- A technical analyst predicted that NEAR’s price could reach $15 in the long term if it maintains its current support levels.

- The increased Total Value Locked (TVL) and increased retail investor activity indicated that NEAR may be poised for a rally.

Despite a decline of 2.74% in the last 24 hours, Near Protocol [NEAR] has been looking for a level that could spur additional buying pressure to extend its current monthly gain of 4.67%.

According to an analysis by AMBCrypto, NEAR’s trajectory is expected to rise, with the recent one-day price decline seen as a simple retracement.

$15 goal projected for NEAR

Analyst Michael Van De Poppe predicted a bullish trend for NEARnoting that the cryptocurrency’s market structure showed promising patterns for an upcoming rally.

He explained,

“The markets are preparing for a turnaround.”

This optimistic view was reinforced as NEAR re-entered a critical support zone that Van De Poppe had previously identified as key to substantial buying activity.

He noted:

“Provided the $2.75-3.40 range holds, we can expect NEAR to reach $15 within the next three to six months.”

Source:

Reaching $15 would be notable for NEAR, which last traded at this level on April 26, 2022, as discovered by AMBCrypto.

While this long-term forecast may seem optimistic, a combination of solid fundamentals and a significant reduction in Bitcoin’s dominance could support NEAR’s potential upside.

AMBCrypto has examined the key drivers behind NEAR’s expected rally.

Retail investors are fueling NEAR’s rally

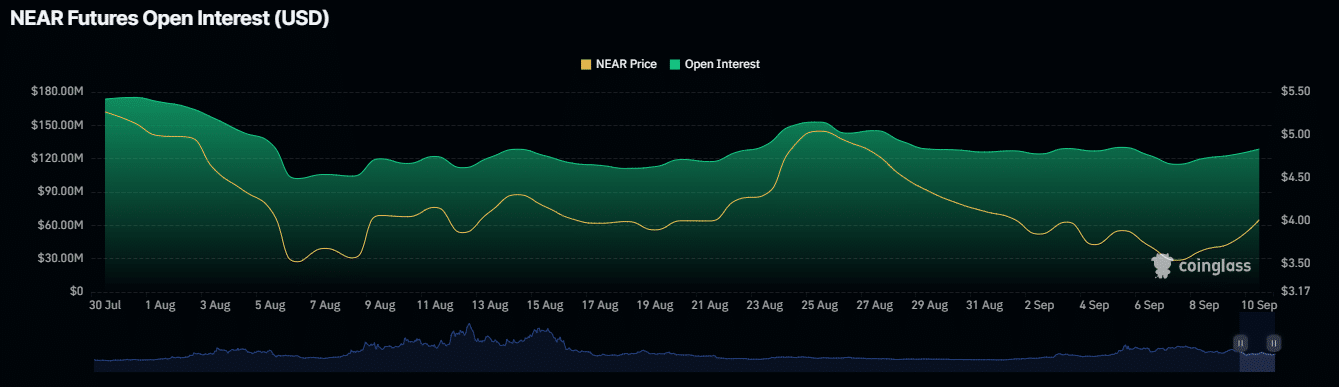

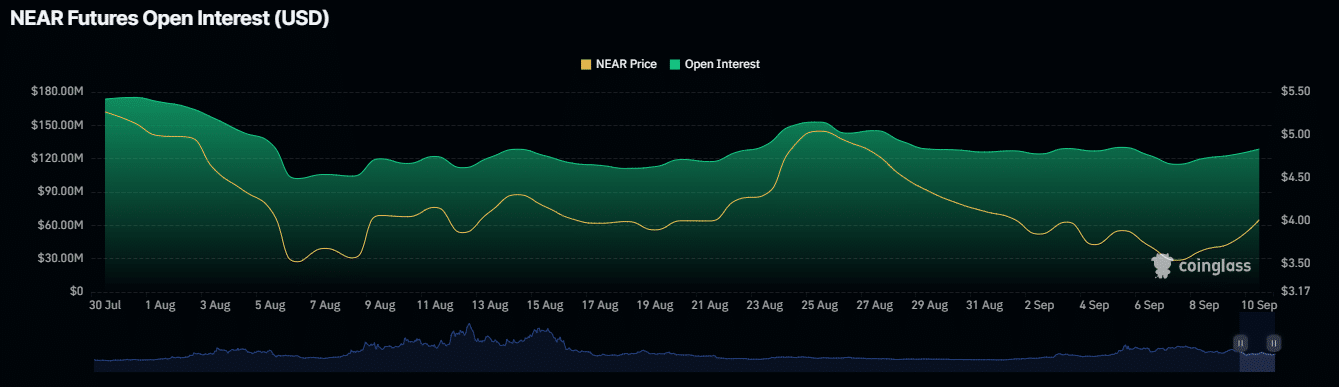

AMBCrypto, using insights from Coinglassfound that retail investors were bullish on NEAR, sending the cryptocurrency higher as both Open Interest (OI) and OI-weighted funding rates continued to rise.

Open Interest represents the total of unsettled contracts in derivatives trading, while the OI-Weighted Funding Rate helps align perpetual contract prices with the spot price based on this open interest.

At the time of writing, NEAR’s Open Interest peaked at $130.26 million, recovering from a decline to $114.95 million on September 7.

