- Bitcoin’s foreign exchange reserves suggested selling pressure was high

- Market indicators pointed to a bullish trend reversal

Bitcoin [BTC]despite a brief recovery, it is struggling again after its price fell below $55,000 on the charts. In the meantime, an institutional investor has poured millions of dollars worth of BTC, fueling sell-off concerns. Does this mean that BTC may see another price correction in the coming days?

Are Investors Selling BTC?

Bitcoin, like most other cryptos, also registered a price drop last week as the coin’s price plummeted by almost 8%. The bearish price trend continued over the past 24 hours as it fell by more than 2%. At the time of writing, BTC was trading at $54,284.69 with a market cap of over $1 trillion.

While that was happening, a large-scale investor sold a significant amount of BTC. To be precise, Galaxy Digital has deposited 1,458 BTC worth $78.5 million into Coinbase Prime. This update from Lookonchain suggested that whales are now selling BTC. When whales sell BTC, it means they expect the price of an asset to fall further.

Therefore, it is worth looking a lot at other data sets to see if the selling pressure on the coin has increased or not.

According to AMBCrypto’s analysis of CryptoQuant data, Bitcoin’s foreign exchange reserves have been rising lately. By extension, this meant that selling pressure on the currency was high.

Apart from that, at the time of writing, both BTC’s Coinbase Premium and Funds Premium were in the red – a sign that selling sentiment was dominant among US and institutional investors.

Source: CryptoQuant

What do the market indicators suggest?

We then assessed the crypto’s metrics to find out if they also indicated a further price correction.

