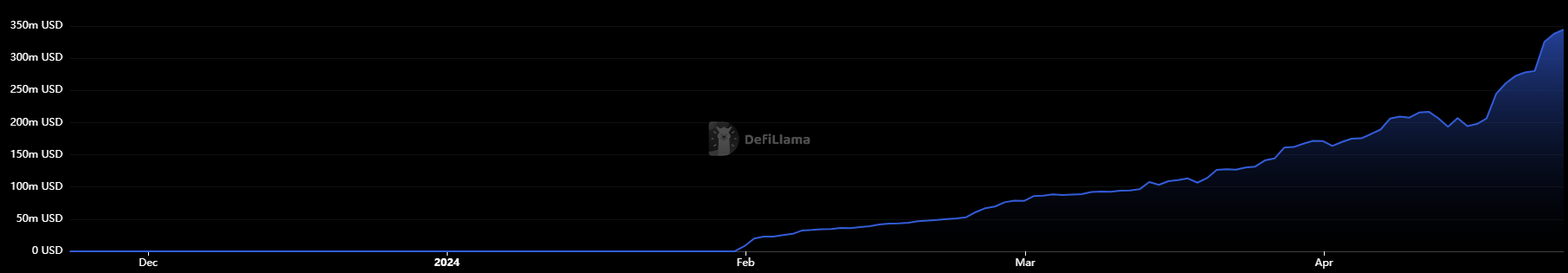

Mode surpassed $344 million in total value locked (TVL) and is showing the largest growth among Ethereum layer-2 blockchains over the past 7 and 30 days, according to data aggregator DefiLlama. This huge jump in TVL could be due to users rushing to Farm Mode’s native token, which reportedly had a snapshot in early May.

Over the past seven days, Mode rose 40.4% in TVL, with an even more significant 138% growth in the past month. Liquidity Withdrawal Protocol Renzo leads in TVL dominance, with nearly $140 million in escrow funds and up 85% over the past 30 days.

The reason behind Renzo’s jump into TVL on Mode could be related to the ‘Turbo Points’ campaign started on April 23, benefiting users who want to qualify for airdrops of Mode and Renzo native tokens.

Users who redeployed Ether (ETH) to Renzo using Mode were awarded double Mode Points, criteria taken into account to qualify for airdrops, in addition to the usual amount. Additionally, the campaign also includes other decentralized applications (dApps), which explains TVL’s growth on other platforms such as Kim Exchange.

The Turbo Points campaign is multiplied by three times Renzo points and by four times Mode points for users who provide liquidity in ezETH/WETH pools on Kim Exchange. As a result, Kim has shown the most significant growth in TVL over the past seven days, up almost 30%.

Credit protocol Ionic also showed significant growth in valuation, jumping 5.3% in the past week and 26% in the past month. Ionic is also included in the Turbo Points campaign, giving users two times more Renzo and Mode points that offer ezETH as collateral for loans.