- Bitcoin has experienced a significant decline over the past month.

- The falling Sharpe ratio in the short term led analysts to look for a recovery.

Bitcoin [BTC]the largest cryptocurrency by market capitalization, has seen a sustained decline over the past 30 days. However, over the past 24 hours, the crypto has posted moderate gains.

At the time of writing, the stock was trading at $58,820, having risen 1.10% over the past day.

Previously, the king coin was in a downtrend, falling 6.32% over the past seven days. Likewise, it has fallen by 4.37% in the past month.

Despite recent gains on the daily charts, BTC remained 20% below the ATH of $73737 recorded earlier this year.

Despite the recent poor performance, key stakeholders including analysts remained optimistic about the crypto’s direction.

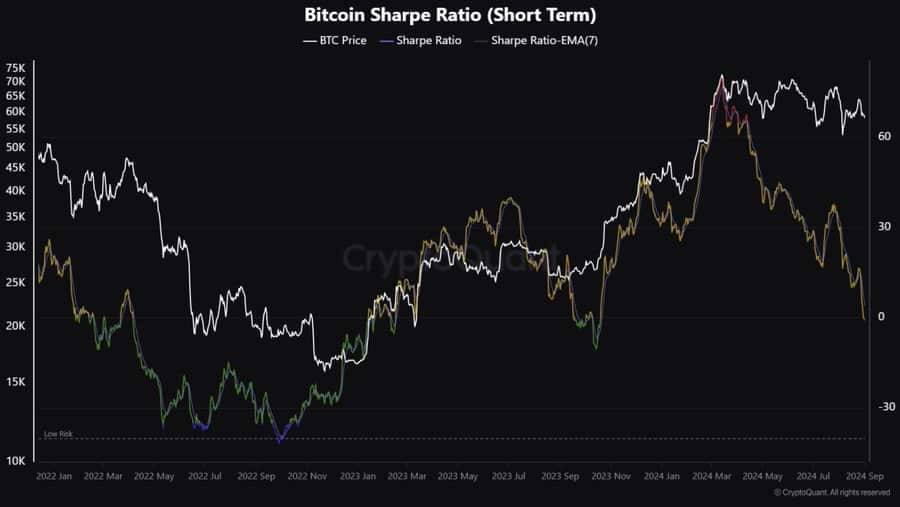

For example, CryptoQuant analyst Kripto Mevsimi saw a recovery from the recorded downtrend, citing short-term Sharpe ratios.

Market sentiment

In his analysis states Mevsimi cited the 2023 cycle, arguing that the current short-term Sharpe ratio reflected the previous year’s cycle.

Source:

During the previous cycle, when the short-term Sharpe ratio fell, BTC prices rose from a low of $26675 to a high of $35137.

Based on this historical performance, those who are optimistic view this as a possible recovery signal.

However, the analyst offered an opposing view for bearish investors, stating that a bearish interpretation could indicate continued volatility.

Overall, a declining Sharpe ratio implied greater volatility in the short term without a commensurate increase in investment returns, making investments less attractive.

If the analysis is purely based on the historical cycle in relation to the short-term Sharpe ratio, BTC could recover.

Accordingly, this bullish assessment is further reinforced by Santiment’s analysis, which stated that BTC performed well without relying on the S&P 500, indicating independence from stocks.

Source: Santiment

What BTC’s charts suggest

This analysis provided a positive outlook for future price movements. Therefore, it is essential to understand what other indicators suggest.

