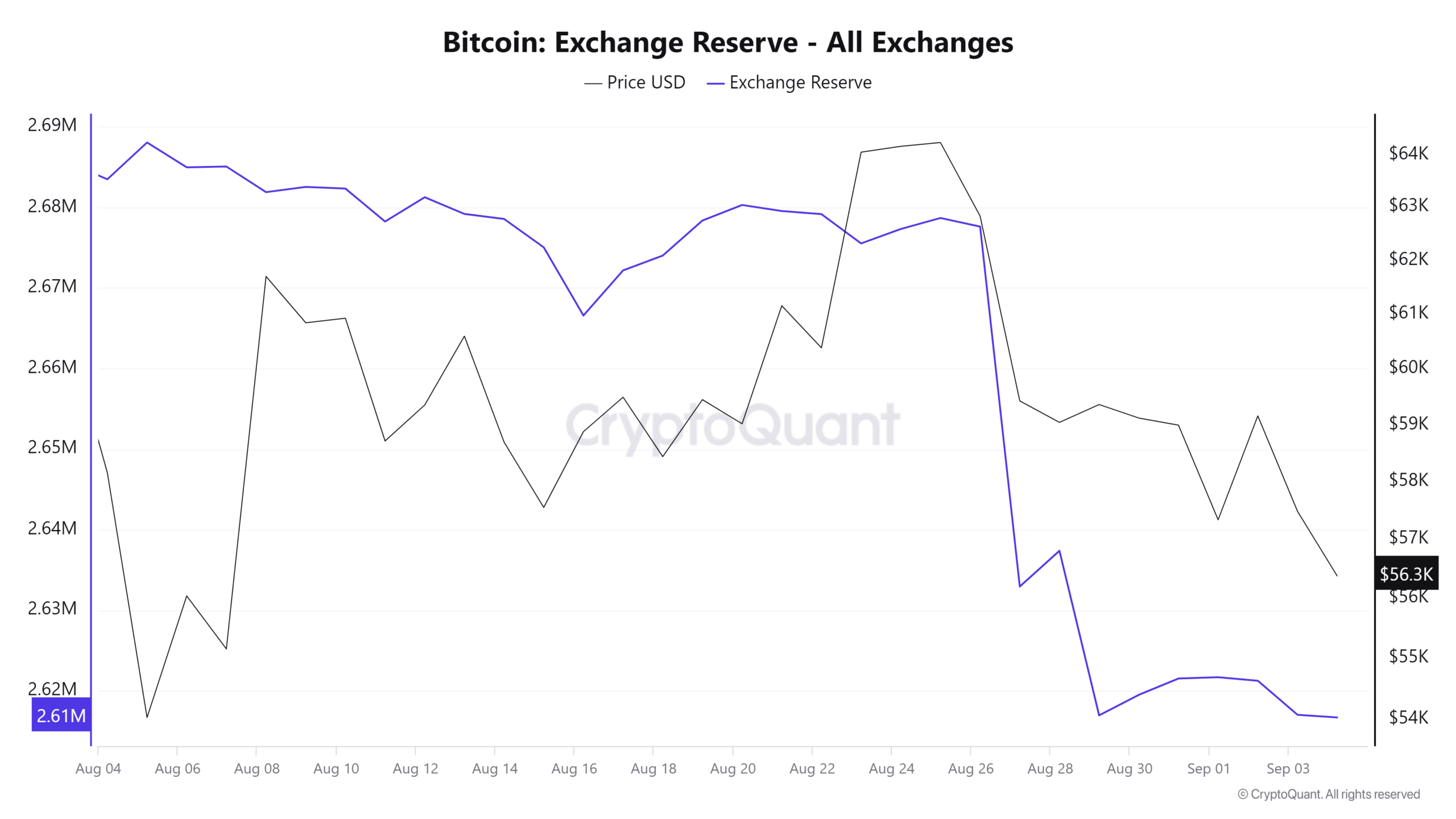

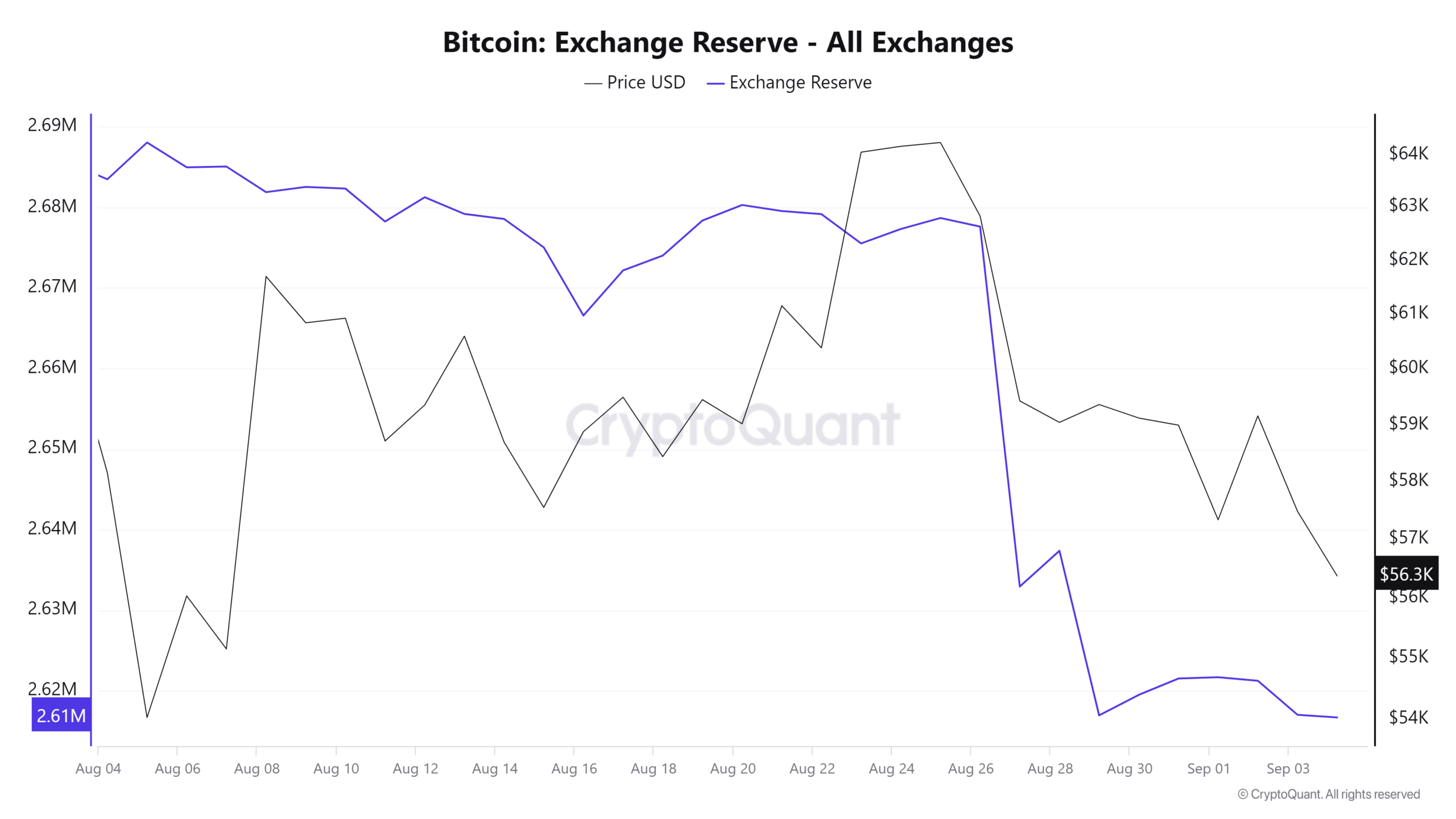

- BTC’s foreign exchange reserve at the time of writing was at its lowest level in recent months, indicating the accumulation of whales.

