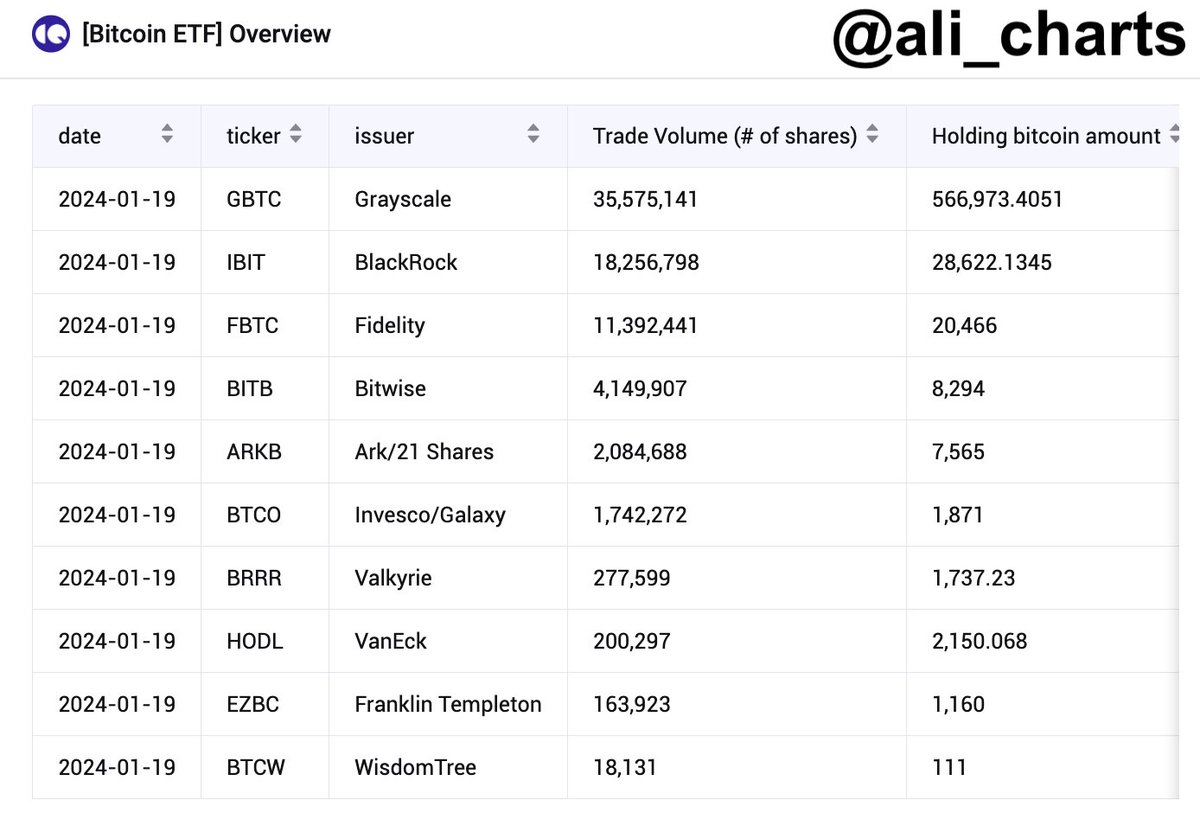

Crypto analyst and trader Ali Martinez says the recently launched spot Bitcoin (BTC) exchange-traded funds (ETFs) suddenly own a huge chunk of the crypto king.

Martinez tells According to his 41,600 followers on social media platform X, ETF products now hold tens of billions of dollars in BTC.

“Bitcoin ETFs in the US Now Hold Over 638,900 BTC, Worth About $27 Billion [as of Sunday]! Probably nothing.”

