- Bitcoin saw a notable increase at the time of writing compared to the previous day’s closing price.

- Are traders taking advantage of the recent pullback or waiting for a further price drop?

Bitcoin [BTC] has risen significantly over the past 24 hours, but a full price correction remains elusive as the price remains below the critical $60,000 mark.

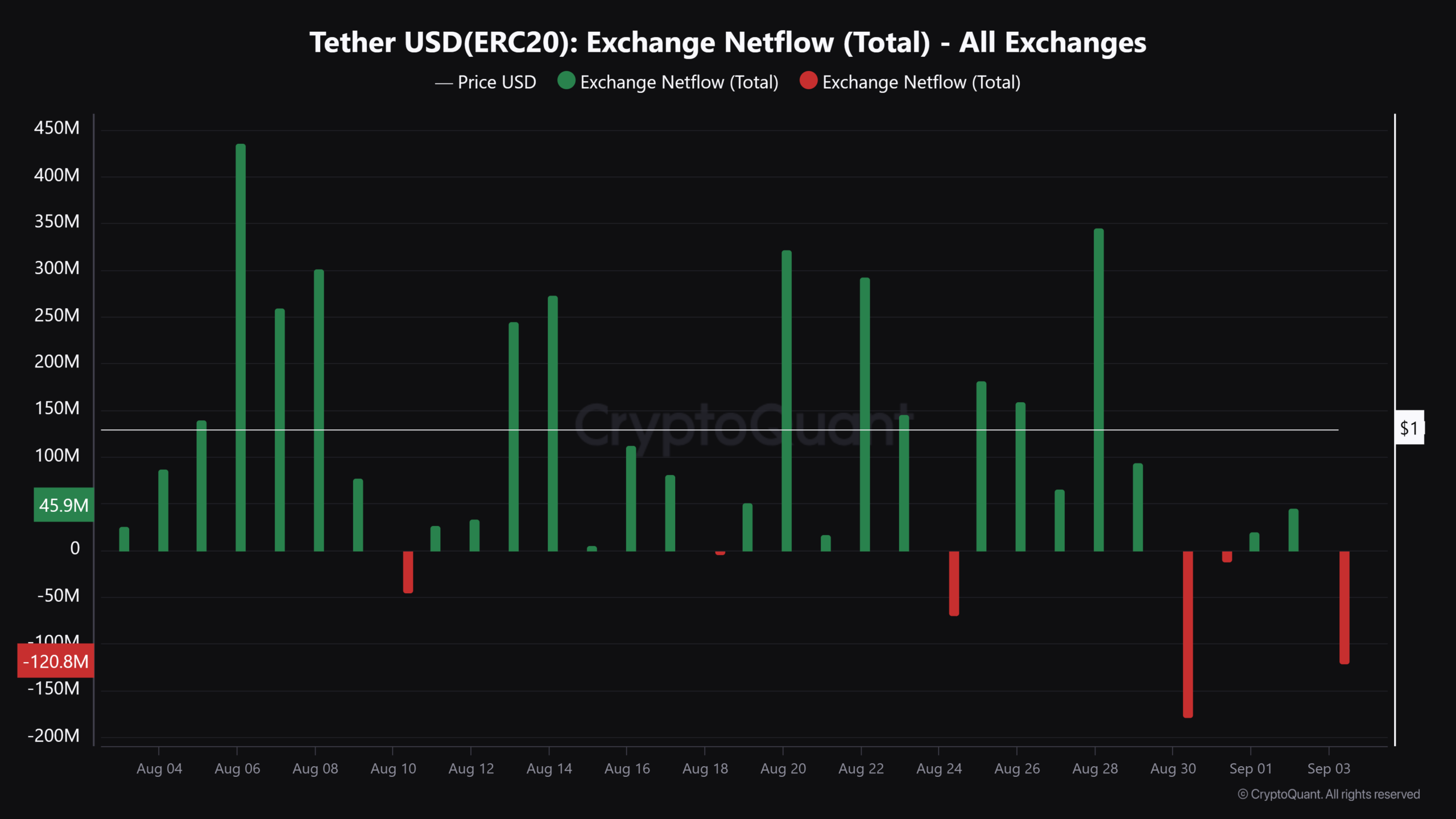

Furthermore, tracking stablecoin movements is a crucial barometer for measuring overall investor sentiment towards BTC.

