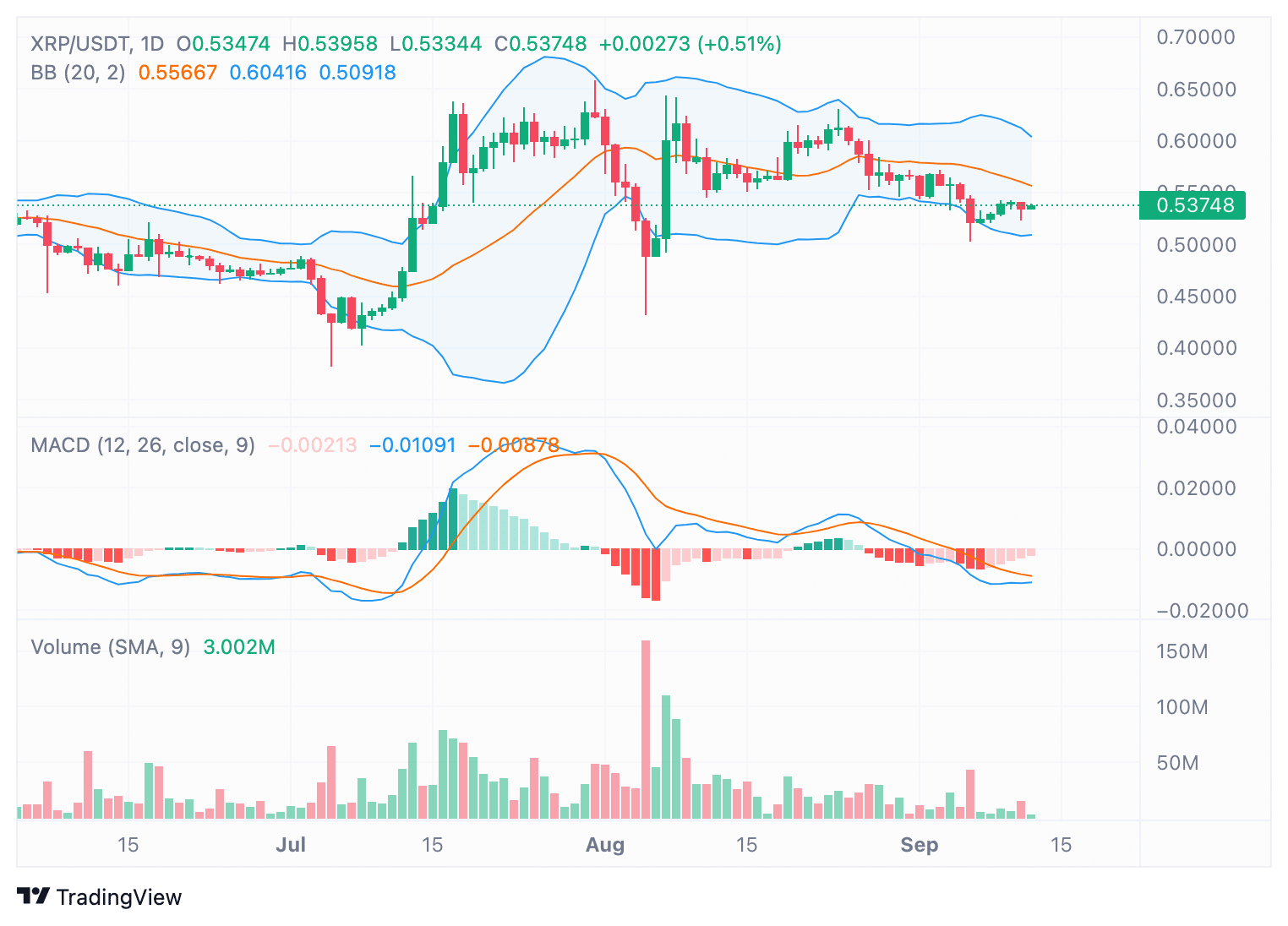

At the time of writing, XRP was priced at $0.5371with a slight increase of 0.70% in the last 24 hours. However, in the past week the price has fallen by 2.85%.

Bollinger Bands, a popular volatility indicator, tighten around the current price, indicating lower short-term volatility.

Moreover, the price has been hovering near the middle band, which represents the 20-day moving average, indicating a neutral to slightly bearish trend.

The MACD (Moving Average Convergence Divergence) indicator, another common tool for predicting price direction, shows a bearish signal with the MACD line below the signal line.

However, the histogram is starting to show signs of reduced negative momentum, which could indicate a possible slowdown in the bearish trend.

