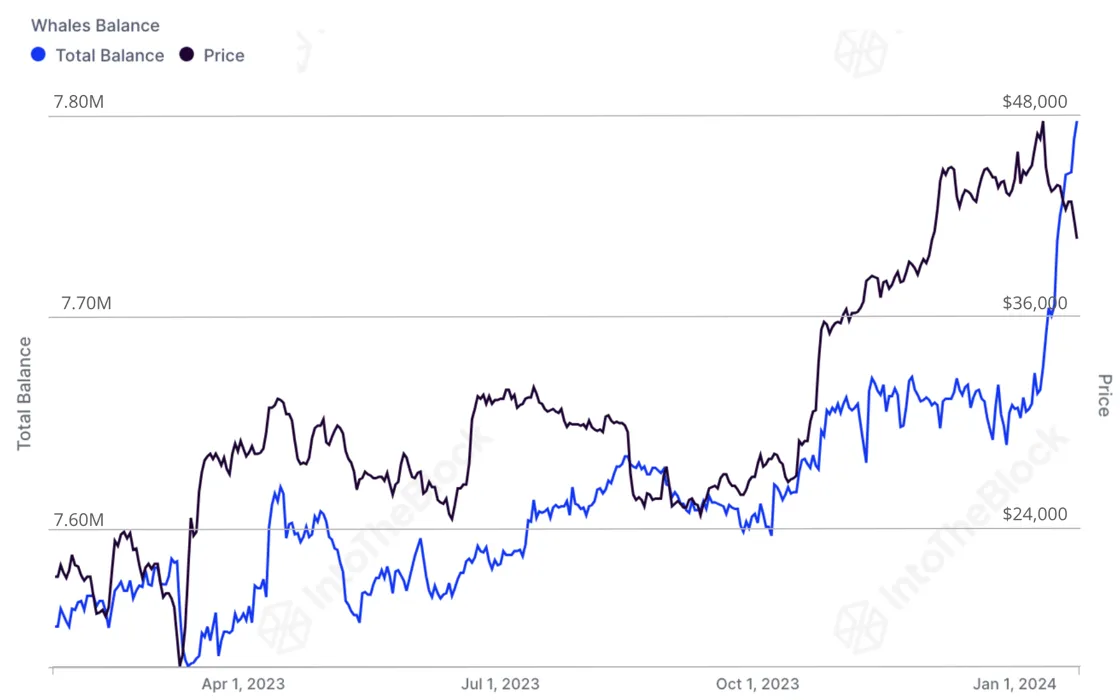

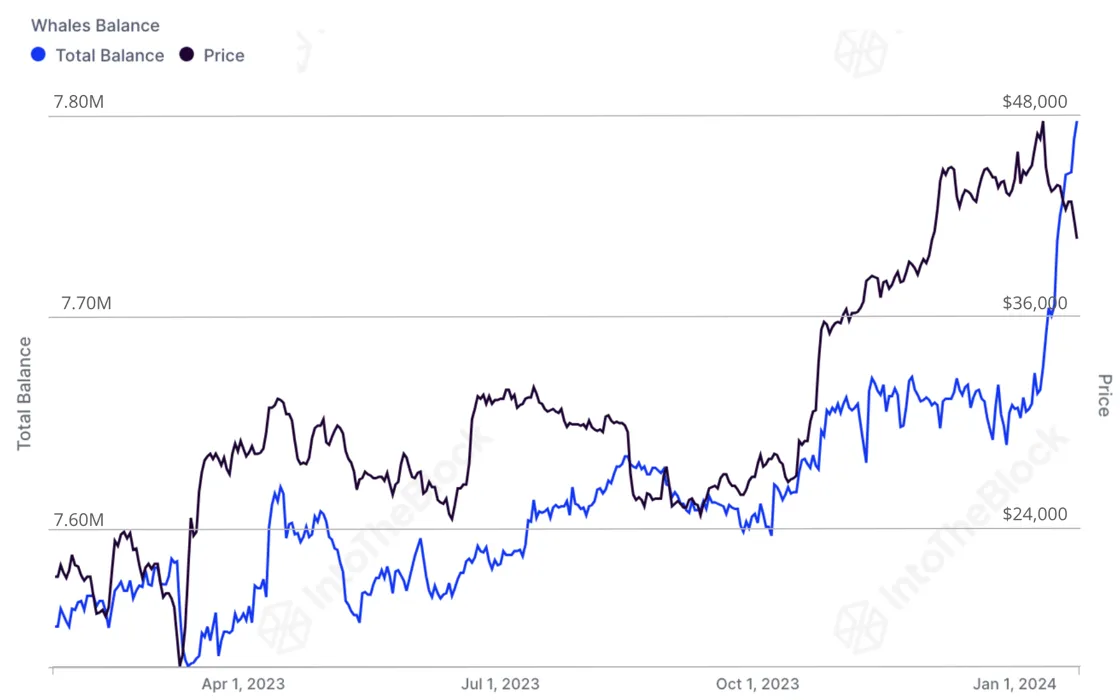

New data from crypto intelligence firm IntoTheBlock shows that Bitcoin (BTC) whales have amassed billions of dollars in crypto kingship in less than 30 days.

In a new article, the crypto analysis platform say the amount of BTC in wallets holding more than 1,000 Bitcoin rose sharply in the first month of 2024.

IntoTheBlock notes that the figure includes entities such as BTC Exchange-Traded Funds (ETFs), which were approved by the US Securities and Exchange Commission (SEC) earlier this year.

“’Whales’ include any entity, individual or fund (including the ETFs) that owns more than 1,000 BTC. While Bitcoin ETFs have seen net inflows of $820 million, Bitcoin whales have seen an increase of ~$3 billion (76,000 BTC) so far in 2024. Including GBTC, Bitcoin ETFs now control 3.23% of Bitcoin’s circulating supply.

This is a larger share of supply than in the case of gold, where $110 billion of a ~$10 trillion market cap is held in US-traded ETFs (about 1% of supply). Despite Bitcoin’s correction, the high ownership of Bitcoin ETFs suggests that they have actually received considerable attention among traditional financial investors.”

The analytics firm then analyzes the fear, uncertainty and doubt (FUD) surrounding Grayscale’s spot market BTC ETF (GBTC) and says the $4.3 billion outflow casts doubt on the success of BTC ETFs.

IntoTheBlock notes that at least $1 billion of the outflow came from bankrupt crypto exchange FTX.

“FTX’s bankruptcy estate held GBTC at a discount and chose not to realize a loss by selling before the likely ETF conversion. Many other entities, including DCG (Genesis’ parent company), which were loss-making, likely decided to exit GBTC once it converted to an ETF and the discount became close to zero.”

GBTC traded at a discount of -47.35% to the net asset value on February 13, 2023. The discount gradually decreased over time and amounted to zero on January 26.

Bitcoin is trading at $42,274 at the time of writing, down fractionally over the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Stavtceva Iana