- Increased liquidity and a prevailing bullish pattern contribute to the expected upward movement.

- If buying pressure continues, NEAR could rise to $5.2 and possibly expand to $8.

Despite bearing the brunt of the recent market declines – down 16.48% in the past week and down 10.61% in the past four weeks – the NEAR Protocol has [NEAR] has shown signs of resilience. A modest decline of 0.43% in the past 24 hours signals a possible shift to bullish control.

Short traders misjudge market dynamics

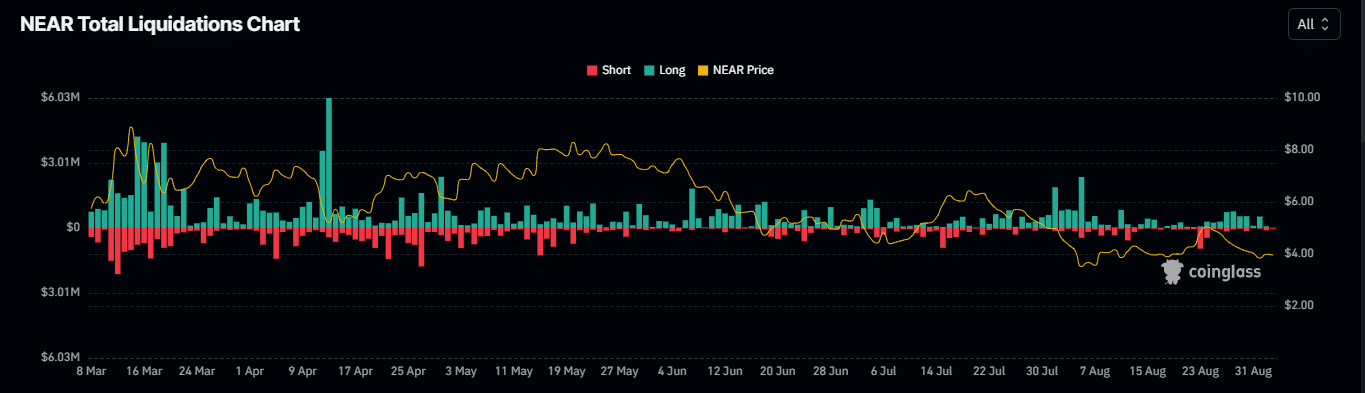

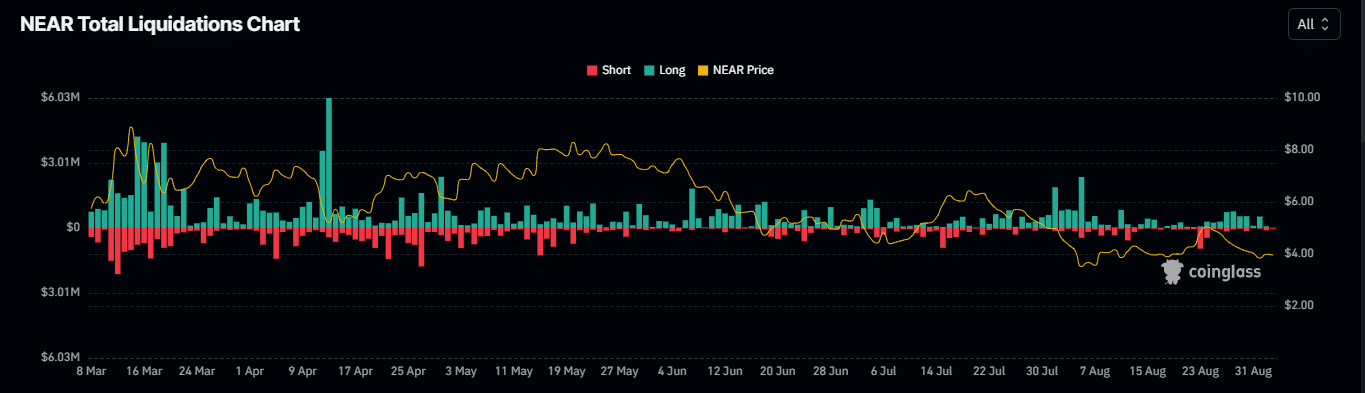

A key indicator of the changing market dynamics is the notable liquidation of traders who bet on NEAR, expecting the price to fall.

