On September 8, the team behind decentralized social media protocol Friend.Tech transferred control of its smart contract to Ethereum’s zero address, effectively relinquishing control of the project a year after its successful launch.

In a social media post on X, the team declared:

“The admin and ownership parameters are set to 0x000…000 to prevent any changes to their costs or functionality in the future.”

Nevertheless, Friend.Tech’s web client continues to work as usual. The team also clarified: “No fees from the smart contracts or Friend.Tech are currently going to the multisig developer team.”

Following the announcement, the platform’s native token FRIEND plummeted more than 47% in 24 hours, hitting an all-time low of $0.06026, according to CryptoSlate data at the time of writing.

Although the team has not given a clear reason for this move, Crypto Slates analysis of on-chain data highlights the platform’s steep decline in popularity.

The decline of Friendtech

Launched last August on Coinbase’s Layer 2 network Base, Friend.Tech initially gained quick traction in the crypto community.

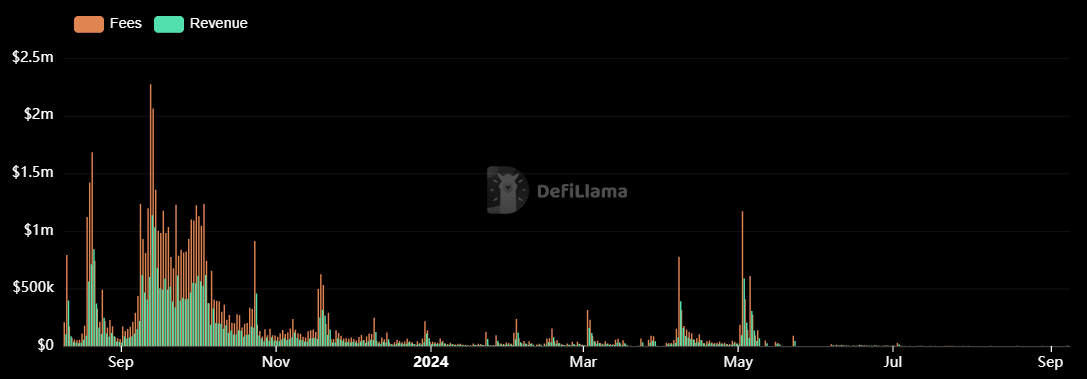

In September 2023, the protocol’s daily revenue surpassed that of Ethereum, and its top keys fetched high prices. Around this time, the platform also raised an undisclosed seed round from crypto VC firm Paradigm.

However, the hype faded as the platform struggled to maintain momentum. It faced several challenges, including SIM swap attacks and poorly managed plans to abandon the Base blockchain.

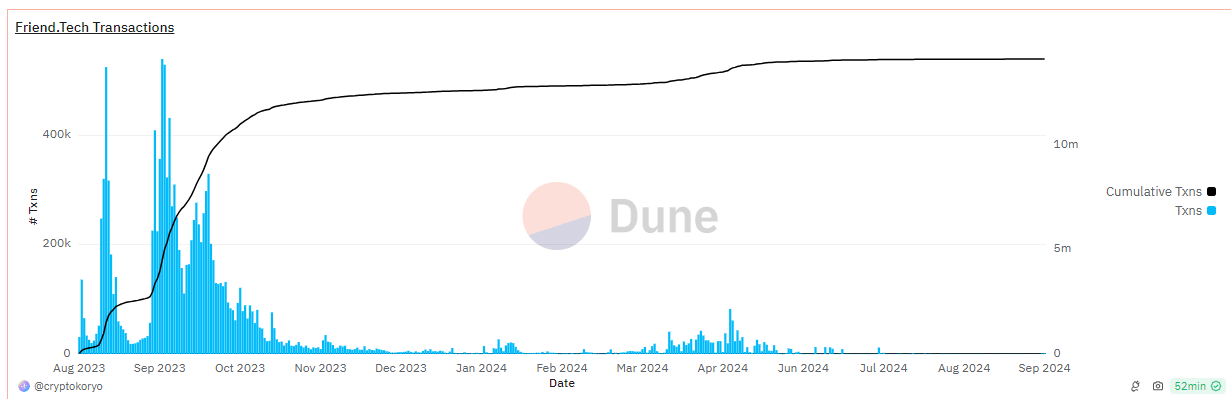

These issues have contributed to a sharp decline in user engagement. Dune Analytics facts shows that the platform’s transaction volume fell by 99%, and it failed to attract new users in September.

This drop inadvertently had a serious impact on revenue, which fell to just $21 over the past 30 days, according to DeFillama data. During the same period, the platform generated less than $10,000 in fees.

Crypto Community Responds

The demise of Friend.Tech drew a lot of criticism from the crypto community, especially regarding the way the team handled the project.

Calvin Chu, core builder at Impossible Finance, expressed his disappointment by saying: “Friend.Tech had become more of a laboratory experiment than a real social finance project.” He further expressed frustration at being “robust” by the decision to halt future upgrade options, which he said ended any hope for further development.

Similarly, Mikko Ohtamaa, the CEO of Trading Strategy, said added that Friend.Tech was a great example of monetizing hype and paying out quickly.