Source: Coinglass

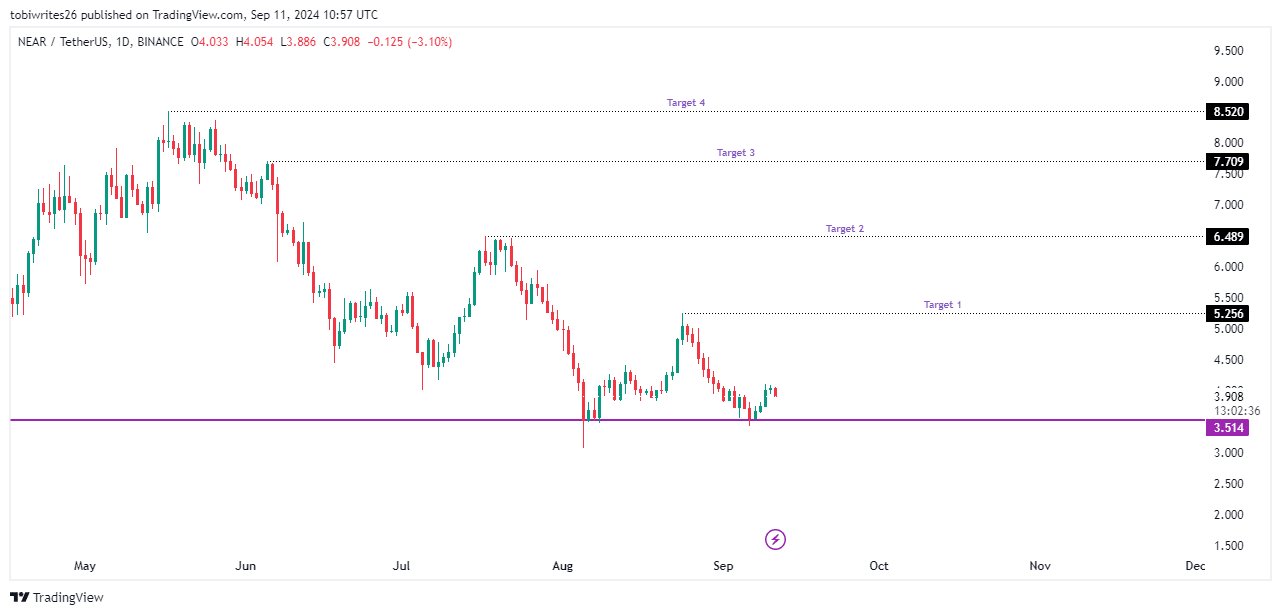

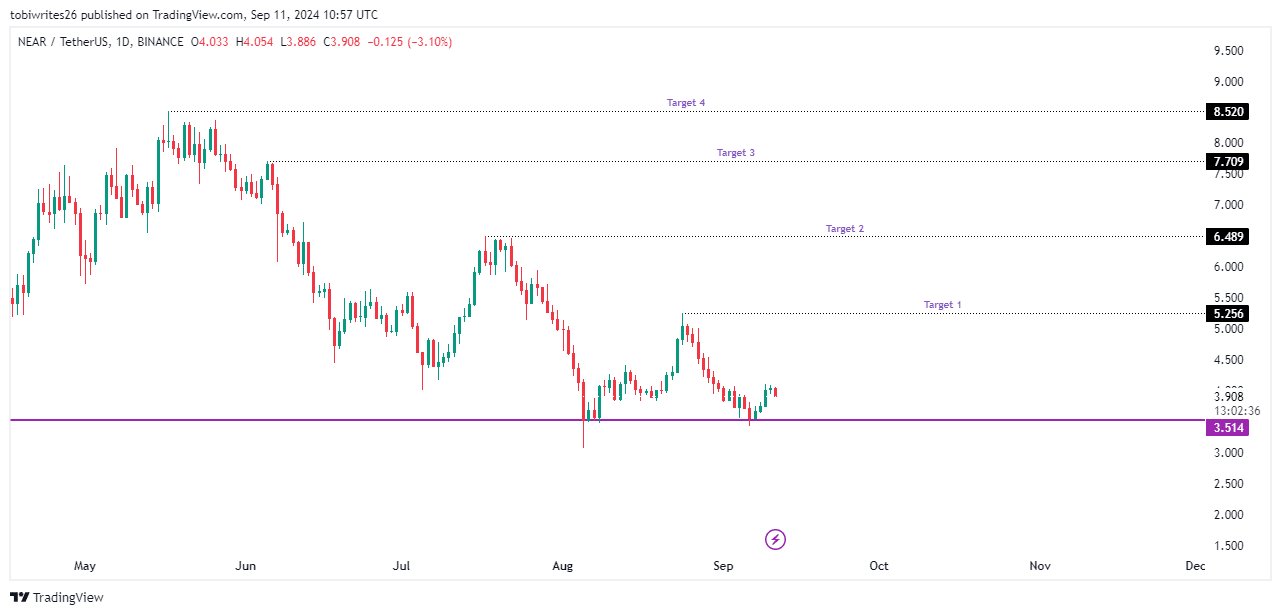

If this uptrend continues, NEAR could target short-term prices of $5,256 or $6,489, where there is significant liquidity. Further momentum could potentially push prices towards $7,709 and then towards $8,520.

Source: trading view

In addition to these dynamics, broader investor activity also influenced NEAR’s price trajectory.

NEAR investors in play

According to DeFiLlama, the Total Value Locked (TVL) in NEAR has increased, reflecting increased investor activity.

TVL, which measures the cumulative value of assets deposited within a cryptocurrency protocol, has reached $198.72 million, recovering from a recent dip on September 6.

Source: DeFilLama

Read Near Protocols [NEAR] Price forecast 2024–2025

A rising TVL is a bullish indicator, pointing to growing deposits and demonstrating increasing investor confidence and commitment to the protocol.

If this trend continues, NEAR’s price will likely follow suit and benefit from the positive momentum.