- BTC whales now control 20% of the BTC supply.

- BTC has risen to around $55,000 in the past 24 hours.

Bitcoin [BTC] accumulation at certain addresses has notably increased in recent months. Accumulation is significantly higher when you compare the volume of these addresses to six months ago.

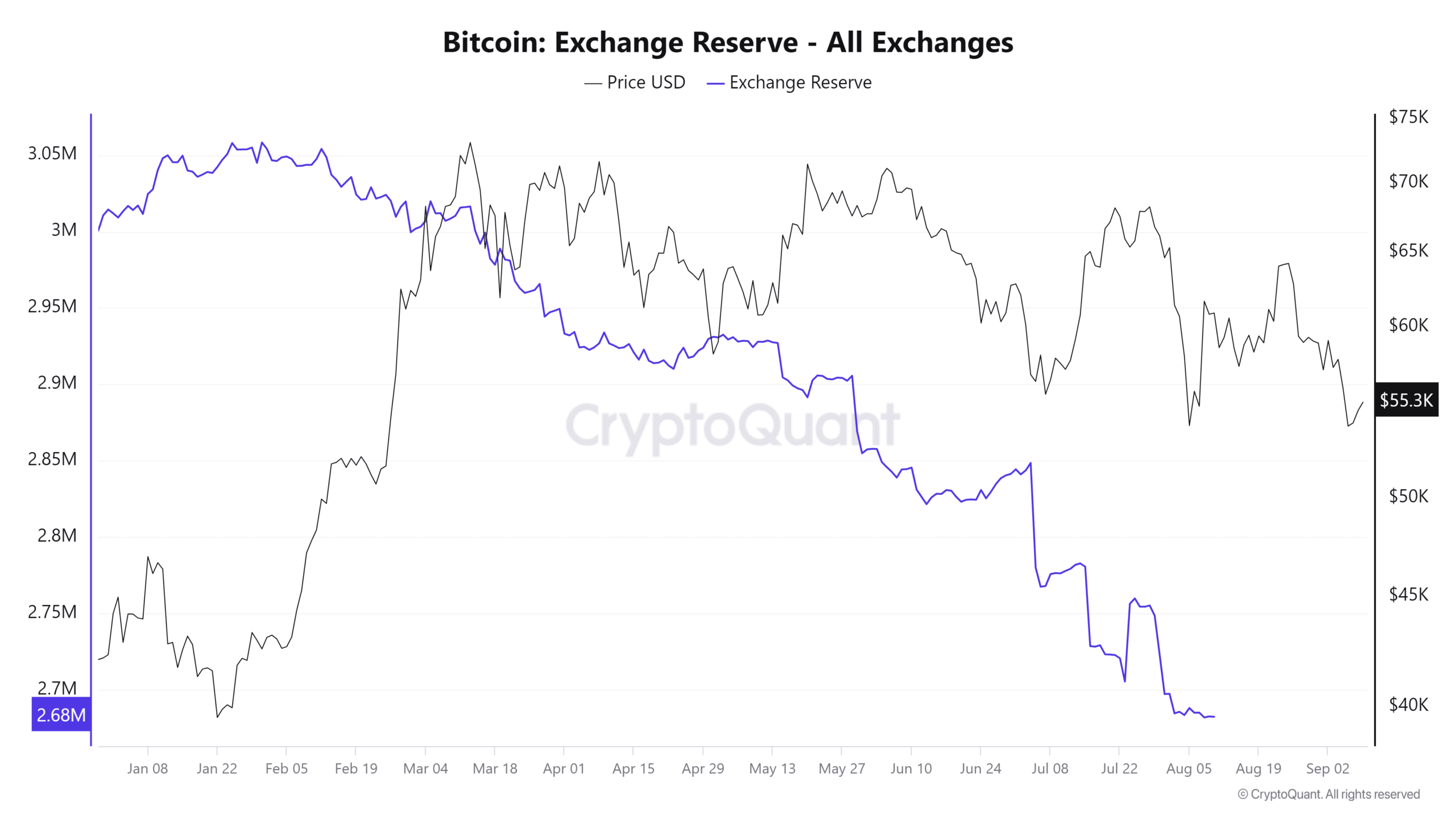

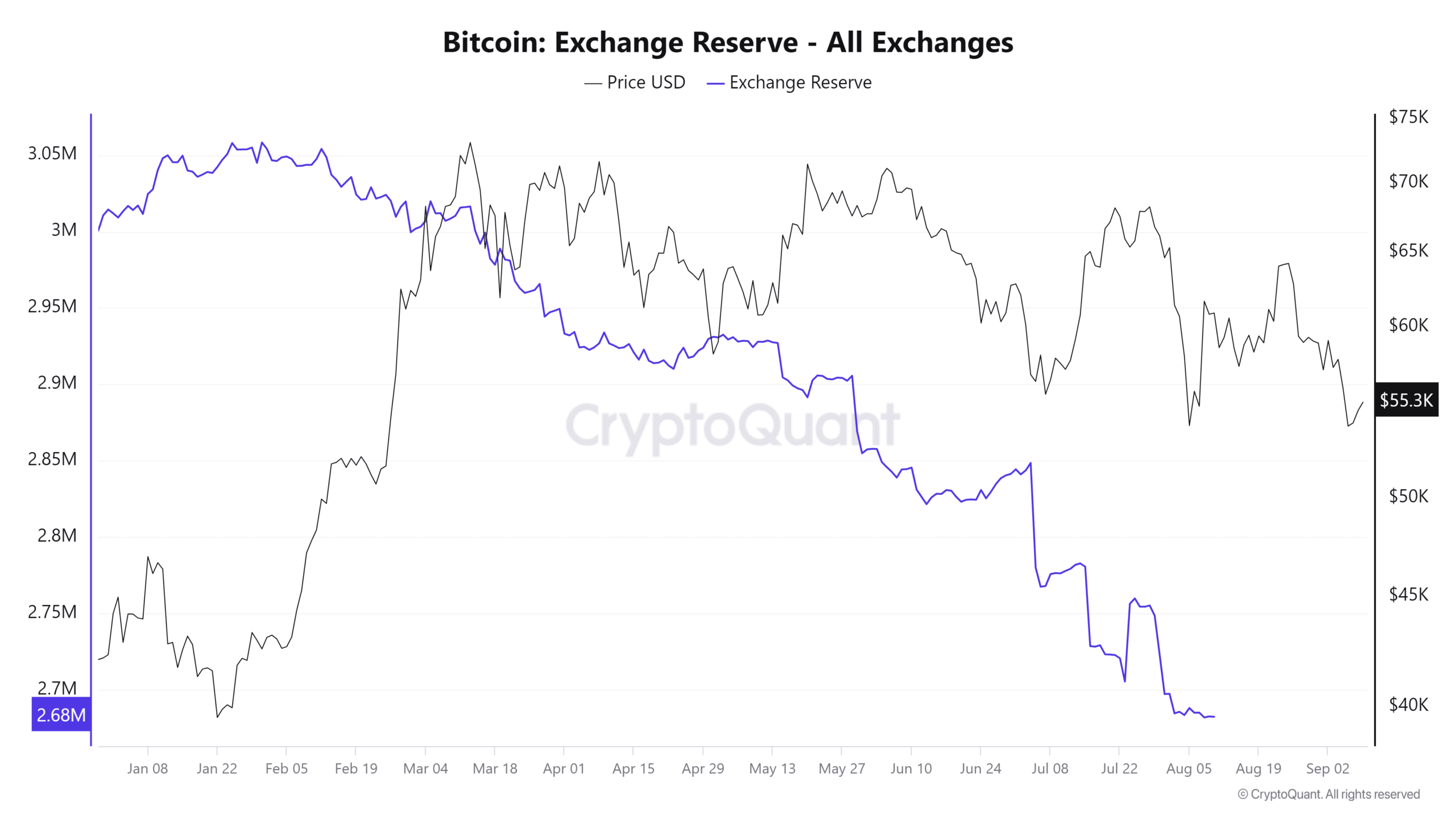

A more positive sign emerges when these increasing assets are compared with foreign exchange reserves over the same period.

Bitcoin Whales Collect an Extra 5%

Recent data from InTheBlok showed that Bitcoin addresses holding 100-1,000 BTC significantly increased their accumulation.

These addresses now hold over 4 million BTC, representing over 20% of the total Bitcoin supply.

This notable increase reflected a 5% increase in holdings compared to six months ago. At that time, these whale addresses contained approximately 3.82 million BTC.

