This article is available in Spanish.

In its newest market analysis Titled “Sugar High,” BitMEX founder Arthur Hayes lists four reasons to be optimistic about Bitcoin and the broader crypto market in the final quarter of 2024.

Hayes opens his analysis with a metaphorical comparison of his ski diet with the budgetary approach of the major central banks. He compares quick energy snacks to short-term monetary policy adjustments, particularly interest rate cuts by the US Federal Reserve, the Bank of England and the European Central Bank. These cuts, he argues, are like “sugar highs”: they temporarily raise asset prices, but must be balanced with more sustainable financial policies, akin to “real food” in his analogy.

This crucial shift in monetary policy following Fed Chairman Jerome Powell’s announcement at the Jackson Hole symposium caused a positive reaction in the market, in line with Hayes’ forecast. He suggests that anticipating lower rates makes assets priced in fiat currencies with fixed supplies, such as Bitcoin, more attractive, increasing their value. He explains: “Investors believe that if money is cheaper, assets priced in fiat dollars should rise out of fixed supply. I agree.”

However, Hayes warns of the potential risks if a carry trade in the yen comes to a halt, which could disrupt markets. He explains that expected future interest rate cuts by the Fed, BOE and ECB could narrow the interest rate differential between these currencies and the yen, risking destabilizing financial markets.

Hayes argues that unless real economic measures, akin to his “real food” on ski trips, are taken by central banks – particularly by expanding their balance sheets and implementing quantitative easing – there could be negative consequences for the market. “If the dollar-yen falls through 140 in the near term, I don’t believe they will hesitate to provide the ‘real food’ that the filthy fiat financial markets need to survive,” he adds.

Related reading

To further strengthen his argument, Hayes points to the resilience of the American economy. He notes that the US has had only two quarters of negative real GDP growth since the start of the COVID-19 pandemic, which he said is not indicative of an economy requiring further interest rate cuts. “Even the latest real GDP estimate for Q3 2024 is a solid +2.0%. Again, this is not an economy that suffers from overly restrictive interest rates,” Hayes argues.

4 reasons to be positive about Bitcoin in the fourth quarter

This claim challenges the Fed’s current trajectory toward a rate cut, suggesting this could be politically motivated rather than based on economic necessity. In light of this, Hayes presents four key reasons to be positive about Bitcoin and the broader crypto market in the fourth quarter.

1. Global Central Bank Policy: Hayes highlights the current trend of major central banks cutting interest rates to stimulate their economies despite persistent inflation and growth. “Central banks worldwide, now led by the Fed, are lowering the price of money. The Fed is cutting rates while inflation is above its target and the US economy continues to grow. The BOE and ECB will likely continue to cut rates at their upcoming meetings,” Hayes wrote.

Related reading

2. Increased dollar liquidity: The US Treasury Department, led by Secretary Janet Yellen, will inject significant liquidity into the financial markets through the issuance of $271 billion in government bonds and another $30 billion in buybacks. This increase in dollar liquidity, which will total approximately $301 billion by the end of the year, is expected to keep financial markets buoyant and could lead to greater flows into Bitcoin and crypto as investors look for higher returns .

3. Strategic use of general treasury accounts: There remains approximately $740 billion in the US Treasury General Account (TGA), which Hayes suggests will be used strategically to support market conditions favorable to the current administration. This substantial financial maneuvering ability could further increase market liquidity, which would indirectly benefit assets like Bitcoin, which thrive in high liquidity environments.

4. Cautious approach to interest rates by the Bank of Japan: The BOJ’s recent worried stance on raising interest rates, especially after observing the impact of a small rate hike on July 31, 2024, signals a cautious approach that will take market reactions into close consideration. This caution, intended to avoid destabilizing markets, signals a global environment where central banks could prioritize market stability over tightening, which again bodes well for Bitcoin and crypto.

Hayes concludes that the combination of these factors creates fertile ground for Bitcoin’s growth. While central banks worldwide lean toward policies that increase liquidity and reduce the attractiveness of holding fiat currencies, Bitcoin stands out as a finite supply that could potentially skyrocket in value.

