- Ethereum saw a notable price surge, testing the crucial $2,500 resistance level.

- Will the bulls maintain the momentum, or will the bears regain control?

Ethereum [ETH] suffered a significant pullback at the start of the last week of August, wiping out most of the gains it made during the first week of the month when the altcoin tested the $2,700 ceiling.

However, the bearish tone that started September changed as ETH rose more than 3% in the past 24 hours to trade at $2,521 at the time of writing.

Interestingly, the altcoin seasonal index fell despite the price increase, indicating weak investor confidence in the ongoing bullish trend.

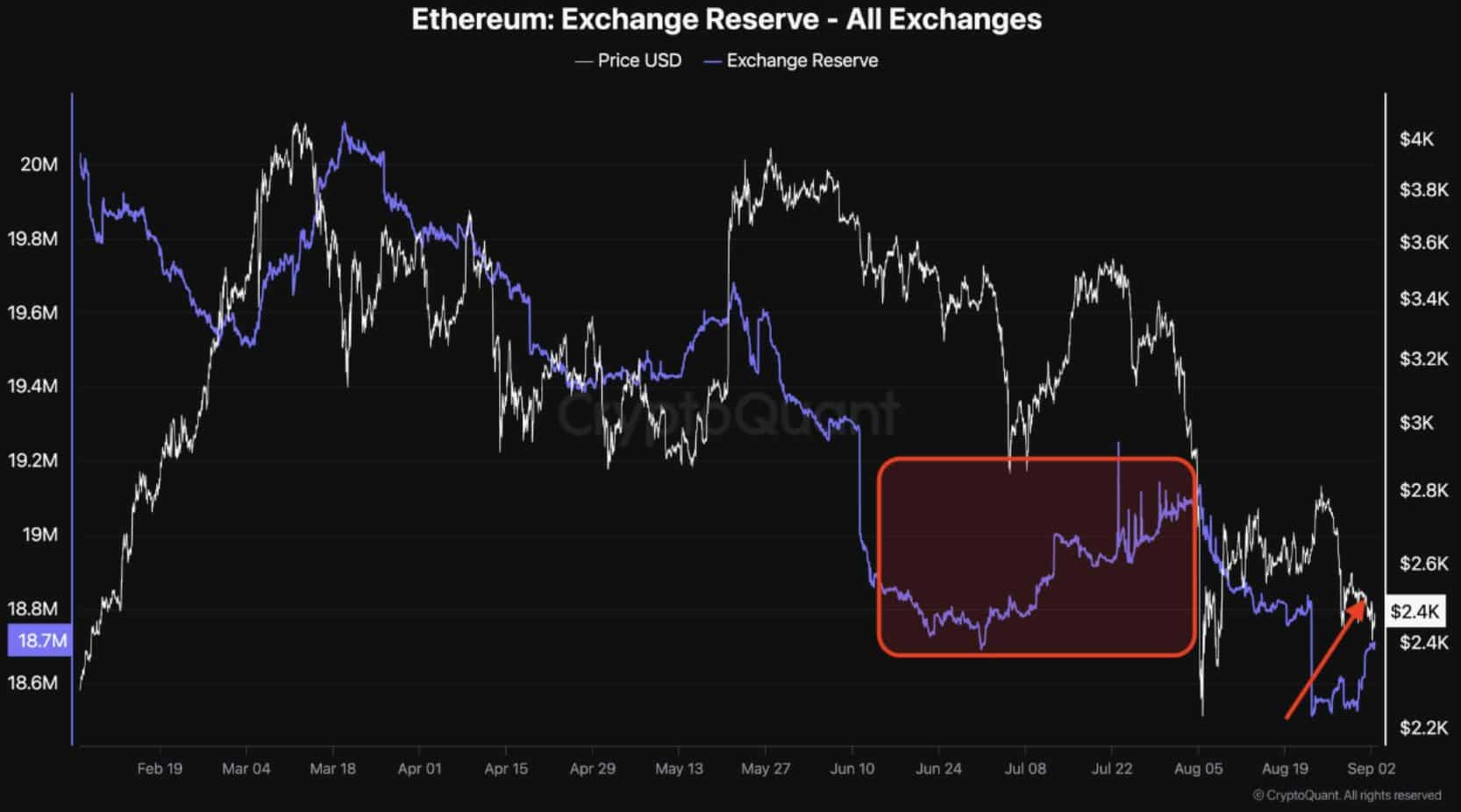

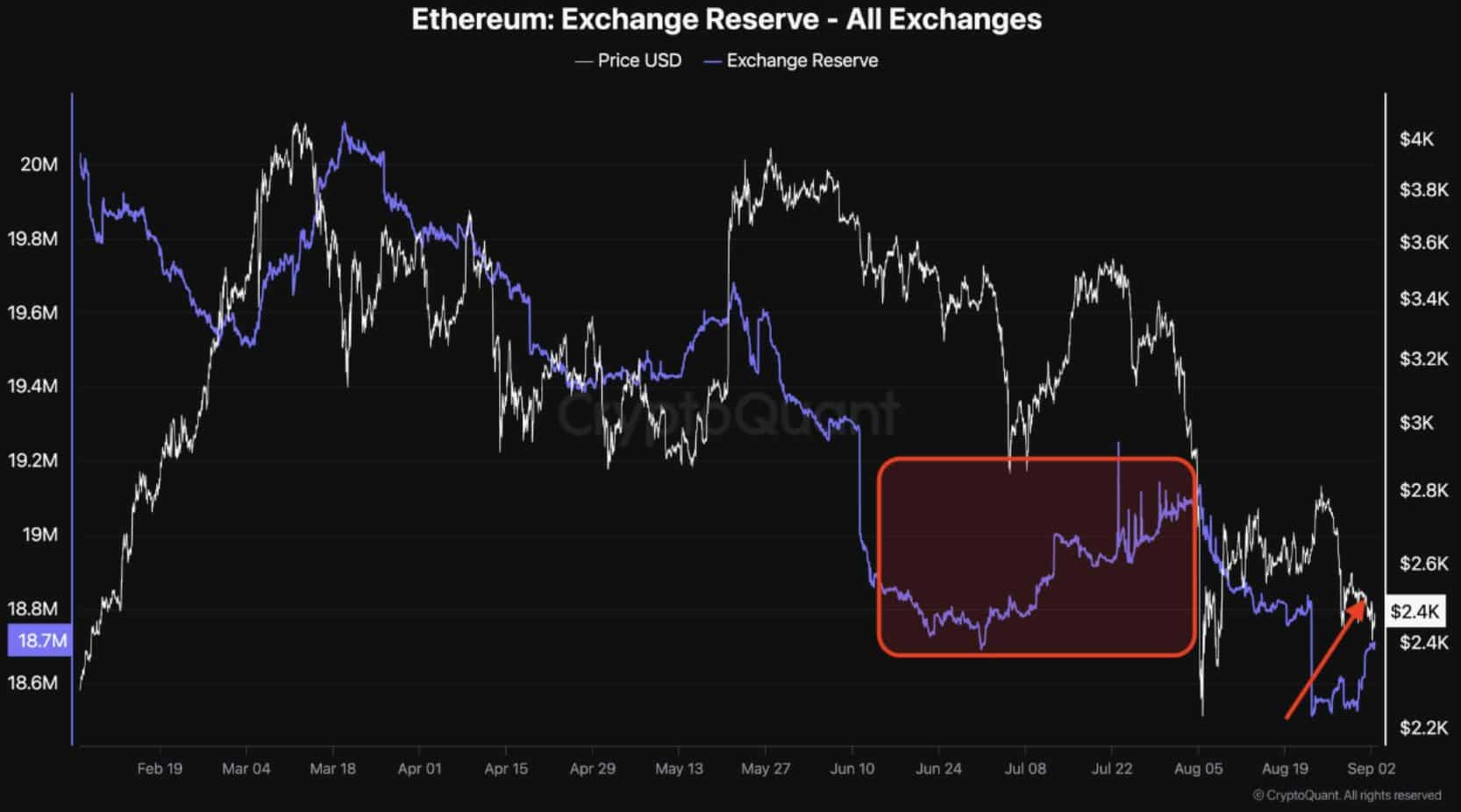

Backed by growing ETH exchange reserves

In one aftera prominent crypto analyst highlighted an important development, indicating the beginning of a distribution phase.