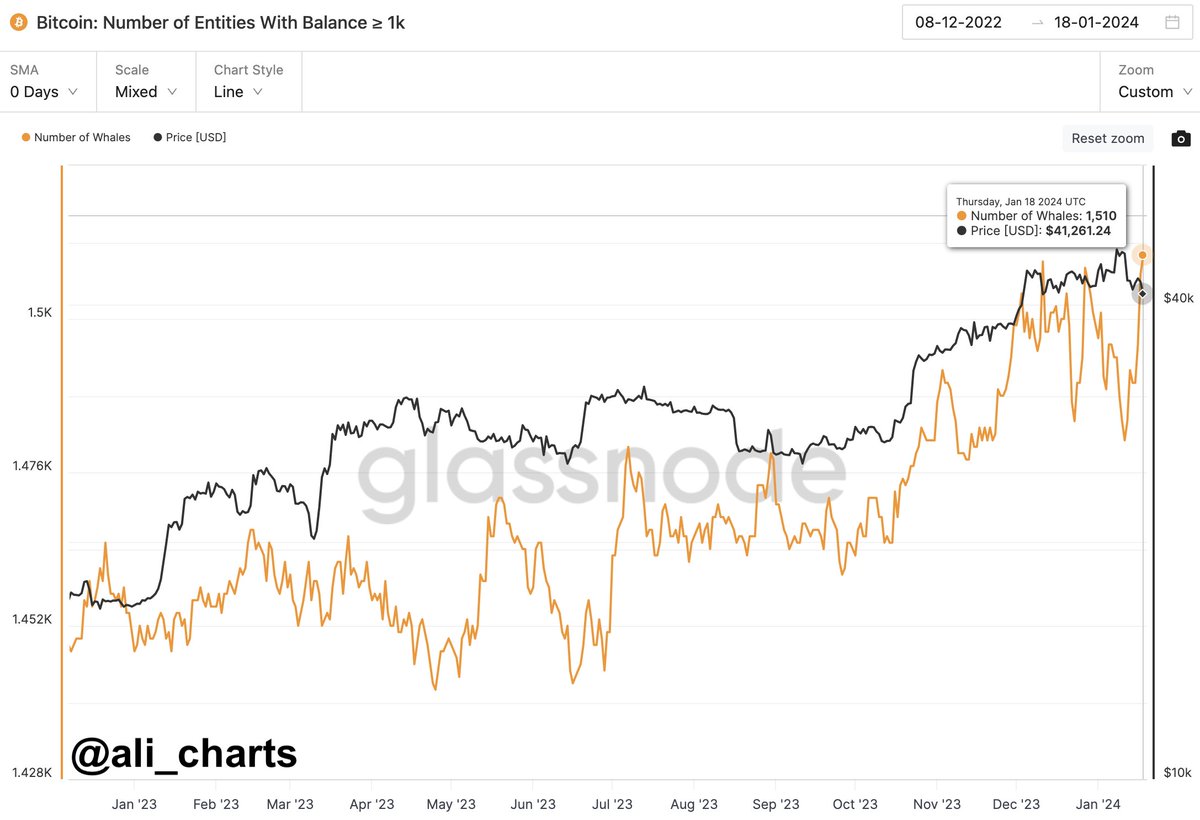

The trader too noticed that there was a rise in the number of Bitcoin whales on Friday – investors with deep pockets who held more than 1,000 BTC.

“[January 19th] marks a remarkable increase in the number of Bitcoin whales! The number of addresses holding more than 1,000 BTC has reached the highest point since August 2022 and now stands at 1,510 [BTC]. This increase in the number of large BTC holders could indicate strong confidence or strategic positioning in the market.”

Bitcoin is trading at $39,893 at the time of writing, down more than 4% in the past 24 hours.

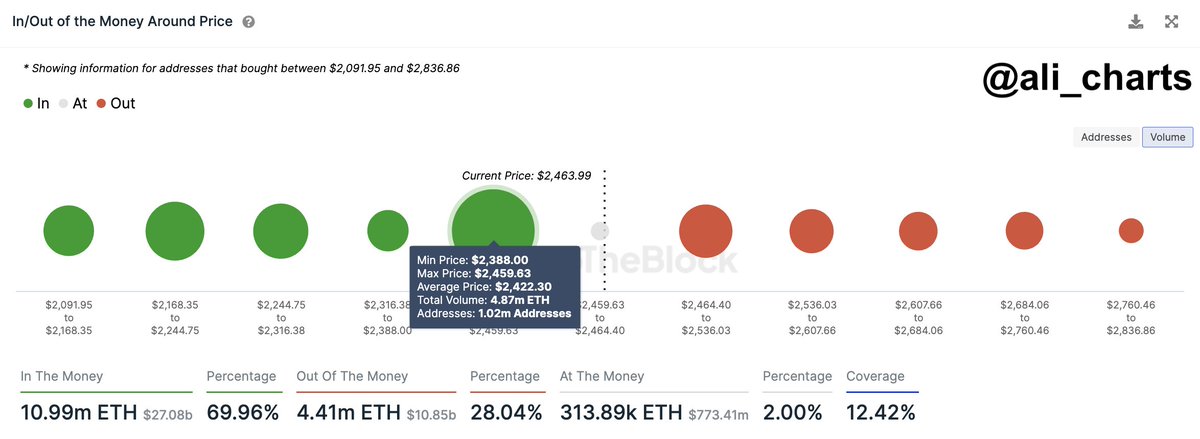

The trader too say that Ethereum (ETH) may be at a critical juncture where it could break out or suddenly fall based on the In/Out of the Money Around Price (IOMAP) metric, which attempts to discover key buying and selling areas.

“Ethereum Market Update: ETH is currently in a key demand zone, ranging between $2,388 and $2,460. If this support remains strong, there is a clear path ahead with minimal resistance, offering the potential for upside.

However, if ETH fails to maintain this level, we may see a pullback to the next major support area around $2,000.”

Ethereum is trading at $2,325 at the time of writing, down nearly 6% in the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney