- About 311,000 wallets have left the network in the past ten days.

- The 30-day MVRV ratio indicated that the coin could yield more gains.

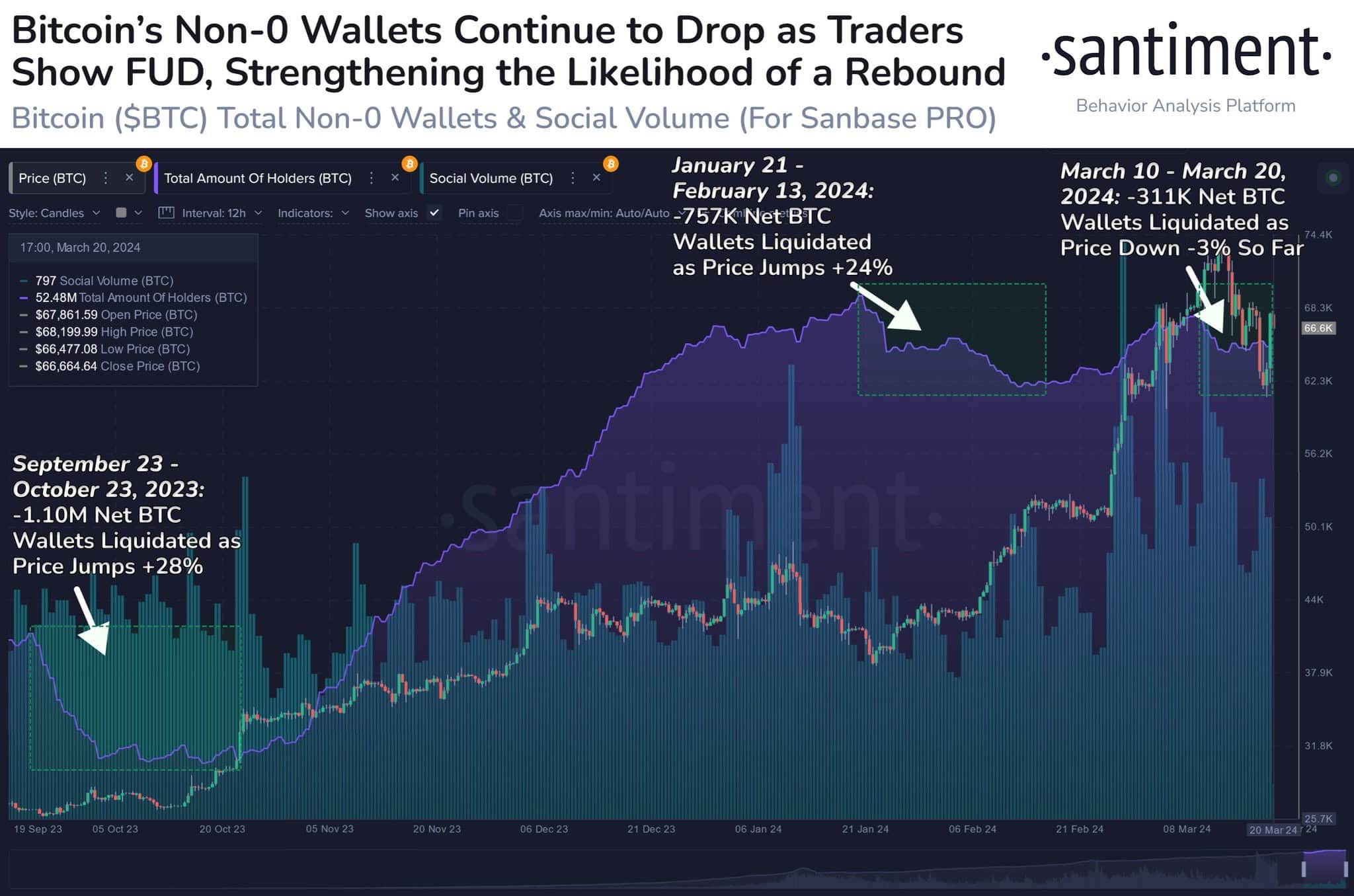

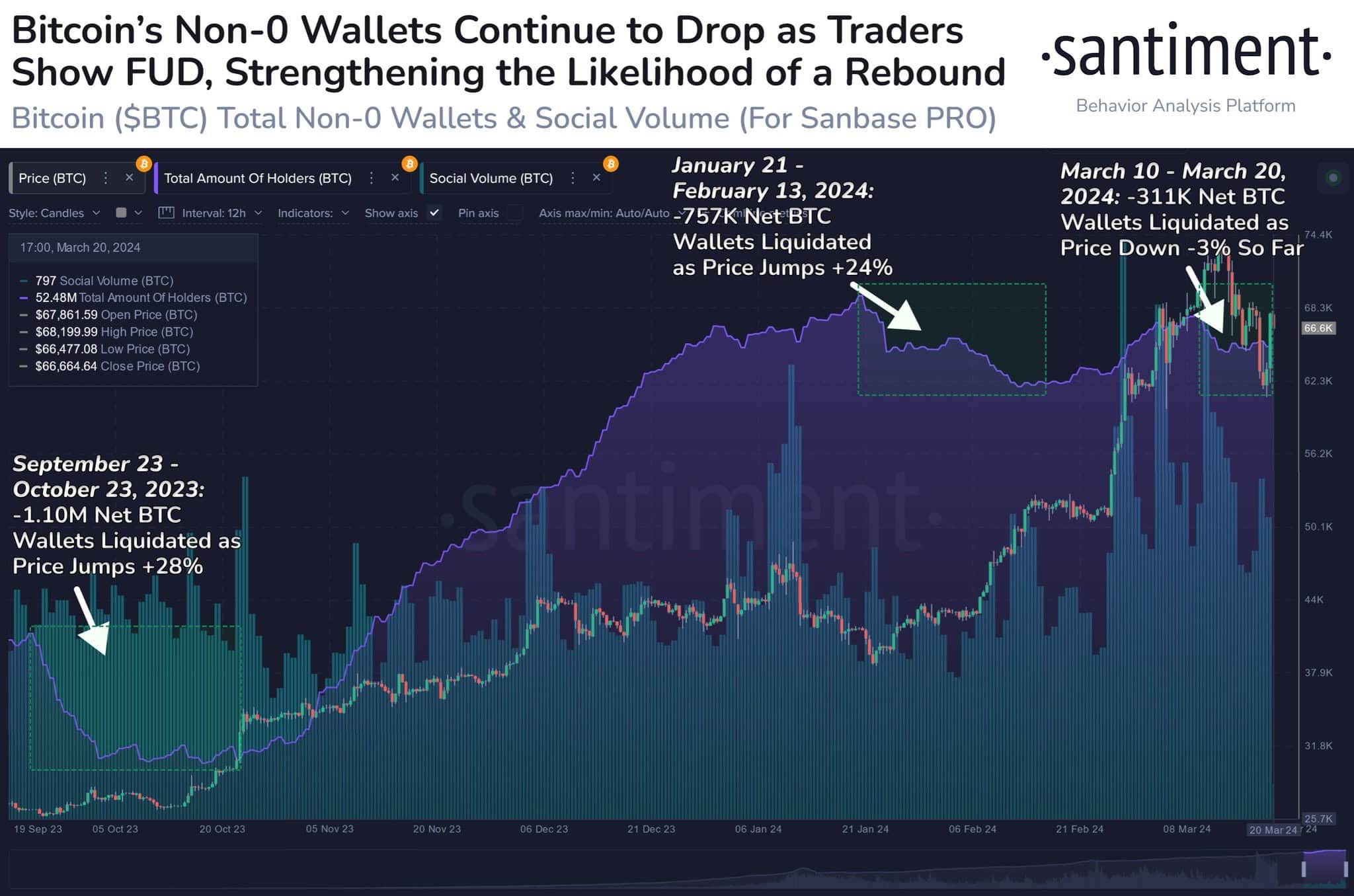

Although Bitcoin [BTC] The price almost reached $68,000 again, but on-chain data showed that the previous correction led to significant exits. According to AMBCrypto’s analysis, 311,00 non-zero addresses have left the Bitcoin network in the last ten days.

