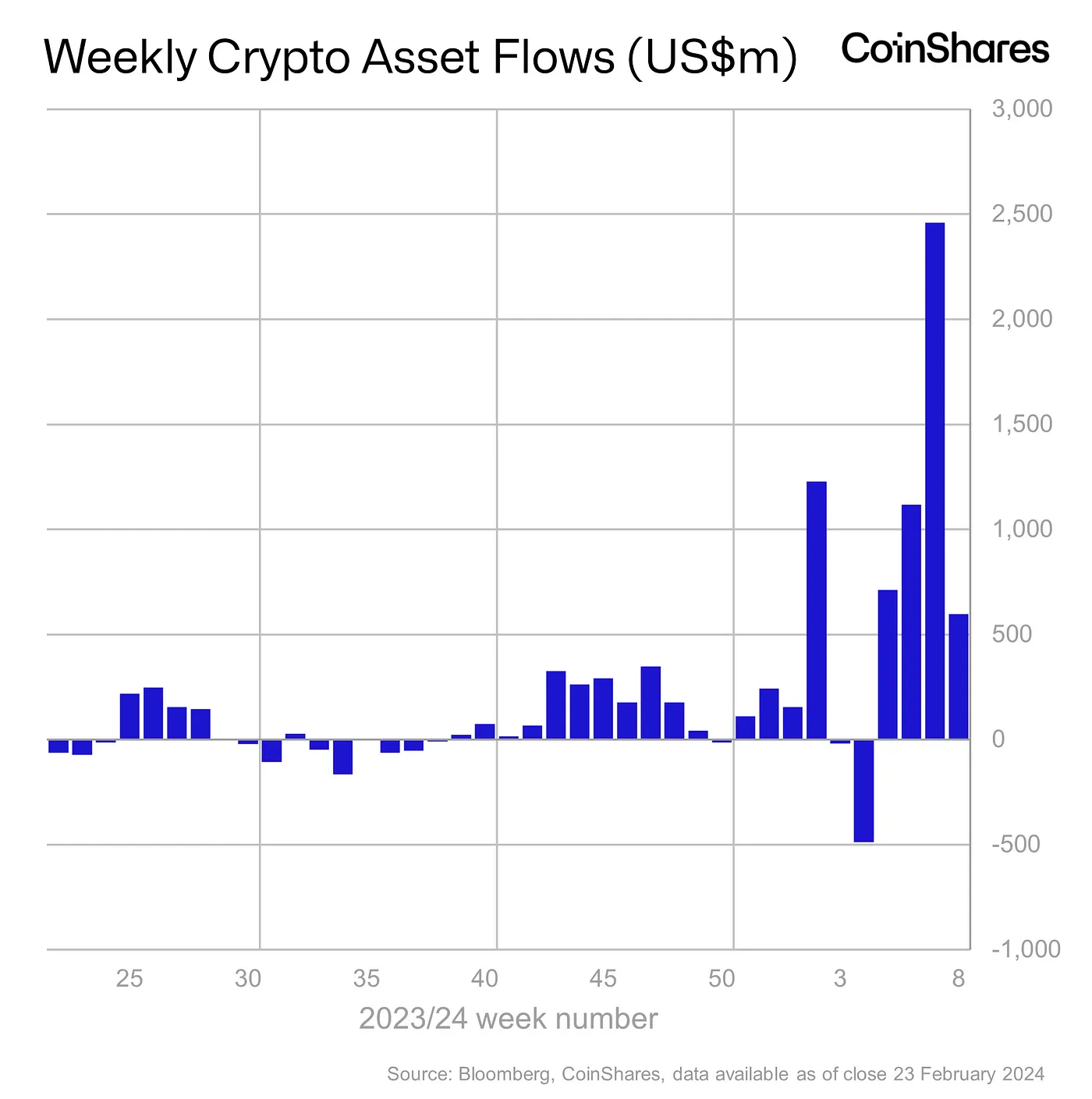

- Year-to-date, inflows exceeded the $5.7 billion mark.

- Total assets under management reached a 26-week high.

Digital asset investment products recorded fourth straight week of net inflows as institutional interest in spot Bitcoin [BTC] continued to assemble.

According to the latter report by crypto asset management firm CoinShares, investors poured $598 million into cryptocurrency-linked funds last week, pushing year-to-date (YTD) inflows past the $5.7 billion mark.

This figure already represented 55% of the record inflows in 2021 – the year when the crypto market reached its peak.

Total assets under management (AuM) reached a 26-week high of $68.3 billion, moving closer to the $87 billion peak recorded in November 2021.

AUM is an important performance gradient of a fund. The higher the value of the assets under management, the more investments it usually attracts.

The US accounts for the majority of the inflow

The US remained the focus, with the recently launched spot Bitcoin ETFs accounting for the majority of investment ($610 million).

Much to the market’s relief, Grayscale Bitcoin Trust (GBTC) outflows ebbed significantly last week, totaling $436 million.

To add context to the decline, about $640 million was pulled from the incumbent issuer in one day last week.

Hits and misses

The largest institutional crypto product Bitcoin enjoyed investments of $570 million last week, bringing YTD inflows to $5.6 billion.

The leading crypto asset’s sideways trajectory affected market sentiment, causing a marked decline from the $2.3 billion inflows recorded in the previous week.

Funds linked to the second largest cryptocurrency Ethereum [ETH] also saw impressive inflows, totaling $17 million last week.

On the other hand, the outage-induced FUD caused a second consecutive week of outflows from Solana [SOL]-linked crypto products.

The global crypto market is up 6.32% in the past 24 hours thanks to significant gains from leading assets, data from CoinMarketCap showed.

If the rally continues, there will likely be significantly higher inflows into the digital asset market in the coming week.