- BTC’s weighted sentiment has been negative for the past three weeks.

- Other on-chain indicators point to the possibility of a further price drop below $66,000.

Like Bitcoin [BTC] extends the weekly loss by another 4%, weighted sentiment continues to follow its bearish trend, according to Santiment data.

In a post on X (formerly Twitter), Santiment noted that BTC’s weighted sentiment has been negative for the past three weeks.

The beginning of this bearish trend, which took place on March 14, coincided with the coin’s price falling from an all-time high of $73,750. Exchanging hands at $66,572 at the time of writing, the price of BTC has fallen 10% since then.

The audience’s sentiment towards #Bitcoin And #crypto markets in general have wobbled since the big correction three weeks ago. Even with the $BTC Halving now only two weeks away, reflecting traders’ sentiment #FUD And #bearish expectations.

With prices bouncing back to $69,000… pic.twitter.com/DYs5RYNR95

— Santiment (@santimentfeed) April 5, 2024

Using historical precedents, Santiment added that the price of BTC often “moves in the opposite direction of public expectations.”

During periods when the market is reaching euphoric highs and expecting a sustained rally, BTC’s price reverses. Conversely, when sentiment turns bad and the market expects further downward developments, the price of BTC is known to initiate an uptrend.

In fact, this pattern has been playing out recently.

More decline in the short term?

On April 4, the price of BTC briefly rose above the $69,000 price level before returning to the $66,500 area. With new resistance formed at $69,000, on-chain data suggests the possibility of a further decline in the leading crypto’s value in the near term.