Our research found that the exodus was due to fear, uncertainty and doubt (FUD) as prices collapsed. However, those familiar with the marketplace can confirm that this departure should cause panic.

The coin’s showtime is not over yet

Instead, it gave whales the opportunity to buy cheap BTC at the expense of those ‘paper hands’. In addition, data from Santiment showed Bitcoin typically benefits from a scenario like this.

For example, between September and October 2023, 1.10 million non-zero addresses left the network. But the resulting result was a 28% price increase.

Source: Santiment

Some addresses also left between January 21 and February 13. But the price of BTC later rose by 24%. At the time of writing, Bitcoin had a negative 10-day performance of 3%.

If history repeats itself, Bitcoin could head towards $83,000 within a few weeks. However, it is also important to look at BTC from a different angle.

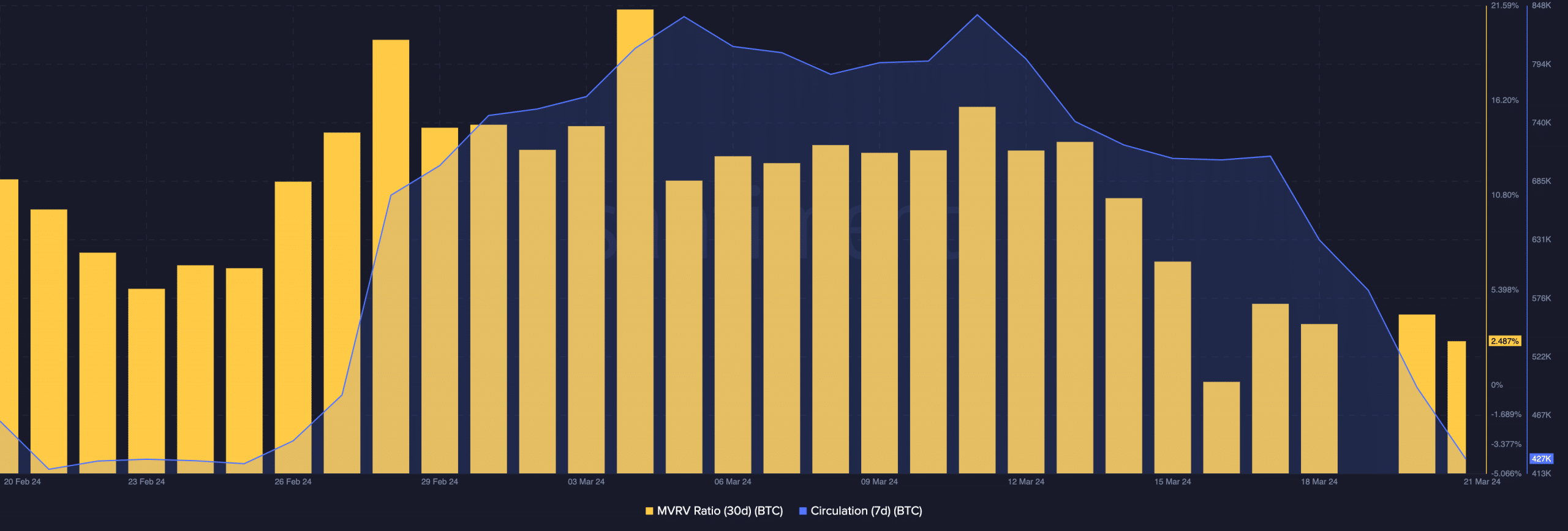

