- Corporate adoption of BTC has increased by more than 30% in the past year.

- How is this mass adoption changing the financial landscape?

Bitcoin [BTC] has been consolidating for three days in a row, with the price fluctuating between a defined price range of $56,000 – $59,000.

Amid analyst speculation that BTC could fall below the $51,000 support, a new trend has emerged, potentially increasing the chances of a price correction.

Could the business world be the next hidden catalyst for Bitcoin’s revival? AMBCrypto investigates.

Companies increase the accumulation of BTC

In a message on X (formerly Twitter) a new one study revealed a 30% increase in corporate adoption of Bitcoin in one year.

For context, the report identified 52 publicly traded companies with Bitcoin holdings, a number that has increased by 40% in the past year.

According to AMBCrypto’s analysis of the report, a quieter but significant trend is emerging.

Source:

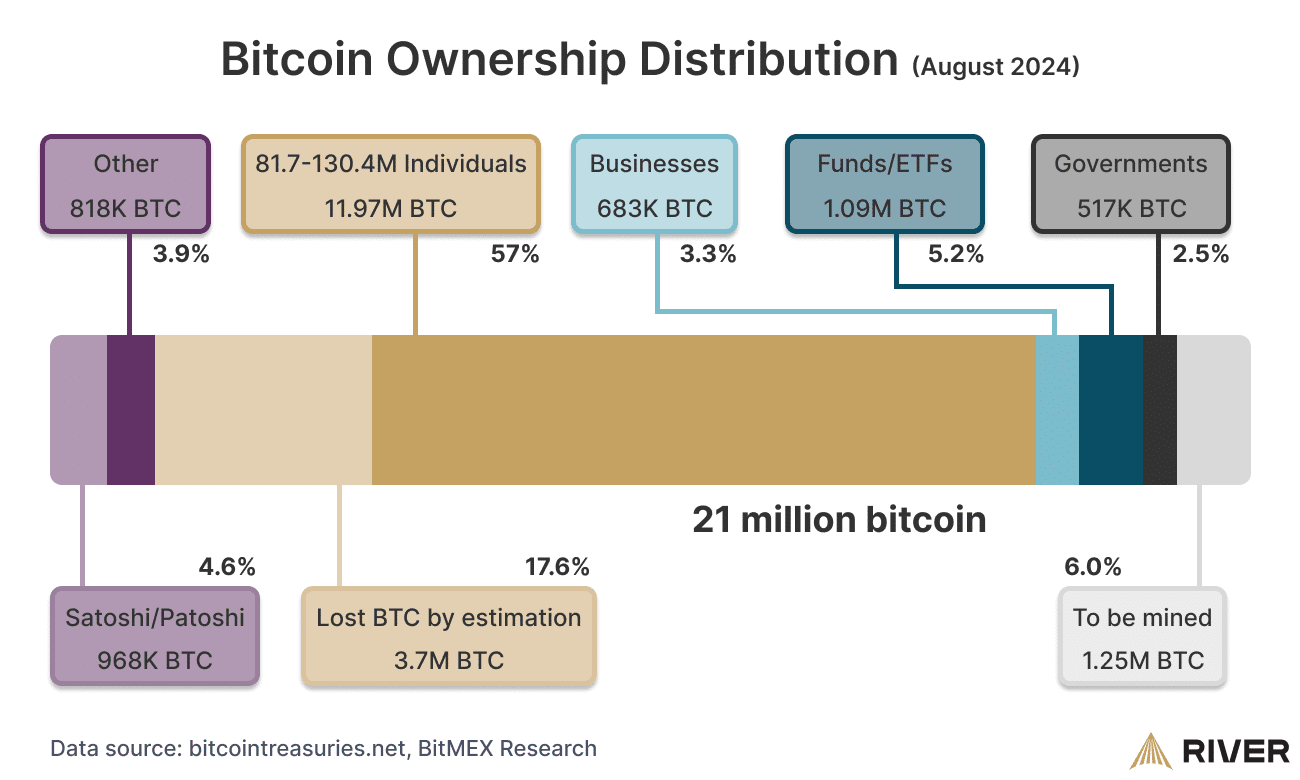

While much attention has been focused on individual investors, investment firms, and large corporations making headlines with multimillion-dollar BTC purchases, small-scale businesses are steadily contributing to the Bitcoin ecosystem.

Today, companies collectively own more than 3% of all Bitcoin in circulation – a remarkable increase of 500% in recent years.

Interestingly, companies have quickly surpassed governments in Bitcoin accumulation.

If this trend continues, companies could soon compete with Bitcoin-owned ETFs, increasing Bitcoin’s financial significance.

