Expectations for the near future Bitcoin Halving events are high in the cryptocurrency community, with hopes that BTC will witness a huge rally after the event. Nevertheless, a number of important factors need to be taken into account prior to the halving.

Key considerations ahead of Bitcoin’s impending halving

Ali Martinez, a famous cryptocurrency analyst, has revealed the key points that investors should pay attention to ahead of Bitcoin’s halving. The analyst shared his opinion on the subject via the social media platform X (formerly Twitter).

In the X-post, Martinez pointed out just four key factors to consider as the event approached. The following halveexpected to take place in April this year, will be the fourth time this has happened.

One of the first and most important areas Martinez notes is the corrections following Bitcoin’s halving. Martinez stated that BTC saw substantial corrections within a month of the 2020 and 2026 halvings, which preceded this price increase.

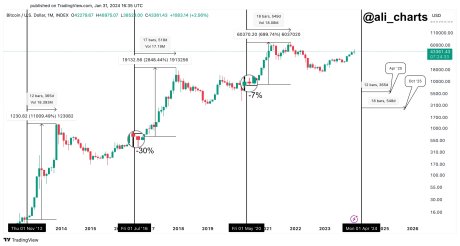

He explained that within a month of the 2016 event, the price of Bitcoin fell by 30%. He also said a similar scenario played out during the 2020 halving, with the price falling by around 7%.

The Bitcoin halving is always seen as a bullish development leading to a significant increase in the price of BTC. This is mainly due to the fact that as demand increases, the amount of new BTC entering the market decreases.

As for the second important point to pay attention to, Martinez has underlined the huge rallies after the halving. According to him, there is usually a sharp increase in the price of Bitcoin after the decline after the halving.

In particular, the expert claimed that Bitcoin’s price rose by 11,000%, 2,850% and 700% respectively after the halvings in 2012, 2016 and 2020. That’s why many experts expect it BTC price will reach a new all-time high after the event ends.

Significant change in the market

The third crucial aspect of Martinez to consider is the duration of the bull market. As is common knowledge, any previous halving often heralds a bull market.

He then shared a calculated time of how long the market recovered during the previous halving. Martinez stated that the 2012, 2016, and 2020 bull markets lasted 365 days, 518 days, and 549 days, respectively.

Meanwhile, the last part the expert points out is the next market top. He believes Bitcoin will reach a new peak in April or October 2025. Martinez expects this to happen if only the upcoming event follows suit historical patterns. Therefore, he has urged the crypto community to be vigilant and observe these patterns.

As of now, BTC is trading just above $42,000, showing a decline of almost 2% in the last 24 hours. Trading volume is up 14% today, while market capitalization is down 1.90%.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.