Simply put, the notable spike in ETH exchange reserves indicated that more traders are taking advantage of the recent surge by moving their profits to exchanges before the hype dies down.

Source: CryptoQuant

According to AMBCrypto’s analysis of the chart above, every time ETH closed near its resistance level, it was accompanied by an increase in ETH exchange reserves.

For example, when ETH tested the $4,050 resistance earlier in March, its currency reserves rose from $19.5 million to $20.8 million.

Similarly, when ETH’s price rose above the $2,800 ceiling last month, rising currency reserves led to strong resistance, preventing bulls from pushing the price higher.

Consequently, the price returned to the $2,390 support level.

Since then, however, bulls have been eagerly awaiting a price correction. So is the recent 3% gain the key to a rally?

No guarantee of a bullish rebound

Unsurprisingly, the above chart showed a notable spike in foreign exchange reserves from $18.5 million to $18.7 million, the day after ETH saw a significant increase on September 2.

This confirmed the conventional day trading strategy of locking in profits once the price showed a slight upward trend.

However, to counter this algorithmic behavior, new traders must enter the market while long-term holders avoid selling.

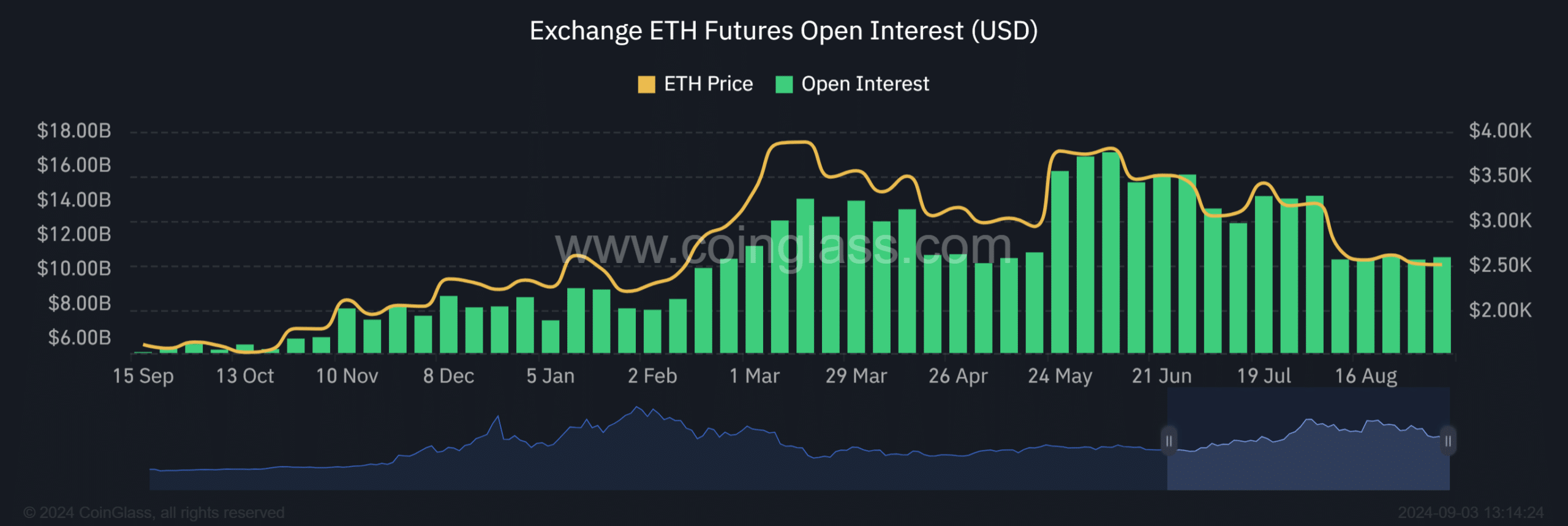

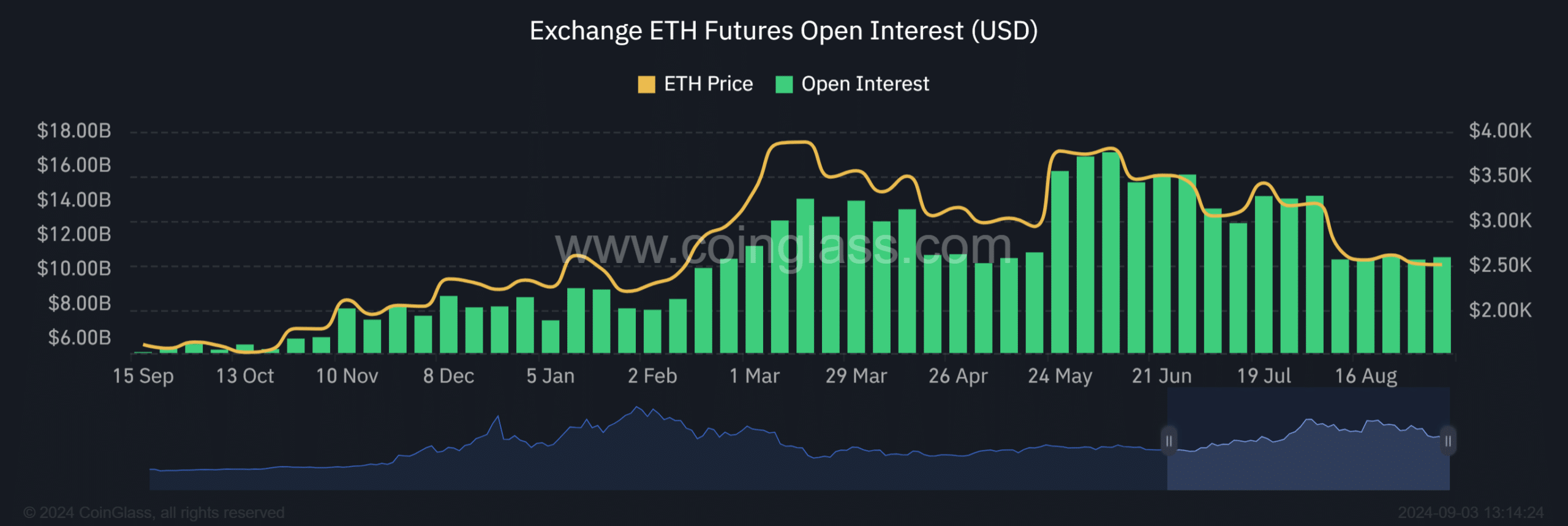

Source: Coinglass

To the relief of bulls, AMBCrypto noted an increase in open interest among futures traders.

According to the chart above, OI rose to $10.72 billion, up 0.37% from the previous day’s $10.68 billion.

Despite this uptick, a much stronger rise in Open Interest would be needed to ensure a sustained bullish swing.

