- Bitcoin whales accumulated large amounts of BTC as the price of the king coin grew.

- Traders remain optimistic and a large majority continued to hold long positions.

Bitcoin [BTC] generated a lot of optimism over the past 24 hours as the price reached the $69,000 level again. One of the reasons for this is said to be the increasing interest of whales in BTC.

Whales come in

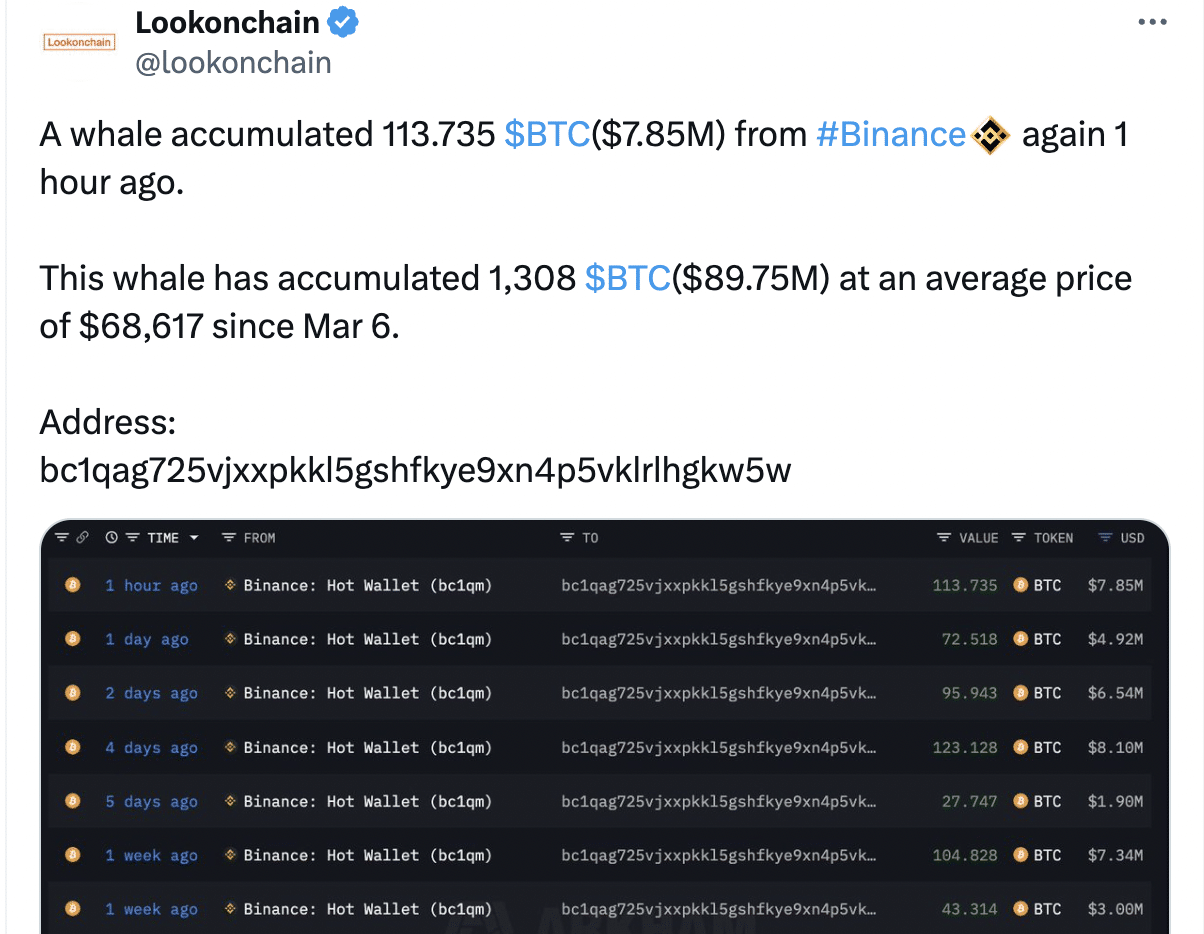

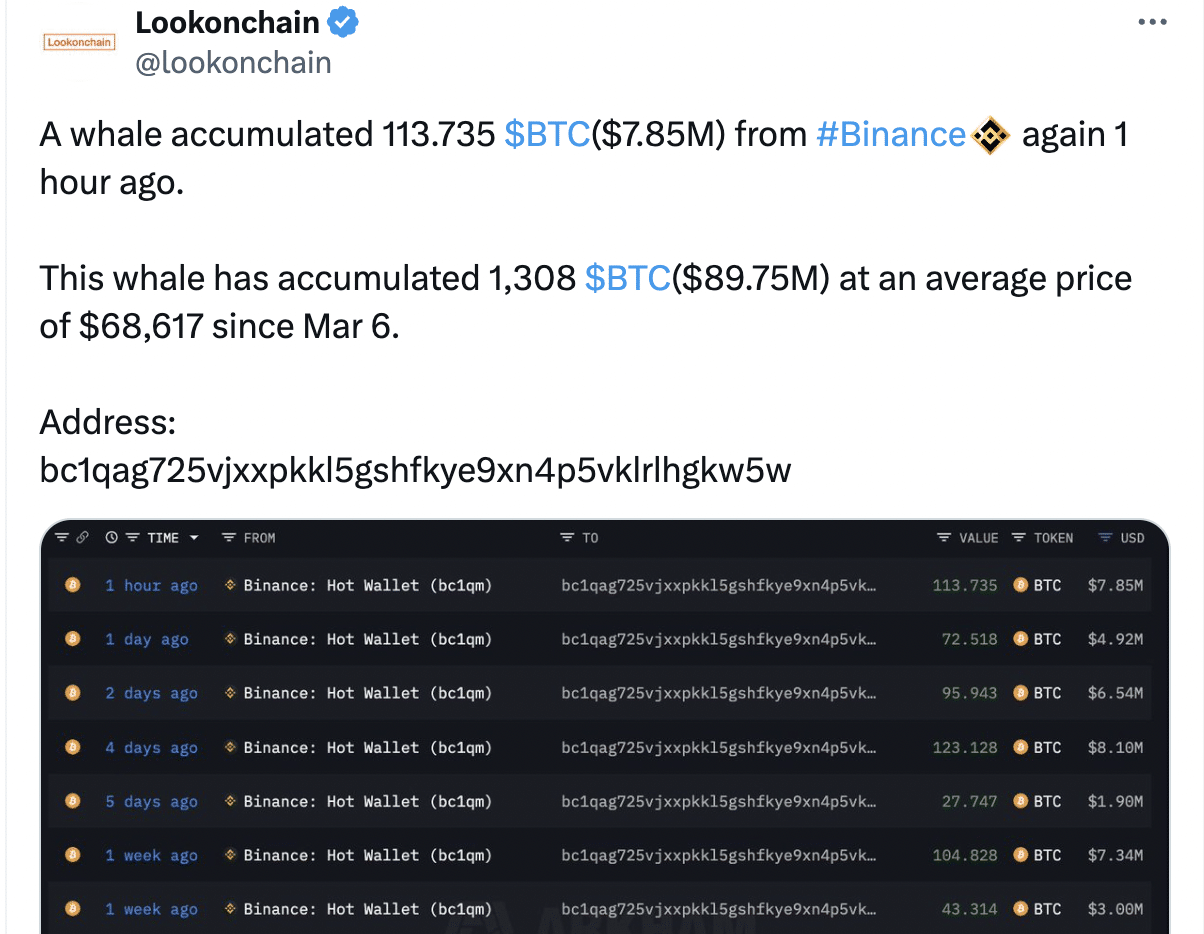

According to data from Lookonchain, a whale has collected 113,735 BTC, which totals $7.85 million, from Binance.

Since March 6, this whale has accumulated a total of 1,308 BTC, worth $89.75 million, at an average price of $68,617.

Source:

This increased confidence from major investors could act as a catalyst, attracting more buyers and pushing the price higher.

Whales’ involvement can also validate Bitcoin’s potential in the eyes of other investors, further strengthening the market. However, this newfound influence comes with a double-edged sword.

While whale activity can cause prices to rise, it can also lead to sharp declines if whales decide to sell their assets.