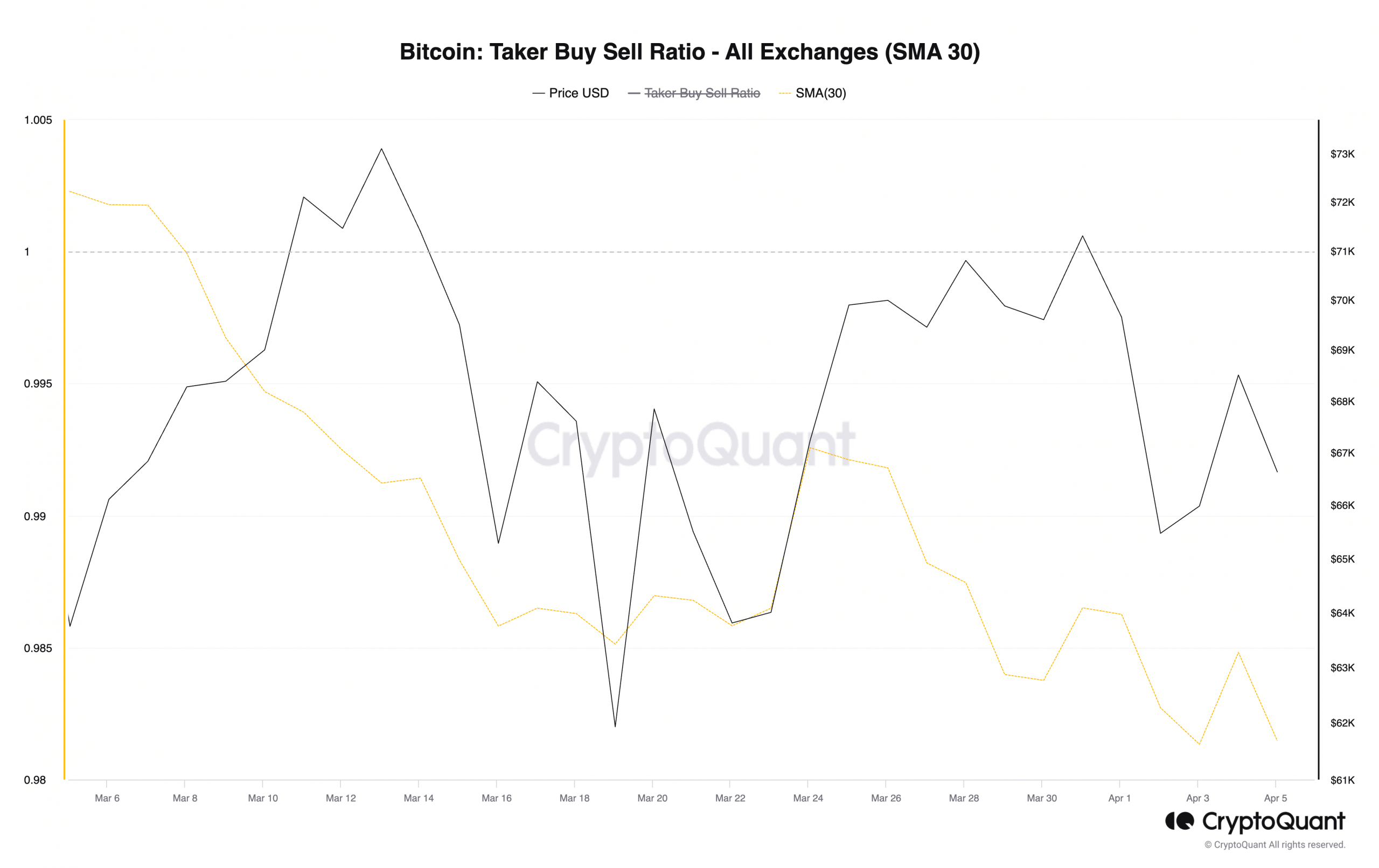

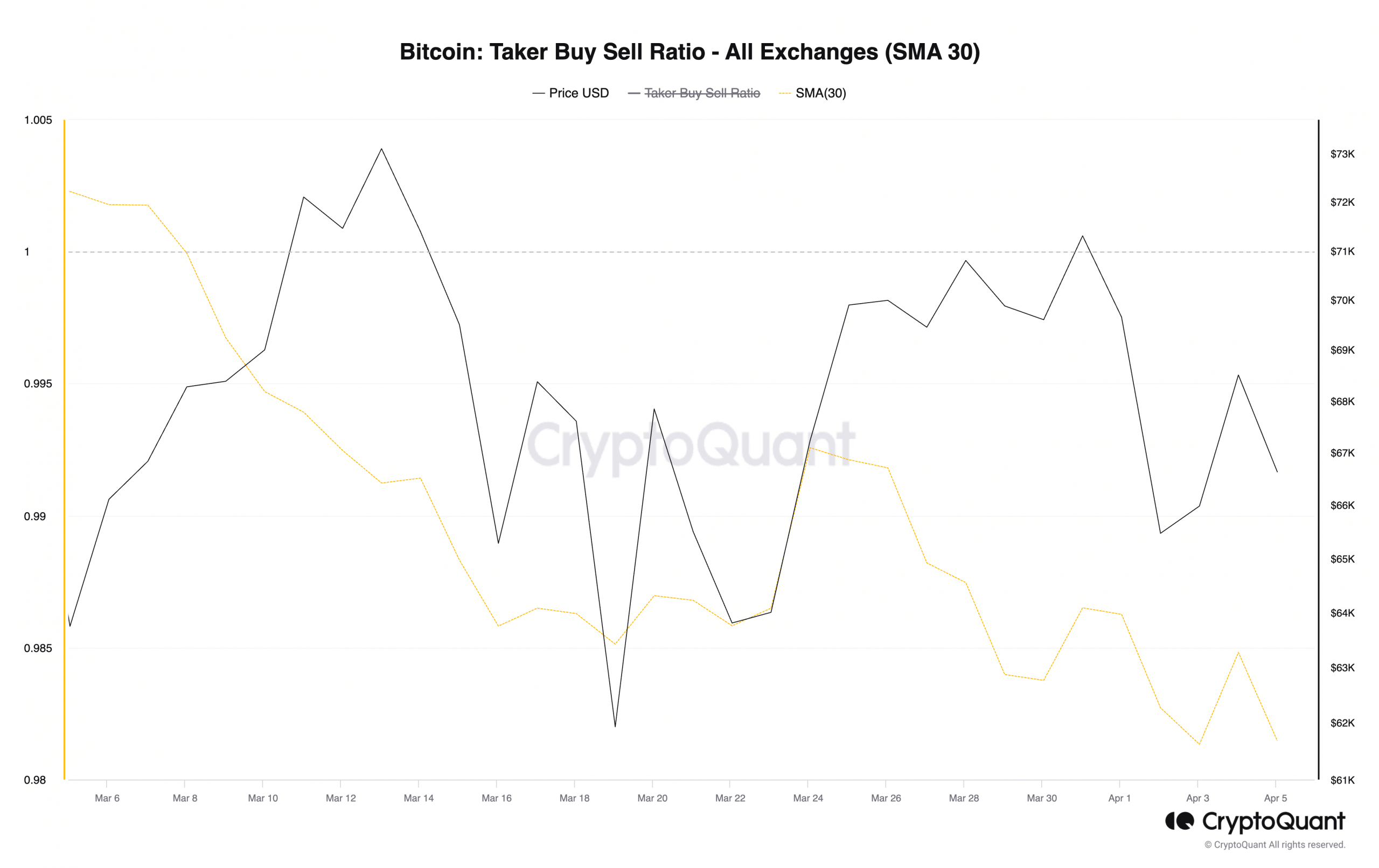

First, the coin’s buy-sell ratio, assessed on a 30-day simple moving average (SMA), fell below the zero line on March 8, foreshadowing the price decline that began on March 14.

The taker buy-sell ratio is a metric that measures the ratio between the buying volume and the selling volume in the futures market of an asset. A value greater than 1 indicates more buying volume than selling volume, while a value less than 1 indicates more selling volume than buying volume.

Since March 8, BTC’s taker buy-sell ratio has been less than 1. The steady decline of this metric means that there are more sellers than buyers among those transacting directly in the BTC market.

This is expected to continue as long as sentiment remains bearish, putting downward pressure on the coin’s price.

Source: CryptoQuant

Further in a recent one reportpseudonymous CryptoQuant analyst Tugbachain discovered that BTC’s NVT Golden Cross closed March with a sell signal.

This indicator compares the 30-day moving average of the coin’s Network Value to Transactions (NVT) ratio with the 10-day moving average.

Read Bitcoin’s [BTC] Price forecast 2024-25

It generates a long signal when it returns a value less than 1.6. Conversely, when the value is above 2.2, it is seen as a signal to take short positions.

According to Tugbachain:

“In late March, when the Bitcoin price was around $71,000, the NVT value reaching ‘3.17’ levels served as an indicator of reaching a local peak.”