- Whales started hedging their bets as BTC prices soared.

- Bitcoin’s retail hype seemed to have come to a standstill.

Bitcoins [BTC] Its meteoric rise catapulted it past the $60,000 threshold, triggering waves of excitement and speculation.

However, beneath the surface of this wave lies a nuanced story dominated by institutional maneuvering and a notable absence of retail participation.

AMBCrypto’s examination of BTC showed a rapid rise as prices reached $63,000, before rebounding slightly to $62,725.01 over the past 24 hours.

Whales go without risk

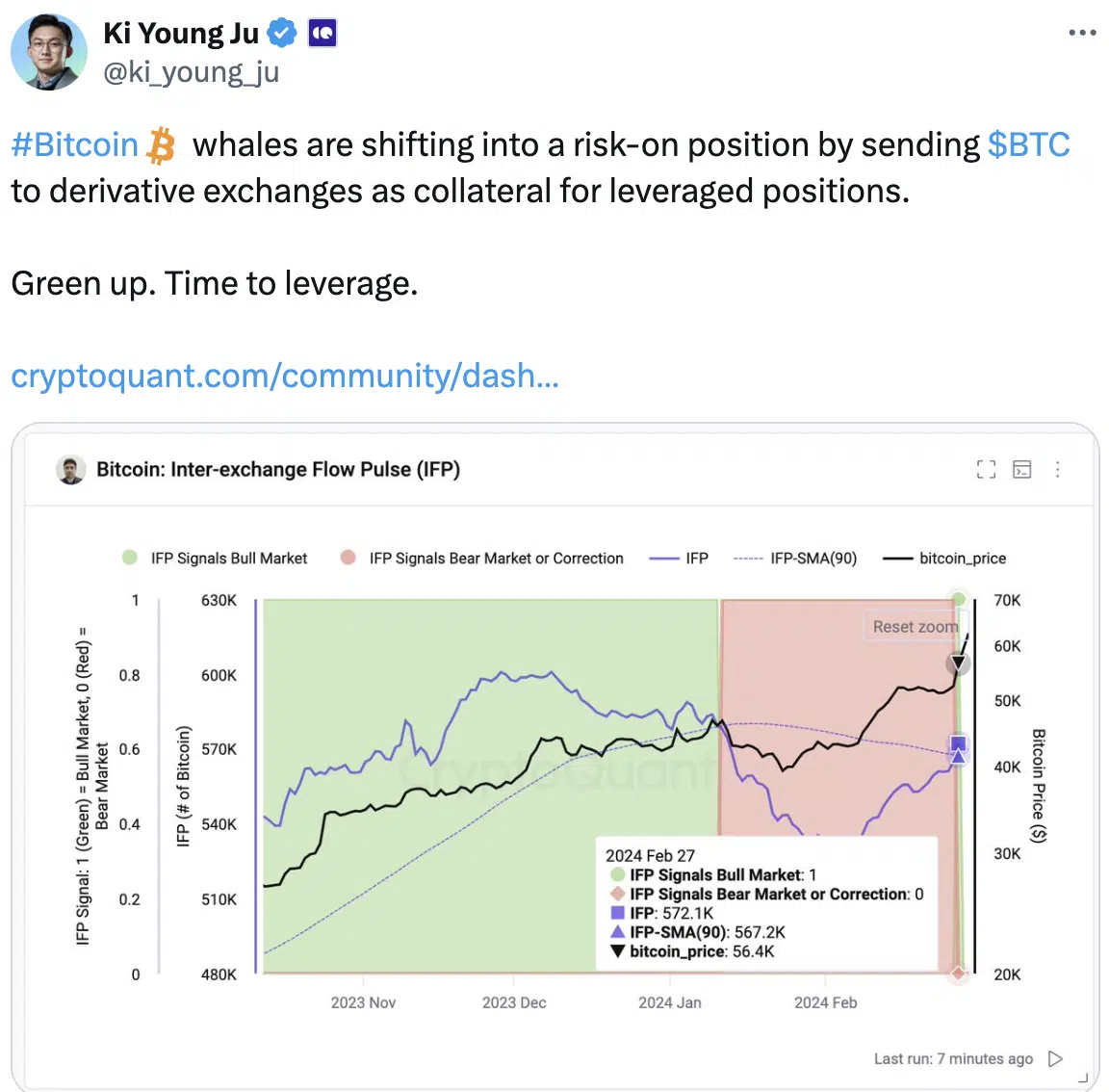

When BTC eclipsed $60,000, the driving force behind this rise was not solely organic market dynamics. Recent data pointed to a strategic move by large Bitcoin holders, known as “whales.”

