Within the last 24 hours, the market witnessed a significant rally in the Bitcoin price, which rose by 10% from a daily low of $60,805 to a high of $68,250. This remarkable price movement can be attributed to several key factors, including yesterday’s Federal Open Market Committee (FOMC) meeting, a notable change in Coinbase Premium, and Bitcoin’s technical breakout from a downtrend channel.

#1 FOMC Meeting: Mild Comments by Jerome Powell Fuel Optimism

As reported yesterday, the macro environment came back into focus for Bitcoin and crypto, following better-than-expected inflation data from the Consumer Price Index (CPI) and Producer Price Index (PPI) in the US. Investors appeared to have reduced their positions ahead of the FOMC event. However, investors received a favorable outcome.

The turning point for Bitcoin’s rally can be traced to the Federal Reserve’s last FOMC meeting, where Chairman Jerome Powell gave a speech that the market interpreted as dovish. The Fed’s stance, especially in light of recent inflation data, has reassured investors.

Crypto analyst Furkan Yildirim as long as a summary of the FOMC’s key points: “The ‘Dot Plot’ projections show the average official expects a three-quarter percent cut by 2024 […] The FOMC voted unanimously to leave the federal funds rate unchanged […] The median forecast for PCE inflation remains unchanged at 2.4% for 2024 […] Officials have also made predictions about where they see long-term interest rates.”

The reaction to these announcements was immediately bullish in traditional financial markets, as well as Bitcoin and crypto. QCP Capital, a Singapore-based crypto asset trading company, marked the mild nature of the FOMC position: “1. In Powell’s speech at the press conference, he was not concerned about the high inflation rates in January and February 2. In the dot graph, more members shifted their projection to three cuts in 2024 (9 members compared to 6 in December).

Analyst Ted (@tedtalksmacro) continues emphasized the positive implications: “FOMC summary: – There will be three times as many rate cuts this year despite inflation remaining above 2% (the Fed expects a core PCE of 2.6%). Growth prospects have improved. Send it.”

#2 Coinbase Premium Turns Green: A Sign of Demand for Spot ETFs

Coinbase Premium’s shift into positive territory can be identified as another critical factor influencing Bitcoin’s price movement. While yesterday’s ETF flows were negative again for the third day in a row, Bitcoin Coinbase Premium was a glimmer of hope that spot Bitcoin ETFs will drive the price further.

CryptoQuant analyst Maartunn noted: “Coinbase Premium is positive again. It’s about +$50. Nice.” The Coinbase Premium has been crucial to the BTC price in recent months as it reflects demand from spot Bitcoin ETFs before the actual numbers are released a day later. Coinbase keeps eight of the eleven spot Bitcoin ETFs, or about 90% of Bitcoin ETF assets, so the Coinbase premium is crucial for a sustained rally.

Coinbase Premium is positive again. It’s about +$50. Beautiful

https://t.co/YJhYLdbipc pic.twitter.com/Hd3xXsg7Bq

— Maartunn (@JA_Maartun) March 20, 2024

GBTC had outflows worth $386.6 million yesterday. Notably, Blackrock had just $49.3 million in inflows, while Fidelity had $12.9 million. This was one of the weakest days of inflows for the leading Bitcoin ETFs yet – a huge disappointment.

But noted crypto analyst WhalePanda noted: “We tracked the FOMC and overall it was better than what boomers expected. The price is now falling after the news of negative flows, but I think they will be in for a nice surprise tomorrow.”

Yesterday’s ETF flows were negative again for the third time in a row.$GBTC had outflows worth $386.6 million.

Blackrock with just $49.3 million in inflows and Fidelity with $12.9 million.I suspect the actual flows won’t be visible until tomorrow.