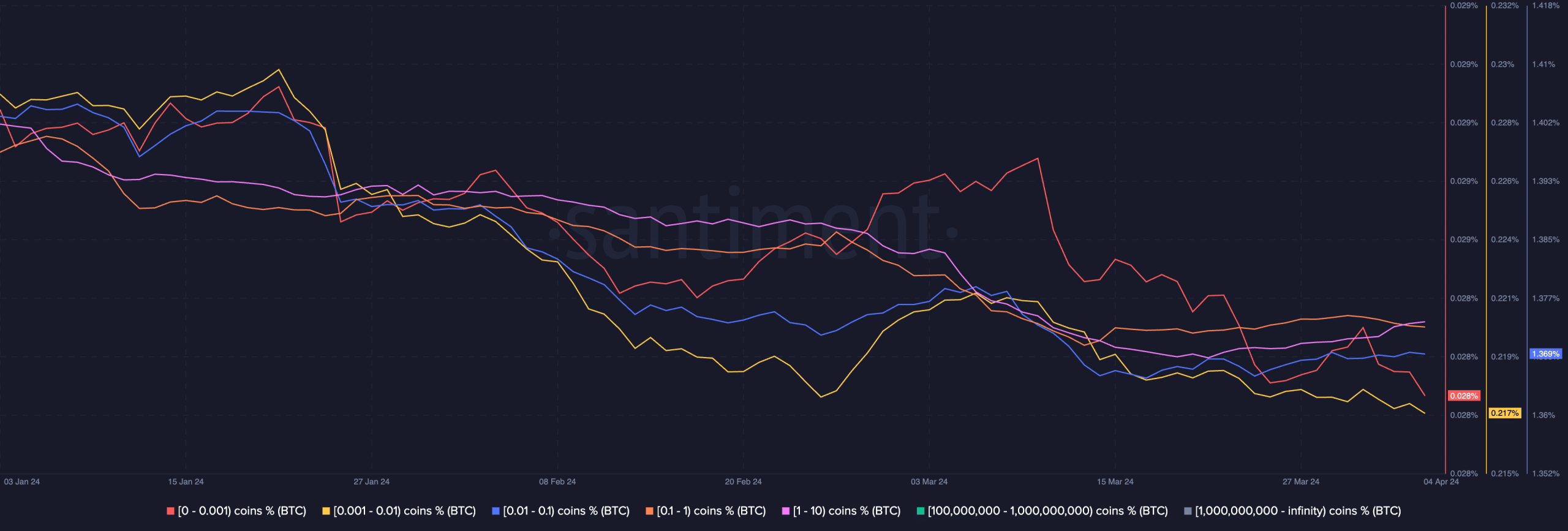

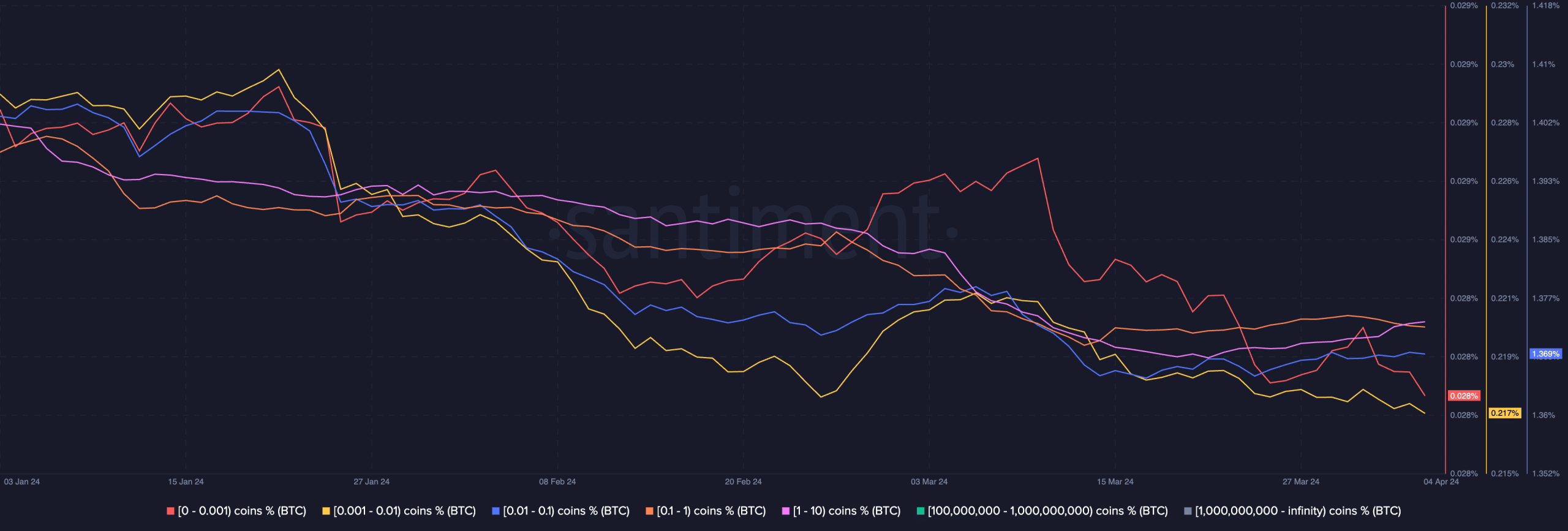

Although whales were accumulating BTC at a faster pace, retail investors showed less and less interest.

AMBCrypto’s analysis of Santiment’s data indicated that the concentration of addresses had decreased by somewhere between 0.001 and 1.0 BTC.

If whale investors continue to accumulate while retail investors become passive, BTC investing could become more centralized.

This centralization of BTC would make retail investors more vulnerable to whale behavior.

