- Michael Saylor saw Bitcoin as a safe and stable investment.

- Bitcoin’s RSI has formed a bullish divergence on a daily time frame, indicating a trend reversal.

Michael Saylor, the Chairman of MicroStrategy, has received a lot of attention from crypto enthusiasts after his recent Bitcoin [BTC] prediction.

On September 10, during an interview with ‘CNBC Squawk Box’, Saylor made a bold prediction that Bitcoin could reach $13 million by 2045.

Michel Saylor’s bold prediction

During the interviewSaylor highlighted that BTC represented only 0.1% of global capital, but he believed this could grow to 7%. If this major shift happens, it could push the price of BTC to $13 million.

Furthermore, Saylor pointed out that Bitcoin is unique in that it is not dependent on a third party, which makes it less risky compared to other investment products.

While many consider Bitcoin a high-risk investment due to its volatile nature, Saylor argued that it is actually a safe option for investors who believe in safe and stable investments.

Bitcoin technical analysis and key levels

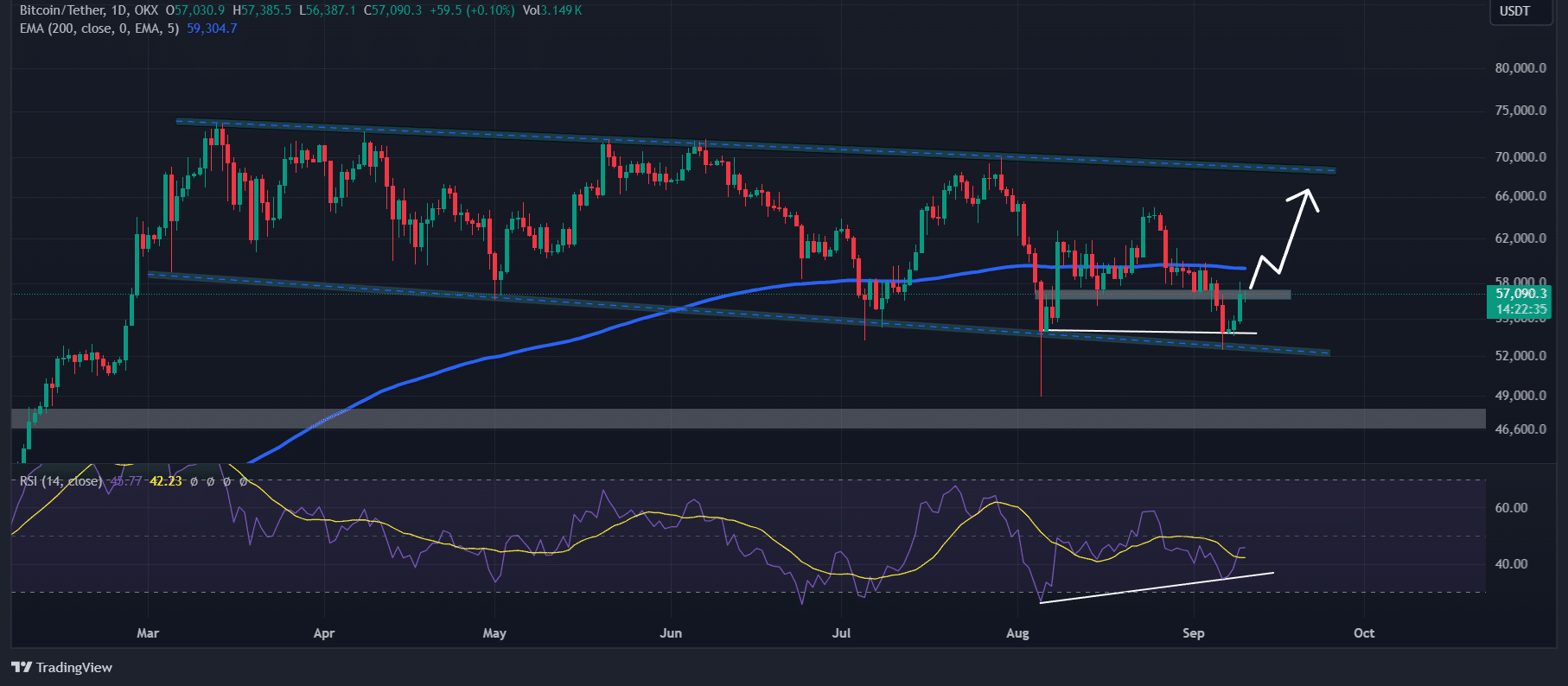

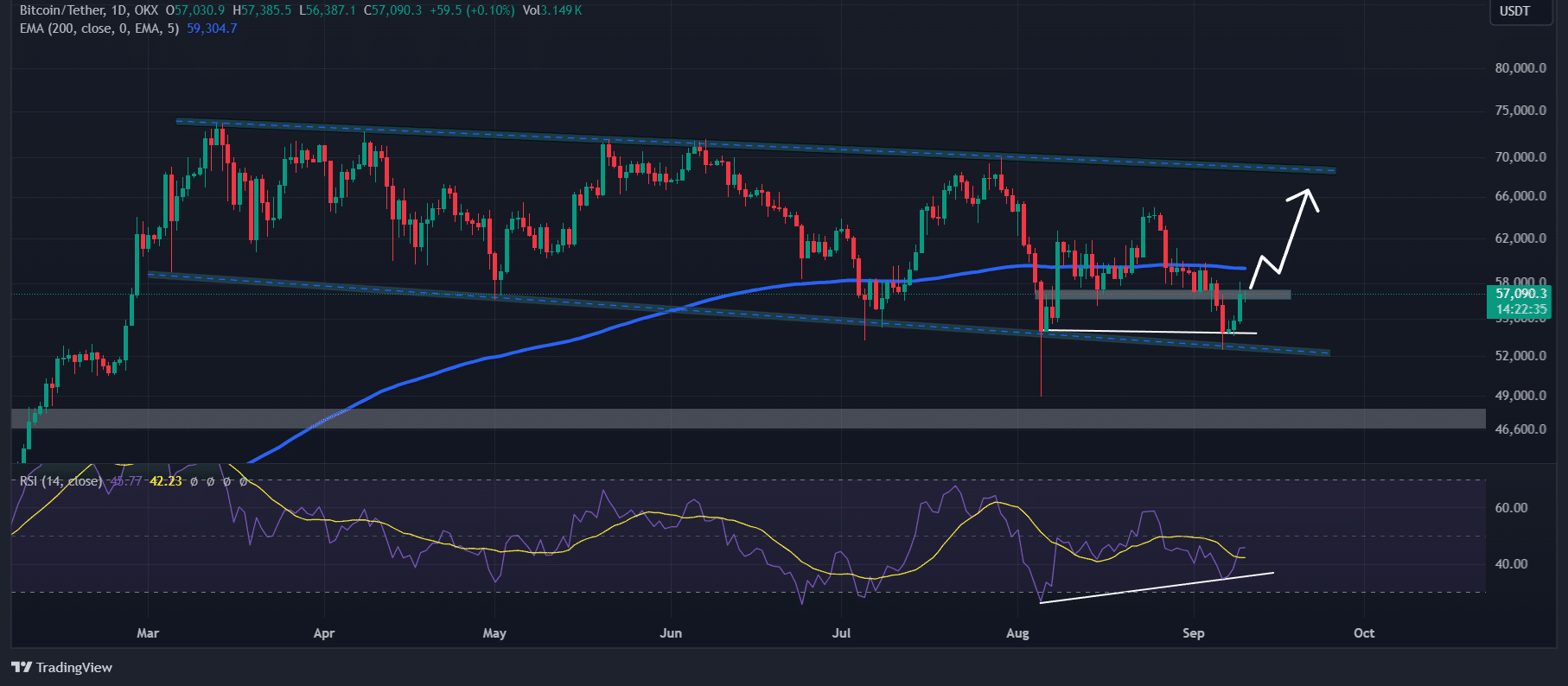

Despite Saylor’s predictions, which span 21 years, AMBCrypto remainsCurrent expert technical analysis showed that Bitcoin appeared bullish despite trading below the 200 Exponential Moving Average (EMA) on the daily time frame.

Since March 2024, Bitcoin has been moving within a descending parallel channel, and during this period, BTC price has reached the lower channel five times.

Source: TradingView

Based on historical data, when BTC reaches the lower channel, it tends to experience a price increase of more than 20%. We may see a similar increase this time.

However, Bitcoin is currently facing strong resistance near the $57,300 level.

If it breaks out and closes a daily candle above that level, there is a good chance that BTC could rise significantly and possibly reach $65,000 and $69,000 in the coming days.

Meanwhile, Bitcoin’s Relative Strength Index (RSI) has formed a bullish divergence on a daily time frame, indicating a trend reversal from a downtrend to an uptrend.