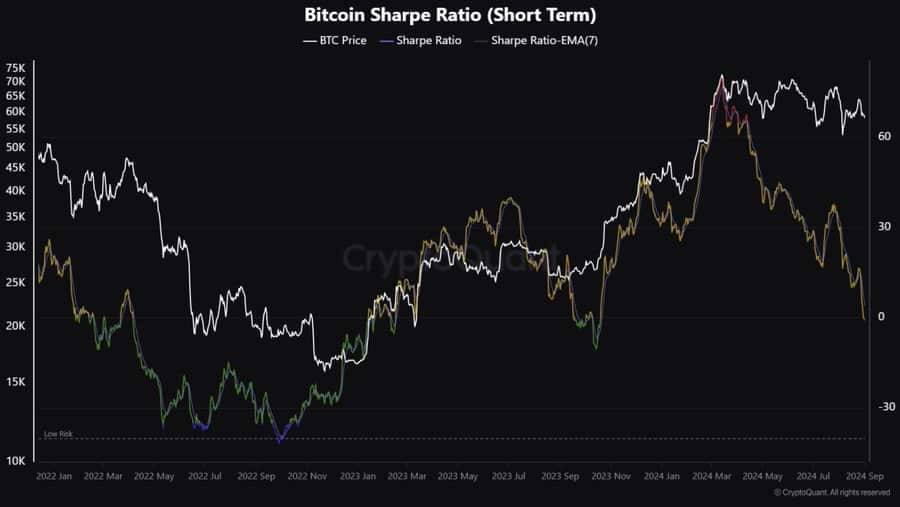

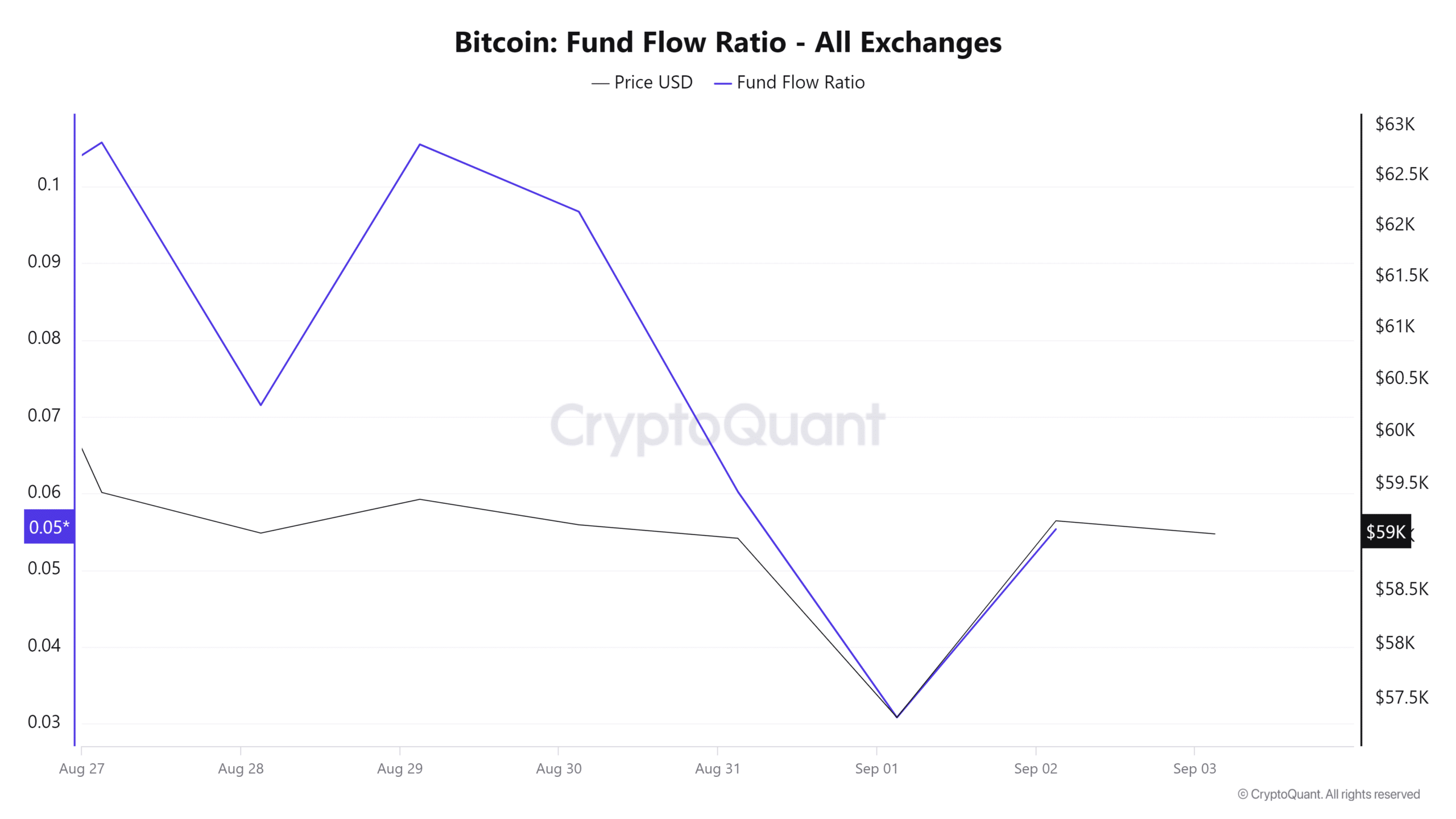

Source: CryptoQuant

For starters, Bitcoin’s Fund Flow Ratio has fallen over the past seven days. A decline in the fund flow ratio implied that investors were choosing to HODL rather than sell their assets.