With this in mind, AMBCrypto analyzed a recent one after by CryptoQuant, which indicated a decline in stablecoin inflows.

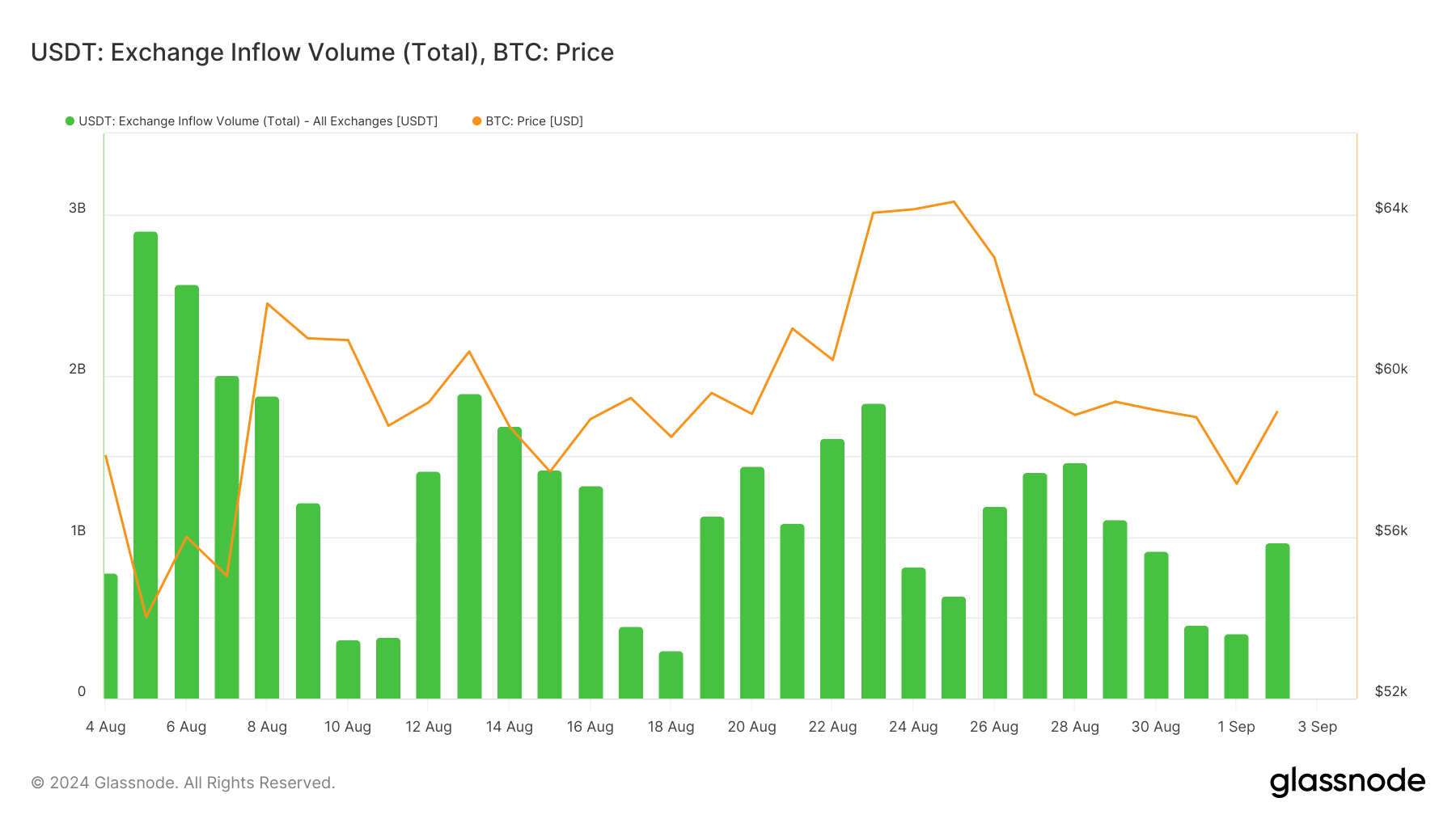

USDT inflows contrast with BTC’s moderate rise

It is no surprise that USDT has a 70% dominance of the stablecoin market. Therefore, AMBCrypto analyzed recent investor behavior regarding this token.