Increased interest in XRP derivatives

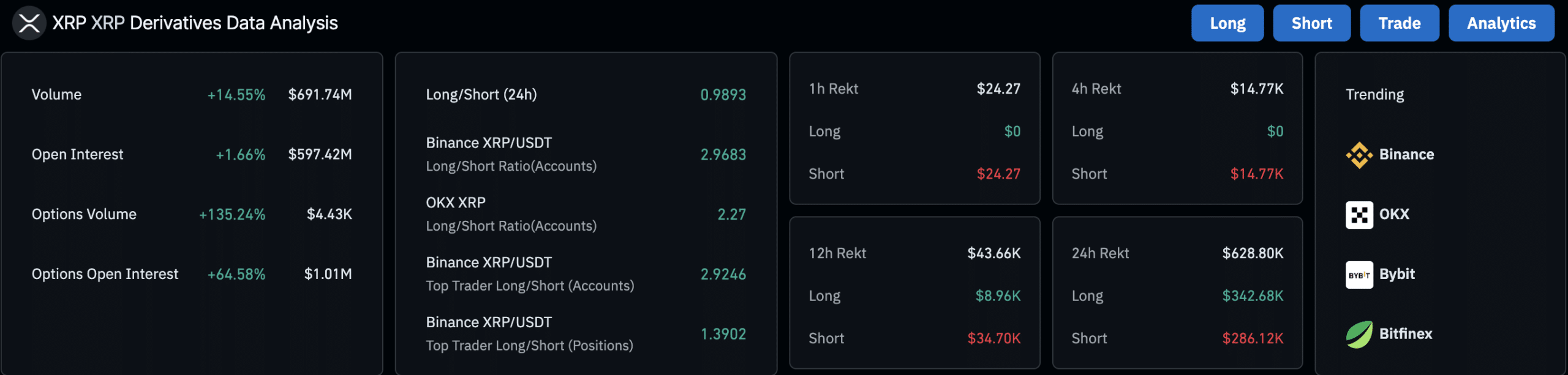

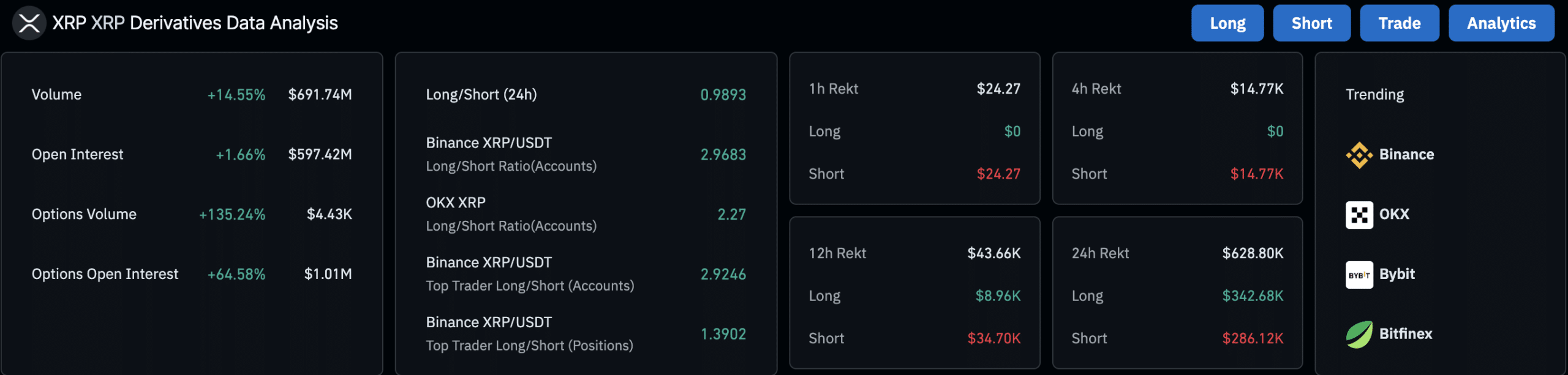

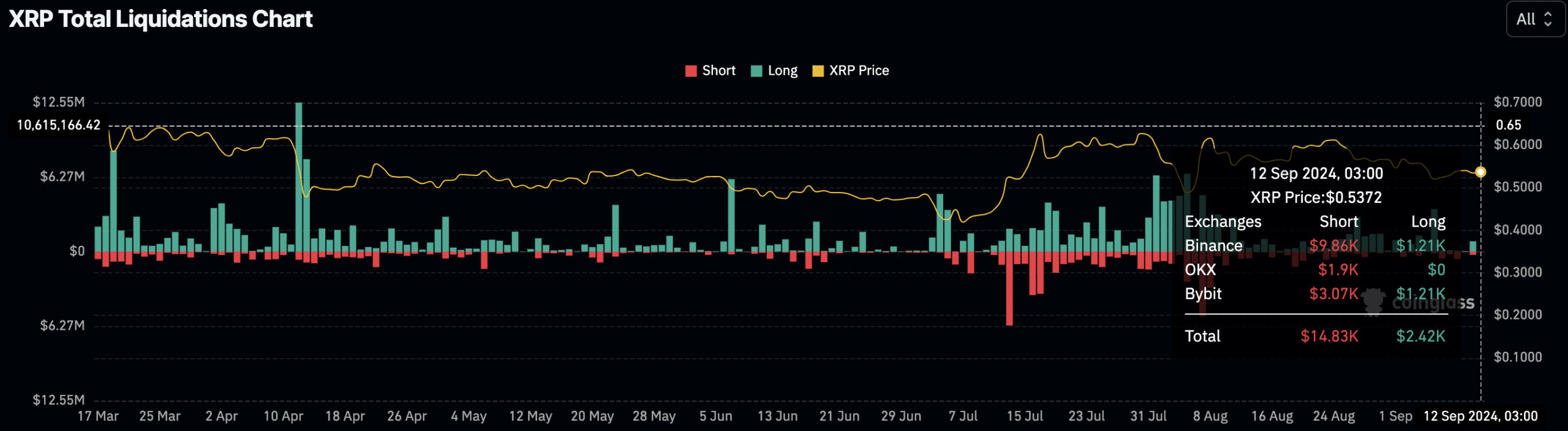

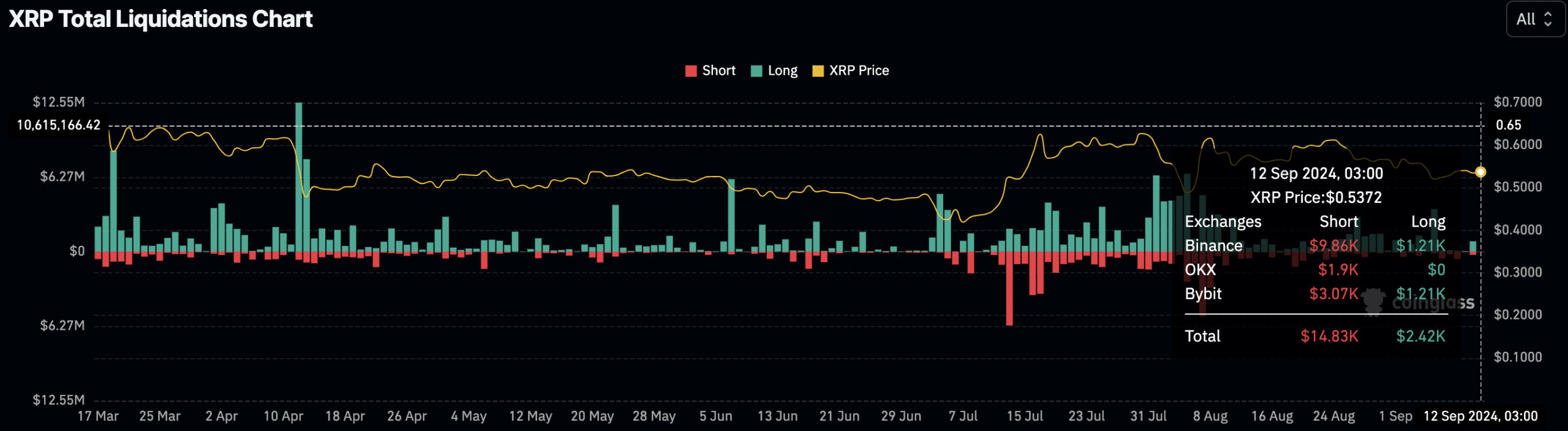

Recently Mint glass data shows growing interest in XRP derivatives. Trading volume increased 14.55% to $691.74 million, and open interest increased 1.66% to $597.42 million.

Options trading in particular has seen a sharp increase: volume increased by 135.24% and open interest on options grew by 64.58%. This uptick in derivatives activity indicates that traders are positioning themselves for possible price movements in the near future.

Source: Coinglass

The long/short ratio over the last 24 hours is almost neutral at 0.9893. However, on major exchanges such as Binance and OKX, the data shows that traders are heavily leaning towards long positions.

Binance’s long/short ratio stands at 2.9683, while OKX stands at 2.27, indicating a strong bias towards bullish expectations.

Additionally, XRP liquidation data over the past 24 hours shows that short positions have been hit the hardest, with a total of $14.83K in liquidations, compared to just $2.42K for long positions.

Source: Coinglass

Read Ripple’s [XRP] Price forecast 2024-25

This liquidation data is consistent with general market sentiment, with short traders experiencing larger losses, potentially signaling a shift in the market’s direction.

With XRP’s history of explosive price movements and current chart patterns indicating hidden bullish signals, many traders are keeping a close eye on the token.