In the last 24 hours, short positions on NEAR worth $114.86k have been eliminated, reflecting the growing number of traders betting on a price rise.

Source: Coinglass

AMBCrypto has now addressed the question of NEAR’s future direction as buying interest continues to rise.

NEAR is on track for a rally to $5.2, with more gains to come

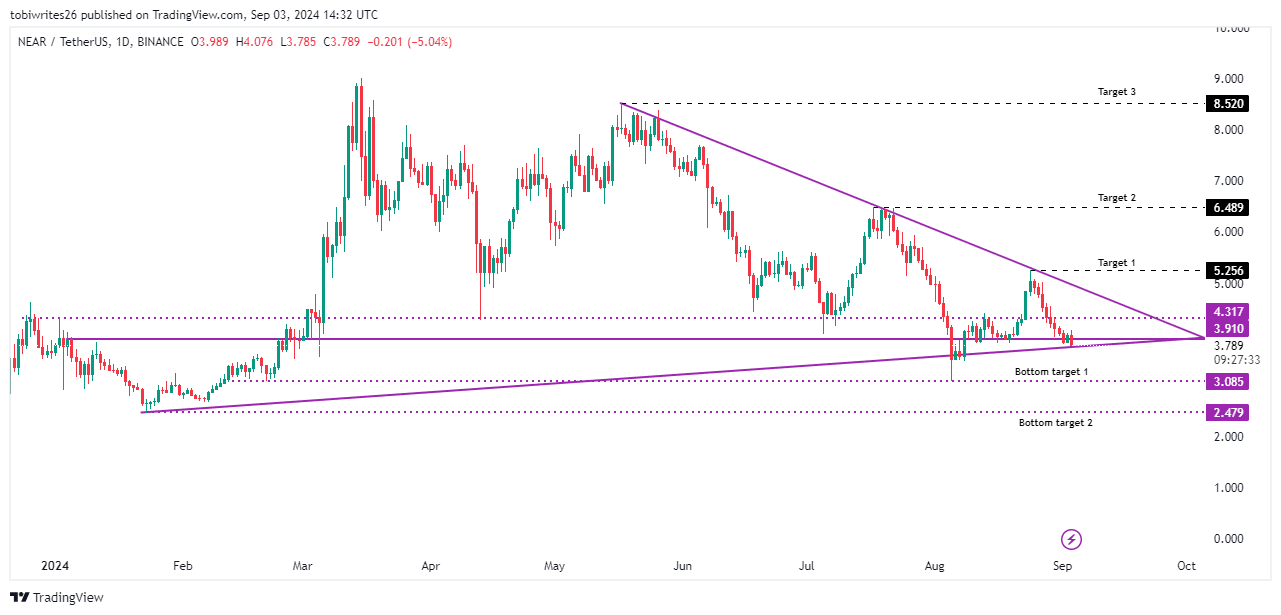

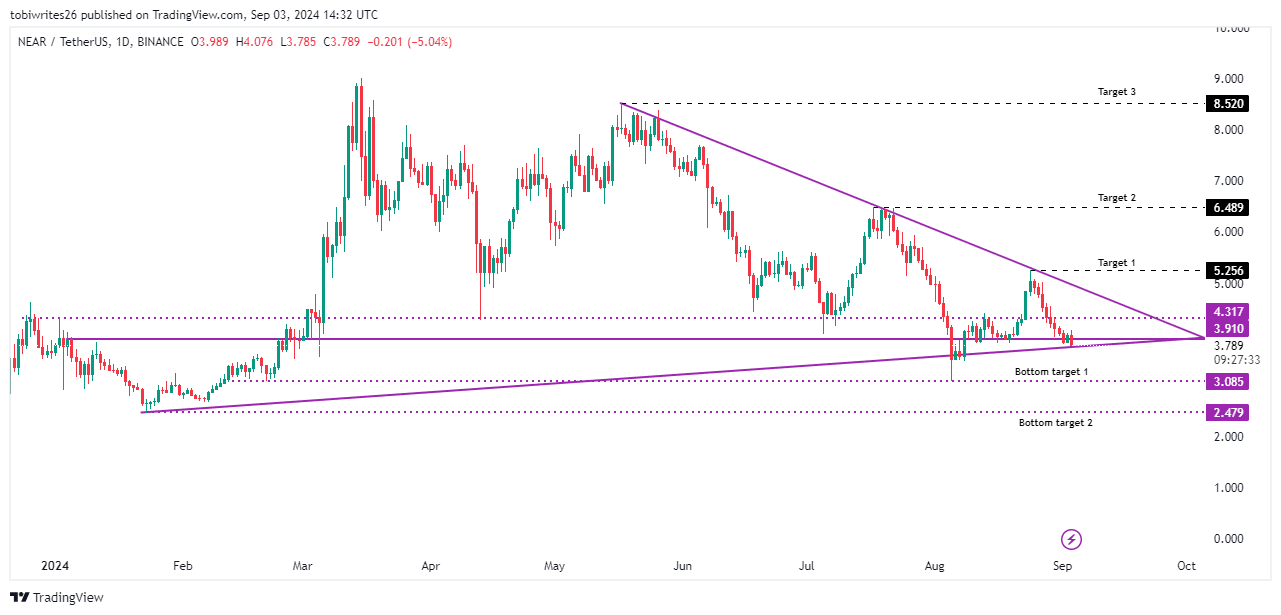

AMBCrypto’s technical analysis indicates that bullish sentiment is supported by a symmetrical triangle and other bullish patterns.

Currently, NEAR is trading at the symmetrical triangle pattern support level at $3.91. If buying pressure continues at this level, the price is expected to reach the initial target of $5.256, although a pullback to $4.317 could occur.

Source: trading view

Stronger buying pressure could then push NEAR towards the longer-term targets of $6,489 and $8,520, where significant liquidity awaits.

Conversely, if market dynamics change and sellers dominate, the token could retreat to likely support levels of $3,085 and $2,479.