Source: Glassnode

On the daily price chart, Bitcoin started September bearish, falling around 3% to $57,300 from the day before. However, a significant upward move the next day brought Bitcoin close to the $60,000 threshold.

Surprisingly, the upward move coincided with a doubling of USDT inflows from $402 million to $970 million.

According to AMBCrypto’s analysis, this indicated renewed optimism among stakeholders, as evidenced by the increase in USDT deposits on exchanges.

Furthermore, these inflows may have caused the recent upward move, causing day traders to buy the dip.

This revelation is generally seen as a bullish signal and stands in stark contrast to the aforementioned message.

Therefore, AMBCrypto dug deeper and noted that despite the rise in USDT, Bitcoin remained just 0.21% above the previous close of $59,129 at the time of writing.

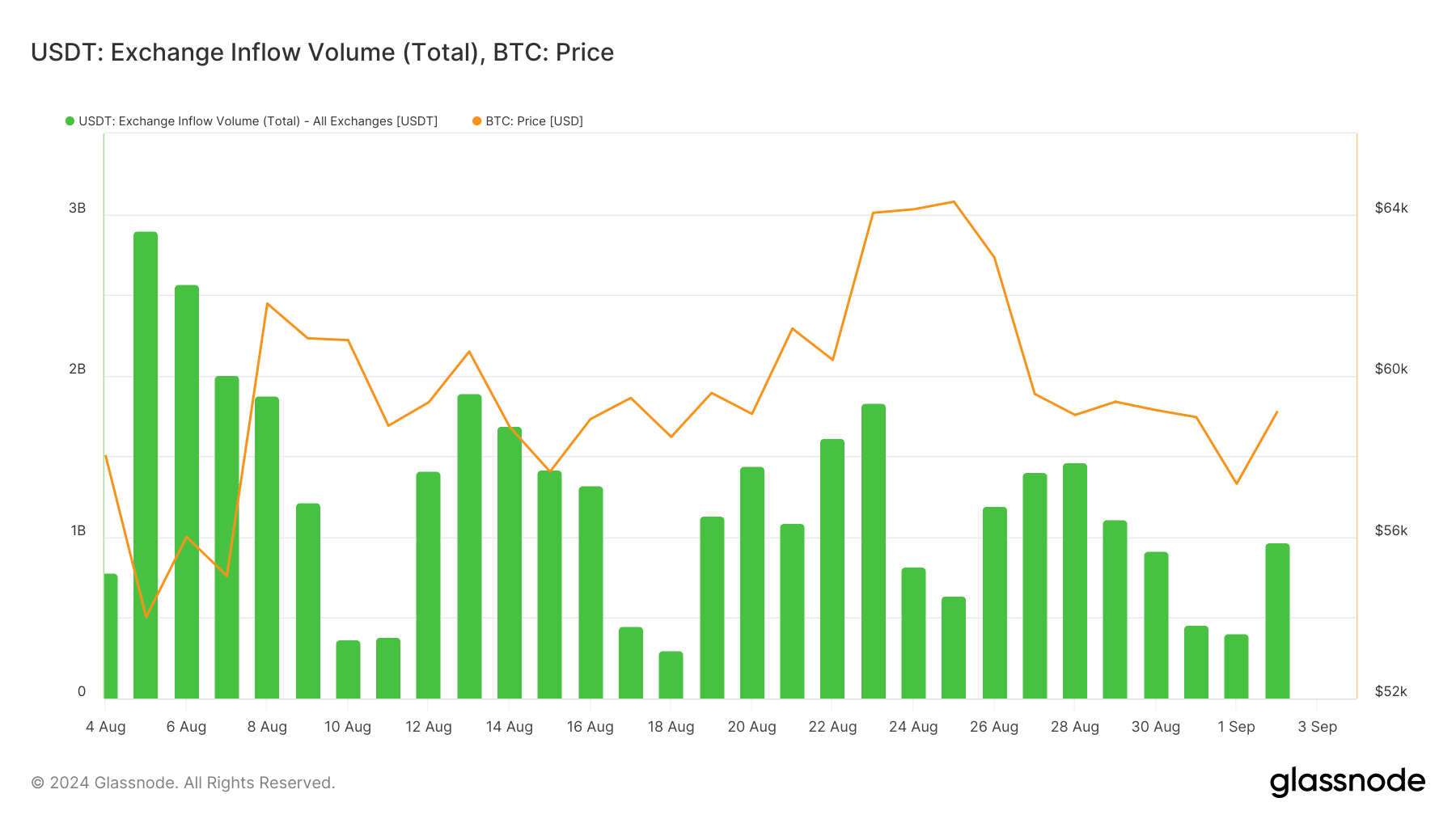

Caution in the market is evident from the net flows

Examining the net flows will provide better insight. Currently, USDT’s net flow is negative at $120.8 million as the trading day continues to unfold.

These significant net outflows certainly indicated growing caution among stakeholders.

Source: CryptoQuant

According to AMBCrypto’s analysis of the chart above, a significant Tether outflow of $180 million from the exchanges occurred four days ago.