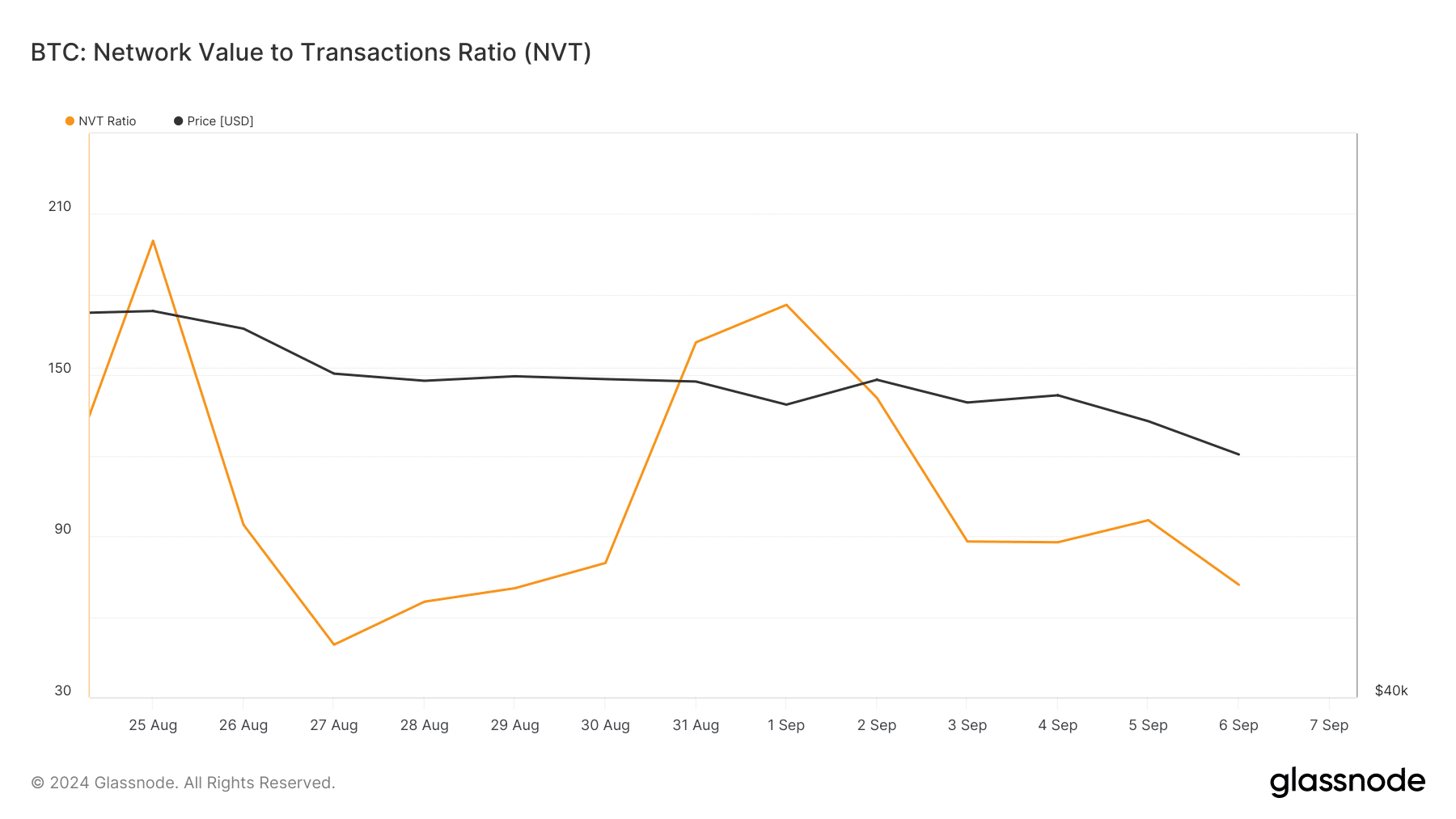

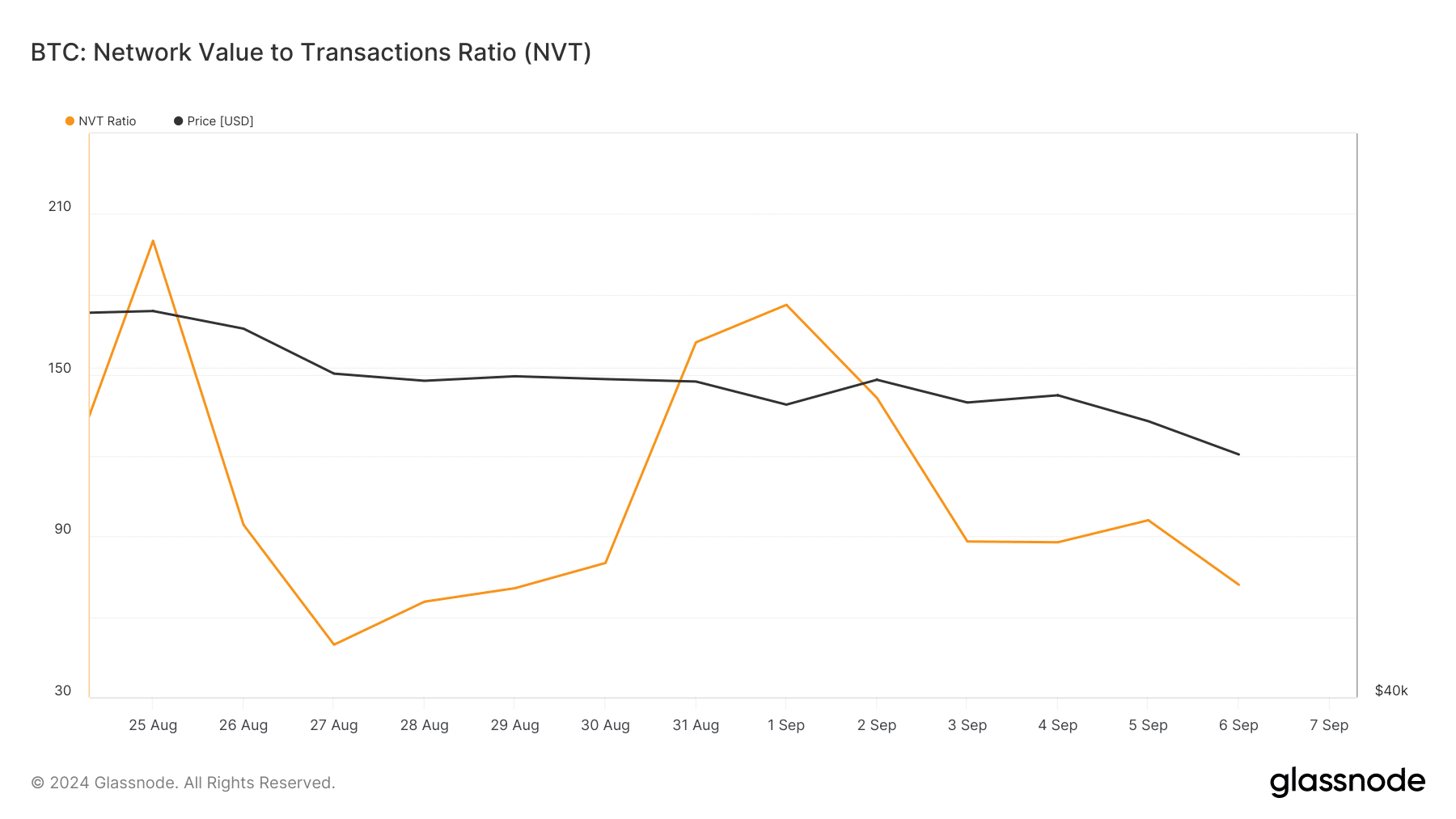

According to our analysis of Glassnode’s data, BTC’s NVT ratio declined on the charts. When that happens, it indicates that an asset is undervalued, which signals an increase in price.

