- LINK prices are up 4.24% in the last 24 hours.

- Analysts are looking at $22 if the altcoin has a resistance level of $12.

Over the past two months, the altcoin market has experienced extreme volatility. However, the altcoin market appears to have started a recovery as of the time of writing.

As altcoins start to recover, Chainlink [LINK] responded positively and recorded moderate gains. As such, LINK was trading at $10.23 at the time of writing after rising 4.24% in 24 hours.

Previously, LINK was experiencing a strong downward trajectory. After reaching $12.6 in August, the altcoin formed a falling wedge pattern. With the decline, it fell to a low of $9.2.

Despite the recent gains, LINK remains relatively low from the recent local high of $15 in July. Moreover, it is still about 80.6% lower than the ATH of $50.88.

Therefore, the recent gains raise questions about whether the altcoin is positioned for further gains or if it is just a market correction. Popular crypto analyst Cryptojack suggested that LINK was willing to make four times the profit.

The prevailing market sentiment

Source:

In his analysis, Jack highlighted two key conditions that LINK must meet to reach $22. According to the analysts, LINK’s falling wedge should remain above the $6 support level.

He noted that the altcoin’s falling wedge is approaching this critical level and that a further decline will result in a breakout.

Second, the analysts argue that LINK needs to break out of the falling wedge to prepare for a strong uptrend. He states that a break from the pattern will strengthen the altcoin to gain 4x and reach $22.

Based on this analysis, breaking this pattern is a recipe for further gains. Looking at the charts, every time LINK breaks out of a falling wedge, it makes significant gains. For example, the price previously rose from a local low of $8.0 to a local high of $12.6.

What LINK graphs suggest

The circumstances highlighted by Jack undoubtedly provide a positive outlook. But what do other market indicators say?

