- Bitcoin’s small BTC retail holders dominated the market at the time of writing.

- Analysts suggest three conditions for Bitcoin to soar to new highs.

Bitcoin [BTC]the largest cryptocurrency by market capitalization, has been on a downward trajectory over the past month. On the price charts, BTC is down 1.01% on the daily charts to trade at $56657.

The price has also fallen 2.80% in the last 30 days, indicating increased volatility.

Since reaching an ATH of $73737 in March 2024, the crypto has struggled to maintain upward momentum, even hitting a local low of $49,000.

The increased market volatility has raised questions about the future prospects based on the behavior of holders. To this extent, Santiment analysts have suggested three conditions for BTC to reach new highs.

What prevailing market sentiments suggest

According to Santiment, While market sentiment among retail traders has turned positive, this is not enough to give BTC momentum for a rally.

The analysis shows that wallets with <1 BTC have now increased their holdings to the highest level in seven months. This means that small retailers control the majority of the BTC supply.

Source: Santiment

However, according to this analogy, increased ownership by retail traders is not good enough for a rally. Based on this analysis, the first condition for BTC’s recovery is that small holders reduce their holdings.

When small farmers dominate the market, this ideally indicates increased speculation or a vulnerable market, as small farmers are emotional sellers.

Fewer small farmers are therefore less preferable for a sustained rally, as they are sensitive to panic selling.

Second, medium-sized investors with 1-100 BTC need to grow their holdings steadily. Continued growth among mid-market investors indicates that more experienced investors and institutions are entering the market.

The entry of such investors is generally optimistic, as it shows confidence in the long-term prospects.

The third and final condition for a rally is aggressive accumulation by more than 100 holders. Aggressive accumulation by large holders suggests that institutions and whales are optimistic about future prospects.

Therefore, whales are accumulating BTC, suggesting they are confident of a longer-term price increase by reducing liquidity on exchanges, which typically supports price appreciation.

Bitcoin Holder Analysis

As noted by Santiment, small retailers have continued to dominate the market in the recent past.