Bullish statistics in the chain

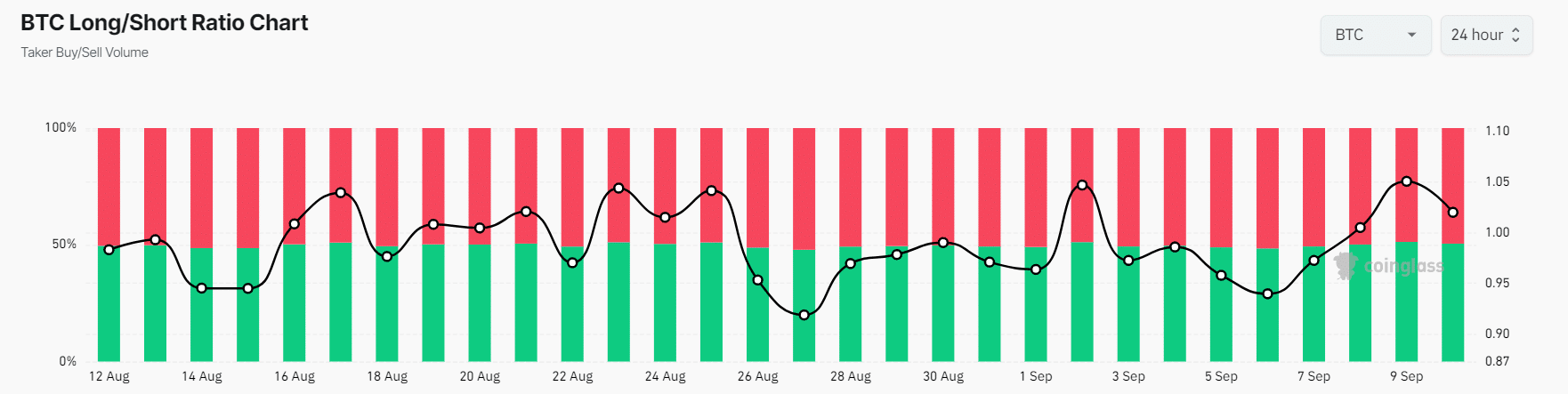

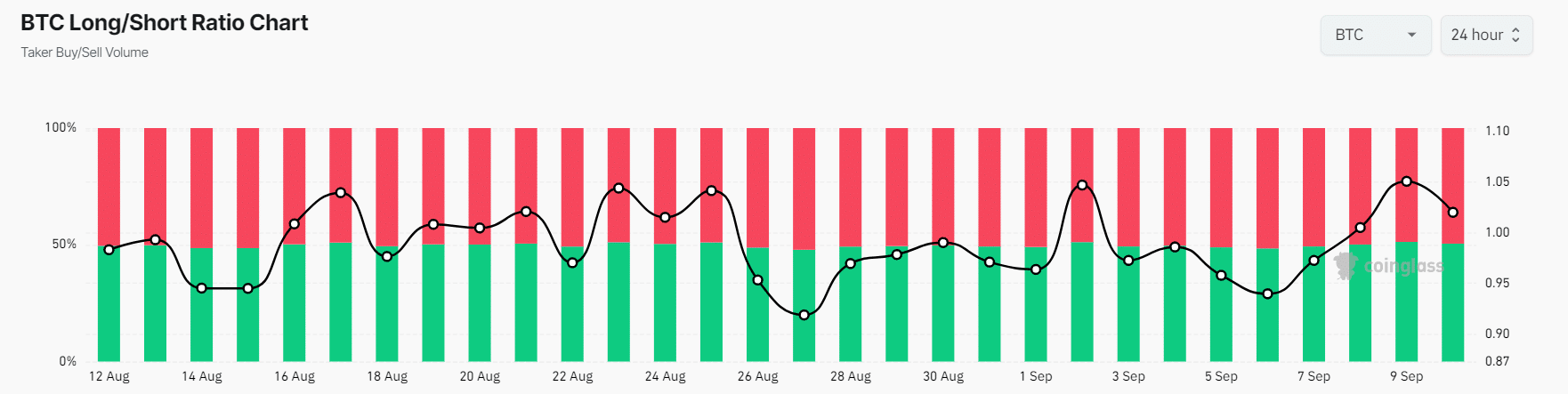

On-chain metrics also support this bullish outlook. Coinglass’s BTC Long/Short ratio stood at +1.039 at the time of writing, reflecting positive sentiment among bullish traders over the past 24 hours.