“Some fear that the Fed’s rate cut is a leading indicator of a recession in the US and, by extension, in developed markets. That may be true, but […] they will ramp up the money printer and dramatically increase the money supply. That leads to inflation, which can be bad for certain types of businesses. But for assets with a limited supply, such as Bitcoin, it will provide a journey at the speed of light 2 Da Moon! Hayes states.

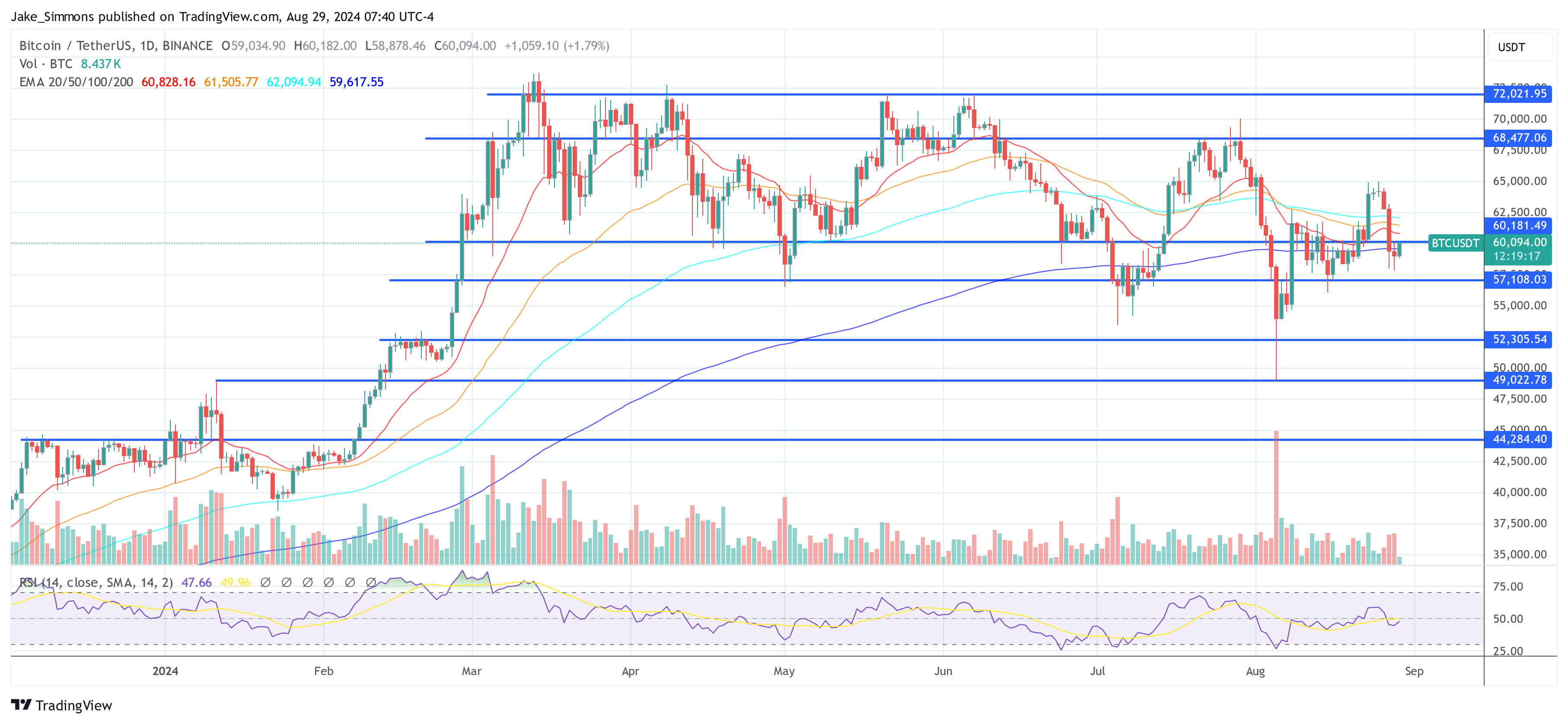

At the time of writing, BTC was trading at $60,094.

Featured image created with DALL.E, chart from TradingView.com