Bitcoin’s price surpassed $42,000 on January 26, amid significant Bitcoin ETF flows and a Coinbase stock rating upgrade.

Bitcoin (BTC) was valued at $42,040.36 with a market cap of $824.4 billion at 20:05 UTC on Friday. That means a growth of 5.3% over 24 hours.

Bitcoin’s current price also represents a five-day high, as prices were nearly $40,000 on January 24 and 25 and as low as $38,678 on January 23.

The cryptocurrency market as a whole rose 4.6% in 24 hours. Other top ten assets saw similar gains today: Avalanche (AVAX) rose 7.3%, Solana (SOL) rose 5.9%, XRP rose 3.7%, BNB rose 3.5%, Cardano (ADA ) rose 3.3%, and Ethereum (ETH) rose 1.9%.

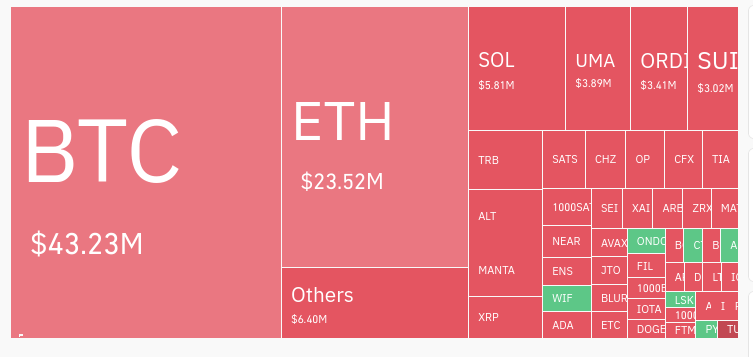

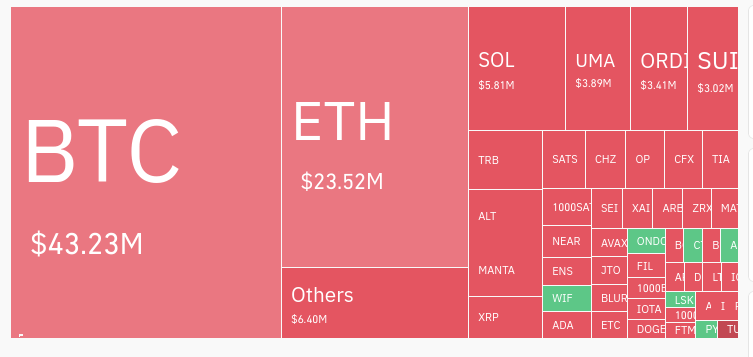

According to Coinglass data, the market saw $116 million in liquidations within 24 hours, with Bitcoin (BTC) responsible for $43.23 million in liquidations and Ethereum (ETH) responsible for $23.52 million in liquidations.

Gains could be due to ETF flows and Coinbase rating

While it is not entirely known why Bitcoin has gained value today, the inflows and outflows of Bitcoin ETFs are a major influence on the market.

According to a Jan. 25 JP Morgan report, outflows from Grayscale’s GBTC ETF are now slowing and may have largely ended. High GBTC outflows mean more Bitcoin (BTC) enters the market, creating a higher supply compared to investor demand. Such outflows likely contributed to falling Bitcoin prices in the weeks following several spot Bitcoin ETF approvals on January 10.

Conversely, inflows into other funds have taken Bitcoin off the market and could help boost prices. While most spot Bitcoin ETFs have positive inflows, BlackRock’s iShares Bitcoin Trust (IBIT) notably surpassed $2 billion in total inflows on January 26. Net inflows for all spot Bitcoin ETFs are $744 million.

Other positive developments may have also affected crypto prices. Yahoo! Financial analysts noted that Coinbase’s (COIN) stock rating was upgraded from Oppenheimer & Co. The price of COIN is also up 3.40% today.