Source: Glassnode

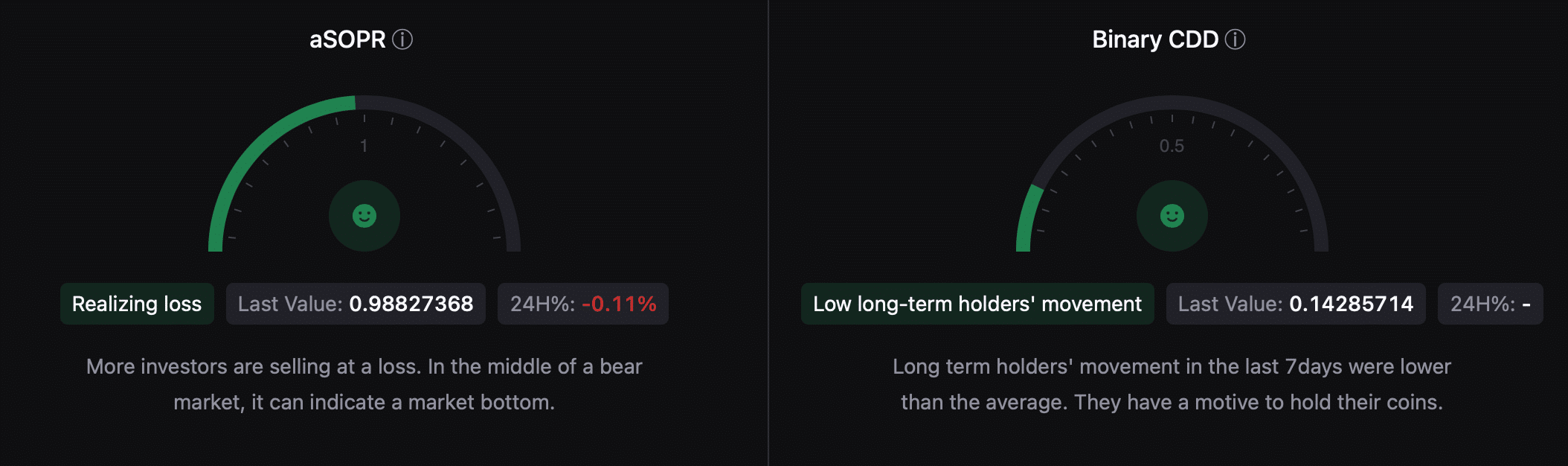

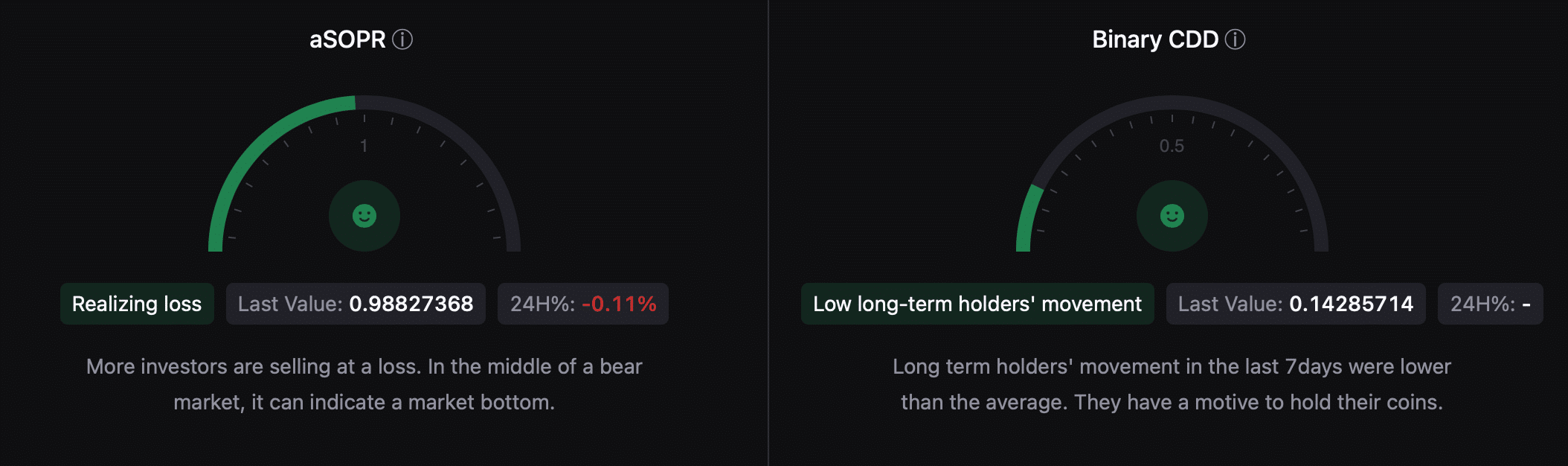

Additionally, BTC’s aSORP was green, meaning more investors sold at a loss. In the middle of a bear market, this could indicate a market bottom.

Moreover, the binary CDD implied that the movement of long-term holders over the past seven days was lower than the average. They have a motive to hold on to their coins. This can be inferred as a bullish signal.

