- About 95% of the offering was profitable at the time of writing.

- A correction could follow once Bitcoin breaks $60,000.

Bitcoin [BTC] rose 9.31% in the past 24 hours to break $57,000 for the first time since November 2021. Yes, the same November 2021 that saw the King Coin sail to its all-time high (ATH).

The market most likely responded to MicroStrategy’s acquisition of 3,000 Bitcoins in the month of February, bringing the total Bitcoin holdings to a whopping 193,000 Bitcoins. Note that MicroStrategy is Bitcoin’s largest business owner.

Bitcoin rises from the ashes

The world’s largest digital asset rose more than 200% from its low during the crypto winter of 2022 – a time when sentiment around digital assets hit rock bottom.

But as we navigate through the challenging times, Bitcoin is now one of the most lucrative assets one could include in their investment portfolio.

At the time of writing, the leading cryptocurrency exchanged hands for $56,000 CoinMarketCapwith experts pinning their hopes high on the magic figure of $69,000.

About 95% of offerings were profitable at the time of writing, according to AMBCrypto’s review of Santiment’s data. With an eye on $69,000, the network moved closer to 100% profitability.

Beware of these levels

Renowned crypto market analyst Ali Martinez called this phase one of “hope,” a market psychology in which investors begin to believe that the rally would continue. His advice to investors: take them all correction as an opportunity to correct the dive.

Well, corrections are inevitable when investors are looking for profit-taking, right? But how soon will the next one come?

A researcher and verified author on CryptoQuant predicted a macro correction once Bitcoin’s profit range exceeds 96%. The forecast was based on historical trends.

“I think we can assume that the price will soon rise to the 55-60K level or even form a new ATH, after which the market will enter a correction, at the end of which a bull rally will begin.”

Read BTC price forecast for 2024-2025

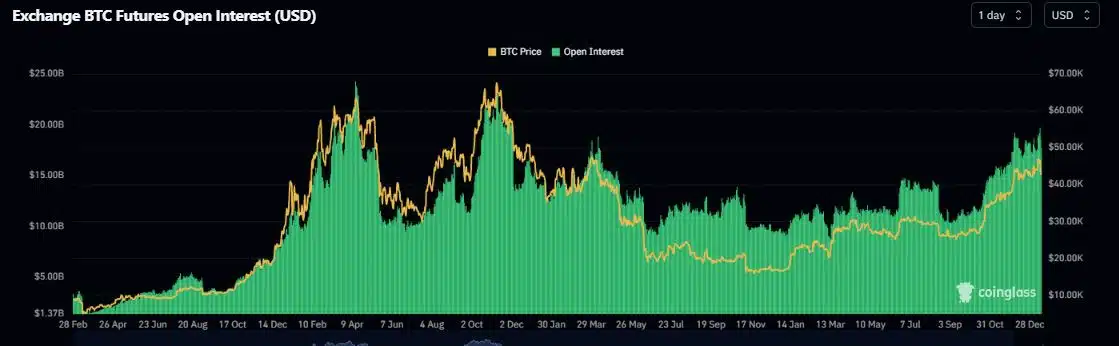

The rally saw an 8% increase in Open Interest (OI) in the Bitcoin futures market, according to AMBCrypto’s analysis of Coinglass data.

In fact, the OI, a measure of the total money invested in the derivatives market, stood at an ATH of $25.51 billion at the time of writing.