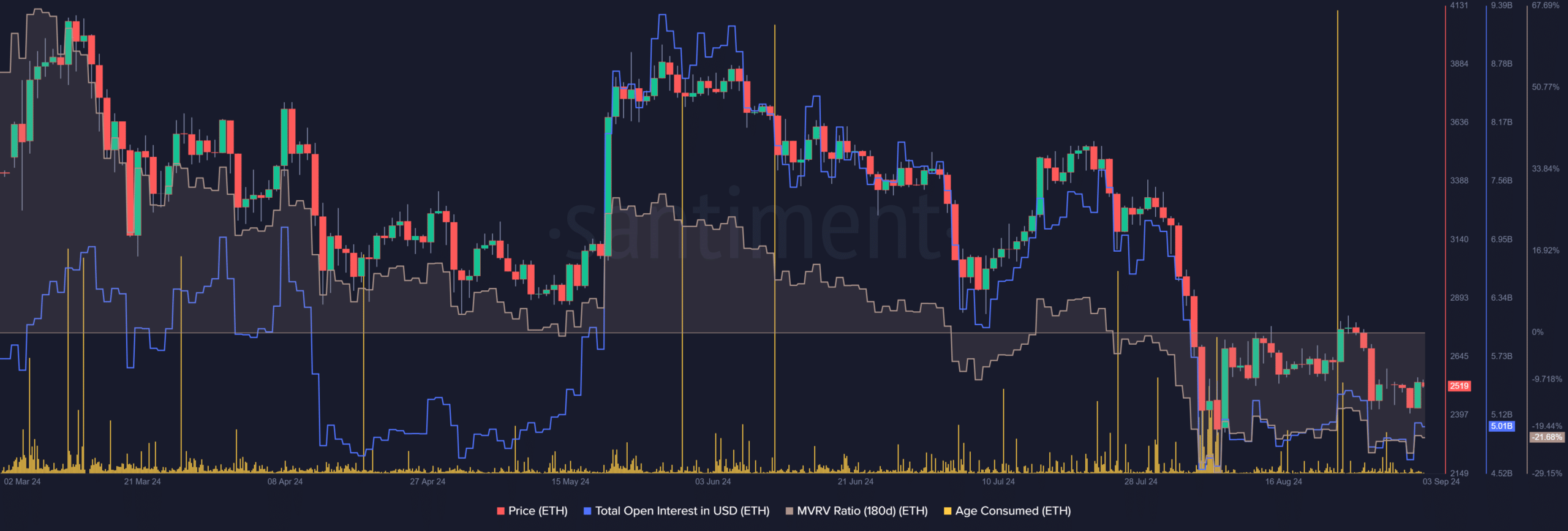

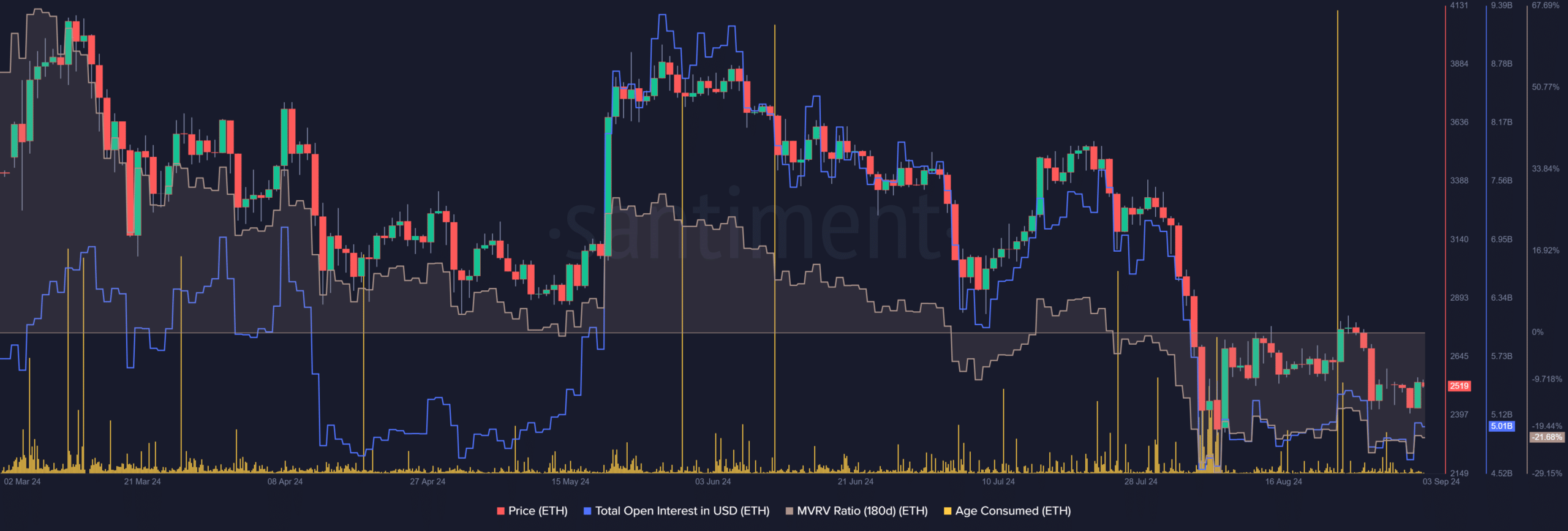

Source: Santiment

While futures traders show limited optimism about a guaranteed ETH price rise, long-term holders are routinely selling off some of their old coins, signaling a bearish trend.

On August 23, old-age consumption rose to an astonishing $629 million, which subsequently led to a price drop.

Additionally, a negative MVRV ratio indicated that ETH’s current market value is below its realized value, indicating that the asset may be undervalued. It can signal a potential buying opportunity.

However, the lack of a significant increase in Open Interest could indicate that the true value of ETH has not yet been realized.

