- Ethereum reflects the 2019 pattern.

- The largest holders of ETH have steadily increased their earnings since 2019.

Ethereum [ETH] remained the second-largest cryptocurrency, with market sentiment shifting from bearish to bullish as 2024 nears its end.

Ethereum’s price action mirrored the 2019 pattern on the ETH/USD pair, where a rising wedge formed.

This cycle’s higher wedge lows were ten times greater than 2019’s.

In 2019, Ethereum’s price fell below the rising wedge before the Federal Reserve’s first rate cut, a situation similar to what happens in 2024.

Source: TradingView

After the 2019 rate cut, both ETH/USD and ETH/BTC bottomed out, forming a strong confluence.

The current pattern is expected to repeat this success, with the price likely to break below the wedge, draining liquidity before turning upside again in late Q4 2024 or early Q1 2025.

However, if the price remains below the rising wedge for an extended period of time, further analysis may be necessary to adjust strategies or minimize potential losses.

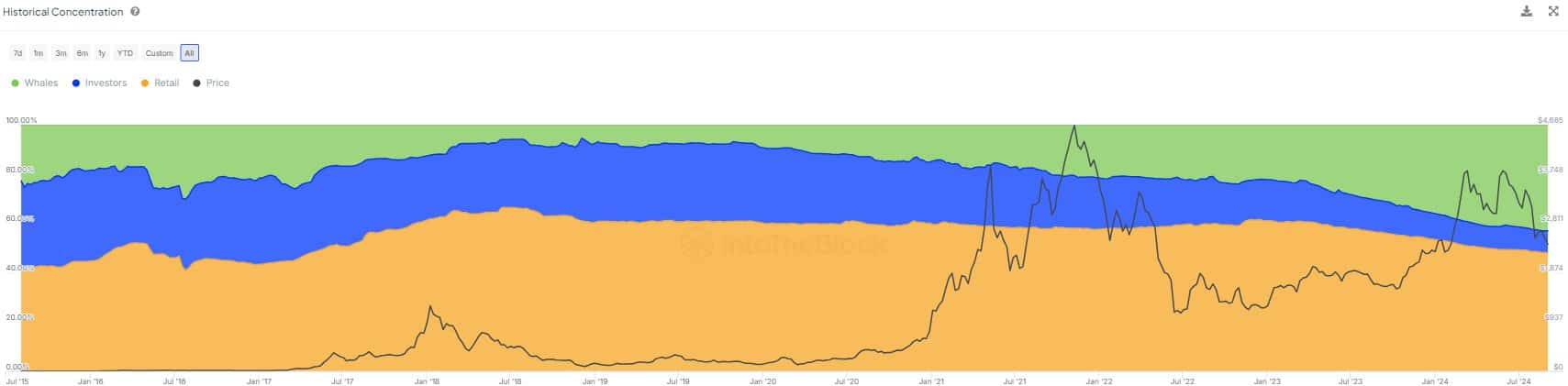

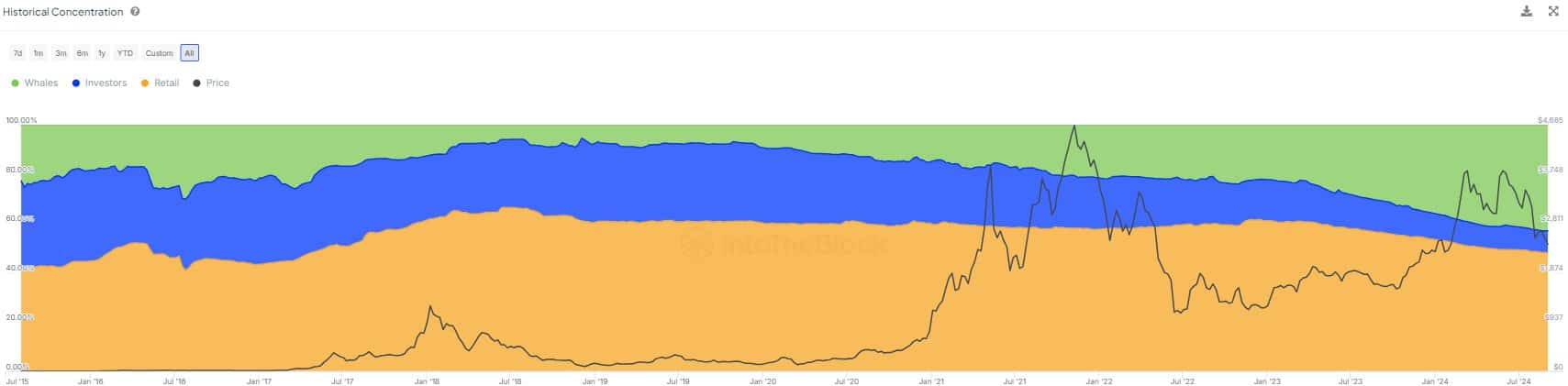

Whales continue to accumulate

Whales play an important role in supporting this expected upward movement. Ethereum’s largest holders have steadily accumulated more ETH since 2019, and this trend intensified after the Shanghai upgrade in early 2023.

At the time of writing, whales controlled over 43% of Ethereum’s circulating supply, bringing them closer to retail investors’ 48%.

This accumulation indicates that these major players expect Ethereum’s price to move higher over time.