- If the price of BTC falls below the $56,500 level, it is likely to drop to the $54,000 or $52,000 level.

Current market sentiment seems extremely bearish as crypto whales take advantage of this opportunity and accumulate strongly.

On September 4, the on-chain analytics company look at chain posted a message on X (formerly Twitter) saying it was a Bitcoin [BTC] Whale bought 545 BTC worth $30.82 million when the price dropped significantly.

Whale activity during price drop

The post on This isn’t the only time whales have used a price drop as an opportunity.

Recently, on-chain analytics company Santiment shared a post on

The significant accumulation of whales and sharks during the recent market downturn signals a potential long-term buying opportunity.

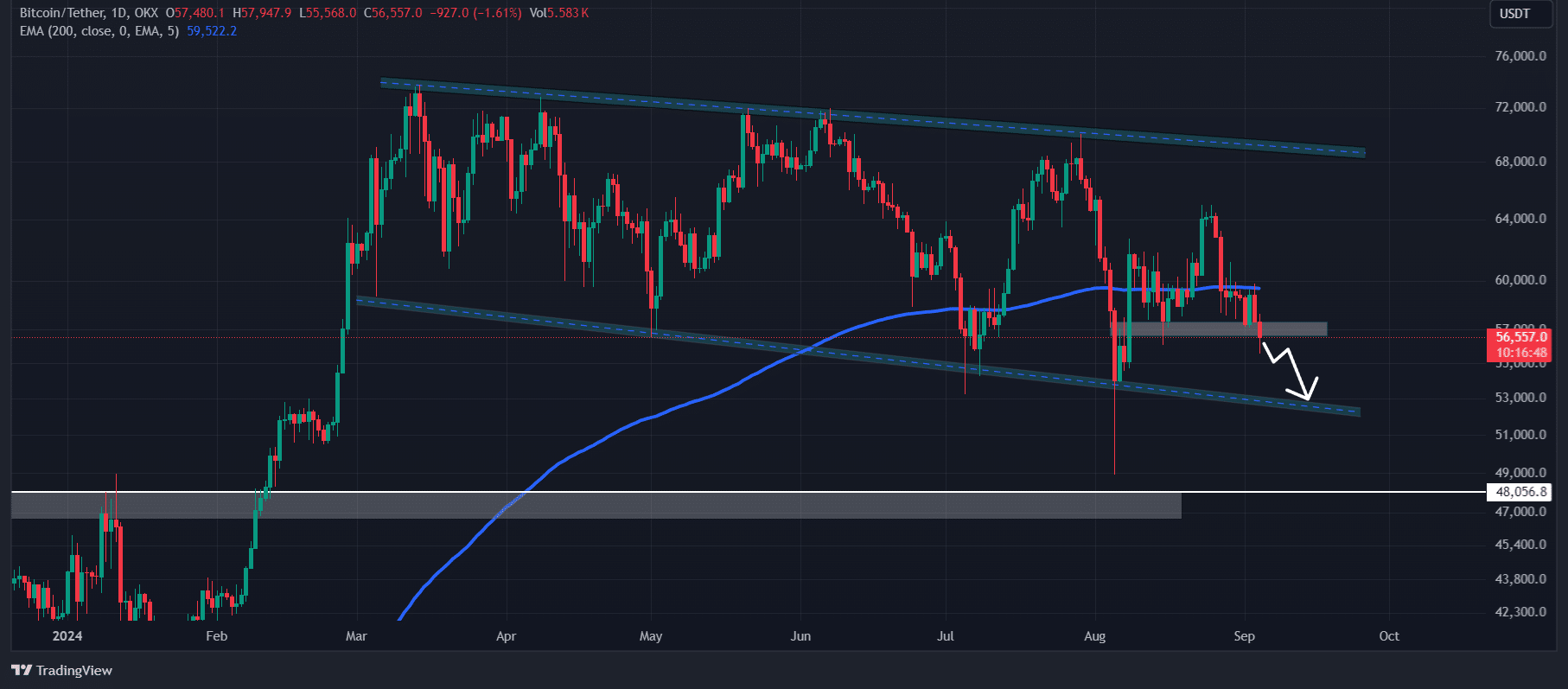

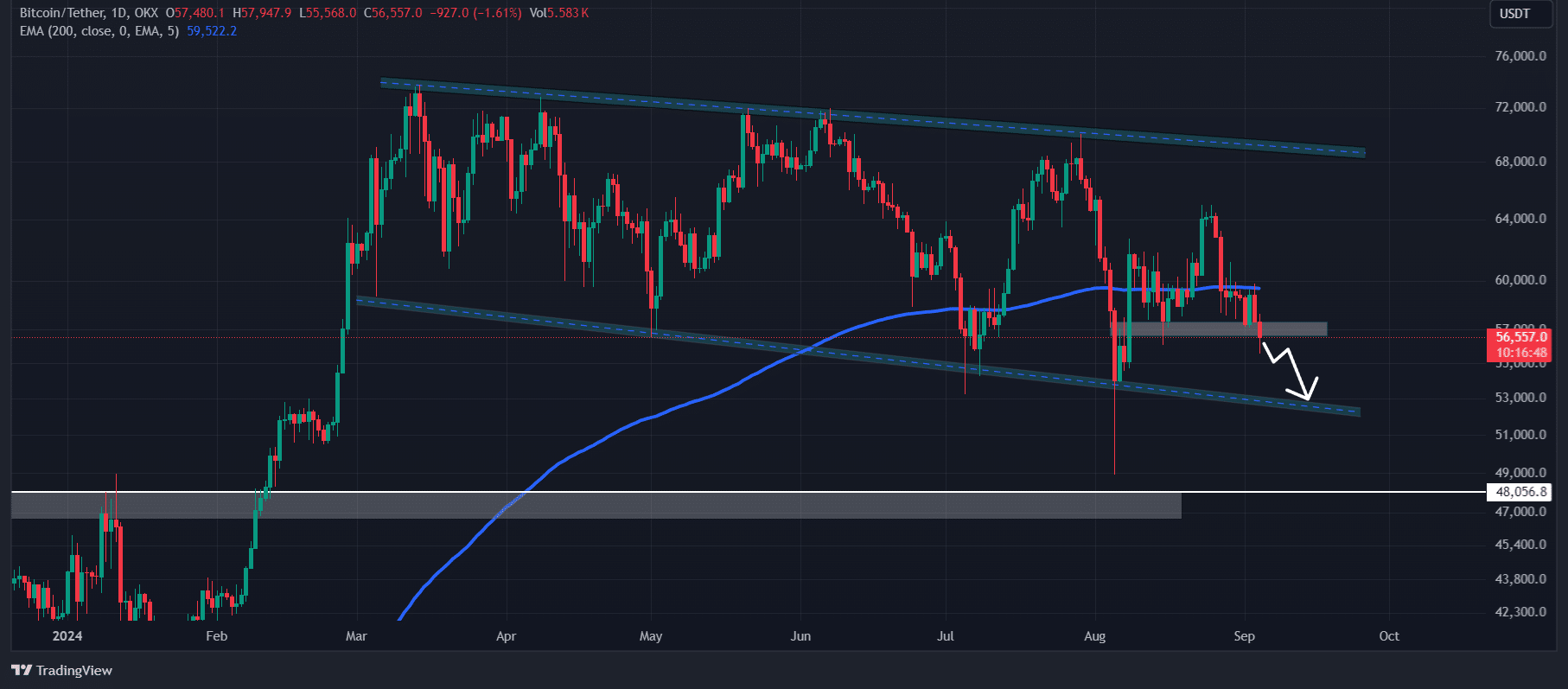

Technical analysis of Bitcoin and upcoming levels

According to the expert technical analysis, Bitcoin appears bearish as it has broken a strong consolidation near the crucial support at USD 57,000.