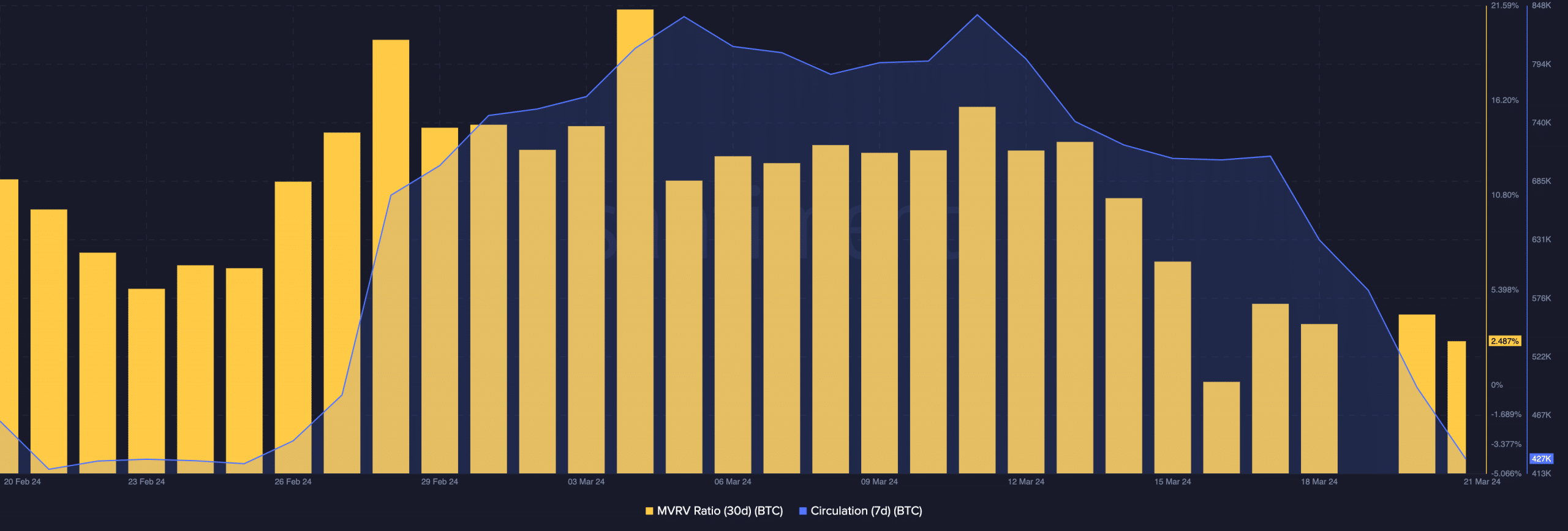

As such, AMBCrypto controlled the market value to realized value (MVRV) ratio. Normally, the MVRV ratio reflects the average gain or loss of all cryptocurrencies currently in circulation. It also indicates whether an asset is at fair value or not.

Will optimism return?

At the time of writing, the 30-day MVRV ratio stood at 2.487%, indicating that BTC holders have been hit hard by the recent correction. But the state of the metric seems like good news for the price. At such a low ratio, Bitcoin’s value has the potential to rise higher.

On a seven-day basis, on-chain data showed that Bitcoin circulation had occurred decreased. At the time of writing, the circulation was 427,000. This was almost 50% lower than on March 11.

Source: Santiment

In terms of price action, the decrease in circulation means that BTC may experience less selling pressure. This can increase the value of the coin.