Clearly, companies see Bitcoin as a store of value, effectively preserving wealth over time. However, can it tolerate volatility and maintain its value?

Companies have enormous confidence that this is possible

Interestingly, the report revealed a major trend: Bitcoin ownership among companies is concentrated among the five largest holders.

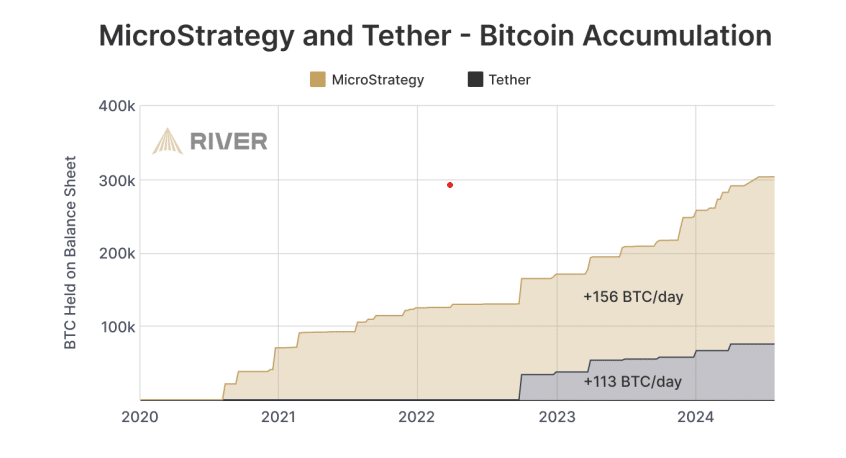

Five companies – MicroStrategyBlock.one, Tether, BitMEX and Xapo – own 82% of all holdings, totaling 559,000 BTC.

Notably, MicroStrategy and Tether account for 85% of reported BTC purchases in early 2024, purchasing an average of 269 BTC per day since late 2022.

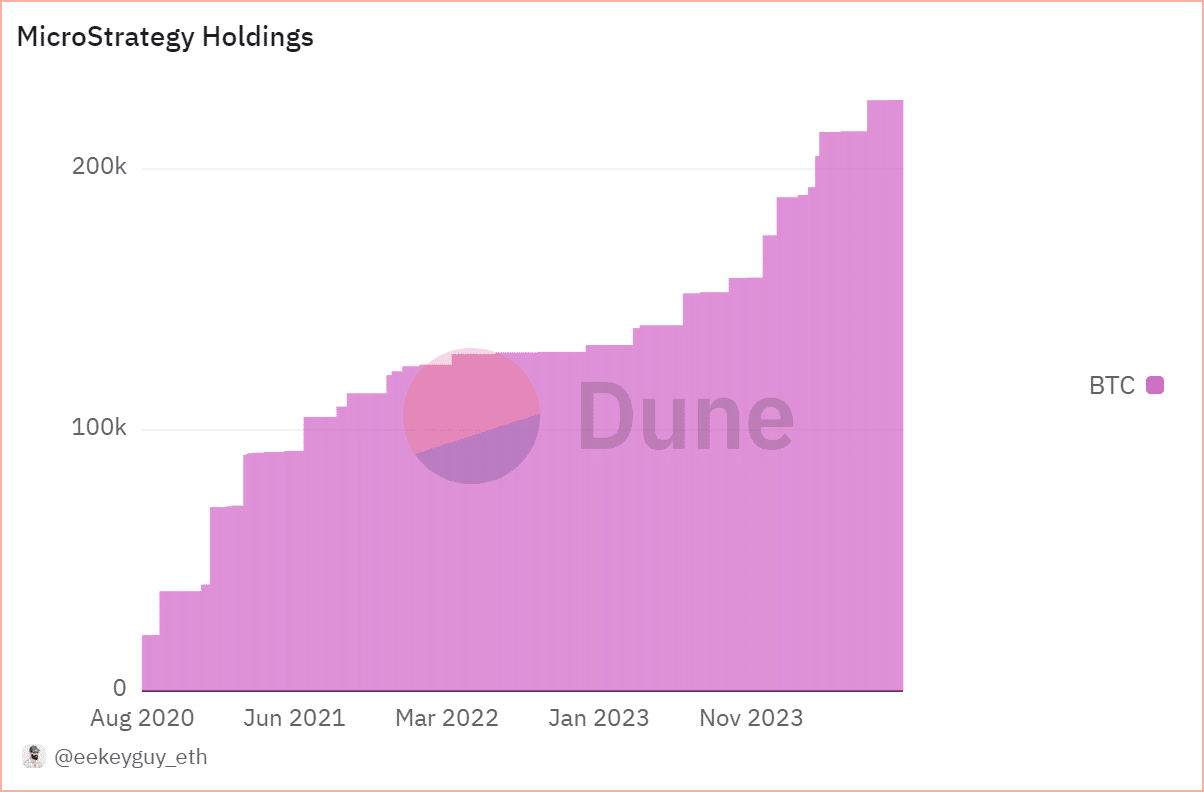

Source:

In summary, substantial corporate interests have been critical in increasing the value of BTC, causing its price to continually rise despite macroeconomic turmoil.