This indicated long-term confidence, with investors keeping their money in cold storage rather than on the stock market. Such market behavior results in accumulation in anticipation of the future price increase.

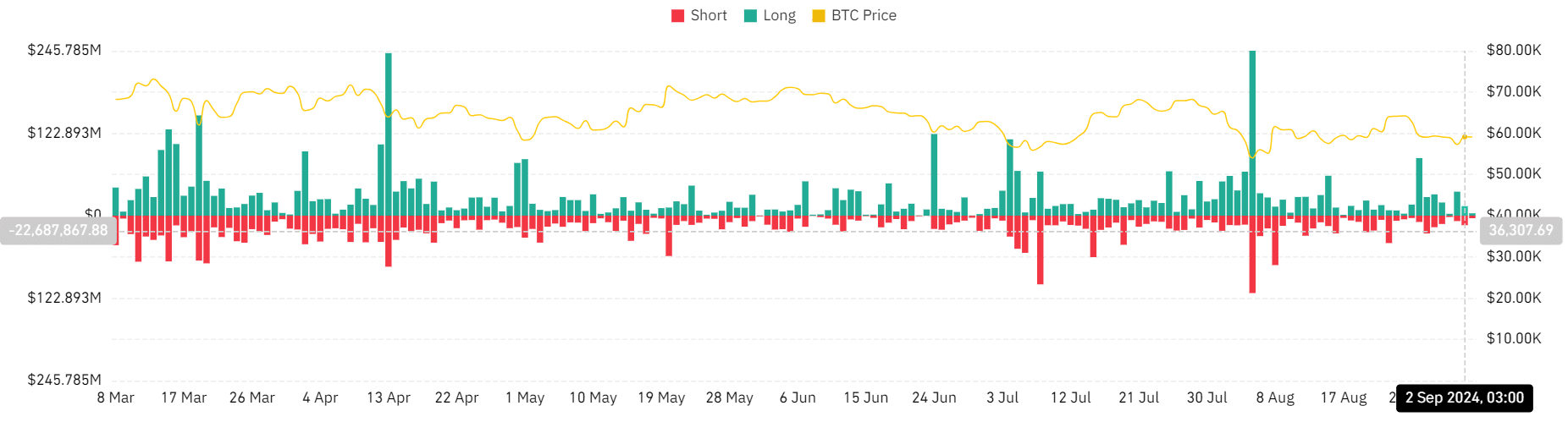

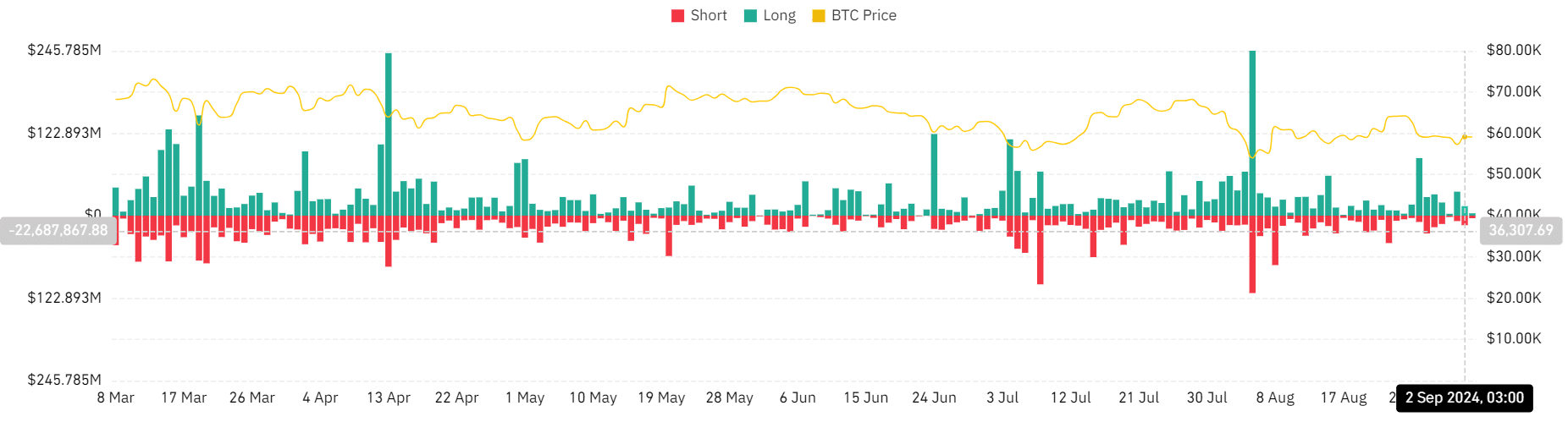

Source: Coinglass

Moreover, BTC liquidation has decreased over the past three days. The long position has fallen from $35.7 million to $3.4 million at the time of writing.