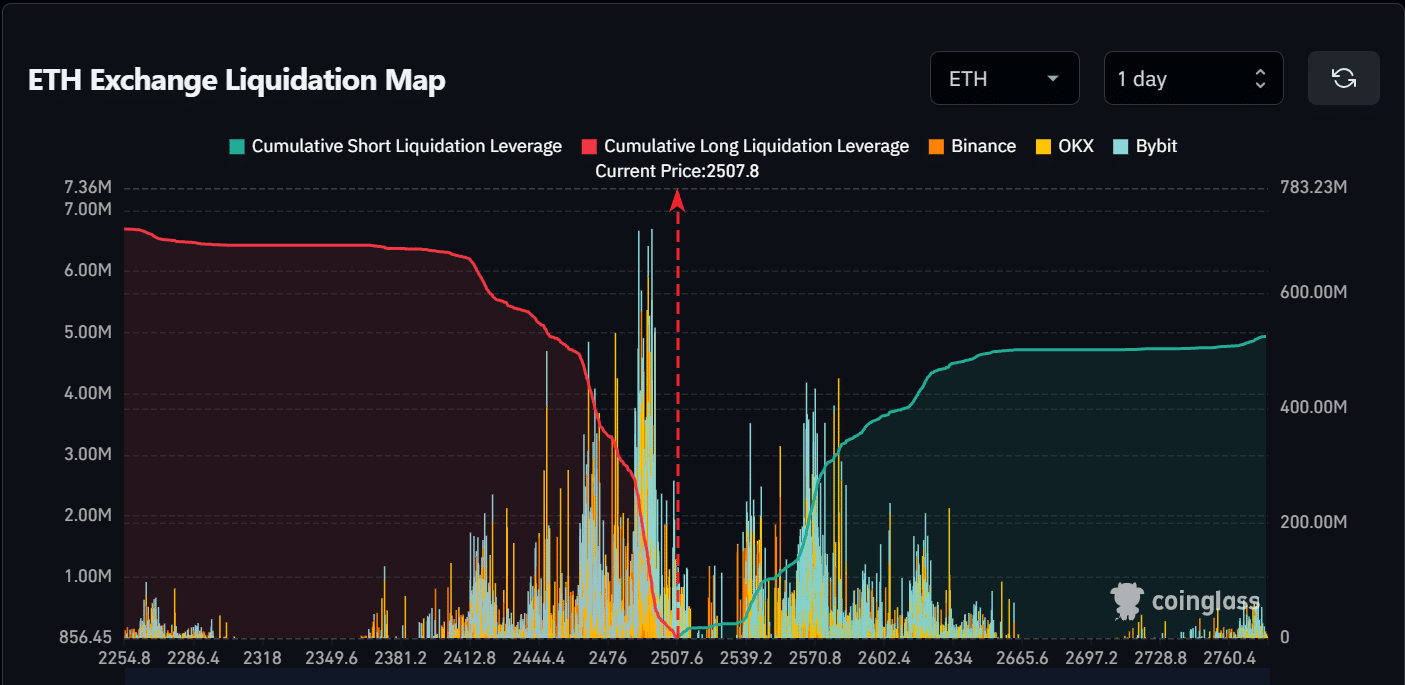

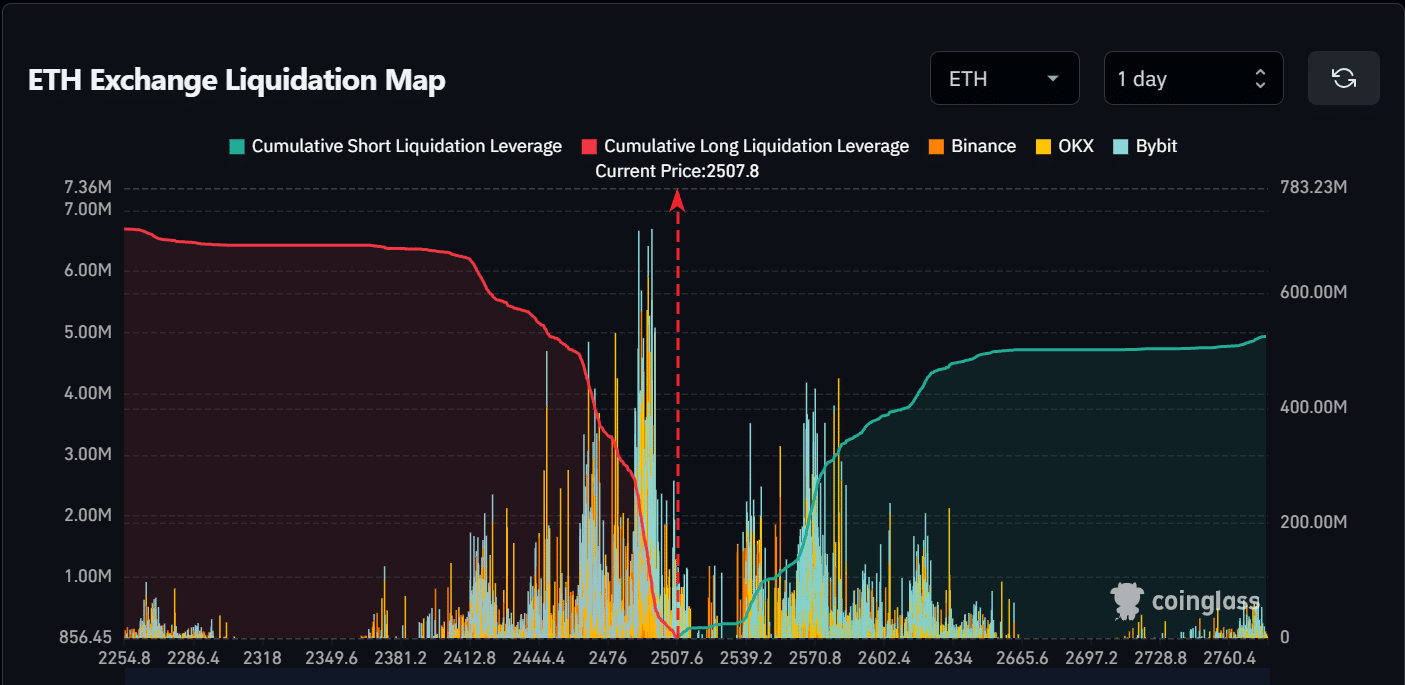

Source: Coinglass

Additionally, AMBCrypto noted that the recent 3% surge may have been a bluff, leading to $34 million in short liquidations and pushing ETH to test the crucial $2,500 level.

Read Ethereum’s [ETH] Price forecast 2024–2025

However, as analyzed by AMBCrypto, the likelihood of a breakout had decreased due to a lack of strong buying activity.

In short, if buying activity does not increase, ETH could face extended liquidations of around $40 million if the price falls below the $2,500 support, taking the price back to $2,300.