Buyers view NEAR as undervalued

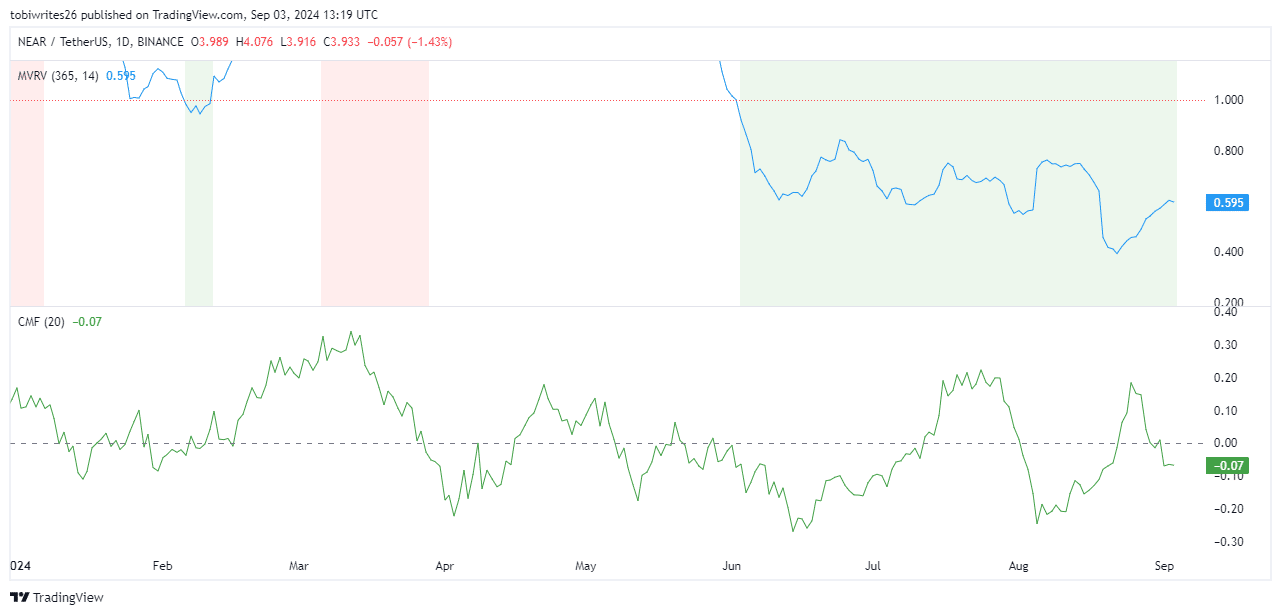

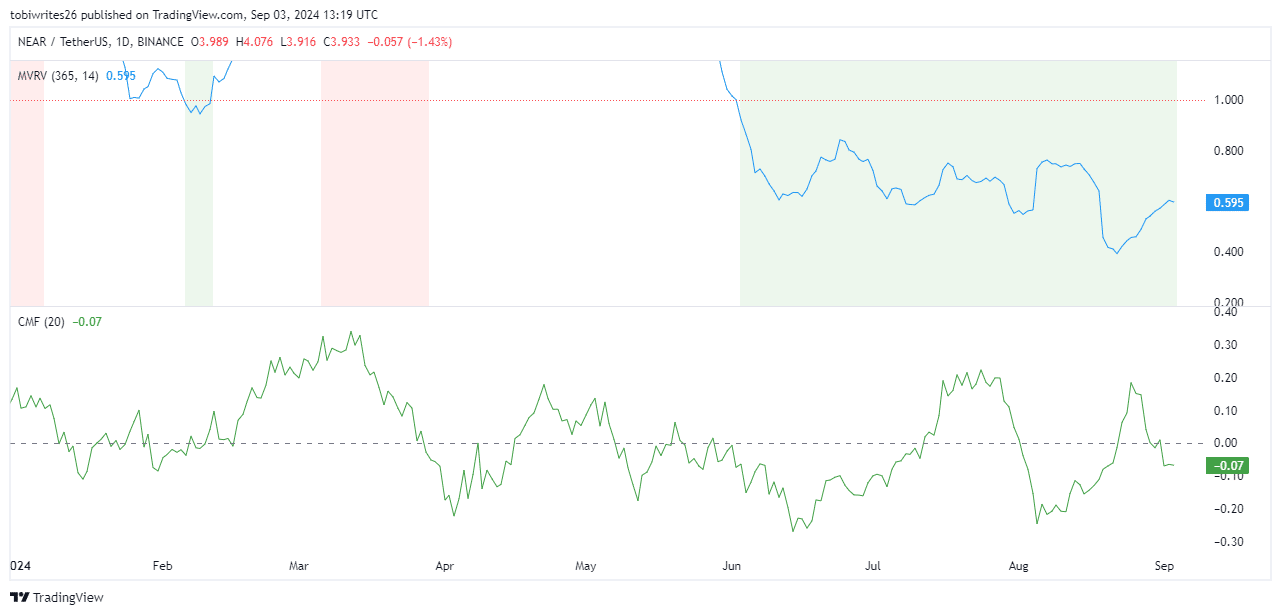

AMBCrypto’s analysis using the Chaikin Money Flow (CMF) and the Market Value to Realized Value (MVRV) indicators suggests that NEAR is currently undervalued.

The MVRV ratio, which compares market capitalization to realized capitalization, indicates undervaluation when it is lower than 1. This indicates a potential reversal in the asset’s price direction, which is currently the case with NEAR as it stands at 0.595 .

Source: trading view

Realistic or not, here is NEAR’s market cap in BTC terms

Meanwhile, the CMF, which measures accumulation and distribution, is below zero but has begun to move sideways, indicating balanced buying and selling pressure.

Such conditions often precede a market breakout or collapse. A breakout would reinforce bullish confidence, while a slump could lead to a price drop.