- Bitcoin witnessed a massive price surge driven by ETF anticipation.

- Gary Gensler’s tweet further exaggerated the hype as applicants sent updates.

Bitcoin [BTC] witnessed a massive surge in the last 24 hours due to the increasing anticipation around ETFs.

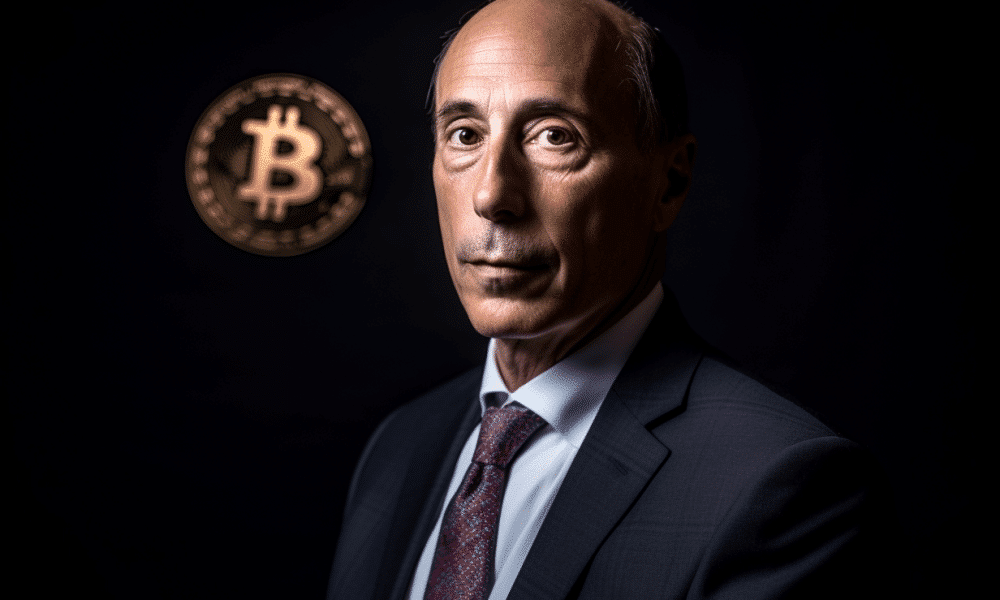

Gary Gensler enters

The hype was amplified by tweets from SEC Chairman Gary Gensler, who tweeted a list of things retail investors should consider before making crypto investments.

While Gensler’s comments primarily advise retail investors to be cautious, many in the market are interpreting them as a possible indication that the announcement of a Bitcoin ETF is imminent.

Gensler raised concerns about how those offering crypto investments may not comply with applicable laws in the crypto asset investment/services industry.

He also highlighted the potential lack of compliance with federal securities laws and warned investors of the risk of being deprived of vital information and protections related to their investments in crypto assets.

Gensler highlighted the exceptionally risky and volatile nature of investing in crypto assets, citing examples of major platforms and crypto assets becoming insolvent or losing value.

He also warned against the continued exploitation of the rising popularity of crypto assets by fraudsters.

1⃣ Those offering investments/services in crypto assets may not comply with applicable laws, including federal securities laws. Investors in crypto assets should understand that they may be denied important information and other important protections related to their investment.

— Gary Gensler (@GaryGensler) January 8, 2024

Increasing speculation

During an interview with CNBC on Monday, former SEC Chairman Jay Clayton expressed confidence in the inevitability of ETF approvals. He emphasized that no further decisions need to be made.

Clayton underlined the magnitude of this development, portraying it as a pivotal moment that extends beyond the realm of cryptocurrency. According to him, the approval represented a substantial step forward in the evolution of the financial sector as a whole.

Additionally, Standard Chartered released a note predicting significant inflows of between $50 billion and $100 billion into the Bitcoin spot ETF in the year 2024 alone.

Moreover, the financial institution has made a prediction, claiming that the price of Bitcoin will cross $200,000 by the end of 2025.

ETF fees to be announced

Another factor that makes people believe in the possibility of an ETF’s approval is the publication of ETF fees. The fee structure shows very competitive rates, some of which are below operating costs.

Issuers are prioritizing market share over short-term profits, anticipating a surge in future demand for the Bitcoin market.

$BTC ETF fees have just been released.

With extremely competitive management fees, some even below operating costs, issuers are prioritizing market share over short-term profits, likely anticipating a substantial influx of future demand for the $BTC market.

Moreover, with… pic.twitter.com/xDHRKxkbWv

— A Monkey’s Prologue (@apes_prologue) January 8, 2024

Analysts make a statement

Despite these positive indicators implying that the ETF’s approval is certain, there were some who believed that there could be a delay in the work. This was due to the fact that the SEC recently issued additional comments on the applicant’s pending S-1s.

However, James Seyffart, an ETF analyst, responded to the FUD by providing several insights.

First, he acknowledged the accuracy of the comments on the S-1 documents.

Balchunas, another ETF analyst, also anticipated the likelihood of further changes happening the next day due to the current developments. However, despite these observations, he believed that this does not necessarily indicate a signal of slowing down.

1. That’s right, comments came back on those S-1 documents with the reimbursements that drove us all crazy this morning (this is not uncommon)

2. Expect to see more amendments tomorrow as a result

3. That said, I don’t think this is necessarily a delay signal https://t.co/o2m0lIBSct— James Seyffart (@JSeyff) January 9, 2024

A story about S-1s and S-3s

At the time of writing, Valkyrie, Wisdomtree, Invesco/Galaxy, iShares, Ark/21Shares, and Vaneck had filed updated S-1 filings for Bitcoin spot ETFs with the SEC.

Grayscale has filed a revised S-3 document. The suggested ETF fee for the spot Bitcoin ETF is 1.5%, and liquidity providers include JANE STREET, VIRTU, FLOW TRADERS, and FLOWDESK.

For context, S-1 filings describe a company’s plans for an initial public offering (IPO), while S-3 filings cover securities offerings and corporate updates.