This growth in accumulation underlines growing confidence in Bitcoin’s long-term potential, especially amid volatile market conditions.

The substantial increase in ownership of these addresses suggested that larger investors, or whales, are positioning themselves for future profits.

Bitcoin’s foreign exchange reserves continue to be depleted

The recent accumulation of Bitcoin by large addresses is indeed a bullish sign, and the current Bitcoin exchange reserve trend further reinforces this positive outlook.

According to an analysis of exchange reserve data on CryptoQuant, Bitcoin reserves on exchanges have declined sequentially.

At the time of writing, the foreign exchange reserve stood at approximately 2.68 million BTC, down from approximately 2.93 million BTC six months ago.

Source: CryptoQuant

This consistent decline in the currency reserve, combined with the growth in BTC accumulation by addresses holding 100-1,000 BTC, indicates that many holders have chosen to hold on to their BTC rather than sell or trade it.

By withdrawing their Bitcoin from the exchanges, these holders are signaling a long-term strategy, often indicating growing confidence in future price appreciation.

The shrinking foreign exchange reserve, combined with increased accumulation, signals tighter supply, potentially leading to upward price pressure.

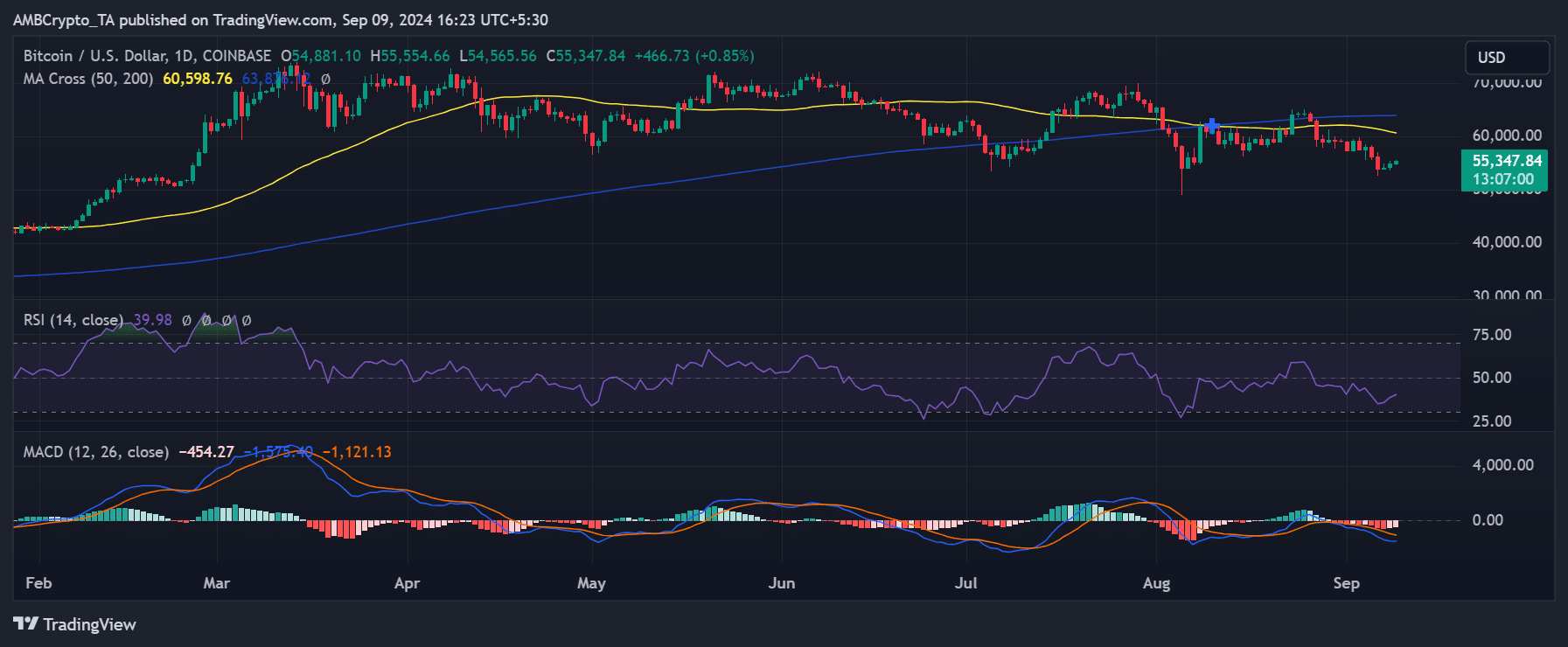

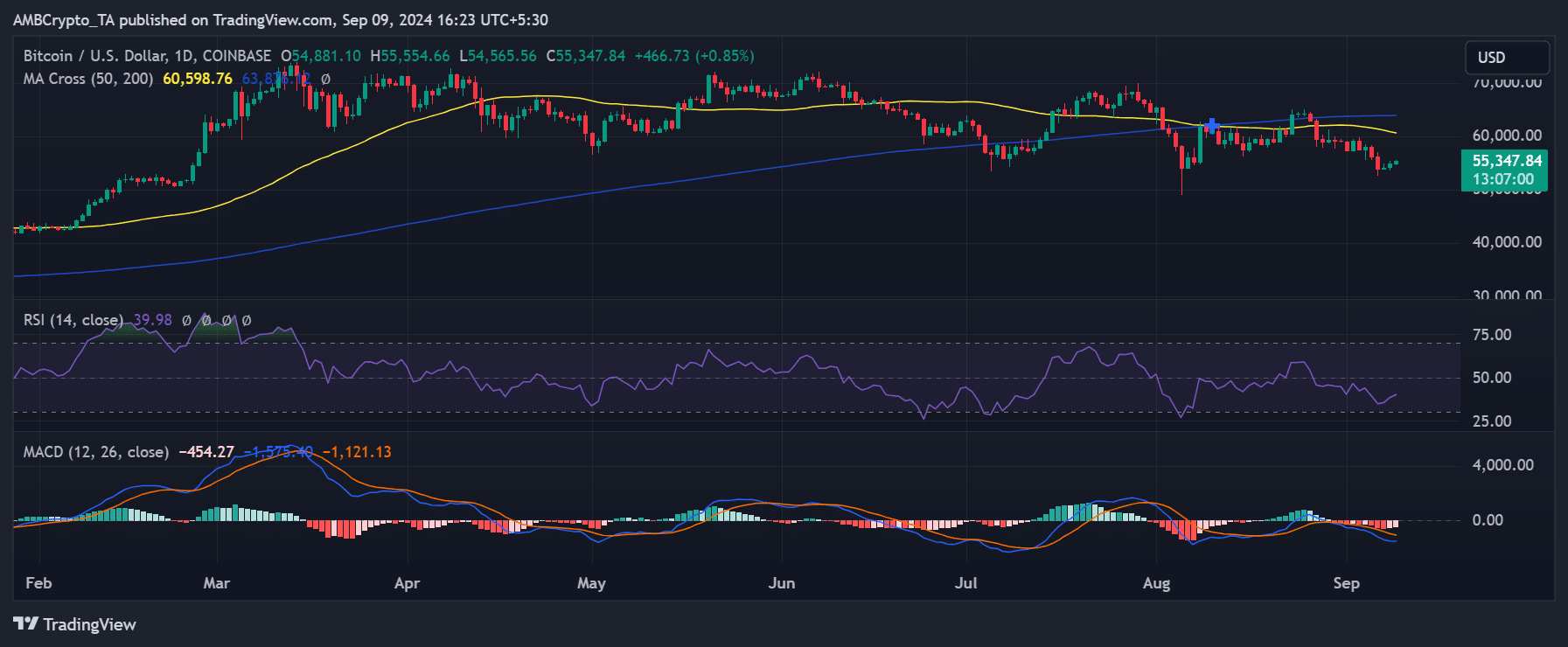

The price of BTC is rising

During the last trading session, Bitcoin saw a rise of over 1%, pushing its price to around $54,881, according to an analysis of the daily price chart.

At the time of writing, Bitcoin has continued to rise to around $55,300, with a slight increase of less than 1%.

Source: TradingView

Read Bitcoin’s [BTC] Price forecast 2024-25

Looking back at the price trend from the beginning of the accumulation phase, BTC traded above $60,000. This means that early accumulators are currently holding their assets at a loss.

However, if BTC can break above the $65,000 price range, these early accumulators would shift into significant profit territory.