This showed that investors had confidence in long-term price increases because they were willing to pay a premium to maintain these positions.

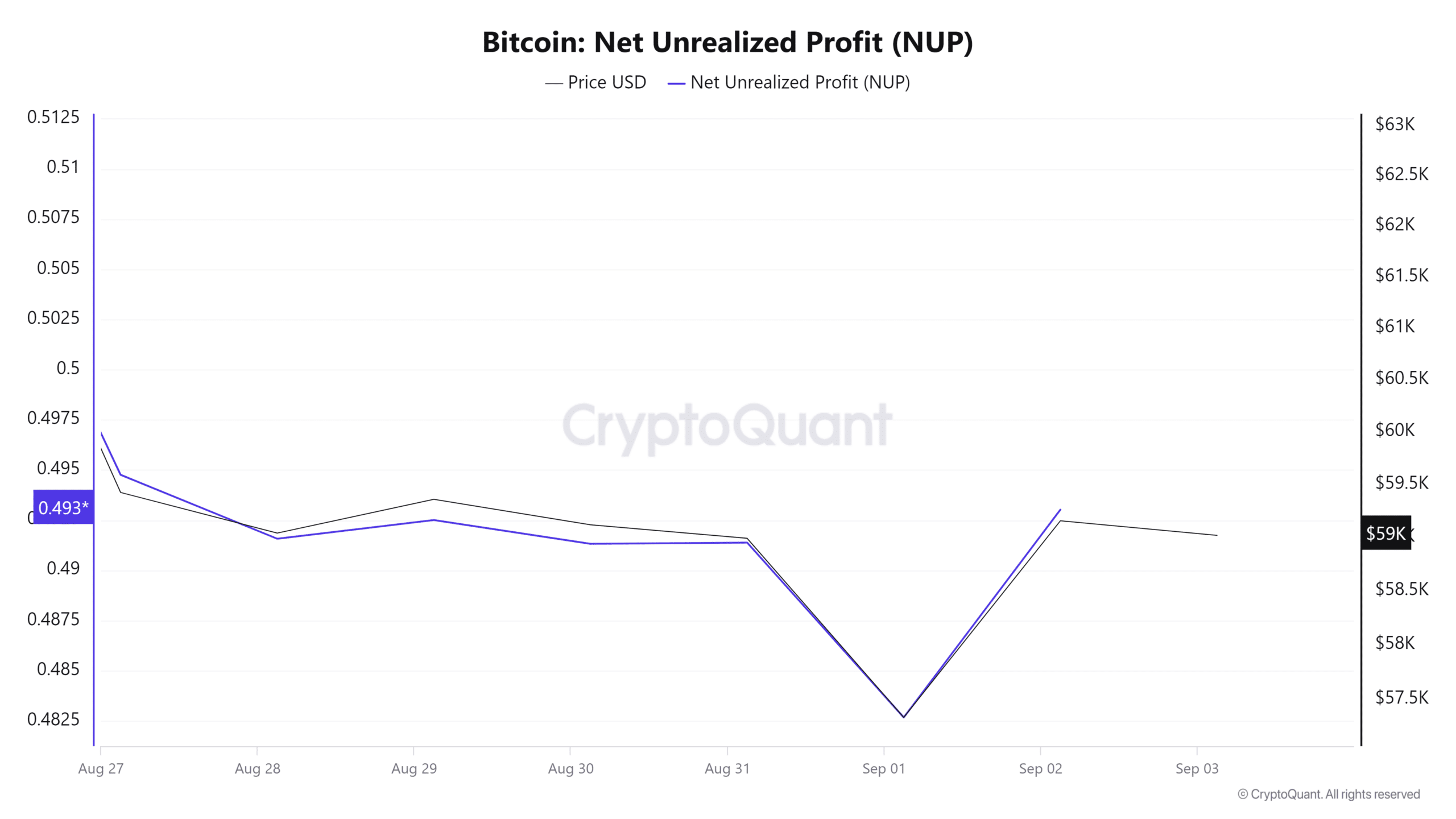

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024–2025

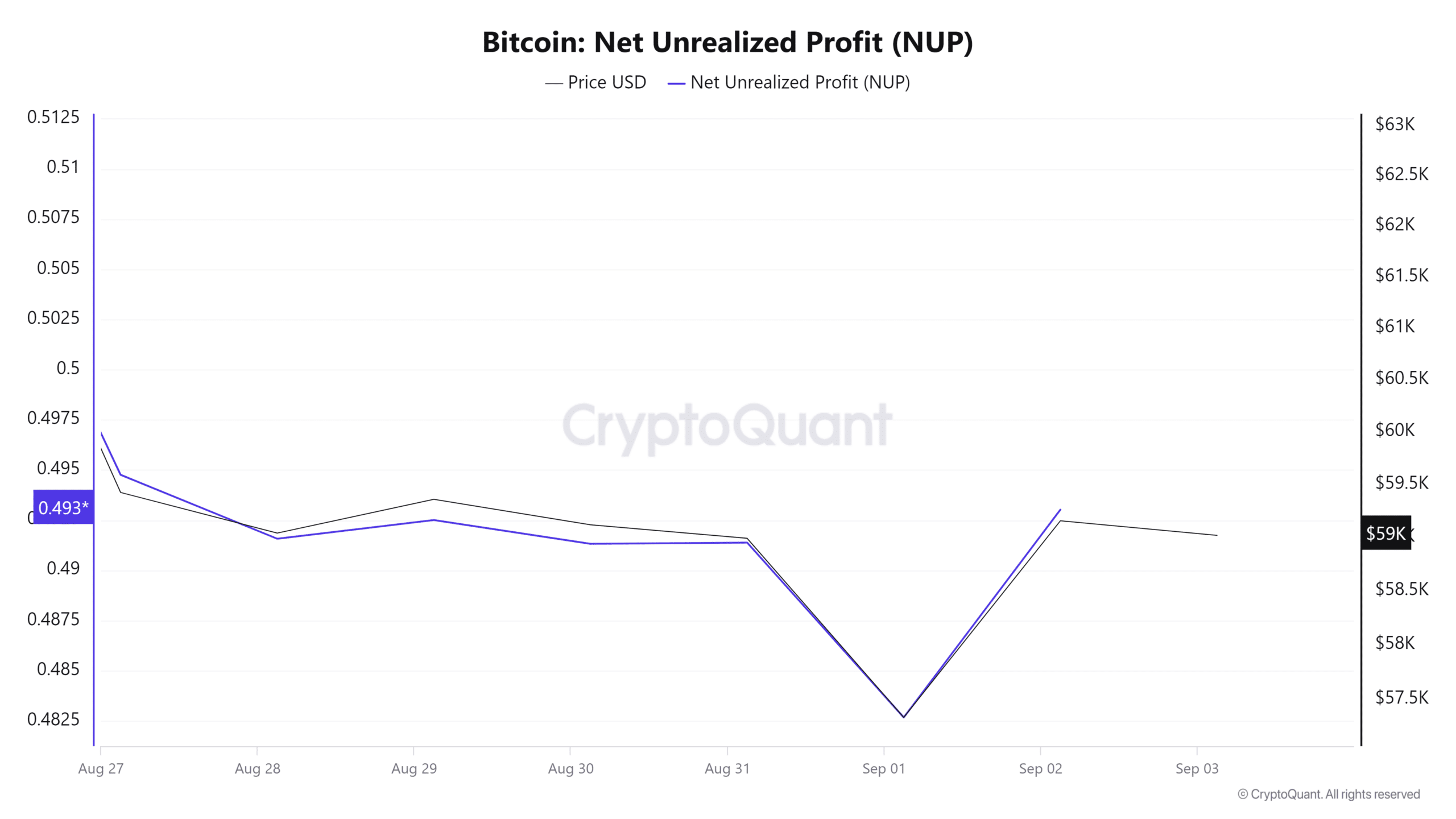

Finally, BTC’s net unrealized gain was 0.49, indicating that the prevailing market sentiment was optimistic. At this pace, despite some profit taking, it was unlikely to lead to a major correction.

Therefore, if prevailing market sentiment holds, BTC is well positioned to break the persistent resistance level around $60,000 and challenge the $64,752 resistance level.