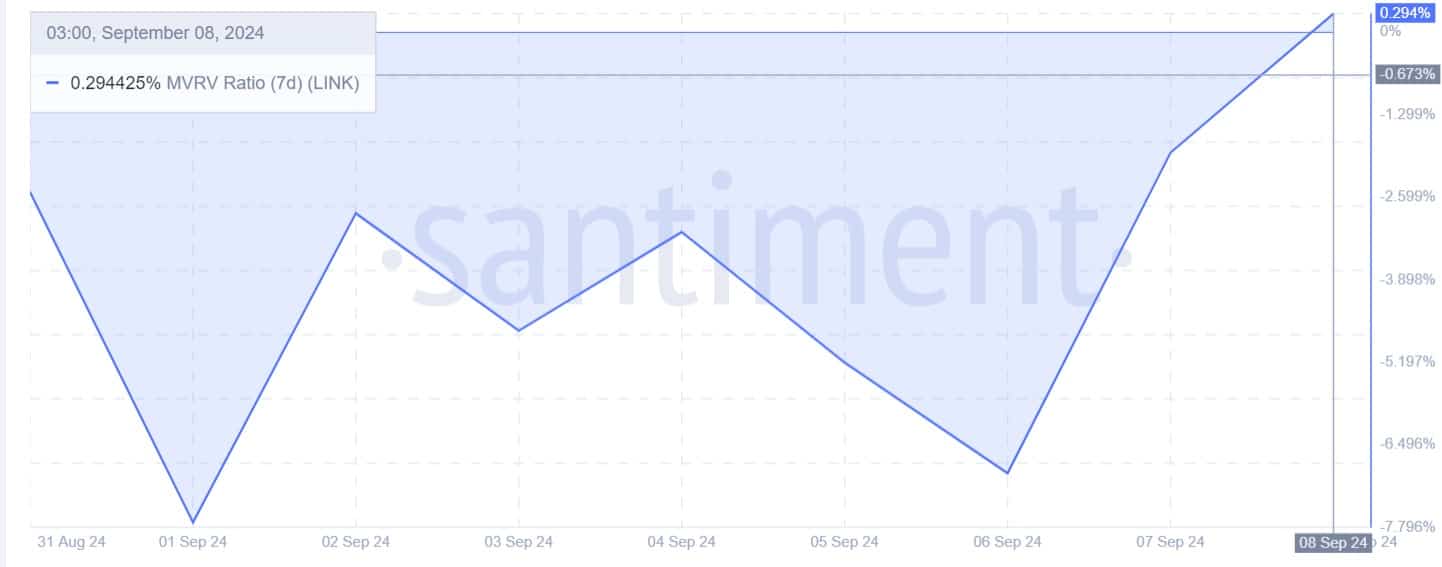

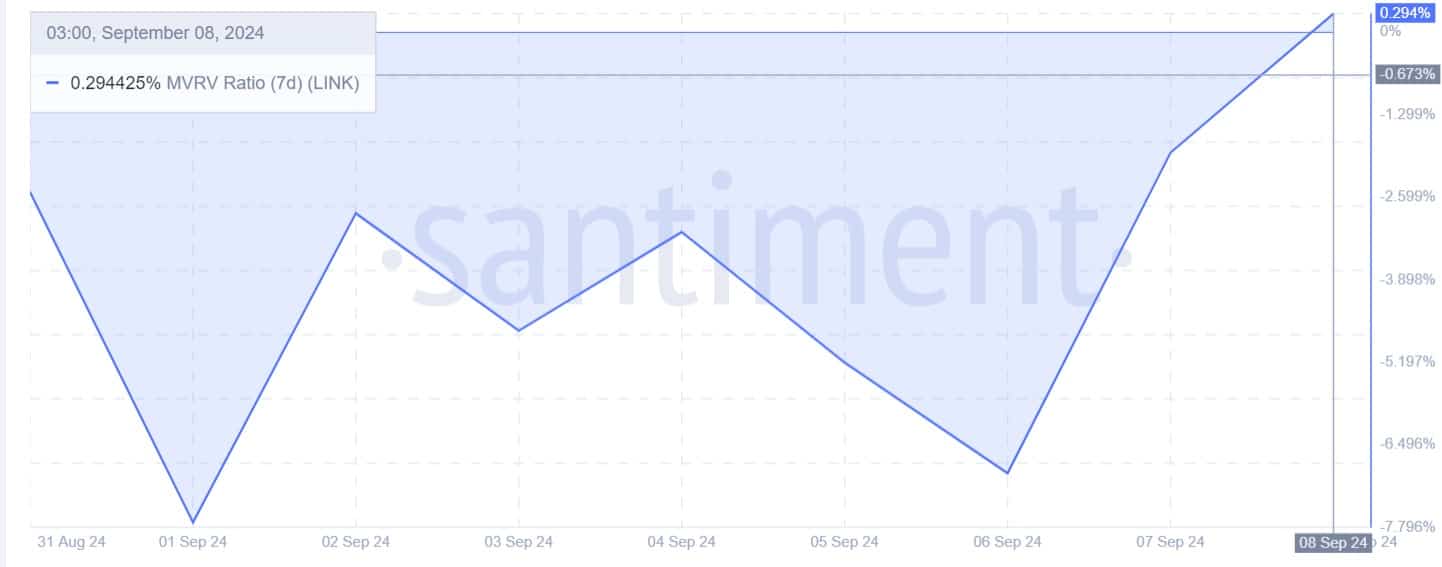

Source: Santiment

First, Chainlink’s market value to realized value (MVRV ratio) has turned positive after a sustained negative reading. The MVRV was negative for most of last week.

However, at the time of writing, the MVRV ratio had turned positive to 0.29. A shift from negative to positive indicates market recovery where the market value rises above the realized value.

This indicates a recovery phase or the market is experiencing bullish sentiment. Moreover, such market behavior shows a shift in market sentiment towards increased demand and optimism.

Source: Santiment

Additionally, LINK’s open interest per exchange has increased over the past week. As such, open interest in stock markets has seen movement over the past week.

It has risen from a low of $36 million to $40 million. The increase in open interest per exchange shows that more investors are betting on further price increases.

Is your portfolio green? View the LINK Profit Calculator

This was a bullish signal as investors open new positions while paying a premium to maintain their positions in the event of a downtrend.

If there is between $10 and $12 in the price, there would be an upward move. If the daily candle closes above $10.5, LINK is well positioned to attempt a near-term $15 resistance level.