Polygon founder Sandeep Nailwal explains two key factors for Web3’s long-term success compared to today’s Internet.

Nailwal highlights blockchains’ unlimited scalability and ability to communicate as a crucial factor, emphasizing the need for individuals to have the freedom to choose from different decentralized profiles.

Polygon’s Sandeep Nailwal outlines Web3 requirements

In a recent post on

“Seamless UX and cross-chain composability would be solved in a while. Ethereum + Rollups/Validium design is the only way to scale web3 to the scale of the internet.”

Nailwal further explains that Polygon is committed to building a network of aggregated blockchains.

“At Polygon, we are only interested in building for that end state, a ‘planetary-scale blockchain network.’

Meanwhile, DCinvestor explained to its 236,900 followers on X that the introduction of Layer-2 will be critical to the success of blockchains in the coming years. He noted that while bridging and interoperability solutions “still require work,” not working on them could pose long-term risks.

“Not everything has to coexist with the complete state of everything else, and periods of congestion bring risks.”

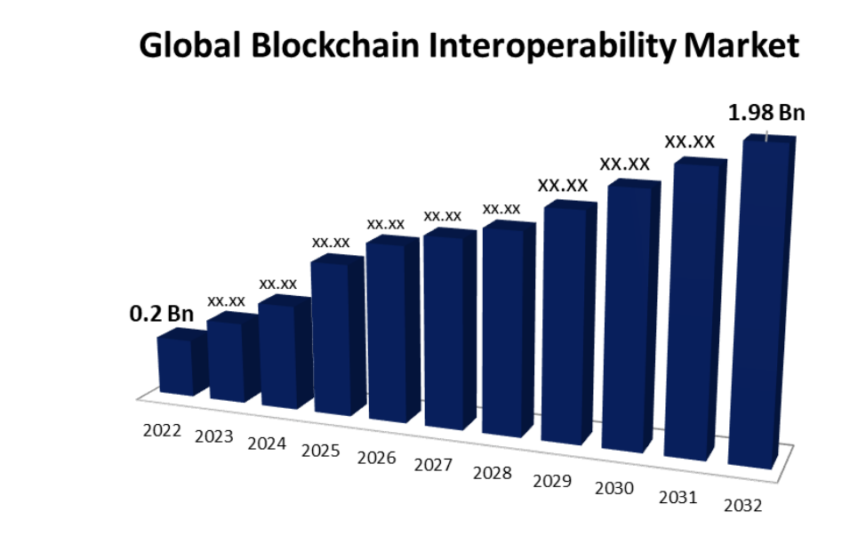

According to recent data from Spherical Insights, the global blockchain interoperability market will exceed $1.98 billion by 2030.

Global Blockchain Interoperability Market. Source: Spherical insights

Blockchain interoperability, an important topic of discussion for banks

Blockchain interoperability has been a major talking point in the industry lately.

Meanwhile, Router Protocol CEO Ramani Ramachandran told BeInCrypto in September 2023 that the shift toward promoting interoperability with Bitcoin, especially with advancing Layer 2 solutions, illustrates the widespread desire for a more connected blockchain ecosystem.

“Bitcoin’s role could evolve significantly when it comes to interoperability. It would allow Bitcoin to participate directly in DeFi and provide liquidity and collateral options.”

However, major banks around the world are interested in cross-chain interoperability for conducting tokenized asset purchases.

Australia’s major bank, Australia and New Zealand Banking Group (ANZ), has announced that it has adopted Chainlink’s cross-chain interoperability protocol (CCIP).

Meanwhile, ANZ Portfolio Lead Nigel Dobson explained that it is a hot topic for major banks around the world:

“Banks are increasingly exploring use cases involving tokenized assets, with 93 percent of institutional investors believing in their long-term value, according to a recent EY report.”

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to impartial, transparent reporting. This news article is intended to provide accurate, timely information. However, readers are advised to independently verify the facts and consult a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimers have been updated.