If the BTC price closes a daily candle below the $56,500 level, there is a good chance that it could drop to the $54,000 or $52,000 level in the coming days.

Source: TradingView

Currently, BTC is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating that the asset is in a downtrend.

However, the Relative Strength Index (RSI) is in oversold territory, indicating a possible price reversal.

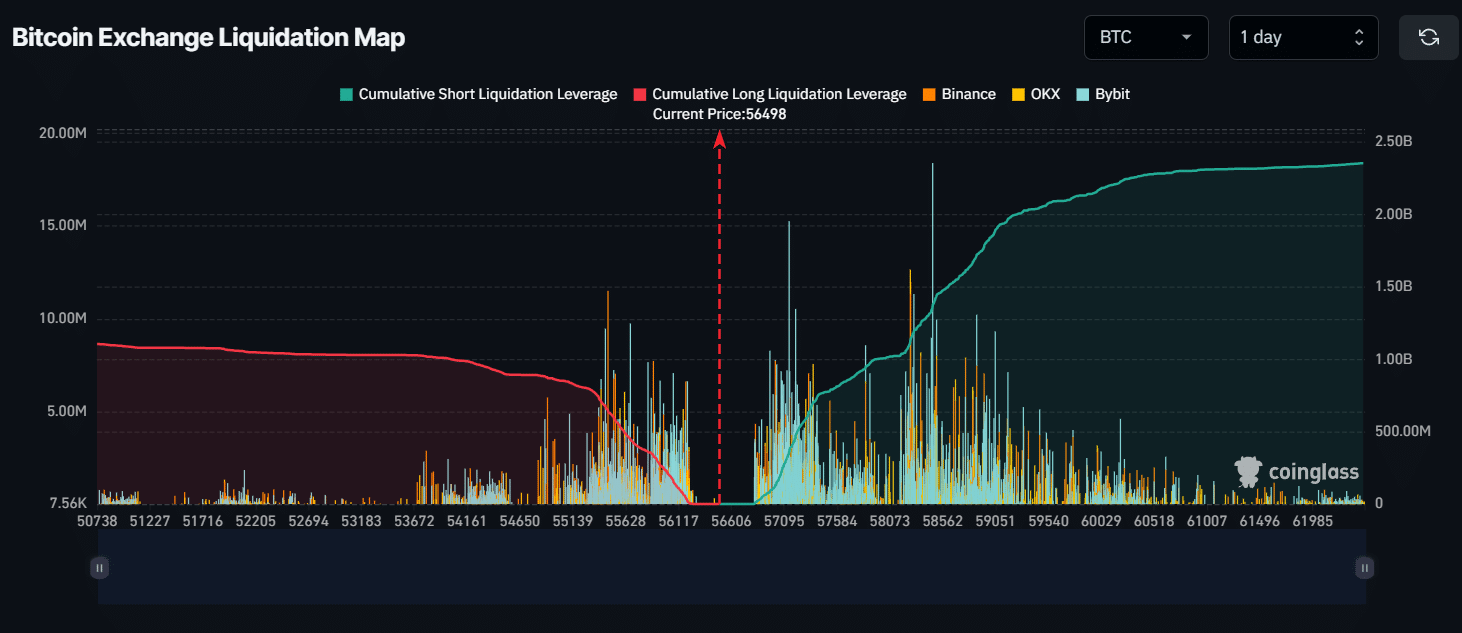

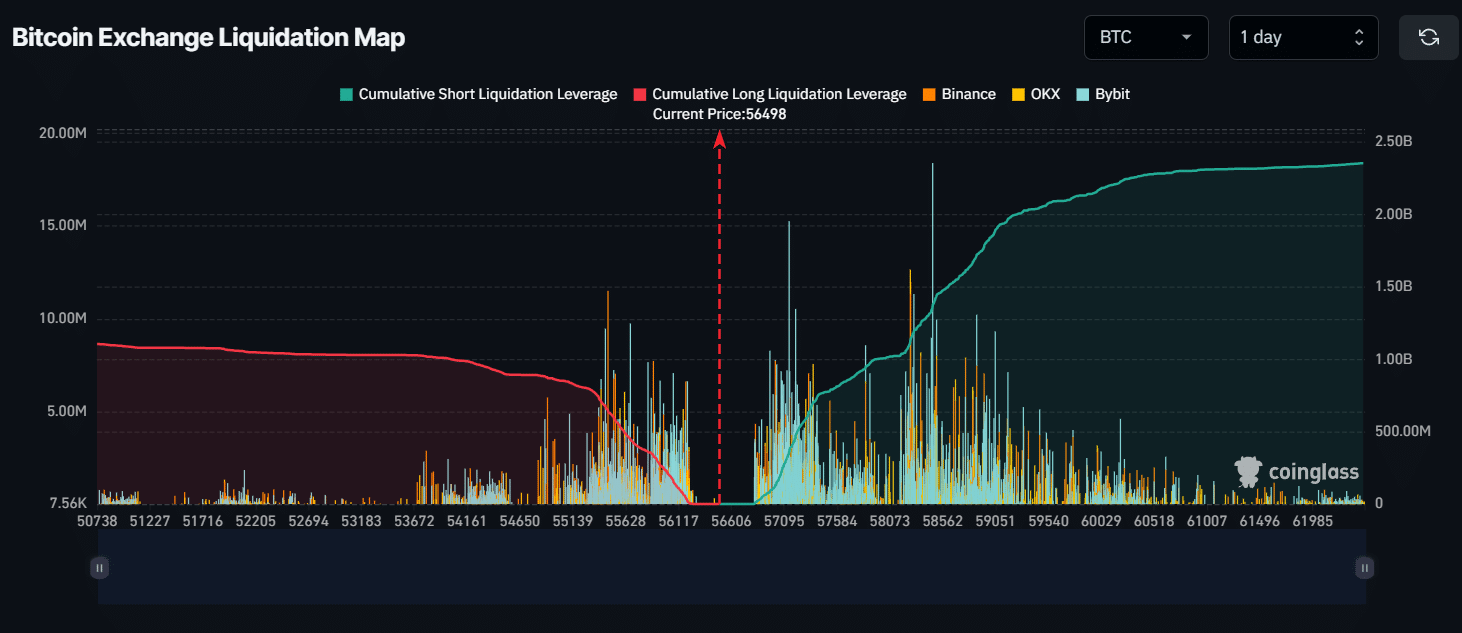

High liquidation levels

At the time of writing, the key liquidation levels were $55,450 on the lower side and $58,450 on the higher side, as these traders are over-indebted at these levels, according to Coinglass data.

Source:

If market sentiment remains bearish and the price falls to the $55,450 level, nearly $650 million in long positions will be liquidated.

Conversely, if sentiments change and the price rises to the $58,450 level, short positions worth approximately $1.32 billion will be liquidated.

Data shows that short sellers currently dominate the assets and have the potential to liquidate more long positions. This statement only works if BTC closes a daily candle below the $56,550 level.

On-chain metrics show bullish signs

CryptoQuant’s on-chain metrics, such as BTC exchange reserve and exchange inflows, give a bullish outlook for BTC.

According to on-chain data, BTC’s foreign exchange reserve is currently at its lowest level in recent months, indicating whale and institutional accumulation. Furthermore, it indicates a potential buying opportunity.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024–2025

While BTC currency inflows have been continuously decliningng in recent months, due to buying pressure from investors and institutions.

At the time of writing, BTC is currently trading near $56,550 and has experienced a price drop of over 4.5% in the last 24 hours. Meanwhile, open interest fell 4.65% over the same period, indicating a decline in investor and trader interest.