We pumped… pic.twitter.com/WVTntqG1by

— WalvisPanda (@WalvisPanda) March 21, 2024

#3 BTC price breaks out of the downtrend channel

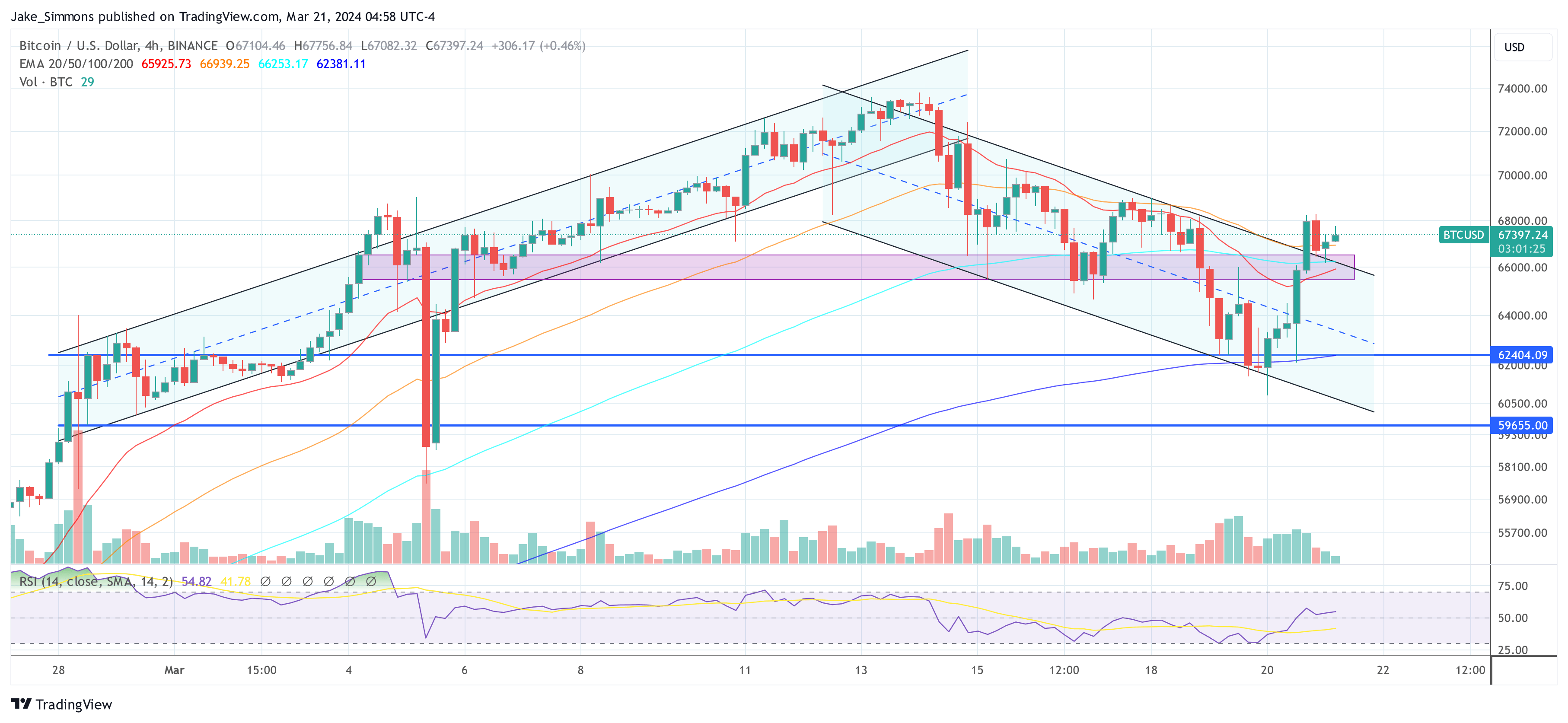

On the technical front, Bitcoin’s breakout from a parallel downtrend channel has caught the attention of traders and analysts alike. Daan Crypto Trades highlighted the importance of this move on X (formerly Twitter): “Bitcoin tested its 4H 200MA/EMA and held well there and broke out. I am still watching this channel, which will dictate BTC’s next move.”

#Bitcoin I tested the 4H 200MA/EMA and it held up well there and broke out.

Still watching this channel that will dictate $BTC‘s next move.

Bulls would like to see this consolidate and not fall back into the channel. pic.twitter.com/94etUo6YAR

— Daan Crypto Trades (@DaanCrypto) March 20, 2024

The chart shared by Daan shows that the BTC price has been consolidating in a parallel downward trend channel for over a week. Yesterday’s rise catapulted the price above the channel. A retest is currently taking place. If this is successful, the BTC price could rise further north.

At the time of writing, BTC was trading at $67,397.

Featured image created with DALLE, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.