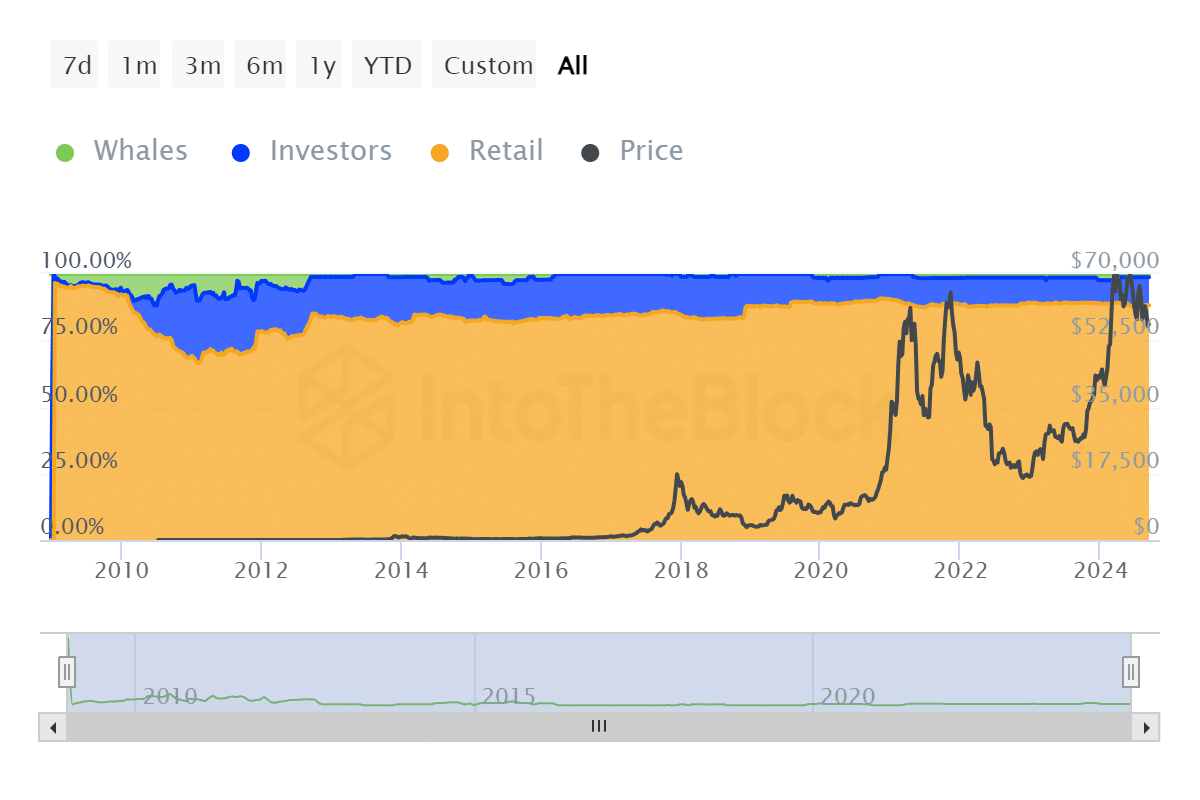

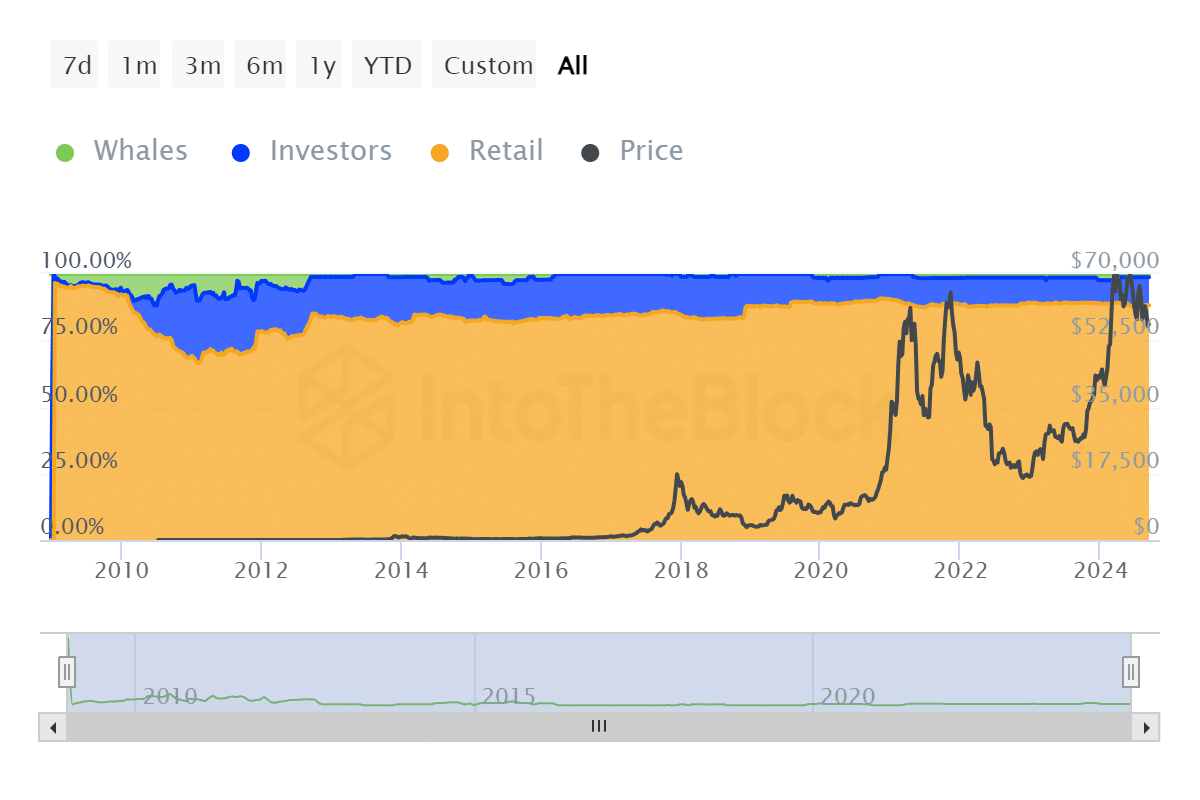

Source: IntoTheBlock

For starters, Bitcoin ownership by historical concentration indicated that retail trader holders owned 88.24%, amounting to 17.44 million Bitcoins, while investors owned 10.5% and whales 1.26%.

This shows that retailers have a large voice in the market, resulting in speculative sales, resulting in the volatility and fluctuations observed recently.