Source: Santiment

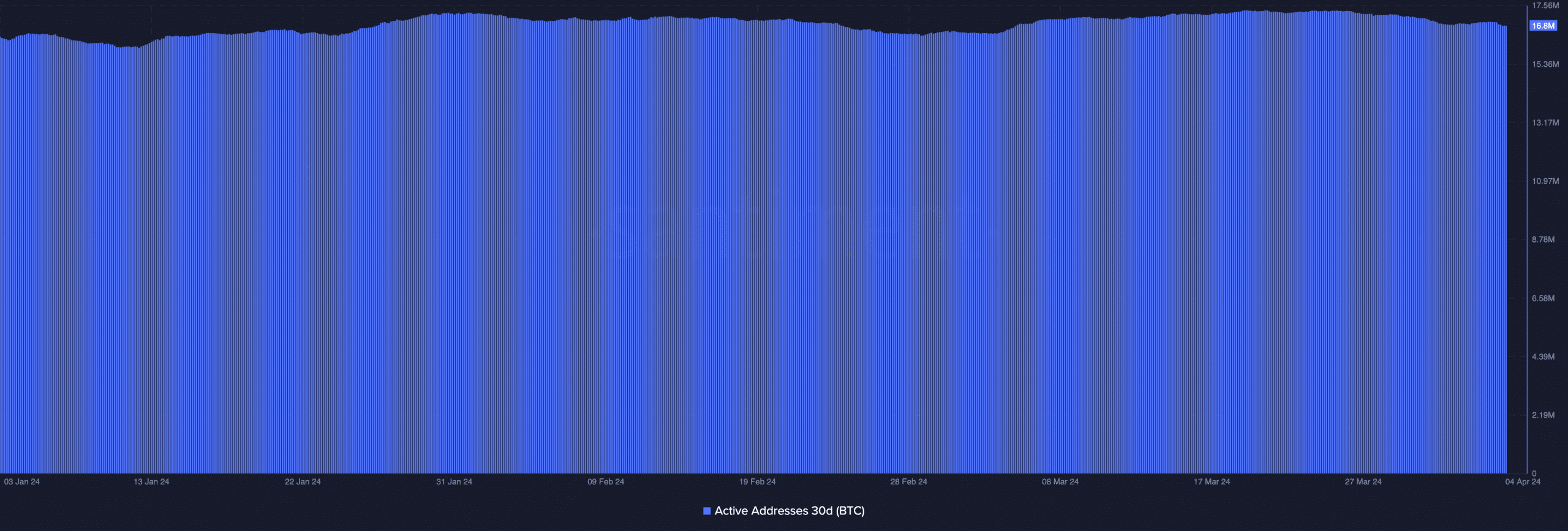

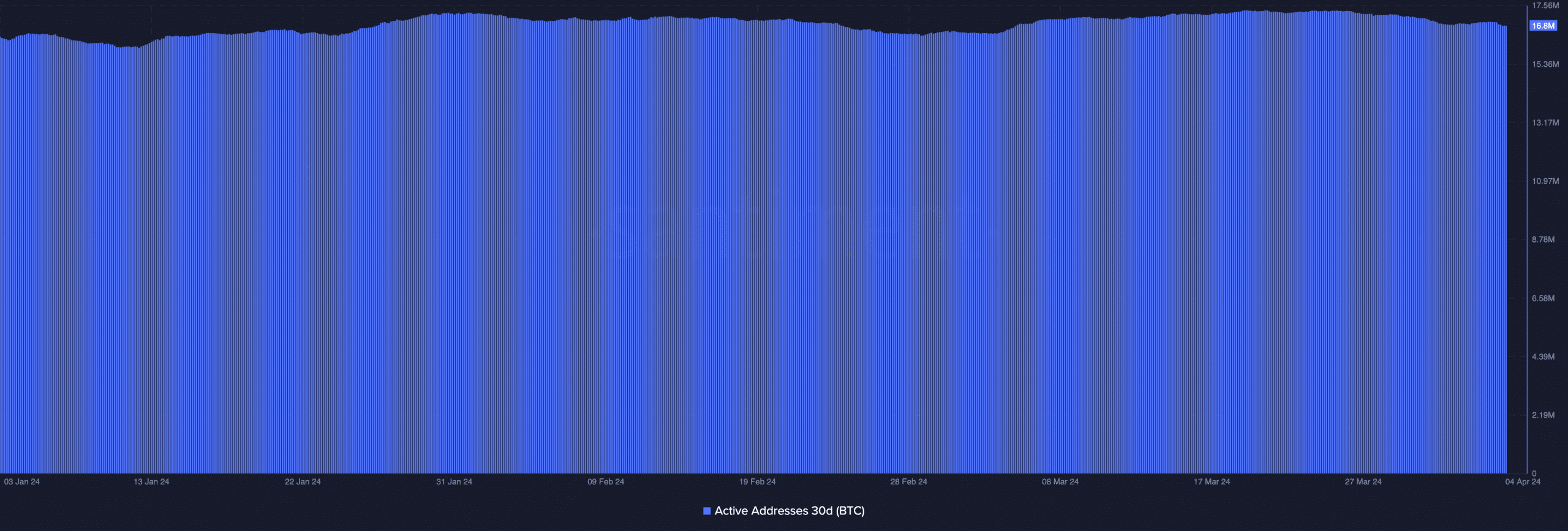

Apart from the behavior of the holders, the activity on the Bitcoin network would be another factor that would influence the price movement of BTC.

Data from Santiment indicated that the number of active addresses on the network had remained high.

