In a tumultuous turn of events, the cryptocurrency market has been rocked by a sharp drop in Bitcoin prices. After a sustained period of remarkable gains and record highs, Bitcoin has fallen to a weekly low of $65,000, marking a significant setback for investors.

At the time of writing it is Bitcoin numbers were all painted red, and trading at $65,710, losing 5.6% and 4.5% respectively within the 24-hour and weekly time frames, according to data from Coingecko.

A few days after the previous low of $68,000, Bitcoin plummeted to current levels, a figure not seen in a week, as the bears continued their downward pressure.

Bitcoin plunging in the last 24 hours. Source: Coingecko.

Altcoins can also take a beating

While Bitcoin is bearing the brunt of the recession, altcoins are not spared the consequences. Ethereum (ETH) and Binance Coin (BNB) have also been witnessed significant lossescausing 10% or more of their value to be lost.

Dogecoin and Shiba Inu, two popular meme coins, have seen even steeper declines, down 20% and almost 30% respectively. The broader altcoin market is mirroring Bitcoin’s downward trajectory, adding to investors’ sense of unease.

BTC market cap currently at $1.29 trillion. Chart: TradingView.com

Bitcoin: impact on market dynamics

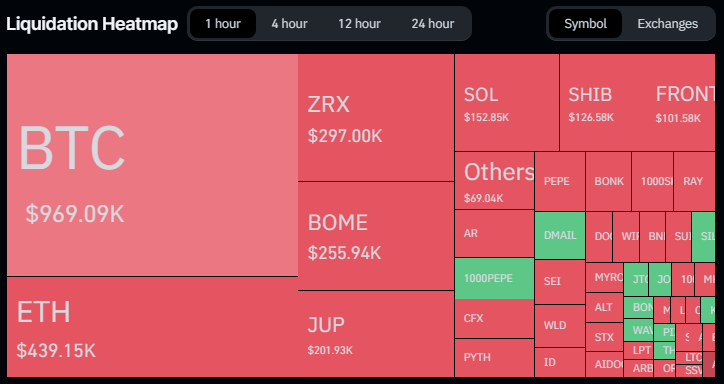

The recent price correction in Bitcoin has resonated across the cryptocurrency landscape, reshaping market dynamics and investor sentiment. The increase in the number of liquidations, which saw more than 151,000 traders experience margin calls in the past 24 hours, underlines the scale of the market turmoil. Bitcoin’s market dominance is evident as Bitcoin accounts for the lion’s share of total liquidations, underscoring its crucial role in shaping overall market trends.

As a result of the drop in value, total market liquidations have reached $426 million, with Bitcoin bearing the brunt.

Liquidation wave

The amount that Bitcoin’s price has liquidated in the last 24 hours has exceeded $104 million, with long traders losing the most money: they lost $86 million, compared to $18 million for short sellers. Ethereum saw a total liquidation of $48 million, with $33 million going to long traders and $15 million to short traders, following the losing run.

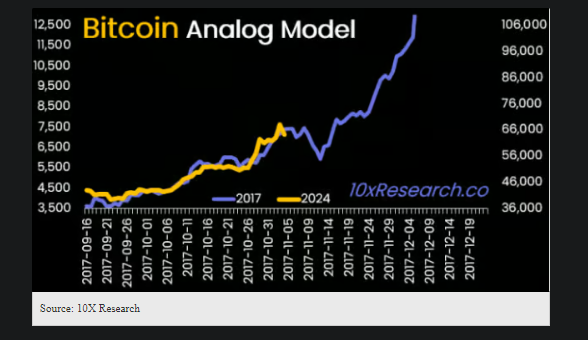

Analyst sounds alarm siren

Meanwhile, market analysts such as Markus Thielen, CEO of 10x Research, have sounded alarm bells and warned of further downside risks for Bitcoin. Thielen’s prediction of a possible drop to $63,000 is a sobering message to investors, calling for caution and caution in navigating the current market environment.

His insights shed light on underlying concerns about Bitcoin’s market structure, including low trading volumes and liquidity, which increase the risk of sharp price corrections.

Amid the market turbulence, investors are grappling with the implications of Thielen’s analysis and adjusting their strategies accordingly. The era of meme coin mania appears to be coming to an end, prompting investors to reassess their positions and secure profits while they still can.

Featured image of Kinesis Money, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.