This article is available in Spanish.

Arthur Hayes, the co-founder of BitMEX, today expressed a gloomy outlook for the immediate future of the Bitcoin price. On his X profile, Hayes revealed his personal market maneuver, which states: “BTC is tough, I’m aiming for less than $50,000 this weekend. I took a cheeky short. Pray for my soul, for I am a sword.”

Why Hayes May Expect a Bitcoin Price Crash

While Hayes did not provide explicit reasons for his prediction, the timing of his statement closely aligns with key US economic indicators set to be released this Friday. US jobs data has been a critical factor for market analysts lately. The Kobeissi Letter Analysts, comment highlighted the increasing influence of unemployment data on Federal Reserve policy.

Related reading

They explained via Over the past two days, forecast markets have priced in an additional rate cut in 2024. This is because labor market data has deteriorated across the board. It is clear that unemployment data is quickly becoming the main driver of Fed policy, along with inflation.”

Today’s jobs report will be the key factor in determining whether the US Federal Reserve (Fed) will cut interest rates by 50 basis points or 25 basis points, according to analysts. The next FOMC meeting will be September 17-18, 2024. “If the jobs report is in line with expectations or better, we think a 25 basis point rate cut is coming. Interest rate expectations appear to be becoming too moderate again,” say the Kobeissi analysts.

Notably, the worsening labor market scenario was just highlighted by data released earlier this week. According to the JOLTs survey, US job openings fell from 7.91 million in June to 7.67 million in July, the lowest level since January 2021. Analysts had expected a figure of around 8.09 million, pushing the actual data has become a significant error. expectations.

Related reading

Since March 2022, job openings have fallen by a whopping 4.51 million, or 38%, a drop that The Kobeissi Letter describes as “MASSIVE.” They added: “The most notable decline was seen in the number of vacancies in the construction sector, which fell to 248,000 in July, the lowest since October 2020. Meanwhile, the ratio of vacancies to unemployed fell to 1.07 in July, in line with the level of 2018.”

This backdrop of weakening jobs numbers and revised economic forecasts has undoubtedly contributed to the poor sentiment in the Bitcoin market. Hayes seems to expect more bad macro data, which he believes could push the Bitcoin price below $50,000.

Is $46,000 the bottom?

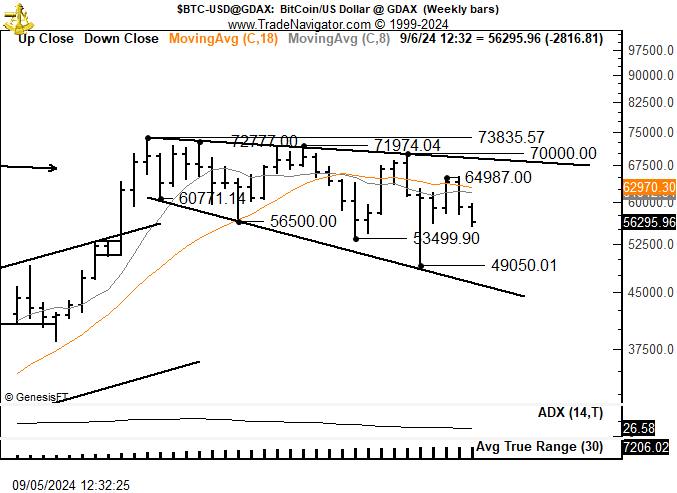

Adding to the chorus of bearish outlooks, noted trader Peter Brandt also provided his technical analysis, observing what he calls an “inverse expanding triangle or a megaphone” pattern in Bitcoin’s weekly chart. Brandt marked the potential for Bitcoin to test a lower bound around $46,000, underscoring the dominance of selling pressure over buying interest in the market.

He explained: “This is called an inverted expanding triangle or a megaphone. A test of the lower bound would be about 46,000. A huge push for new ATHs is needed to get this bull market, BTC, back on track. In this pattern, selling is stronger than buying.”

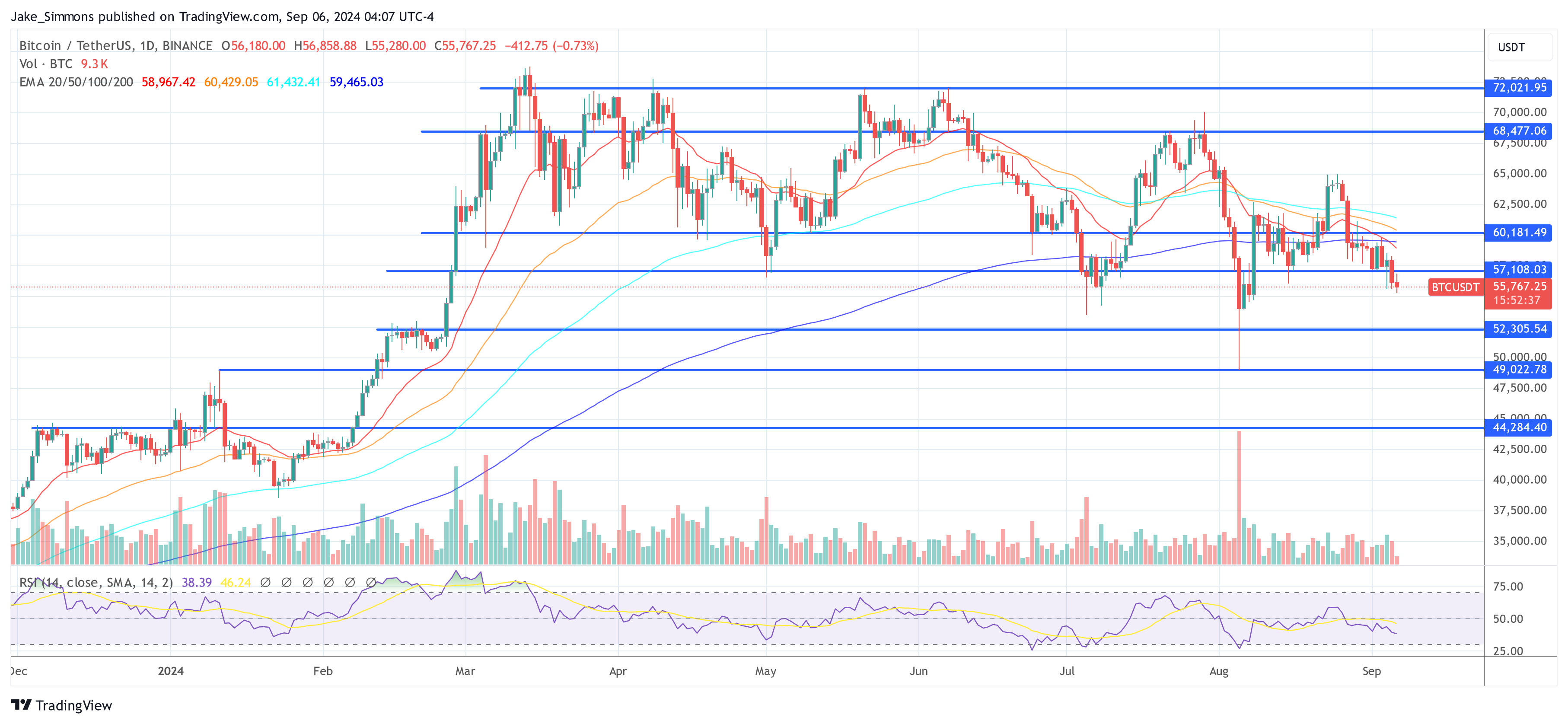

At the time of writing, BTC was trading at $55,767.

Featured image from YouTube, chart from TradingView.com