Source: Santiment

State of the ecosystem

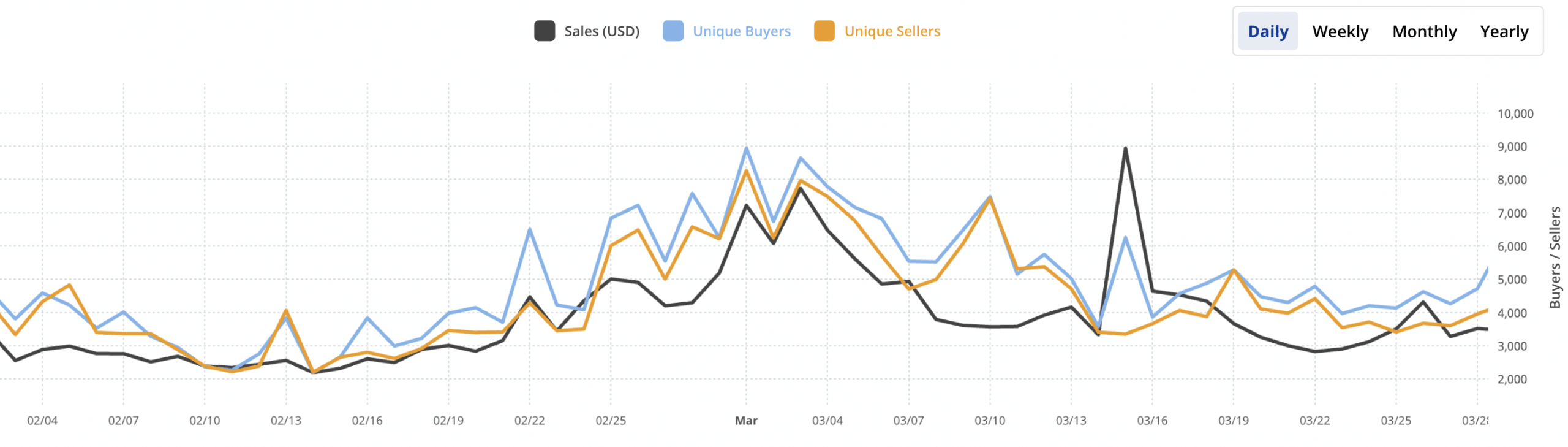

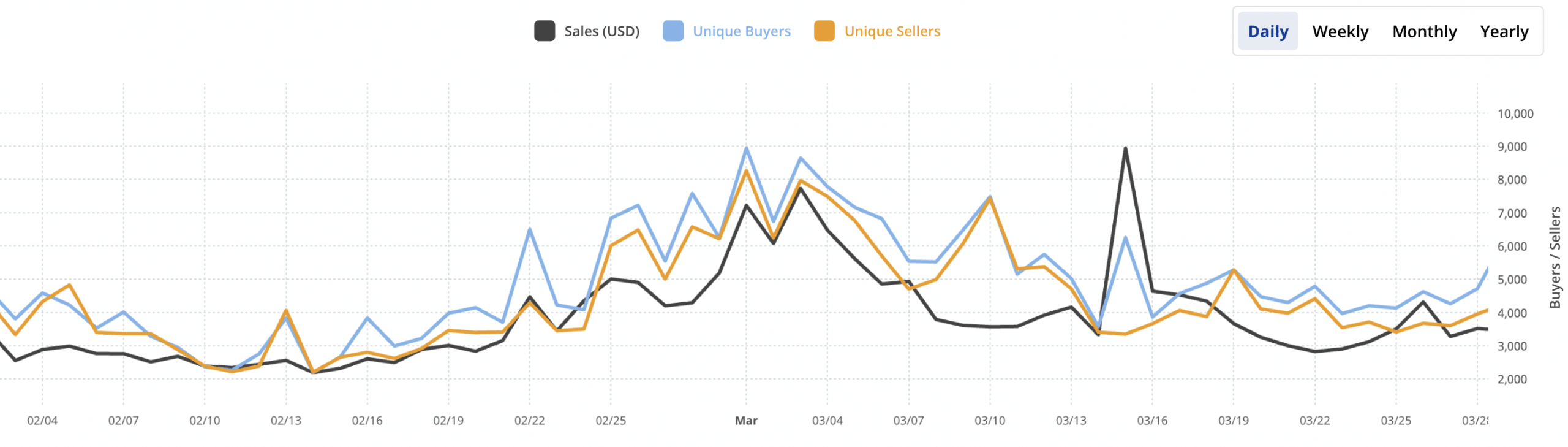

The high activity on the network can be partially attributed to the growing popularity of Ordinals and Inscriptions on the Bitcoin network.

AMBCrypto’s review of CryptoSlam’s data found that the number of unique buyers and unique sellers had grown. Moreover, the number of sales of the NFTs on the Bitcoin network had also grown.

