Chainlink Labs’ capital markets director said traditional finance isn’t the best use case for tokenization, but real-world data is.

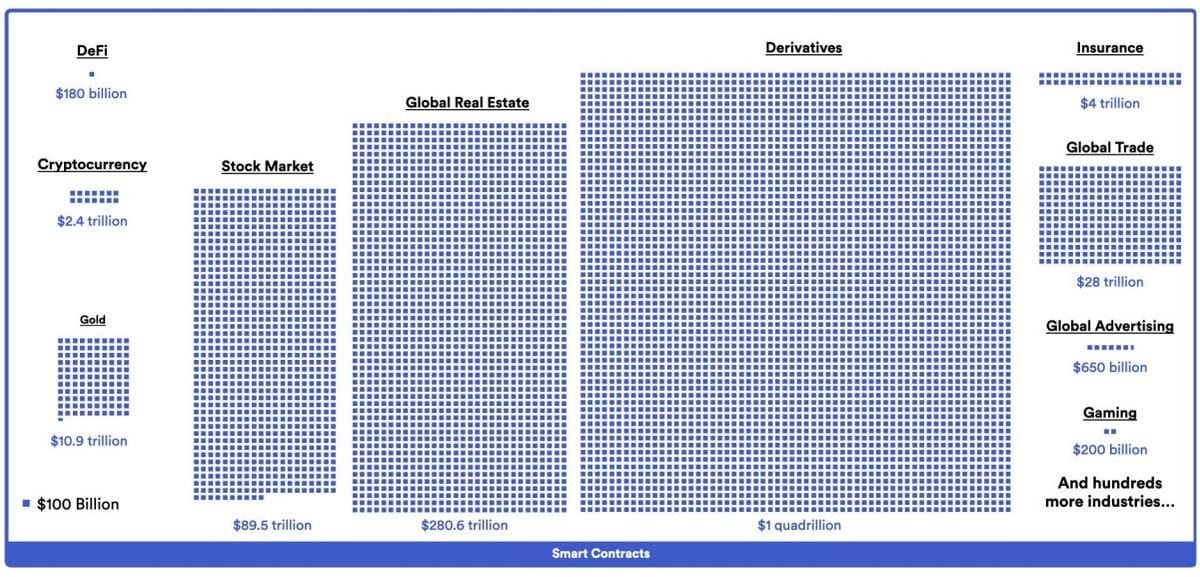

Real-world asset (RWA) tokenization is one of the largest market opportunities in the blockchain industry, with a potential market size of hundreds of trillions of dollars.

1/ The tokenized RWA opportunity is measured in trillions of dollars.

Tokenizing an asset unlocks blockchain-enabled superpowers, from near-instant settlement to improved liquidity, fractional ownership, DeFi integration, and more.

Breaking the RWA mega trend

pic.twitter.com/e4WYSB8iAo

— Chainlink (@chainlink) April 23, 2024

There are a growing number of projects looking to tokenize a wide variety of assets, including cash, commodities, real estate, and more.

However, researchers from the blockchain oracle platform Chain link believe that the biggest opportunity is being overlooked in favor of traditional finance

They argue that as financial asset infrastructure becomes more digital, asset managers will have a “significant” opportunity to enter the tokenization market.

In an industry report Titled ‘Beyond Token Issuance’, Chainlink explained where the opportunities lie and how interoperability and real-world data could unlock the value of tokenized assets.

The report outlined the need for interoperability and real-world data in tokenization so that asset managers can adapt to the rising demand for tokenized assets.

“Many asset managers are unable to construct or offer comprehensive digital asset investment products that involve tokenized assets. As clients increasingly seek exposure to tokenized assets, asset managers who cannot securely integrate these assets into their product offerings risk falling behind their competitors.”

Chainlink believes that the benefits of tokenization outweigh traditional finance

If this were achieved, asset managers could unlock dormant capital with higher returns by allowing them to tap previously inaccessible markets or asset classes and access global, liquid, 24/7 markets.

This would provide greater availability to asset classes that were previously inaccessible challenging to enter.

This allows asset managers to create new revenue models with new sources of income thanks to the unique opportunities that arise. They could differentiate their service offering with new and tailor-made financial products for their customers.

Bridging the gap would unify customer portfolios, bringing both traditional financial assets and digital assets into a single offering.

And finally, back-office operational costs for asset managers would decrease because they would need to use fewer intermediaries, thus exploiting decentralization.

Chainlink states that blockchain technology is evolving into an “integral part of the existing financial ecosystem.” The report highlighted the integration of blockchain and traditional assets into a unified financial ecosystem.

The researchers believe this is the result of ongoing digitalization, as blockchains provide better infrastructure for transactions and asset storage.

While there may be more opportunities to apply tokenization with real-world data, traditional finance should not be overlooked as a target for the development and adoption of the technology.

Chainlink has already anchored itself in the traditional financial market and works with companies such as ARTA TechFin And ANZ bank to customize their services and facilitate tokenization adoption.

Real-world data tokenization is not only a focus, but also contributing to the growing adoption of blockchain technology in the real world.