Source: IntoTheBlock

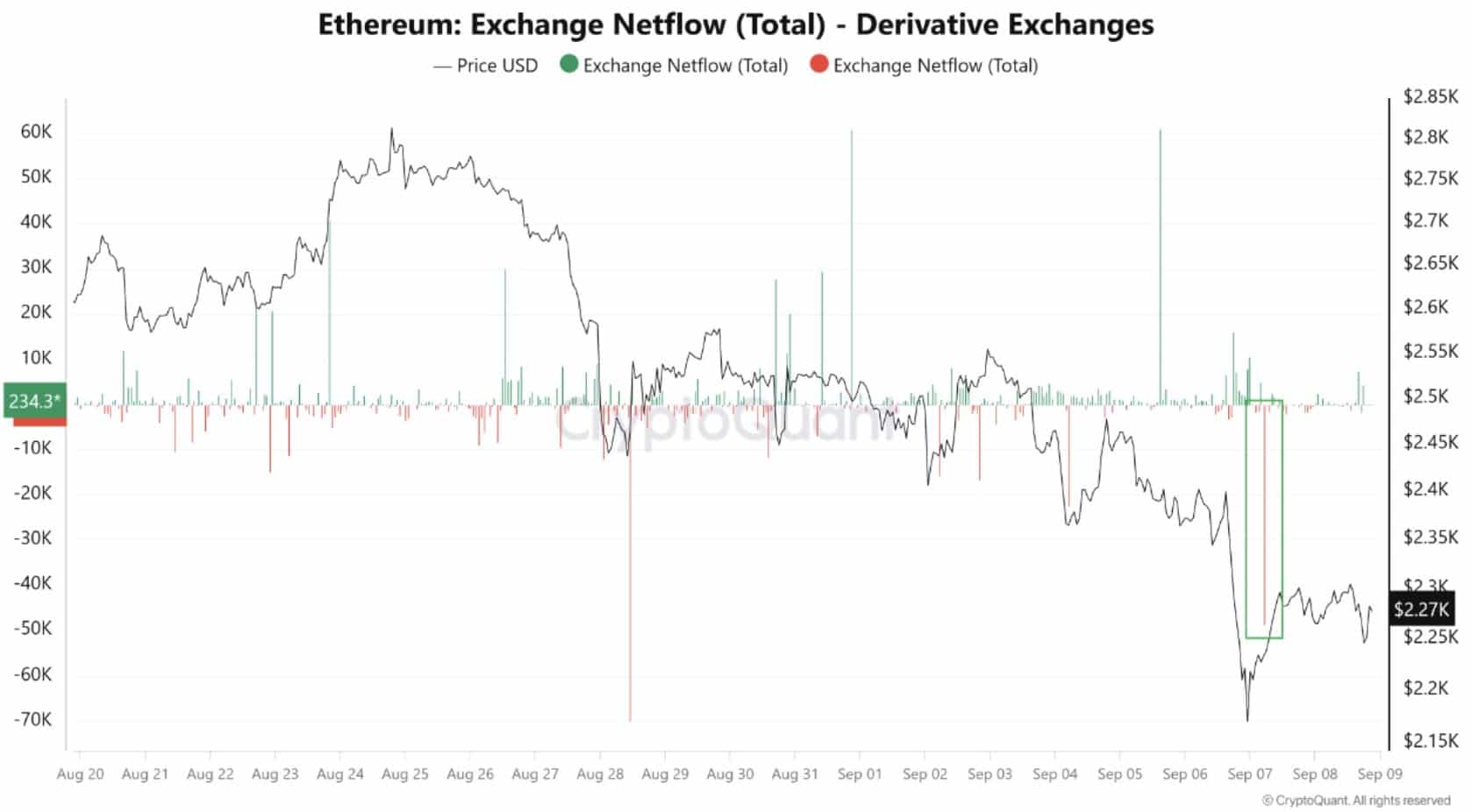

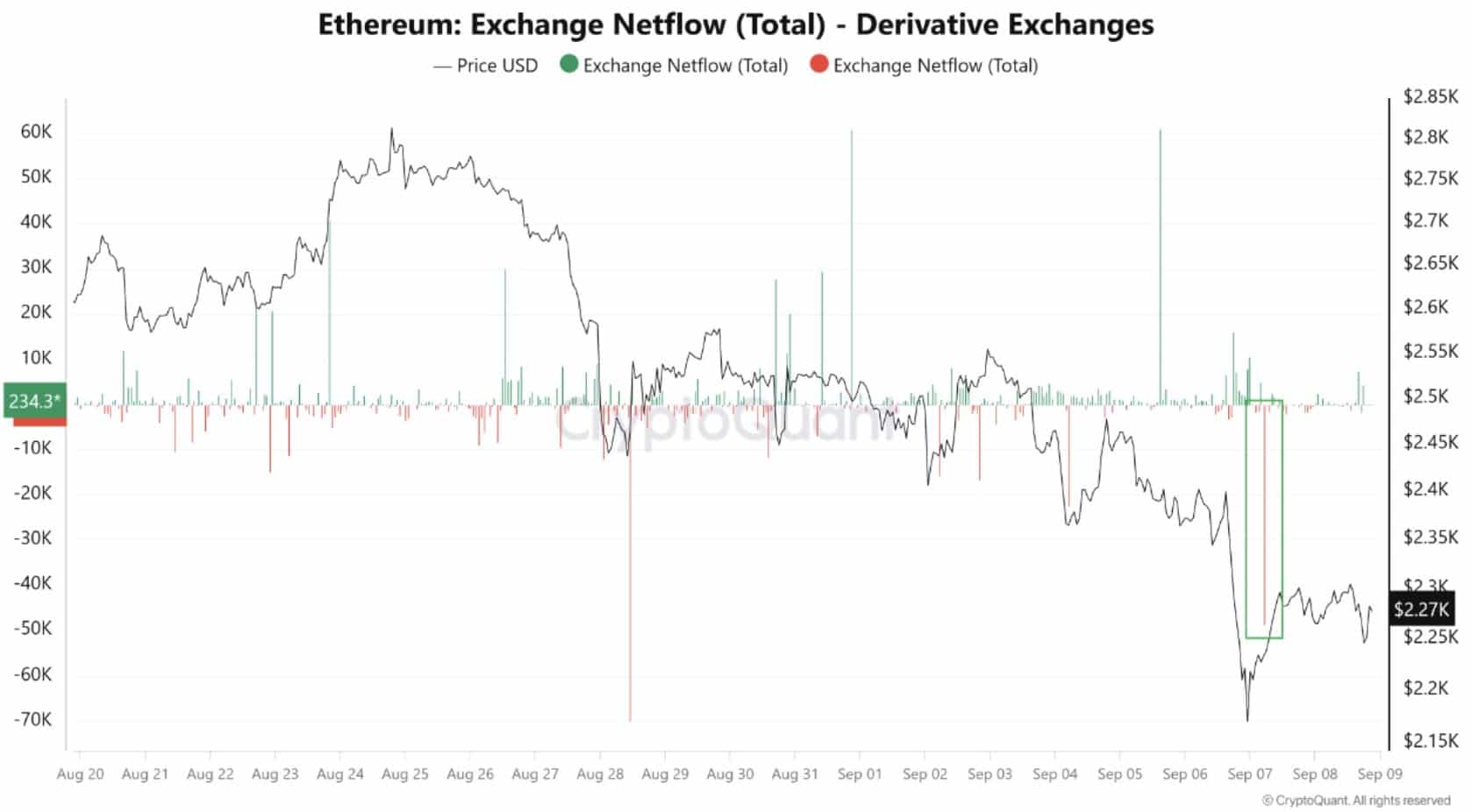

ETH exchange net flows

Looking at Ethereum’s net flow, data showed that negative net flow on derivatives exchanges has exceeded 40,000 ETH.