Source: Santiment

Is your portfolio green? Check out the BTC profit calculator

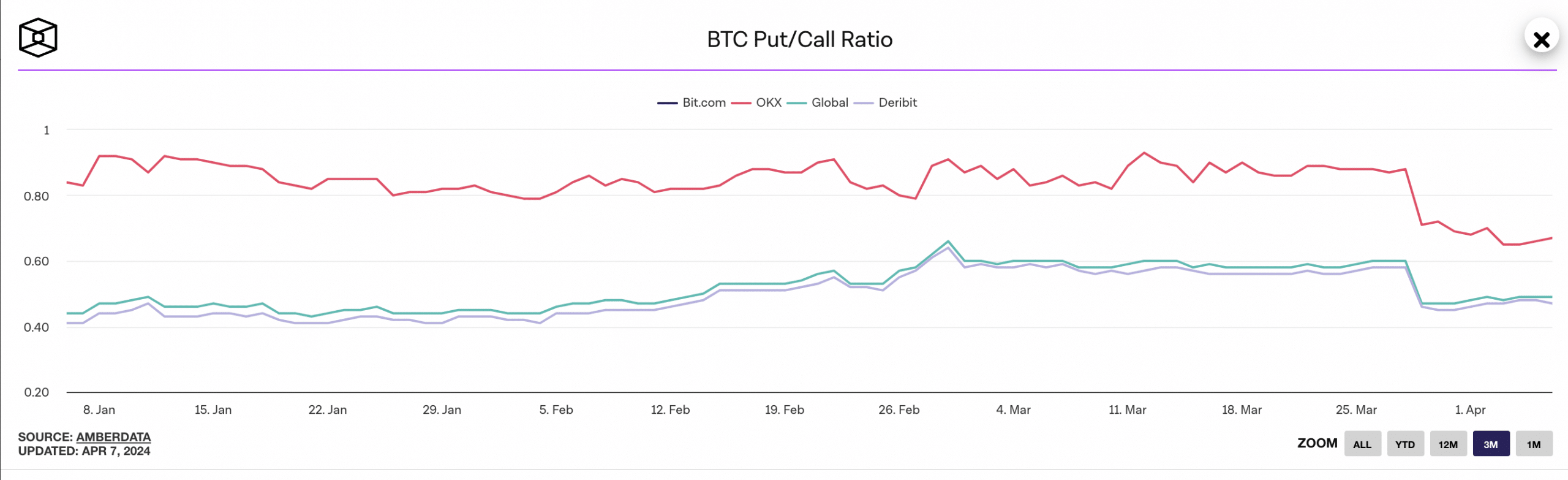

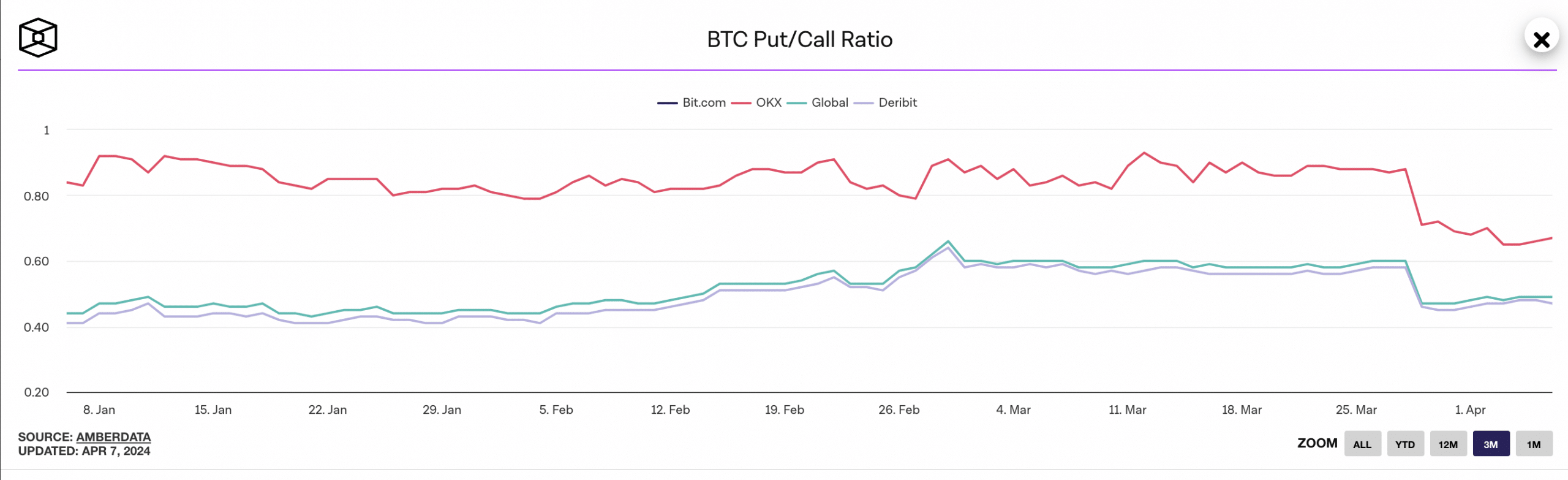

Traders also remain bullish on BTC. This was indicated by the Put to Call ratio around Bitcoin, which had fallen significantly in recent days.

The high number of call options taken by traders showed that many bulls expect the price of BTC to rise further and even reach the all-time high previously reached.

Source: Het Blok