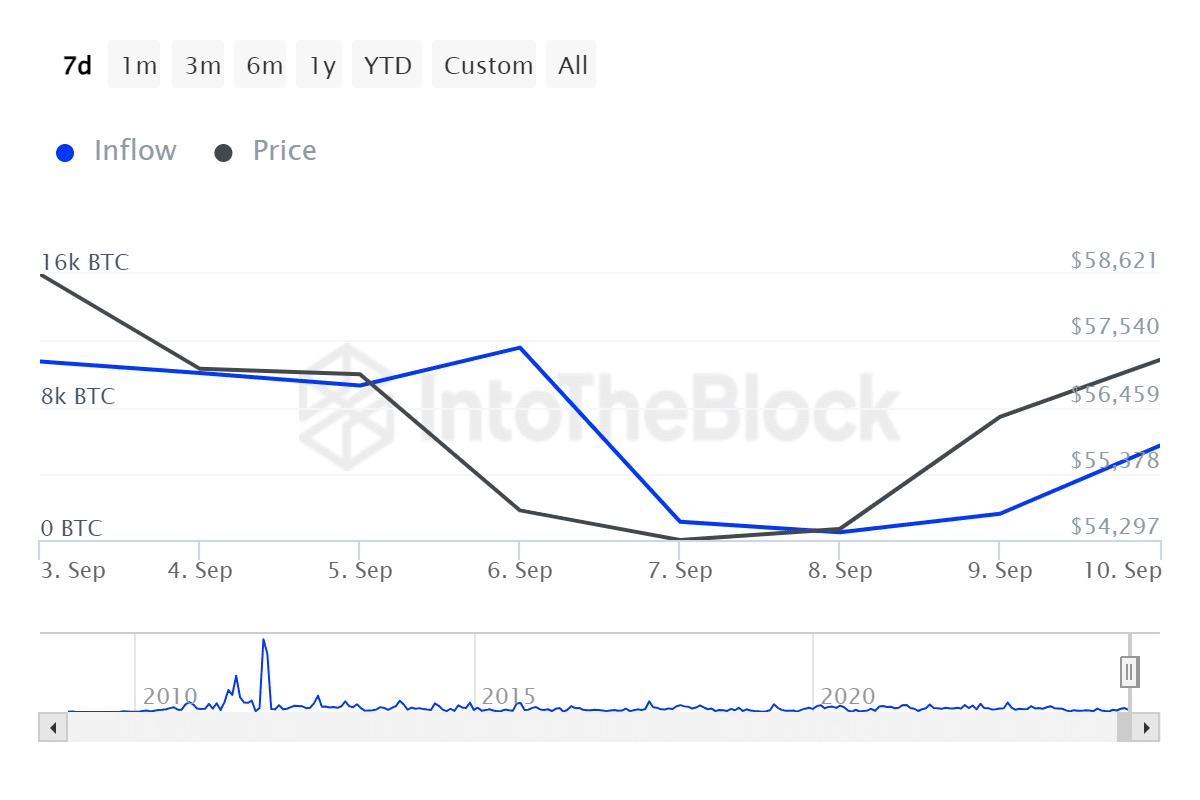

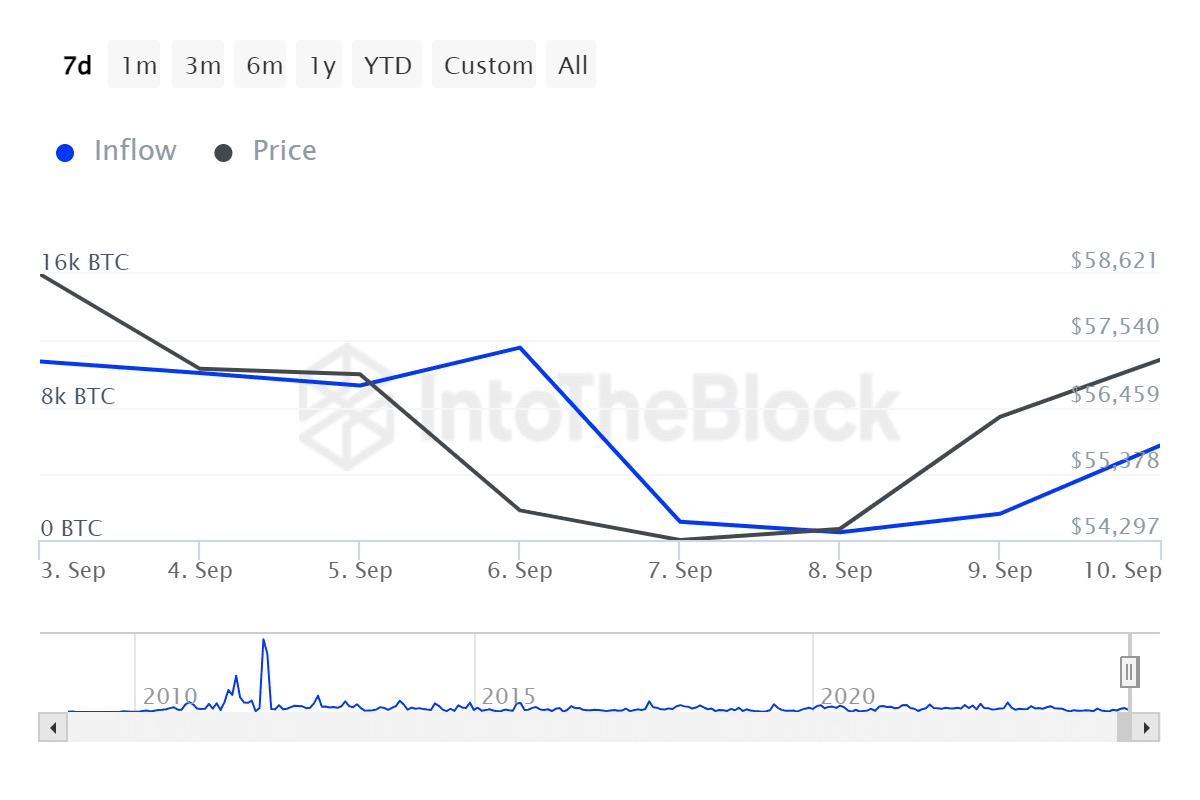

Source: IntoTheBlock

Moreover, large investor inflows have fallen from 11.57k to a low of 1.58k over the past seven days.

This indicates reduced demand from whales as they closed their positions during the market downturn. A reduction in whaling shows confidence in the future prospects.

Therefore, the increase in small retailer ownership reflects current market fluctuations.

Read Bitcoin’s [BTC] Price forecast 2024–2025

During recessions, retail traders tend to close their positions because they are speculative sellers, which drives prices down further.

An increase in the number of large and medium-sized holders would therefore stabilize the market and increase prices. So if the retail traders continue to dominate the markets, BTC will fall to $54587.