That said, BTC started September on a bearish note, with short positions dominating the derivatives market and keeping BTC below $60,000.

Given the report’s insight that Bitcoin is owned by a few big corporate players, could they be driving the pullback?

MicroStrategy Data Signals…

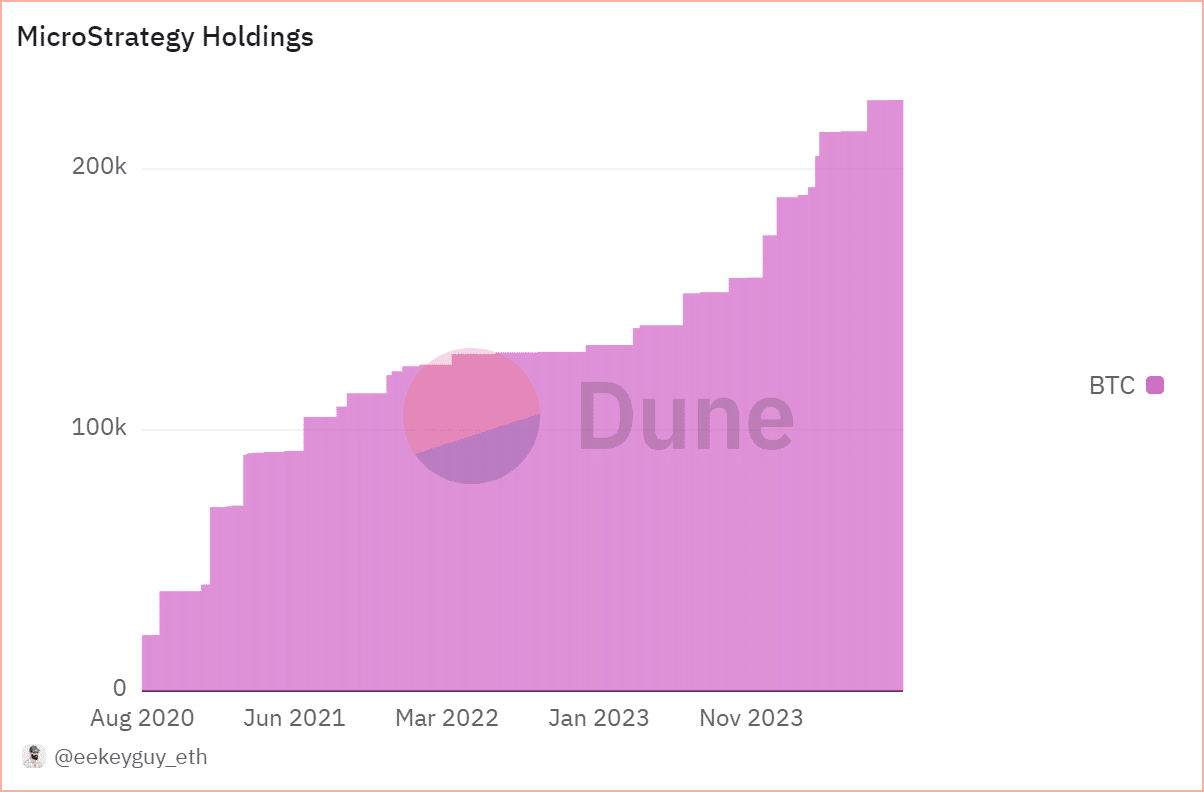

On April 29, MicroStrategy published its first quarter financial report, showing that it now owns 214,400 Bitcoin. The company has acquired an additional 25,250 Bitcoin for a total of $1.65 billion, for an average of $65,232 per coin.

Source: Dune

According to the chart above, MicroStrategy’s BTC holdings have increased more than tenfold over the past four years, from 21,000 in early 2020 to 216,000 at the time of writing.

Meanwhile, the US government has been keeping a close eye on Bitcoin balancewhere BTC is regularly deposited on exchanges.

In short, major companies have held onto Bitcoin despite short-term price fluctuations – a clear bullish sign.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Complementing this optimism, the report highlighted the growing view of Bitcoin as a store of value, predicting that corporate adoption could reach nearly 1 million by 2026.

Therefore, AMBCrypto predicts that Bitcoin may be approaching a price correction, although this ultimately depends on the actions of institutional investors and smart traders.