The price of Bitcoin has been in a bearish trend for the past few days, leading several crypto analysts to predict even more bearish action for the crypto asset in the near future.

Bitcoin price crashes to $38,130

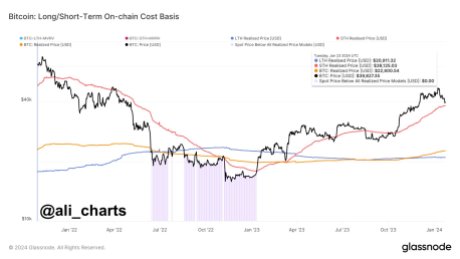

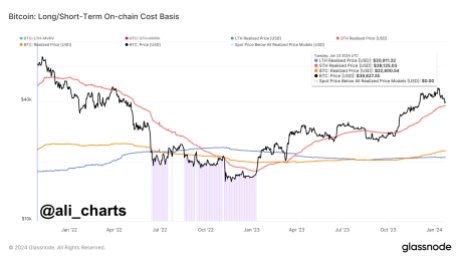

Ali Martinez, a well-known cryptocurrency analyst and enthusiast, has done just that shared a worrying prediction for Bitcoin’s near-term price action. The analyst took to the social media platform X (formerly Twitter) a few hours ago to share his projections with the crypto community.

Martinez’s prediction came amid the recent crash frenzy that encompassed the entire crypto market. The largest crypto asset has been suffering a significant pullback for some time now, with prices falling under $40,000 price mark.

According to the analyst, the latest drop in Bitcoin’s price could be below $38,130. Martinez stated that short-term holders of BTC would suffer losses if prices fell below the aforementioned price level.

He also noted that the price drop among short traders could trigger “panic selling.” As a result, these short sellers will look for methods to limit their losses.

The message read:

If the price of Bitcoin falls below $38,130, BTC holders could find themselves in the red in the short term. This potential Bitcoin dip could trigger a new wave of panic selling as these holders will try to minimize their losses.

Yet Martinez did marked that the bearish shift is only temporary, predicting that BTC’s bull cycle will peak by the end of 2025. In the post, he claimed that Bitcoin’s current state is similar to previous bull runs that lasted from “2015-2018 and 2018-2022.” Afterwards, he said that market estimates suggest BTC could reach a new peak by October 2025.

With his analysis, Martinez has predicted a “600-day bullish momentum” for Bitcoin, which presents future gains for long-term investors.

Historical trends prove further price correction

Charlie Bilelo, chief market strategist at Creative Planning Investor, has done just that noted that historical trends point to more price corrections. According to the head, history does not repeat itself, but often rhymes.

Bilelo underlined that whenever a major event in BTC history occurs, notable price corrections always occur. he emphasized BTC witnessed an 84% pullback after the December 2017 bull run.

He highlighted a similar scenario that occurred during the October 2021 bull run. Then the rally started after the approval of the BTC futures ETF and followed by a 78% retracement.

This pattern appears to be partially manifesting itself, as evidenced by the spike in the price of BTC earlier this year due to BTC Spot ETF approval. Bilelo has so far pointed to a 20% decline since the products were cleared by the SEC.

At the time of writing, the asset’s price stands at $40,088, indicating a decline of more than 5% in the past week. Data from CoinMarketCap shows that market capitalization and trading volume also fell by 0.35% and 31% respectively.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.