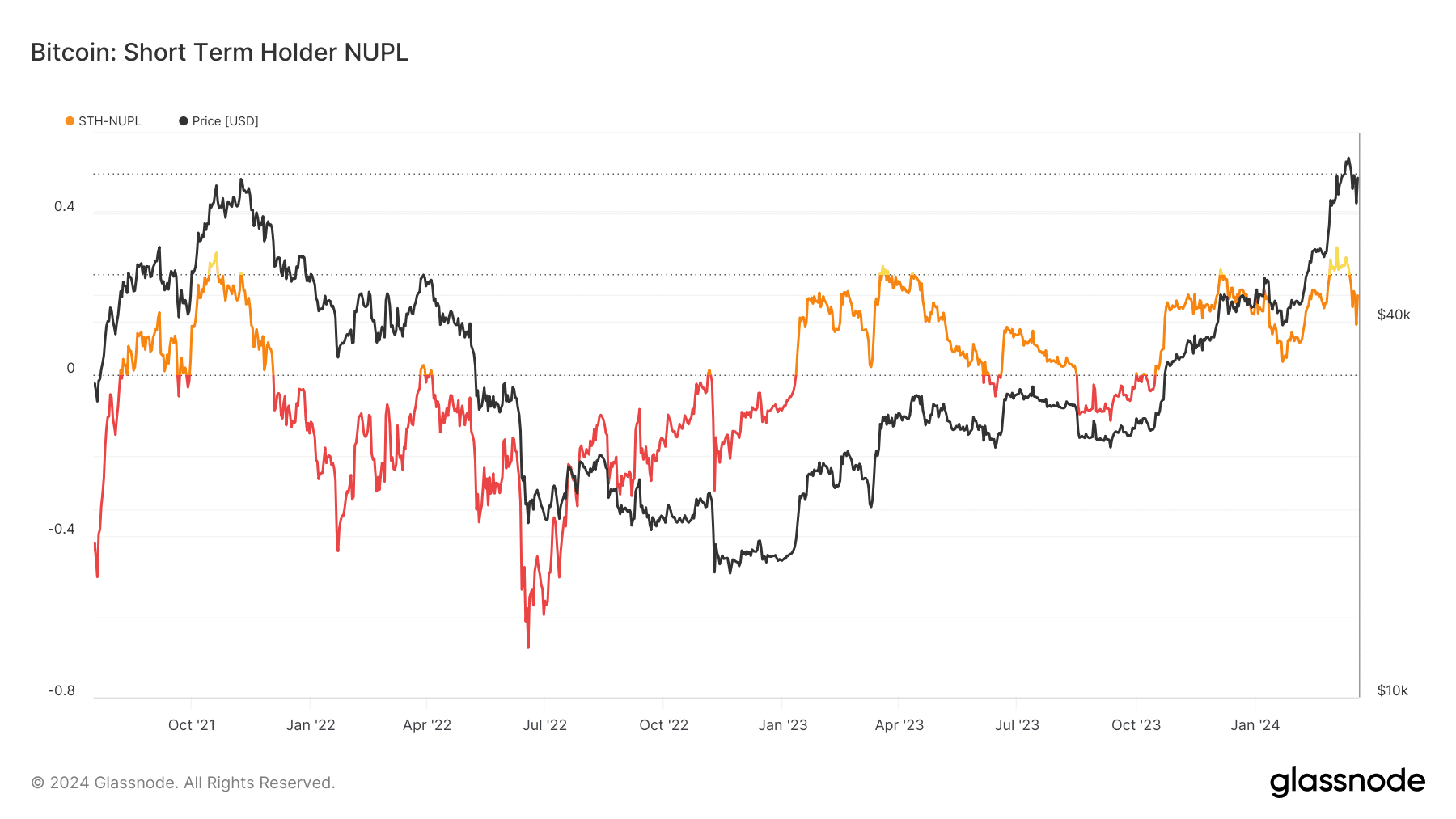

Additionally, AMBCrypto noted that there has been a change in short-term sentiment surrounding Bitcoin. We came to this conclusion after analyzing the Short Term Holder-Net Unrealized Profit/Loss (STH-NUPL).

The STH-NUPL serves as an indicator of the behavior of short-term investors. As March began, the metric shifted from hope (orange) to optimism (yellow).

Read Bitcoin’s [BTC] Price forecast 2024-2025

however, the switch to the brighter color didn’t take long. At the time of writing, STH-NUPL was back in the hope-fear territory, indicating that investors were skeptical about betting on a price increase.

But at the same time, this indicates a slight decrease in greed, indicating that the market was not overheated. Should this continue, the coin price could rise higher than $67,631.

Source: Glassnode