Bitcoin (BTC) is poised for a potential surge after forming a bullish technical pattern and attracting a wave of institutional investment. The world’s leading cryptocurrency recently crossed the $70,000 mark, paving the way for a possible breakout that could surpass the current all-time high of $73,750.

This optimistic outlook comes from analyst Ali Martinez, who identified a bull flag pattern on Bitcoin’s 4-hour chart. This technical indicator usually follows a significant price increase and indicates a consolidation period with a slight downward trend. However, the declining trading volume during this phase indicates a temporary pause rather than a reversal, potentially leading to a renewed uptrend.

Validation of the Bull Flag Pattern: Analysis of the Bitcoin Consolidation Phase

Bitcoin’s recent dip below $61,000 served as a testing ground for this theory. The cryptocurrency showed resilience by returning to the $67,000-$70,000 range, reinforcing the potential validity of the bull flag pattern. This consolidation phase is critical for market participants to reassess their positions and gauge overall investor sentiment.

#Bitcoin it looks like a bull flag is forming on the 4-hour chart! If $BTC If the price stays above $70,000, we could see an increase of almost 10% to a new all-time high of $77,000! pic.twitter.com/MPVB70p9DU

— Ali (@ali_charts) March 28, 2024

The recent dip wasn’t necessarily cause for alarm, Martinez explains. In fact, it could be interpreted as a healthy consolidation that strengthens the foundation for further growth.

In addition to technical analysis, a significant shift in Bitcoin’s ownership structure is creating optimism. The long-awaited launch of spot Bitcoin Exchange Traded Funds (ETFs) in the United States has opened the door for institutional investors. These professionally managed funds, backed by major financial institutions, are estimated to collectively own 5% of the total Bitcoin supply.

Total crypto market cap is currently at $2.545 trillion. Chart: TradingView

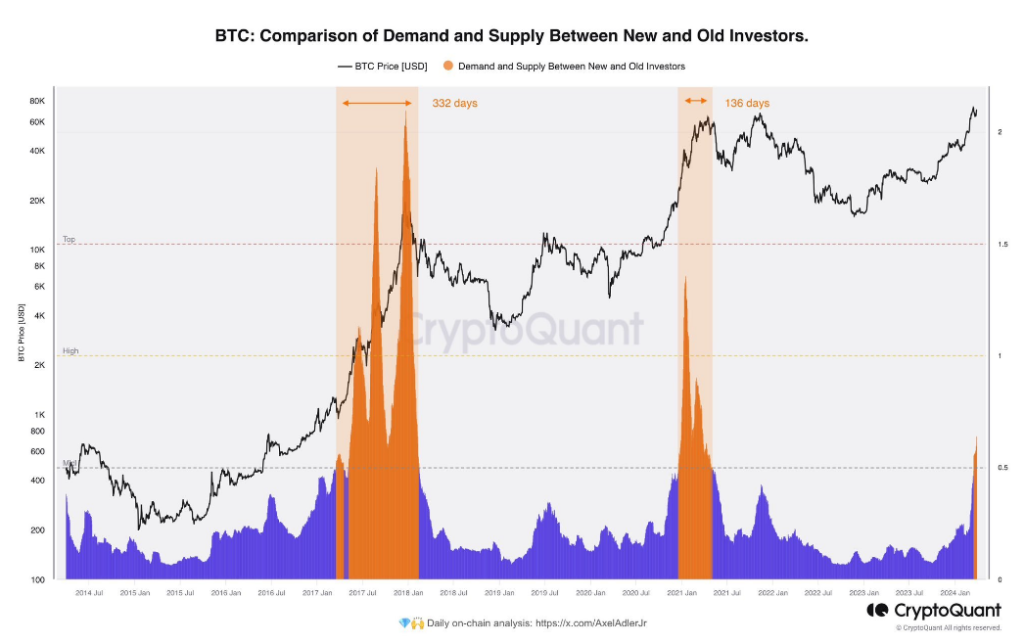

Data about the chain further confirms this institutional inflow. CryptoQuant, a blockchain analytics company, reports a departure from previous bull cycles. Traditional, Bitcoin ownership flowed from existing large holders (“whales”) to private investors. However, the current market cycle seems to be witnessing a transfer from these whales to new whales: traditional financial institutions.

Bitcoin’s bullish price predictions

The influx of institutional capital has prompted some analysts to make bullish price predictions. While Martinez refrained from offering a specific time frame for the expected breakout above $73,750, others are more imminent. Optimistic predictions range from $100,000 to $150,000 for Bitcoin by the end of 2024, with some even predicting a staggering price of $500,000 by 2025.

Related literature: Fantom: Market Slowdown Takes 10% Off Profits – Here’s Why

However, experts warn against blindly following such extreme predictions. The cryptocurrency market remains inherently volatile and technical analysis is not a foolproof method of guaranteeing future price movements. The long-term effects of institutional involvement on market dynamics also remain to be fully understood.

Despite these words of caution, the confluence of a bullish technical pattern and a surge in institutional investment has undeniably created a sense of excitement around Bitcoin. As the world’s leading cryptocurrency continues its march into uncharted territory, all eyes are on whether it can indeed break new ground and set a new all-time high.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.