Following this, Bitcoin experienced a sharp bearish downturn, with the price closing at $57,700 – the lowest of the day.

These negative flows don’t necessarily indicate outright selling pressure on Bitcoin, but they do indicate caution among traders, who may be using USDT to lock in gains or wait for a dip to buy. Which one is that?

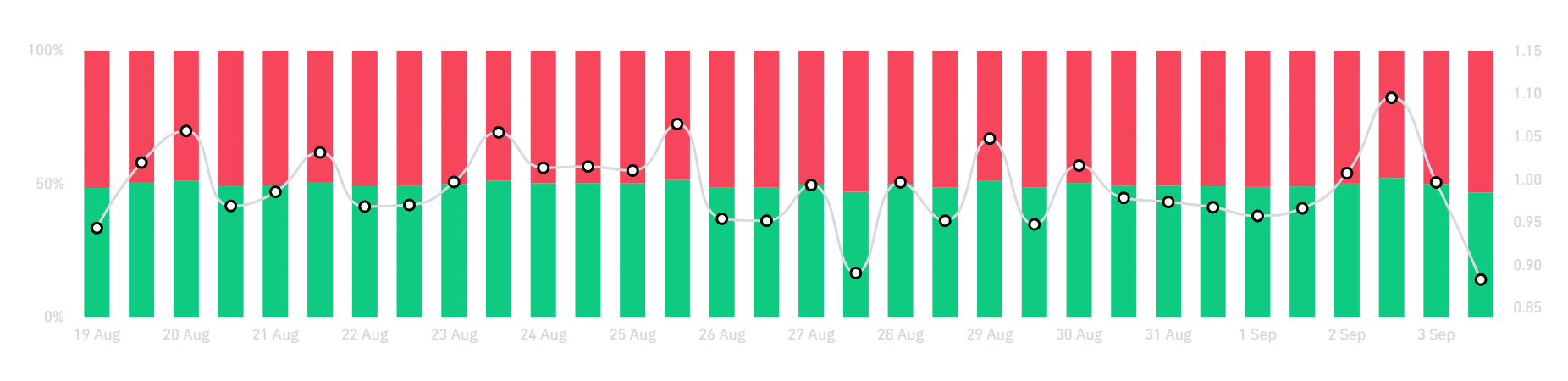

Traders are bracing for a deeper decline amid growing caution in BTC

AMBCrypto analyzed the chart below to determine whether traders are primarily positioning themselves for a potential decline or looking for more profits.

Source: Coinglass

On the 12-hour chart, a sharp dive shows 46% long versus 54% short positions.

Simply put, the dominance of short positions indicates that traders are waiting for a deeper price decline before considering new long positions.

Read Bitcoin’s [BTC] Price forecast 2024-25

Interestingly, if the bulls do not intervene, Bitcoin could return to its previous support, somewhere around $57,000, before expecting a price correction.

However, if the market proves to be more resilient or there is unexpected bullish news, this could lead to short squeezes, with short sellers being forced to buy back their positions, potentially pushing Bitcoin past the $60,000 ceiling.