These entities showed an increased risk tolerance and focused on derivatives exchanges.

By transferring Bitcoin to these platforms as collateral for leveraged trades, whales are signaling a shift toward riskier market strategies.

Surprisingly, retail investor enthusiasm, usually a powerful driving force behind cryptocurrency rallies, seemed to wane.

The current price increase of BTC was mainly driven by institutional interest and strategic whale movements.

If whales start to slow their accumulation and their bullish stance takes a back seat, BTC’s price could stagnate at current levels.

Retail investors may need to invest more in BTC to see the price move further north.

Looking at the condition of the holders

One factor that may deter retail investors from accumulating BTC is their profitability.

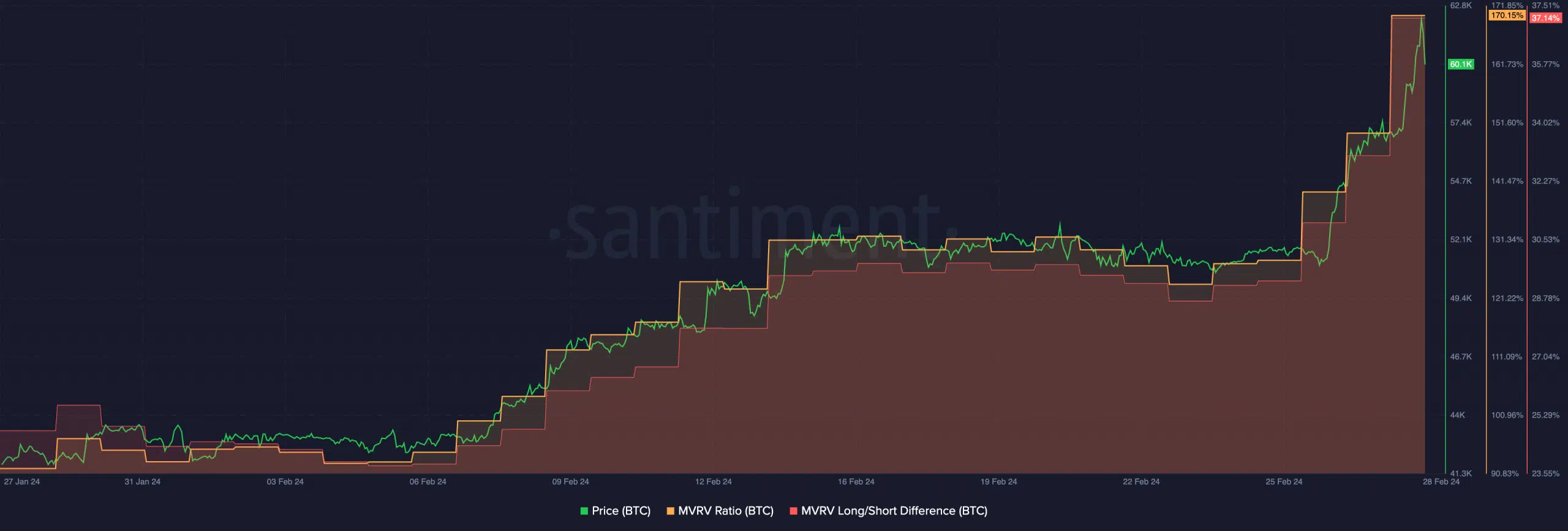

The MVRV (Market-Value-to-Realized-Value) ratio for BTC has increased significantly in recent days.

The growing MVRV ratio indicates that a significant portion of Bitcoin addresses were holding profitable positions. Some of these holders had not seen profitability since 2021.

As a result, many retail investors may want to sell their investments and book their profits.

An additional layer to the analysis is the Long/Short difference around BTC. The growing difference indicates a higher prevalence of long-term addresses compared to short-term addresses.

How much are 1,10,100 BTCs worth today?

Long-term holders tend to be more resilient and less likely to sell in response to short-term market fluctuations.

Only time will tell if investors can continue to hold their BTC as the price shows volatile movements.