This suggested that more ETH was being withdrawn from these exchanges and transferred to cold wallets, indicating reduced selling pressure.

Traders may be preparing for long-term gains, suggesting that the current drop in Ethereum’s price is a temporary correction, potentially paving the way for a significant upward move.

Source: CryptoQuant

Read Ethereum’s [ETH] Price forecast 2024–2025

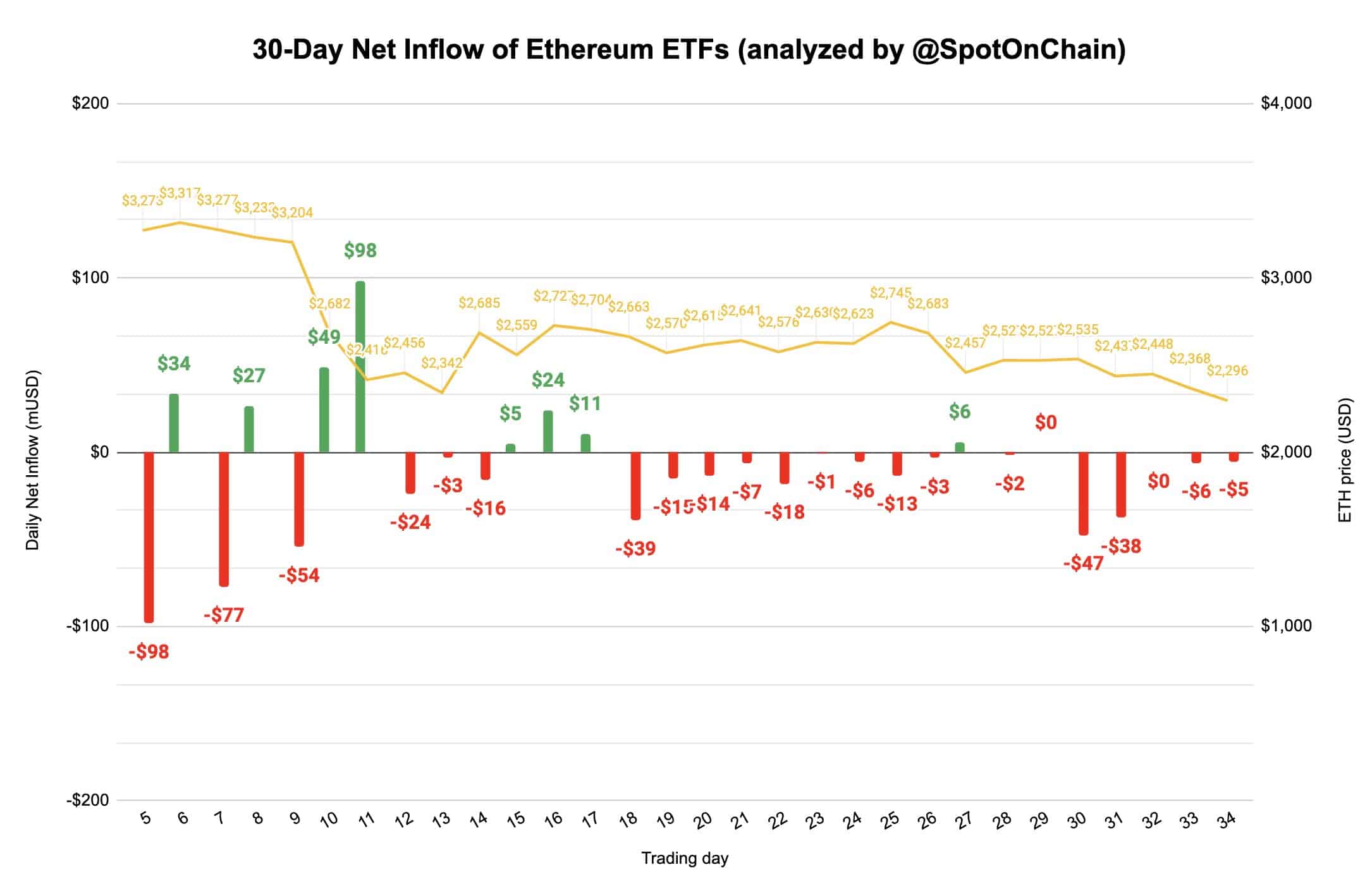

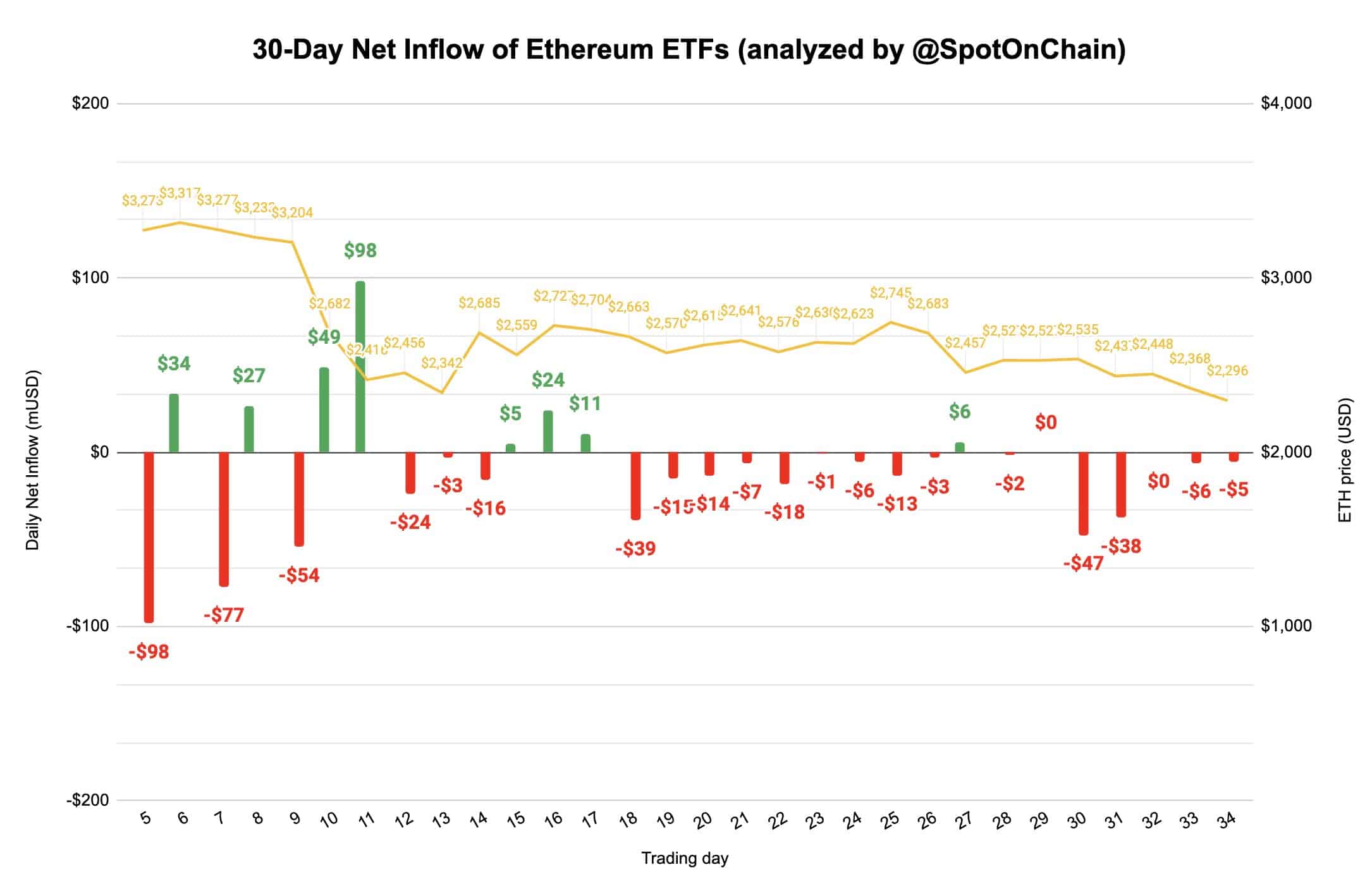

Ethereum ETF update

Despite some negative net flows in Ethereum ETFs, there are positive signs. ETH ETFs, including Fidelity’s, saw inflows over the past 24 hours. Grayscale’s ETHE had the largest and only outflow.

However, the overall positive sentiment surrounding ETFs may ultimately support Ethereum’s future price growth.

Source: Spot On Chain