Source: CryptoQuant

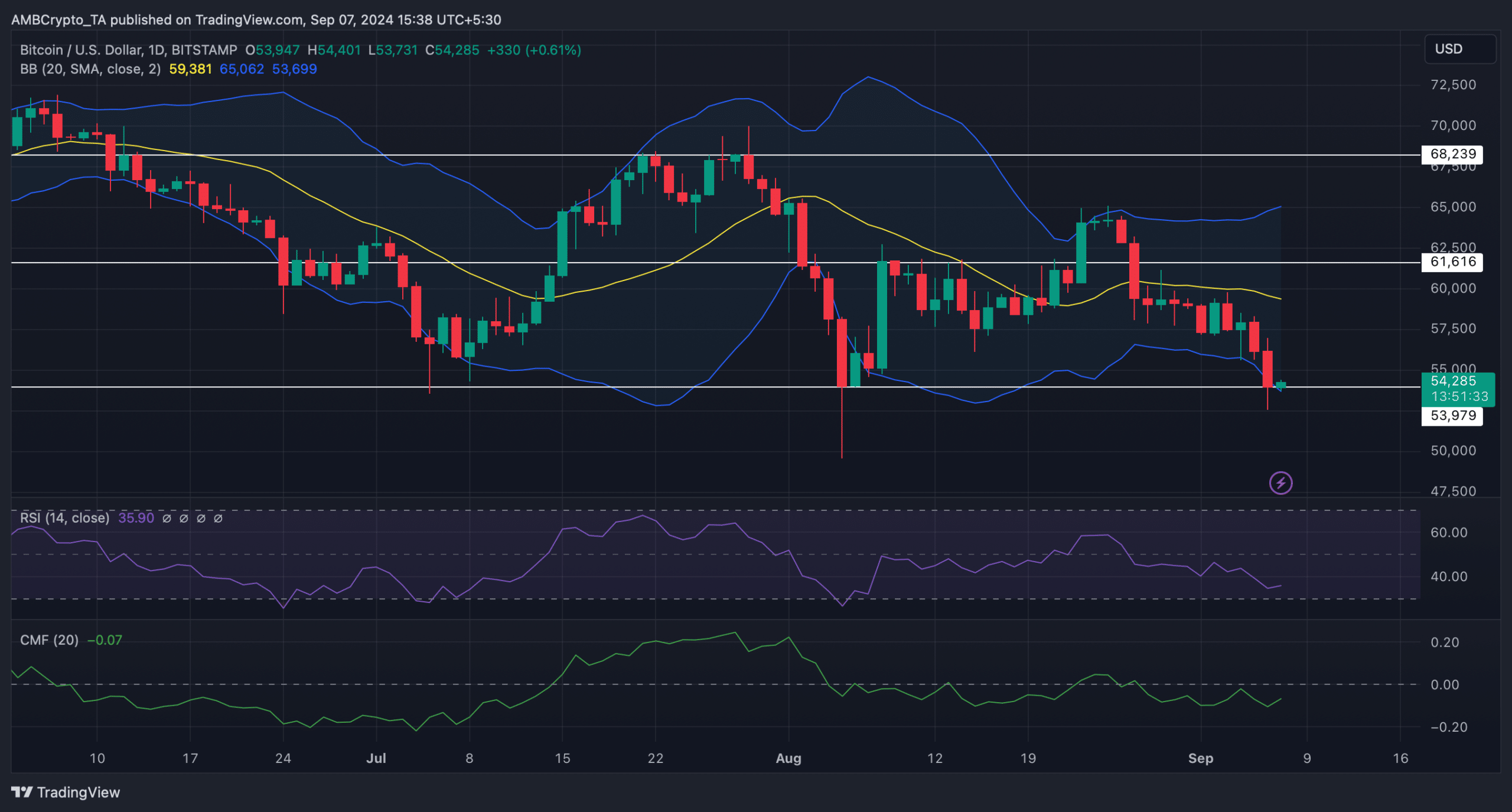

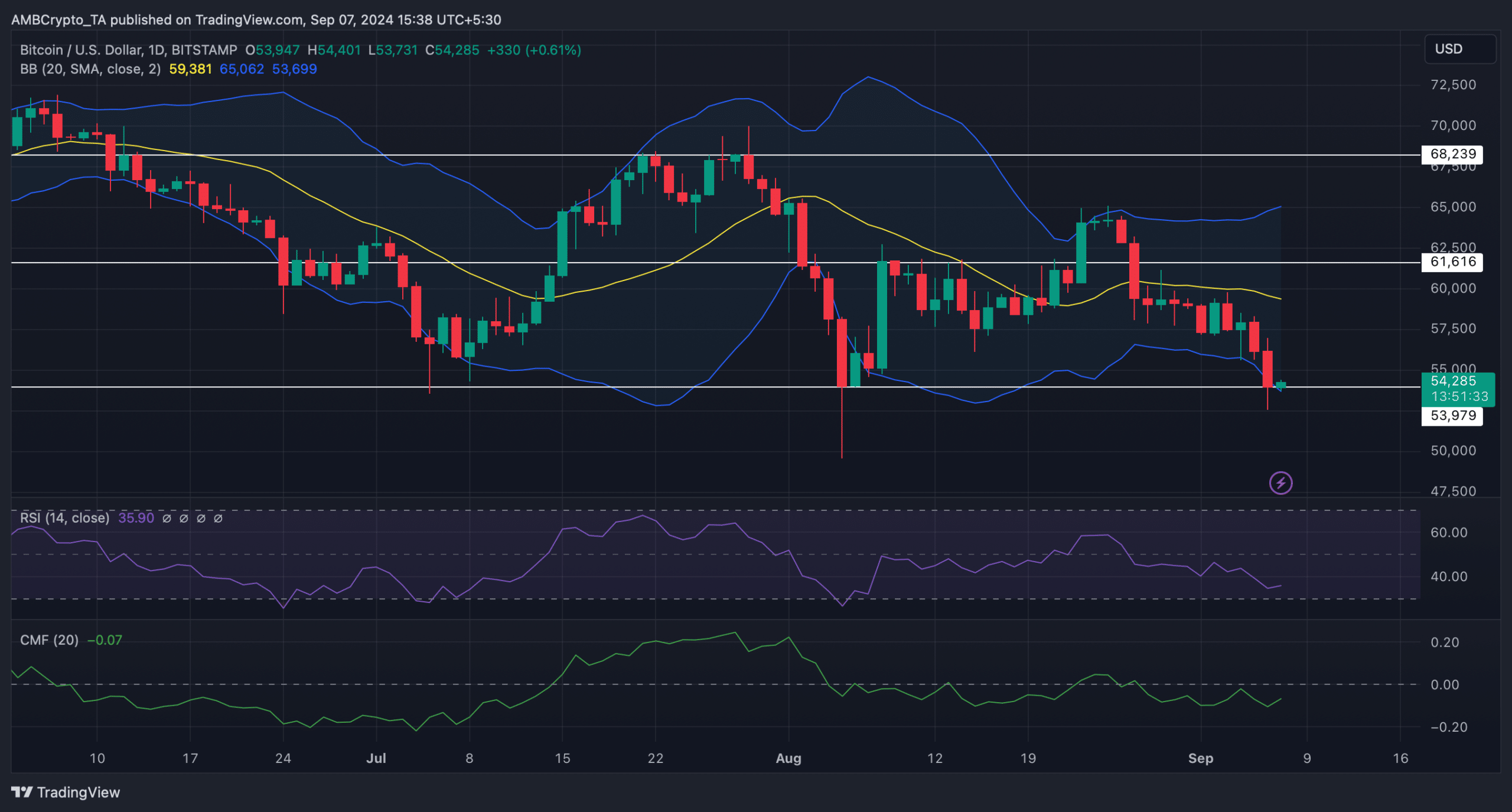

That’s why we took a look at the coin’s daily chart to better understand where it is heading. Our analysis showed that BTC appeared to be testing a support level. The price of the coin also reached the lower limit of the Bollinger Bands, which often results in price increases.

Read Bitcoins [BTC] Price prediction 2024–2025

Finally, both the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF) also recorded increases – again an indicator of an impending rise.

Source: TradingView