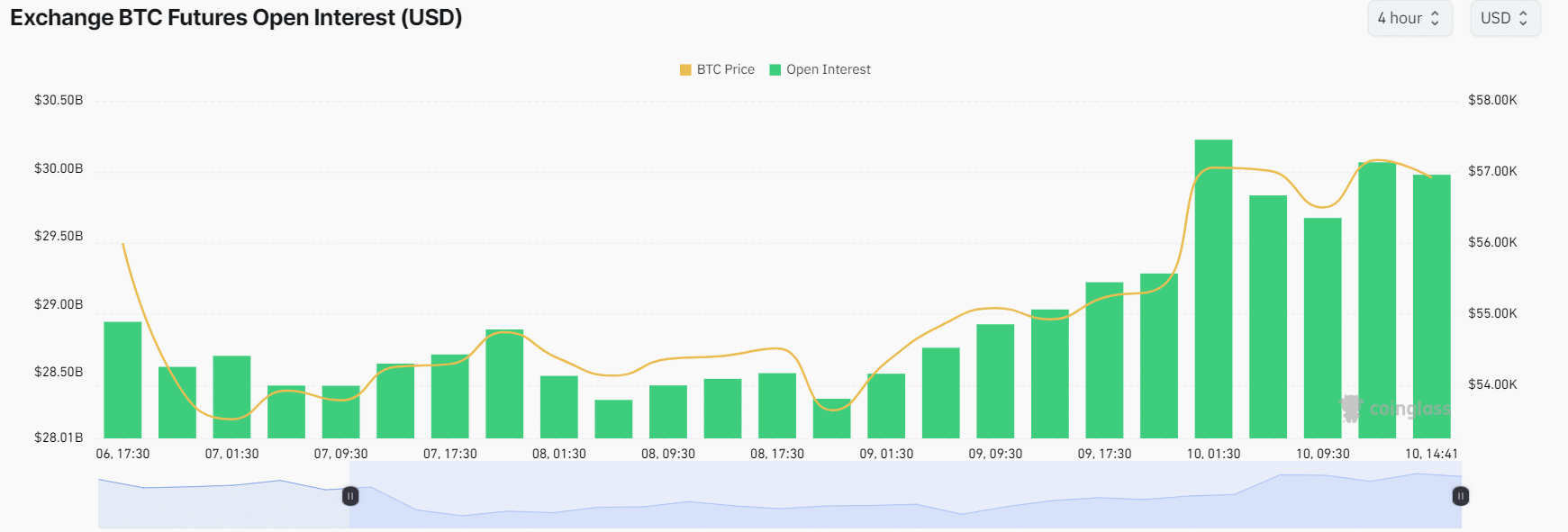

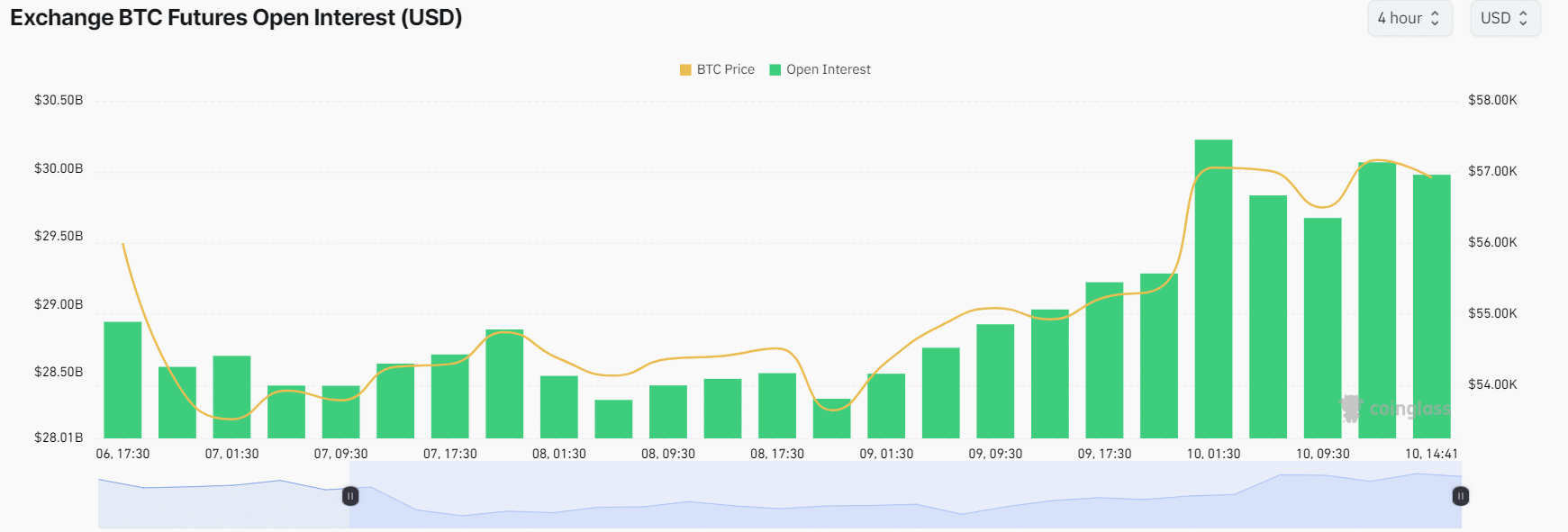

BTC’s Future Open Interest is up over 3% over the same period and has been rising steadily in recent days.

Source: Coinglass

A positive long/short ratio and high open interest indicate potential buying opportunities. Traders often use this combination to build their positions.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024–2025

At the time of writing, BTC was trading around the $57,000 level, following a price increase of more than 3% in the past 24 hours.

Trading volume has skyrocketed by 46% over the same period, indicating greater participation from crypto enthusiasts amid price recovery.